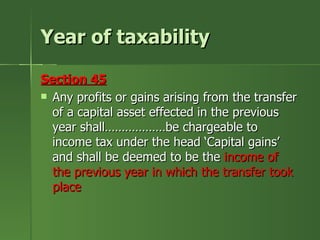

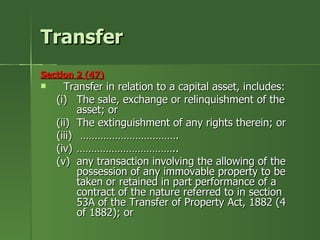

The document discusses various taxability issues related to real estate transactions in India. Some key points:

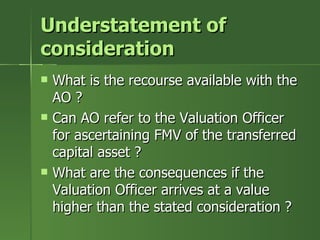

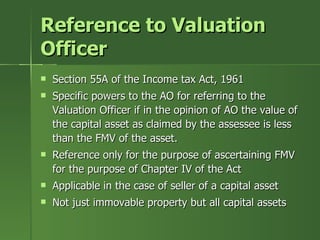

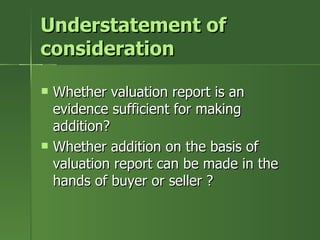

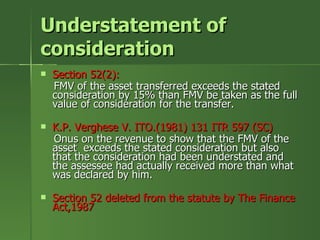

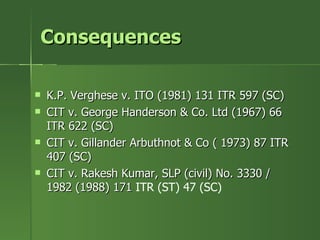

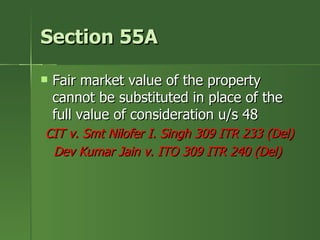

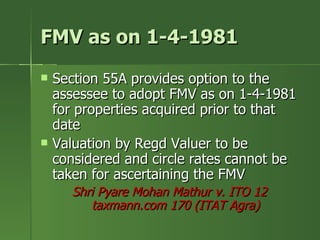

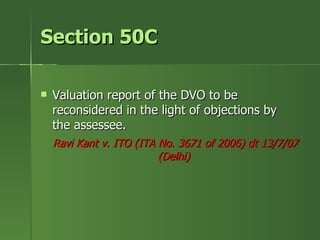

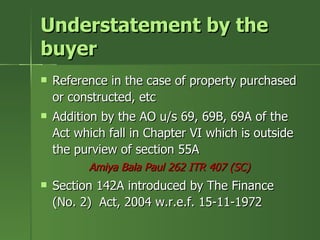

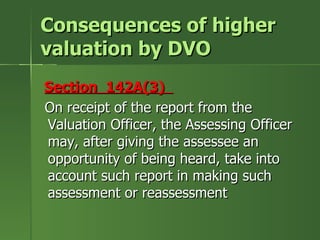

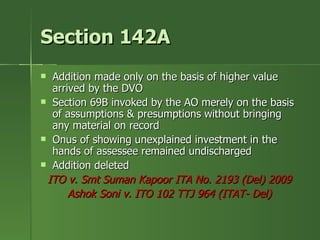

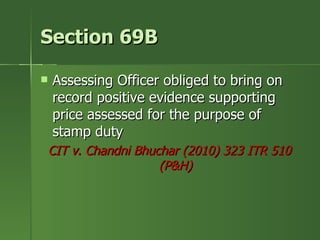

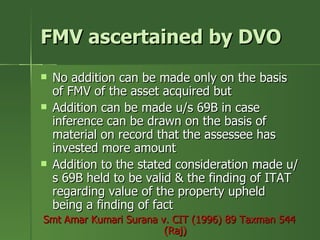

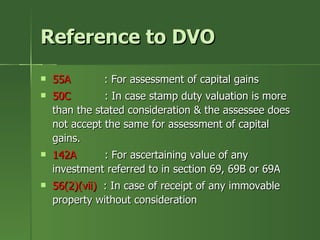

