This document provides a summary of a regional study on financial education in East African Community (EAC) partner states. It includes background information on the economies, populations, and financial sectors of Burundi, Kenya, Rwanda, Tanzania, and Uganda. It then analyzes existing financial education interventions in each country and per sector. Key findings are presented on differences in money culture, language, and behaviors across countries. Challenges to financial literacy and education are discussed. The document concludes with recommendations for regional cooperation on financial education, including proposed institutional arrangements, frameworks, and monitoring/evaluation.

![Regional Study on Financial Education in the EAC: Draft Report

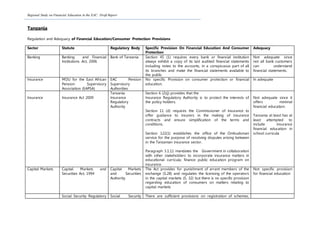

8. CONSUMER PROTECTION PROVISIONS

Burundi

Sectors Applicable

Laws

Regulating Authority Specific Provisions, Financial Education and

Consumer Protection

Adequacy

Burundi's Constitution of 2005. The Republic of

Burundi

Article 53 states every citizen has a right to

equal access to instruction, to education and

to culture. The State has the duty to organize

public education and to favor [its] access.

Inadequate in so far

as financial

education is not

catered for.

Banking The Bank of the Republic of Burundi Act The Bank of the

Republic of Burundi

No specific provision on consumer protection

or financial education

Inadequate

Insurance The Insurance Code of Burundi

Law no. 1/02 of January 7 2014

No specific provision on consumer protection

or financial education

Inadequate

Social Benefits National policy on social security and

protection

- No specific provision on consumer protection

or financial education

Inadequate

Capital Market No law No regulatory body No specific provision on consumer protection

or financial education

Inadequate](https://image.slidesharecdn.com/842112e4-aa7f-4058-9fb2-b7818c5b81d1-170106133032/85/Regional-Study-on-Financial-Education-in-the-EAC-Draft-Report-66-320.jpg)