Embed presentation

Download to read offline

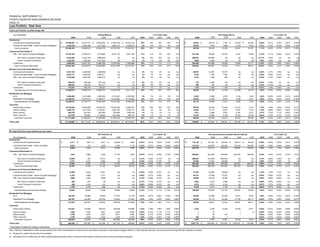

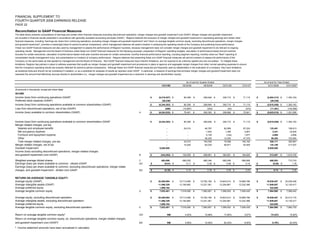

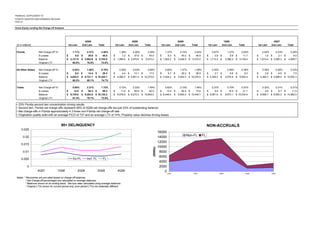

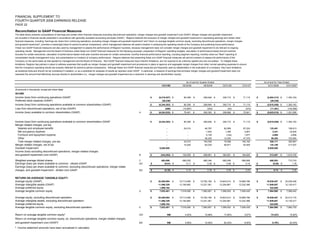

- The quarterly loss of $9.01 per diluted share was driven by a $6 billion non-cash goodwill impairment charge; excluding this, the loss was 35 cents per share. - Key factors included a $1.15 billion loan loss provision, higher net charge-offs, and a mortgage servicing rights impairment charge. - Problem loan dispositions drove increased net charge-offs and provisions for loan losses and allowances for credit losses.