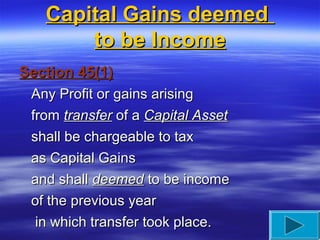

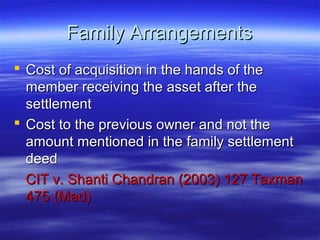

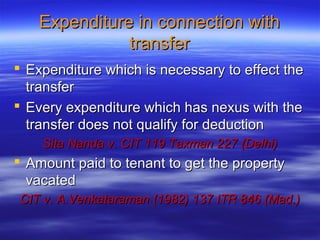

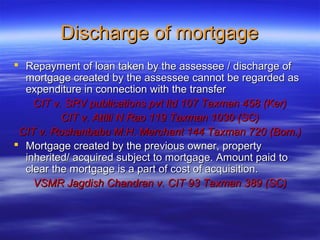

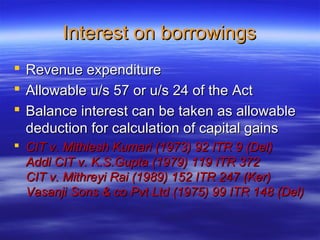

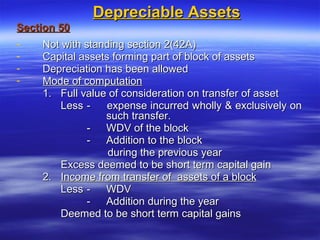

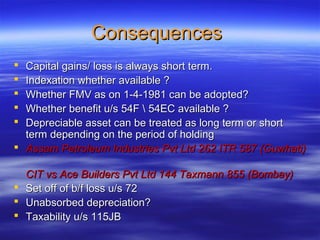

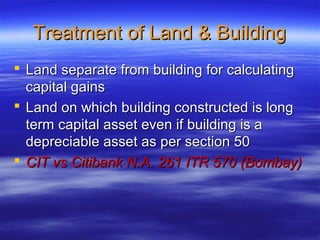

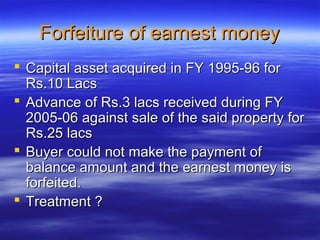

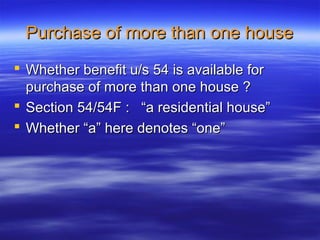

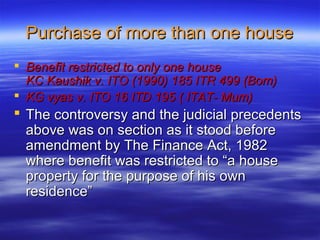

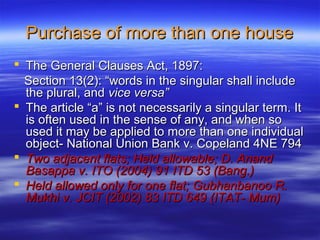

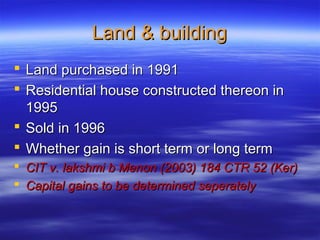

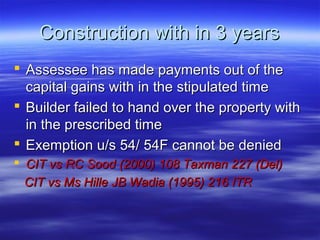

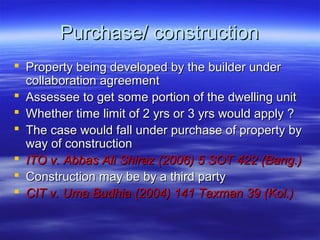

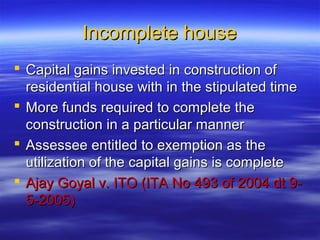

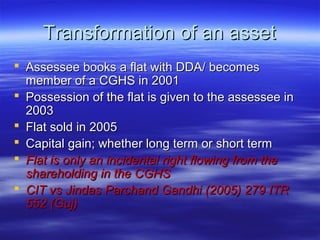

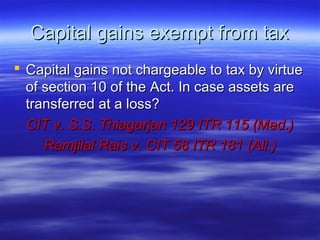

