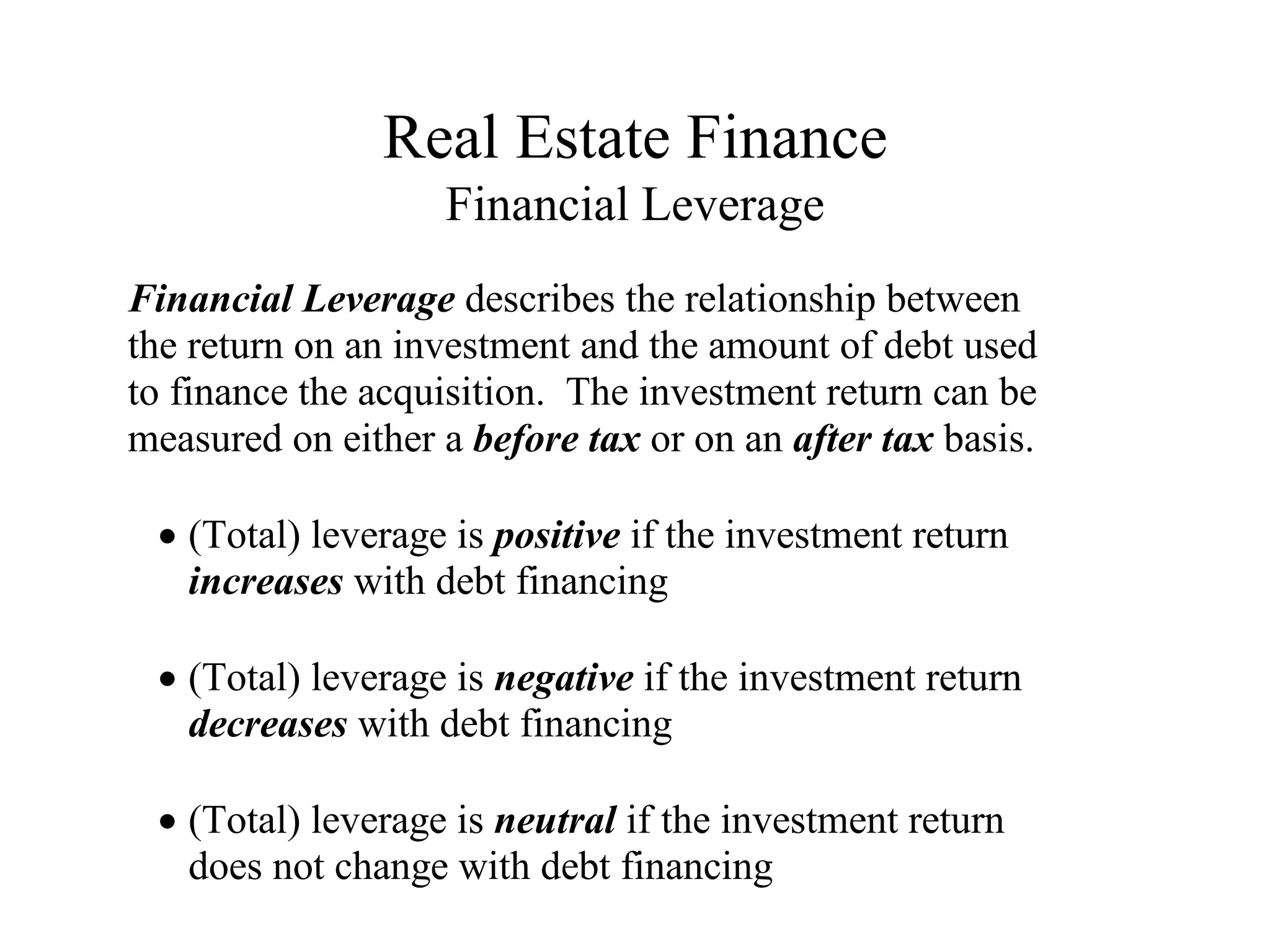

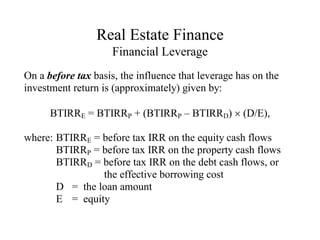

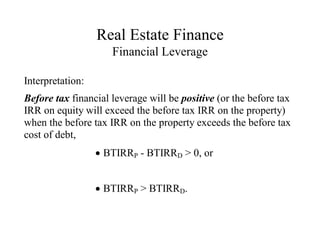

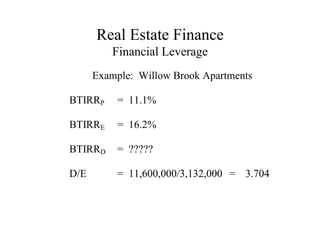

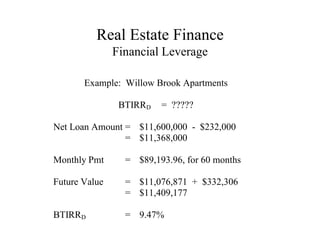

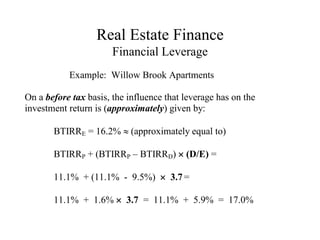

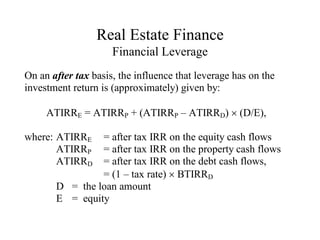

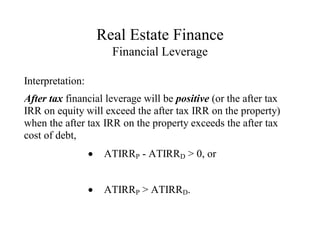

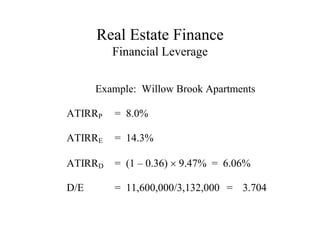

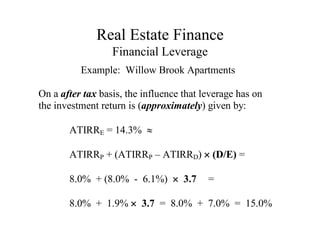

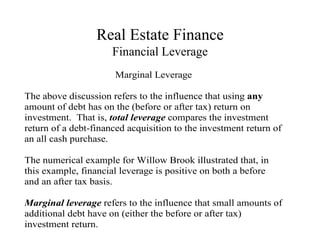

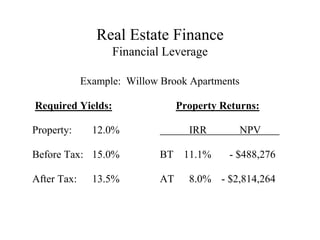

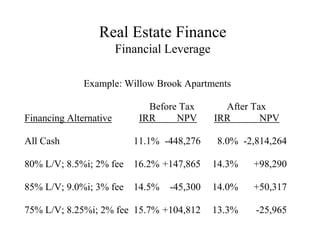

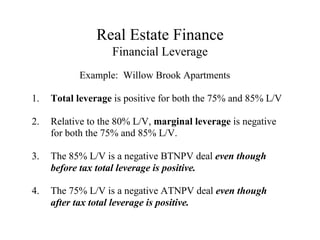

