QNBFS Daily Market Report February 13, 2019

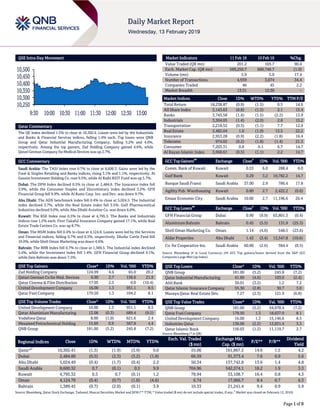

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QE Index declined 1.3% to close at 10,302.4. Losses were led by the Industrials and Banks & Financial Services indices, falling 1.4% each. Top losers were QNB Group and Qatar Industrial Manufacturing Company, falling 5.2% and 4.6%, respectively. Among the top gainers, Zad Holding Company gained 4.6%, while Qatari German Company for Medical Devices was up 2.7%. GCC Commentary Saudi Arabia: The TASI Index rose 0.7% to close at 8,600.3. Gains were led by the Food & Staples Retailing and Banks indices, rising 3.1% and 1.1%, respectively. Al Gassim Investment Holding Co. rose 9.5%, while Al Rajhi REIT Fund was up 5.7%. Dubai: The DFM Index declined 0.5% to close at 2,484.8. The Insurance index fell 3.9%, while the Consumer Staples and Discretionary index declined 3.2%. GFH Financial Group fell 9.9%, while Al Ramz Corp. Inv. and Dev. was down 9.7%. Abu Dhabi: The ADX benchmark index fell 0.4% to close at 5,024.5. The Industrial index declined 3.7%, while the Real Estate index fell 3.5%. Gulf Pharmaceutical Industries declined 9.0%, while Abu Dhabi Aviation Co. was down 6.8%. Kuwait: The KSE Index rose 0.5% to close at 4,795.3. The Banks and Industrials indices rose 1.2% each. First Takaful Insurance Company gained 17.1%, while Real Estate Trade Centers Co. was up 8.7%. Oman: The MSM Index fell 0.4% to close at 4,124.8. Losses were led by the Services and Financial indices, falling 0.7% and 0.3%, respectively. Dhofar Cattle Feed fell 10.0%, while Shell Oman Marketing was down 4.6%. Bahrain: The BHB Index fell 0.7% to close at 1,389.5. The Industrial index declined 5.4%, while the Investment index fell 1.4%. GFH Financial Group declined 9.1%, while Zain Bahrain was down 7.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Zad Holding Company 124.99 4.6 65.0 20.2 Qatari German Co for Med. Devices 6.90 2.7 136.6 21.9 Qatar Cinema & Film Distribution 17.05 2.5 0.0 (10.4) United Development Company 16.00 1.3 951.1 8.5 Qatar Fuel Company 179.50 1.3 104.2 8.1 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% United Development Company 16.00 1.3 951.1 8.5 Qatar Aluminium Manufacturing 12.08 (0.3) 689.4 (9.5) Vodafone Qatar 8.00 (1.0) 621.6 2.4 Mesaieed Petrochemical Holding 15.69 0.9 567.8 4.4 QNB Group 181.00 (5.2) 245.8 (7.2) Market Indicators 11 Feb 19 10 Feb 19 %Chg. Value Traded (QR mn) 201.2 105.7 90.4 Exch. Market Cap. (QR mn) 589,250.7 600,746.7 (1.9) Volume (mn) 5.9 5.0 17.4 Number of Transactions 4,939 3,674 34.4 Companies Traded 46 45 2.2 Market Breadth 13:31 12:30 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,238.87 (0.9) (1.5) 0.5 14.6 All Share Index 3,143.63 (0.8) (1.5) 2.1 15.4 Banks 3,745.58 (1.4) (1.5) (2.2) 13.9 Industrials 3,304.05 (1.4) (2.0) 2.8 15.2 Transportation 2,218.52 (0.5) (1.1) 7.7 12.9 Real Estate 2,482.04 1.0 (1.0) 13.5 22.2 Insurance 2,953.28 (0.9) (2.2) (1.8) 16.4 Telecoms 974.02 (0.2) (1.8) (1.4) 21.3 Consumer 7,203.31 0.8 0.1 6.7 14.7 Al Rayan Islamic Index 3,968.61 (0.5) (1.1) 2.2 14.7 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Comm. Bank of Kuwait Kuwait 0.53 6.0 288.4 6.0 Gulf Bank Kuwait 0.29 3.2 19,782.2 14.7 Banque Saudi Fransi Saudi Arabia 37.00 2.9 786.4 17.8 Agility Pub. Warehousing Kuwait 0.80 2.7 2,422.2 (0.6) Emaar Economic City Saudi Arabia 10.00 2.7 11,196.6 26.4 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% GFH Financial Group Dubai 0.90 (9.9) 63,801.3 (0.4) Aluminium Bahrain Bahrain 0.45 (5.5) 131.9 (25.3) Shell Oman Marketing Co. Oman 1.14 (4.6) 548.5 (23.6) Aldar Properties Abu Dhabi 1.43 (3.4) 13,547.8 (10.6) Co. for Cooperative Ins. Saudi Arabia 60.00 (2.6) 384.4 (0.