The key aspects of the India Budget 2018 document are:

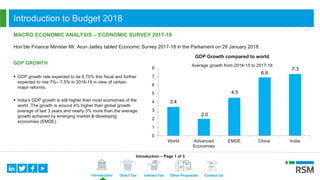

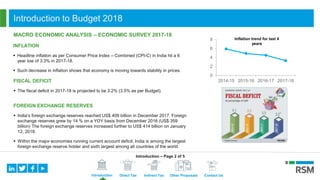

1. GDP growth is projected to be 6.75% in the current fiscal year and rise to 7-7.5% in 2018-19 due to major reforms. Inflation has hit a 6-year low of 3.3% in 2017-18.

2. For companies with revenues up to Rs. 250 crores, the corporate tax rate has been reduced to 25%. No change in personal income tax rates.

3. Exemption on long term capital gains from equity investments is being withdrawn and such gains will be taxed at 10%. Scope of dividend distribution tax has also been expanded.