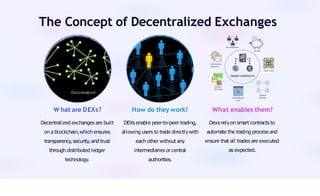

The document discusses the development of decentralized exchanges (DEXs) and their advantages over centralized exchanges (CEXs), including control over funds, privacy, and lower fees. It highlights challenges such as liquidity issues, scaling problems, and low user adoption, while also noting recent developments and future trends in the DEX space, including increased popularity and regulatory attention. Overall, DEXs play a crucial role in the blockchain ecosystem by enabling peer-to-peer trading without intermediaries.