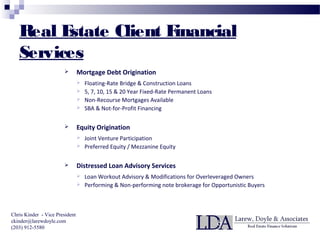

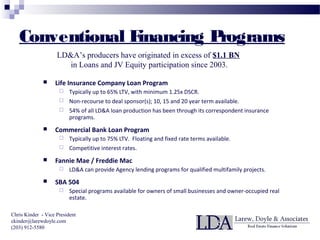

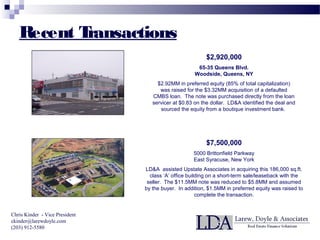

Larew, Doyle & Associates LLC is a commercial real estate financing firm with over 50 years of combined experience, offering mortgage and equity solutions, as well as distressed asset assistance. The firm has originated over $1.1 billion in loans since 2003 and operates from four offices in Connecticut, New York, and Rhode Island. Their services include mortgage debt origination, loan modifications, and distressed asset brokerage to help clients navigate challenging financial situations.