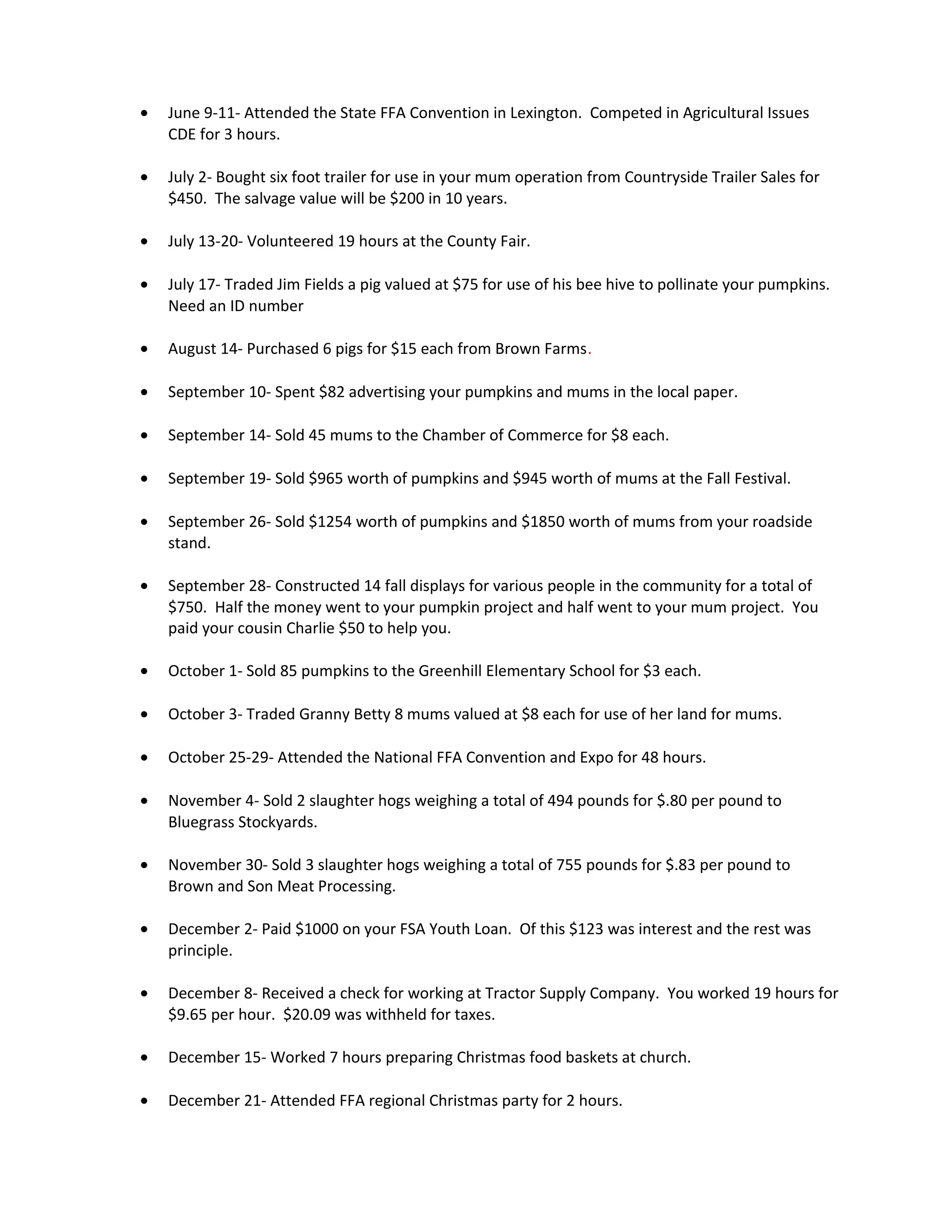

The document provides instructions for a Kentucky FFA record keeping contest. Participants are asked to set up an AET profile and enter records of various farm business transactions that occurred throughout the year. This includes purchasing livestock, feed, supplies and equipment. Income is generated from selling crops, livestock and agricultural services. At the end, participants must generate a PDF of a State FFA Degree application to complete the contest.