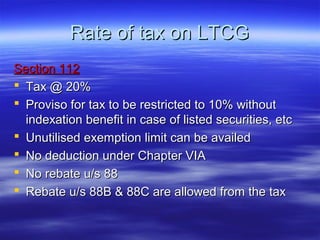

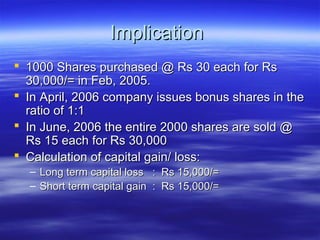

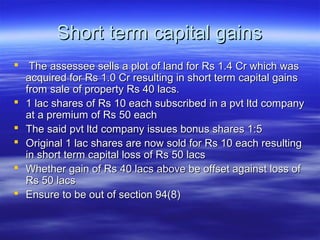

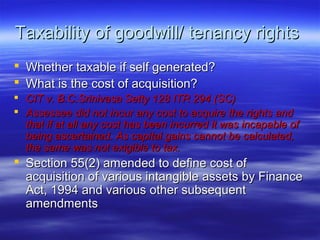

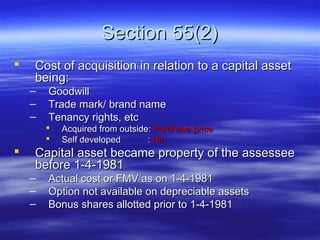

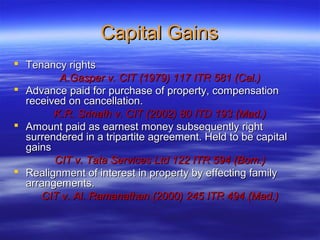

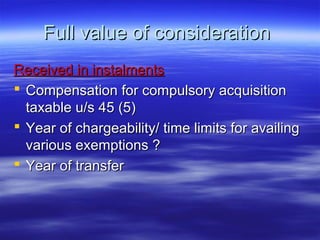

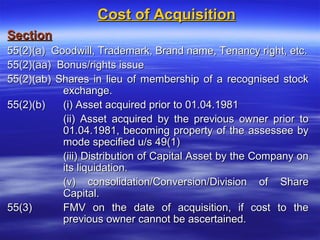

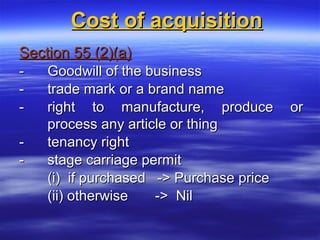

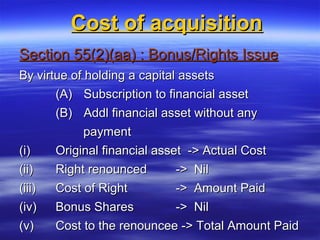

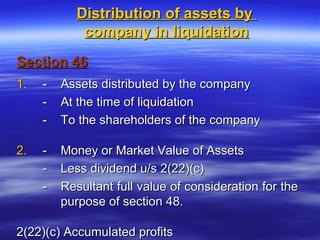

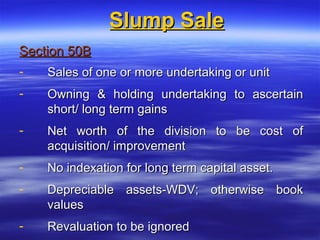

1. The document discusses various aspects related to capital gains tax in India including understatement of consideration, reference to valuation officers, transfers between partners and firms, family arrangements, computation of capital gains, and short term versus long term capital assets.