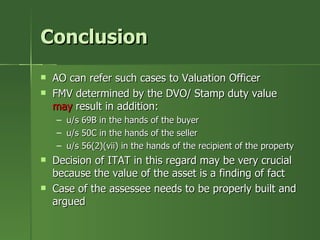

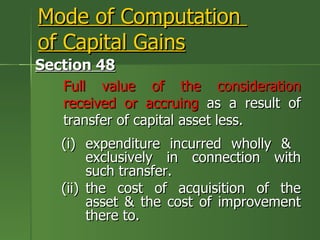

1) The Income Tax Act allows the Assessing Officer to refer cases of understated consideration to the Valuation Officer to determine the fair market value of the capital asset for capital gains purposes.

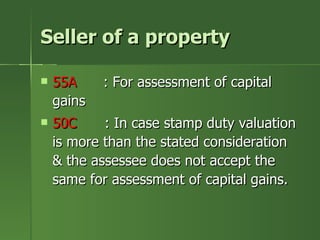

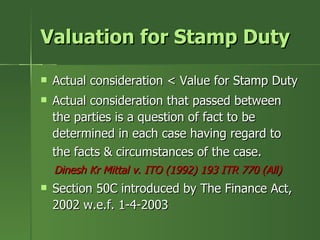

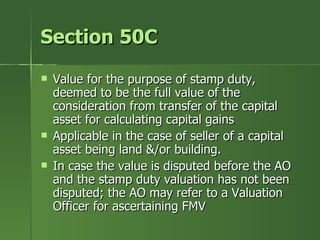

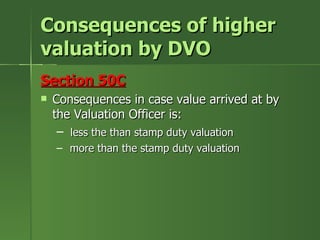

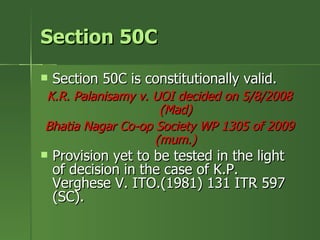

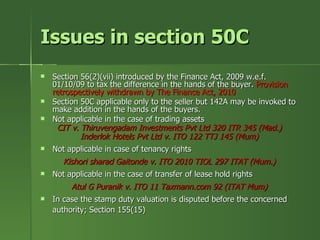

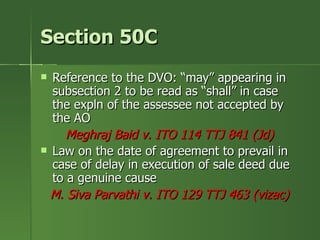

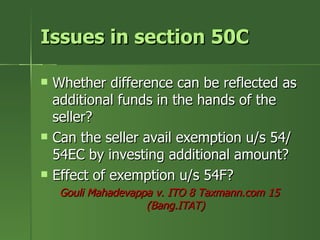

2) For sellers of property, Section 50C deems the stamp duty valuation to be the full value of consideration if it is higher than the stated value.