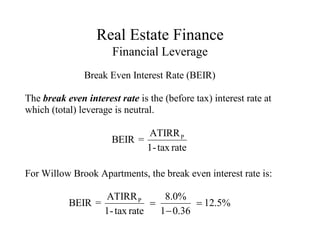

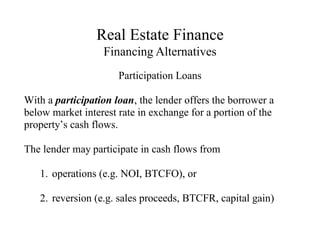

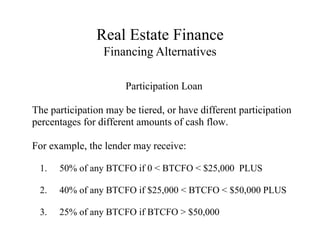

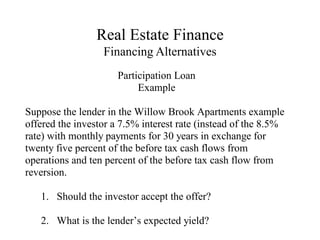

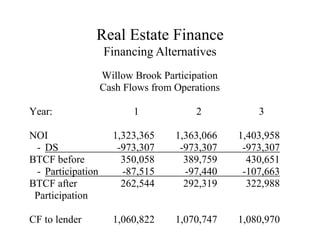

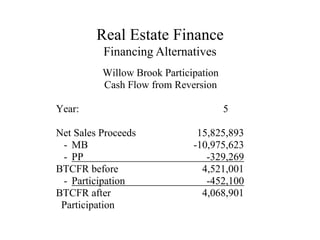

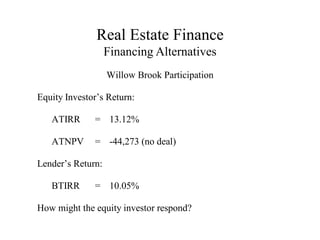

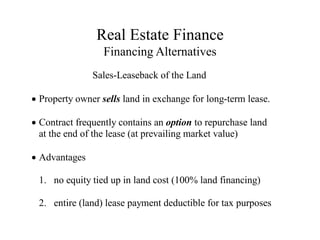

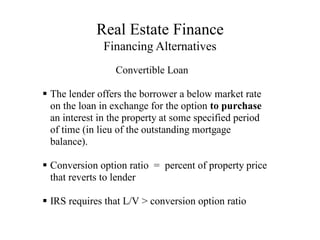

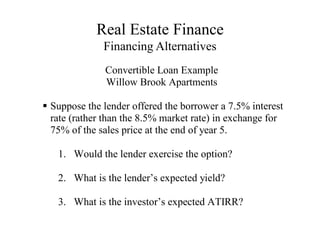

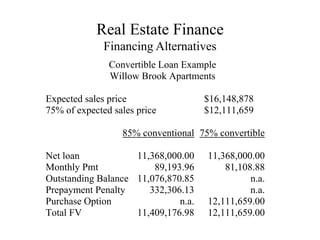

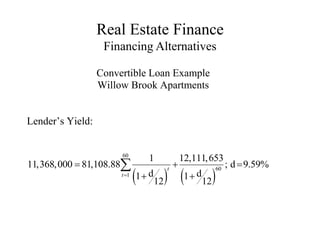

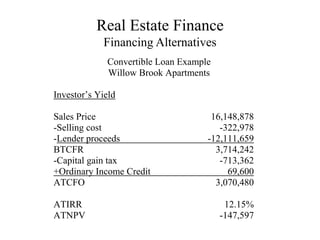

This document discusses financial leverage and various financing alternatives for real estate investments. It defines financial leverage as the relationship between investment return and amount of debt financing. Total leverage compares returns with and without debt, while marginal leverage looks at small amounts of additional debt. The document provides an example analyzing total and marginal leverage for the Willow Brook Apartments project. It then discusses various financing structures like participation loans, sale-leasebacks, interest-only loans, accrual loans, and convertible mortgages. Examples are provided to illustrate how these alternatives could impact investment returns.