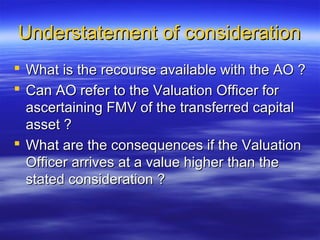

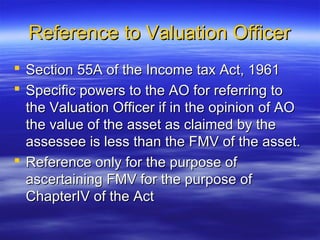

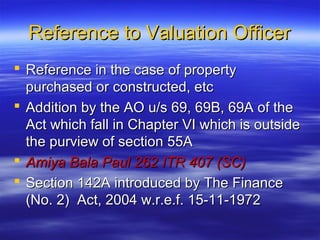

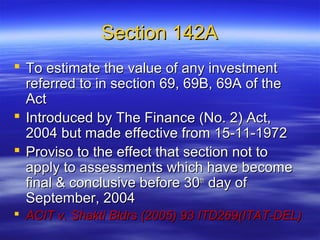

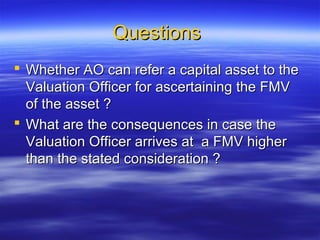

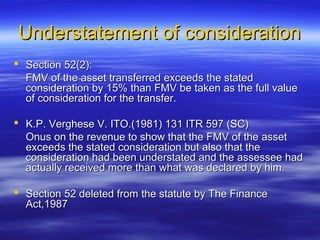

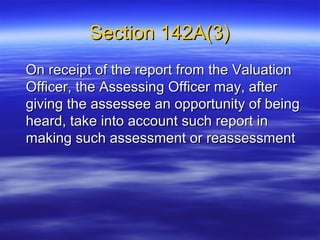

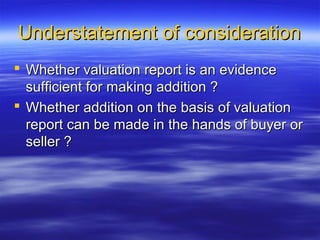

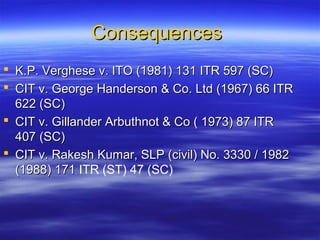

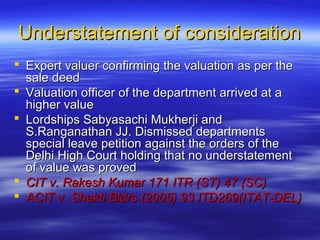

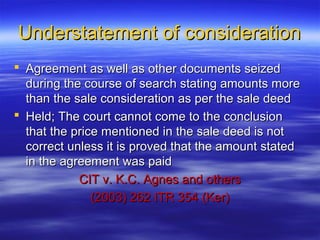

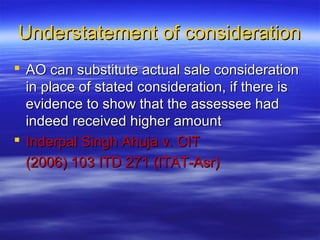

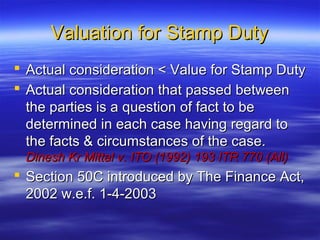

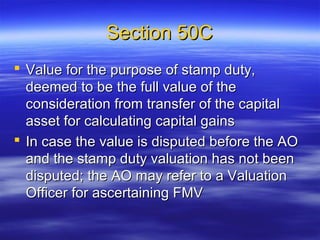

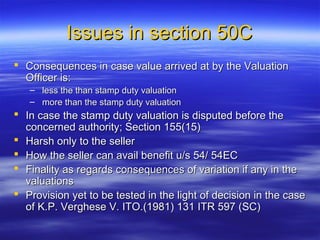

2. It explains the powers of assessing officers to refer cases to valuation officers if the stated consideration is lower than fair market value and the consequences if the valuation officer arrives at a higher value.