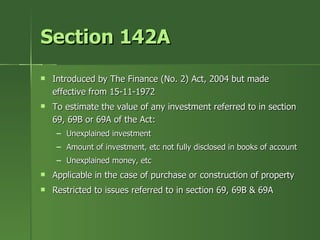

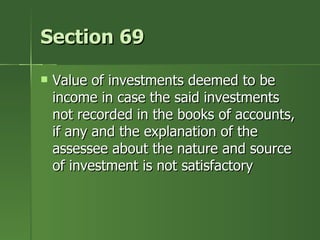

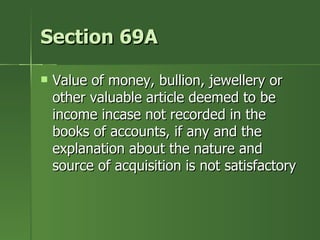

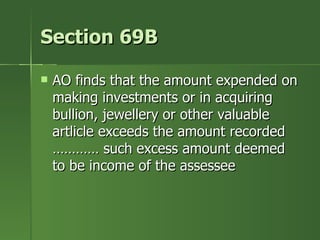

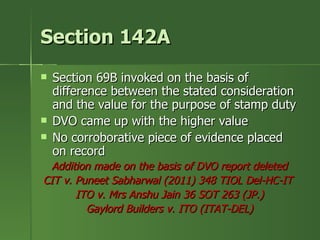

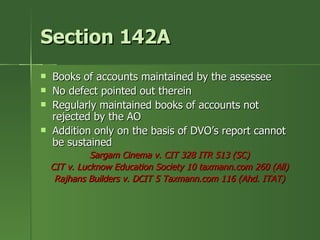

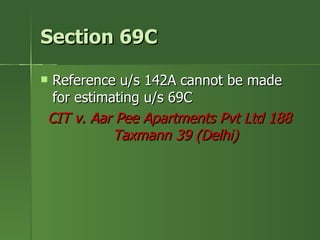

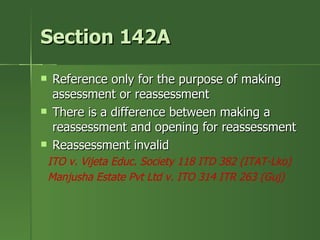

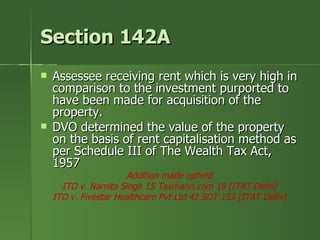

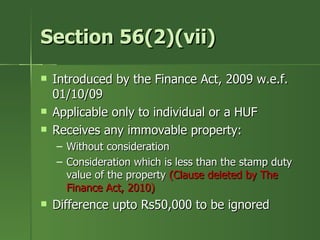

3) For buyers, Section 142A allows reference to the Valuation Officer to estimate the value of investments if the source of funds is not adequately explained under Sections 69, 69A or 69B.

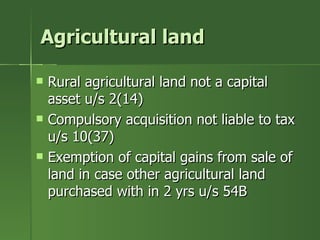

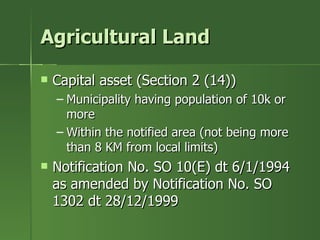

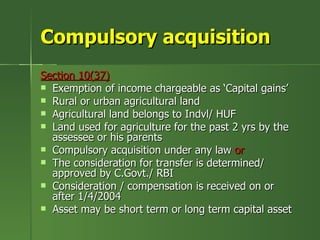

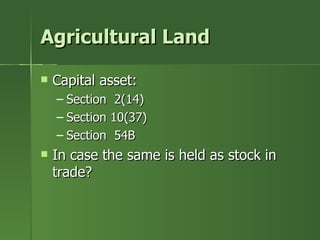

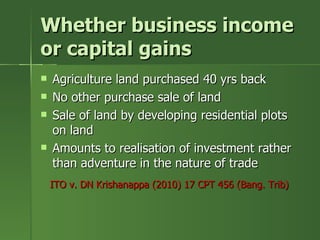

4) Agricultural land may be exempt from