Reorganisation eng

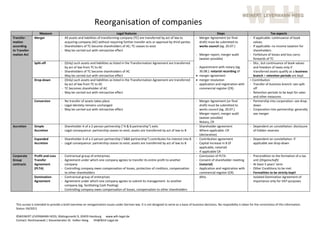

- 1. Reorganisation of companies Measure Legal features Steps Tax aspects Transfor‐ Merger ‐ All assets and liabilities of transforming company (TC) are transferred by act of law to ‐ Merger Agreement (or final ‐ If applicable: continuance of book mation acquiring company (AC) without requiring further transfer acts or approval by third parties draft) must be submitted to values. according ‐ Shareholders of TC become shareholders of AC; TC ceases to exist works council (eg. 20.07.) ‐ If applicable: no income taxation for to Transfor‐ ‐ May be carried out with retroactive effect shareholders mation Act ‐ Merger report, merger audit ‐ Forfeiture of losses and loss carry‐ (waiver possible) forwards of TC Split‐off ‐ (Only) such assets and liabilities as listed in the Transformation Agreement are transferred ‐ Dto., but continuance of book values by act of law from TC to AC ‐ Appointment with notary (eg. and freedom of taxes only if ‐ Shareholders of TC become shareholders of AC 30.08.): notarial recording of transferred assets qualify as a business ‐ May be carried out with retroactive effect merger agreement branch + retention periods are kept Drop‐down ‐ (Only) such assets and liabilities as listed in the Transformation Agreement are transferred merger resolution = Contribution by act of law from TC to AC ‐ application and registration with ‐ Transfer of business branch: see split‐ ‐ TC becomes shareholder of AC commercial register (CR) off ‐ May be carried out with retroactive effect ‐ Retention periods to be kept for sales and other measures Conversion ‐ No transfer of assets takes place ‐ Merger Agreement (or final ‐ Partnership into corporation: see drop‐ ‐ Legal identety remains unchanged draft) must be submitted to down ‐ May be carried out with retroactive effect works council (eg. 20.07.) ‐ Corporation into partnership: generally ‐ Merger report, merger audit see merger (waiver possible) ‐ Notary, CR Accretion Simple ‐ Shareholder A of a 2‐person partnership (“A & B partnership“) exits ‐ Shareholder agreement ‐ Dependent on constellation: disclosure Accretion ‐ Legal consequence: partnership ceases to exist; assets are transferred by act of law to B ‐ Where applicable: CR of hidden reserves (declarative) Expanded ‐ Shareholder A of a 2‐person partnership (“A&B partnership“) contributes his interest into B ‐ Contribution agreement ‐ Dependent on constellation: if Accretion ‐ Legal consequence: partnership ceases to exist; assets are transferred by act of law to B ‐ Capital increase in B (if applicable see drop‐down applicable, notarial) ‐ If applicable CR Corporate Profit‐and‐Loss ‐ Contractual group of enterprises ‐ Conclusion of PLTA ‐ Precondition to the formation of a tax Group Transfer ‐ Agreement under which one company agrees to transfer its entire profit to another ‐ Consent of shareholder meeting unit (Organschaft) contracts Agreement company (notarial) ‐ At least 5 years’ term (PLTA) ‐ Controlling company owes compensation of losses, protection of creditors, compensation ‐ Application and registration with ‐ Other Conditions to be met to other shareholders commercial register (CR) ‐ Formalities to be strictly kept! Domination‐ ‐ Contractual group of enterprises ditto. Isolated Domination Agreement of Agreement ‐ Agreement under which one company agrees to submit its management to another importance only for VAT‐purposes company (eg. facilitating Cash Pooling) ‐ Controlling company owes compensation of losses, compensation to other shareholders This survey is intended to provide a brief overview on reorganization issues under German law. It is not designed to serve as a basis of business decisions. No responbility is taken for the correctness of this information. Status: 04/2012 ©WEINERT LEVERMANN HEEG, Rödingsmarkt 9, 20459 Hamburg www.wlh‐legal.de Contact: Rechtsanwalt | Steuerberater Dr. Volker Heeg VH@WLH‐Legal.de