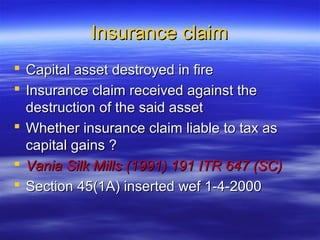

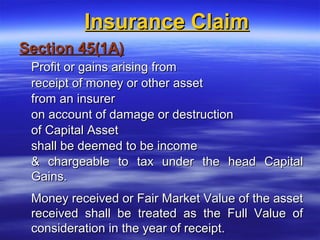

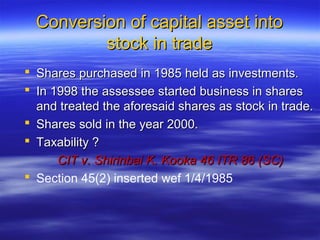

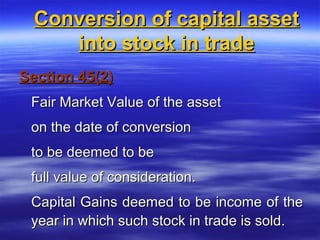

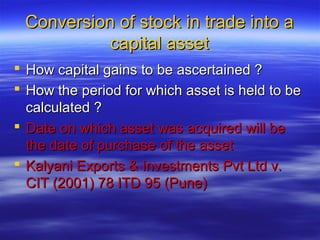

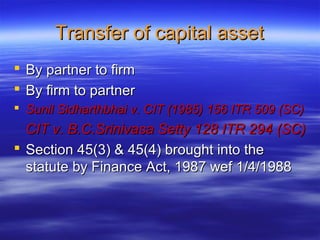

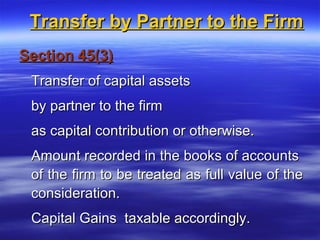

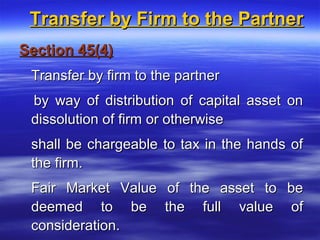

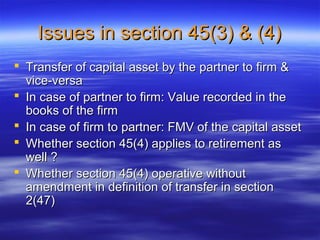

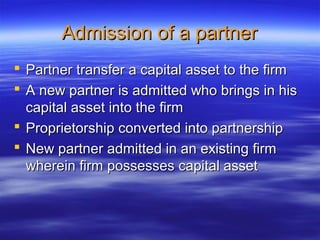

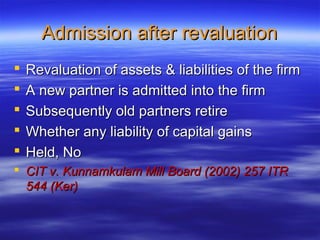

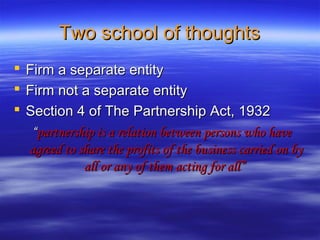

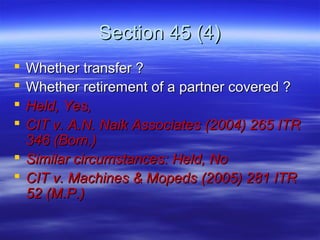

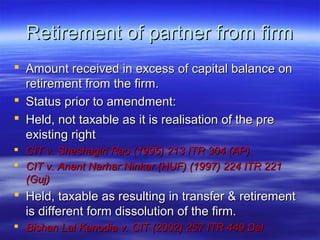

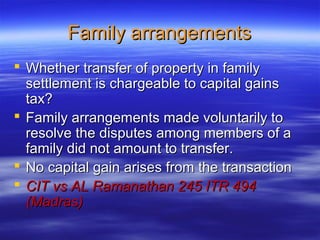

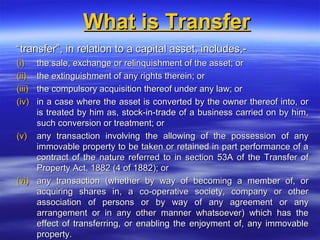

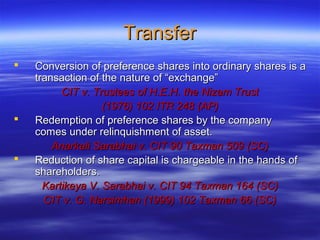

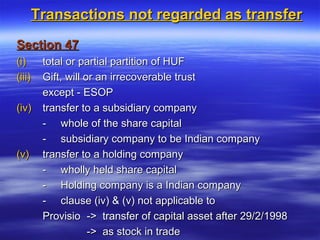

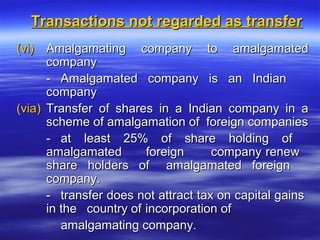

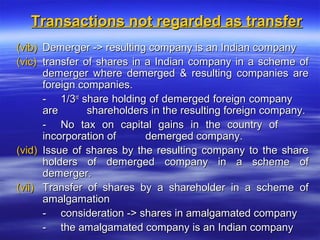

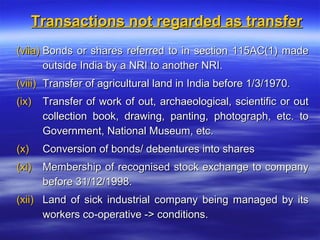

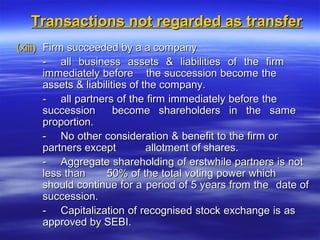

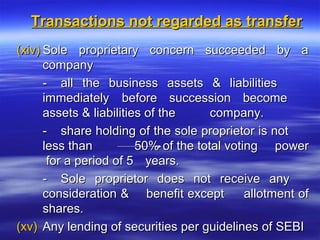

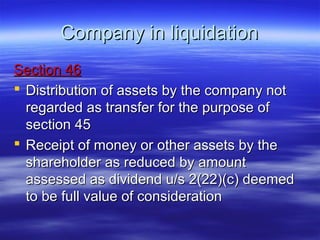

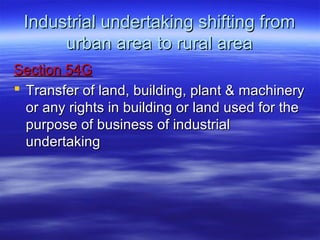

3. The treatment of various transfers like between partners and firms, conversion of assets, insurance claims, and retirement of partners is explained citing relevant case laws and tax law sections.