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% QNB Group 181.00 (5.2) 245.8 (7.2) Qatar Industrial Manufacturing 41.69 (4.6) 103.0 (2.4) Ahli Bank 30.01 (3.2) 1.2 7.2 Qatar Islamic Insurance Company 55.30 (2.8) 30.7 3.0 Mazaya Qatar Real Estate Dev. 7.27 (2.3) 121.9 (6.8) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 181.00 (5.2) 44,978.4 (7.2) Qatar Fuel Company 179.50 1.3 18,637.9 8.1 United Development Company 16.00 1.3 15,146.6 8.5 Industries Qatar 138.00 (2.2) 13,831.4 3.3 Qatar Islamic Bank 156.03 (1.2) 11,119.7 2.7 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar*# 10,302.41 (1.3) (1.9) (3.9) 0.0 55.06 161,867.2 14.6 1.5 4.2 Dubai 2,484.80 (0.5) (2.3) (3.2) (1.8) 66.59 91,373.4 7.6 0.9 5.6 Abu Dhabi 5,024.49 (0.4) (1.7) (0.4) 2.2 50.34 137,742.8 13.6 1.4 4.8 Saudi Arabia 8,600.32 0.7 (0.1) 0.5 9.9 704.96 542,574.1 18.2 1.9 3.3 Kuwait 4,795.32 0.5 0.7 (0.1) 1.2 78.94 33,108.7 16.4 0.8 4.3 Oman 4,124.79 (0.4) (0.7) (1.0) (4.6) 6.74 17,966.7 8.4 0.7 6.3 Bahrain 1,389.45 (0.7) (2.0) (0.1) 3.9 10.33 21,241.4 9.4 0.9 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and DFM (** TTM; * Value traded ($ mn) do not include special trades, if any, # Market was closed on February 12, 2019) 10,250 10,300 10,350 10,400 10,450 10,500 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QE Index declined 1.3% to close at 10,302.4. The Industrials and Banks & Financial Services indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. QNB Group and Qatar Industrial Manufacturing Company were the top losers, falling 5.2% and 4.6%, respectively. Among the top gainers, Zad Holding Company gained 4.6%, while Qatari German Company for Medical Devices was up 2.7%. Volume of shares traded on Tuesday rose by 17.4% to 5.9mn from 5.0mn on Monday. However, as compared to the 30-day moving average of 9.2mn, volume for the day was 35.5% lower. United Development Company and Qatar Aluminium Manufacturing Company were the most active stocks, contributing 16.1% and 11.7% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Al Yamamah Steel Industries Co. Saudi Arabia SR 198.8 -21.2% -28.6 – -30.2 – Fawaz Abdulaziz Alhokair Co. Saudi Arabia SR 1,233.0 -8.6% 85.2 -17.4% 26.5 -45.5% Tihama Advertising and Public Relations Co. Saudi Arabia SR 38.8 34.7% 1.5 1400.0% 1.5 87.5% United Foods Company Dubai AED 451.2 0.1% – – 19.1 -3.9% Amlak Finance Dubai AED 342.0 -5.8% -13.5 N/A -125.6 N/A Alliance Insurance Dubai AED 291.4 0.5% 49.9 -8.8% 51.3 6.4% GFH Financial Group Dubai USD 246.2 20.5% – – 114.1 9.5% Reem Investments Abu Dhabi AED – – – – 420.6 -57.2% Ras Al Khaimah Co. for White Cement & Const. Materials Abu Dhabi AED 228.1 -9.9% 5.5 -72.4% 13.0 -57.3% Al Khaleej Investment Abu Dhabi AED 26.0 -6.5% 22.7 -6.2% 5.9 -81.2% Abu Dhabi Aviation Abu Dhabi AED 1,806.8 12.5% – – 231.4 -5.0% Emirates Driving Company Abu Dhabi AED 201.9 -14.2% – – 94.4 -9.4% Zain Bahrain Bahrain BHD 66.2 -10.2% 5.1 12.5% 5.2 20.2% Delmon Poultry Co. Bahrain BHD 15.9 10.1% 0.3 N/A 0.4 N/A Bahrain Cinema Company Bahrain BHD – – – – 4.2 -87.8% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/11 UK UK Office for National Statistics GDP QoQ 4Q 2018 0.2% 0.3% 0.6% 02/11 UK UK Office for National Statistics GDP YoY 4Q 2018 1.3% 1.4% 1.5% 02/11 UK UK Office for National Statistics Industrial Production MoM December -0.5% 0.1% -0.3% 02/11 UK UK Office for National Statistics Industrial Production YoY December -0.9% -0.5% -1.3% 02/11 UK UK Office for National Statistics Manufacturing Production MoM December -0.7% 0.2% -0.1% 02/11 UK UK Office for National Statistics Manufacturing Production YoY December -2.1% -1.1% -1.2% 02/11 UK UK Office for National Statistics GDP (MoM) December -0.4% 0.0% 0.2% 02/11 IN India Central Statistical Organization CPI YoY January 2.1% 2.5% 2.1% 02/11 IN India Central Statistical Organization Industrial Production YoY December 2.4% 1.6% 0.3% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 29.40% 43.25% (27,871,213.76) Qatari Institutions 21.64% 13.79% 15,792,950.91 Qatari 51.04% 57.04% (12,078,262.85) GCC Individuals 0.61% 2.01% (2,810,272.35) GCC Institutions 5.56% 4.71% 1,707,498.61 GCC 6.17% 6.72% (1,102,773.74) Non-Qatari Individuals 9.14% 9.03% 226,659.82 Non-Qatari Institutions 33.65% 27.21% 12,954,376.77 Non-Qatari 42.79% 36.24% 13,181,036.59

- 3. Page 3 of 9 Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status GISS Gulf International Services 13-Feb-19 0 Due DOHI Doha Insurance Group 13-Feb-19 0 Due ORDS Ooredoo 13-Feb-19 0 Due MPHC Mesaieed Petrochemical Holding Company 14-Feb-19 1 Due QAMC Qatar Aluminum Manufacturing Company 20-Feb-19 7 Due QOIS Qatar Oman Investment Company 20-Feb-19 7 Due MERS Al Meera Consumer Goods Company 24-Feb-19 11 Due QFLS Qatar Fuel Company 25-Feb-19 12 Due BRES Barwa Real Estate Company 25-Feb-19 12 Due QISI The Group Islamic Insurance Company 25-Feb-19 12 Due QNNS Qatar Navigation (Milaha) 25-Feb-19 12 Due QCFS Qatar Cinema & Film Distribution Company 26-Feb-19 13 Due MCCS Mannai Corporation 26-Feb-19 13 Due SIIS Salam International Investment Limited 6-Mar-19 21 Due Source: QSE News Qatar IQCD reports 4Q2018 net income moderately below our estimate; DPS of QR6 below our estimate of QR7; Maintain Market Perform – Industries Qatar's (IQCD) net profit rose 25.7% YoY (but declined 8.5% on QoQ basis) to QR1,203.9mn in 4Q2018; our estimate was QR1,282.7mn (variation of -6.1%). The miss vs. our model was across the board for segments. For steel, gross profits (on a cash basis, ex. depreciation and amortization) fell short by 16.5% vs. our estimate despite steel gross margins coming in at 15% vs. our estimate of 14.8% as steel revenue at QR1,234.0mn (-15.2% YoY,-19.5% QoQ) fell below our estimate. In terms of JV income (representing the company’s share of petrochemicals and fertilizer segments), IQCD reported QR952.1mn (+16.3% YoY, -11.3% QoQ), again falling 17.5% lower than our forecast of QR1,154.2mn. Income from associates surprised positively given a nice uptick from Foulath Holding (steel company in Bahrain). As expected, IQCD wrote-off its remaining carrying value in SOLB Steel (KSA) to the tune of QR49.5mn; the company also recognized QR389mn (of its maximum exposure of QR489mn) as provisions on financial guarantees given to lenders in SOLB Steel. In FY2018, IQCD reported a 51.7% YoY jump in net profit to QR5.0bn in FY2018 on increased product prices and sales volume. Sales volumes increased marginally vs. 2017 (about 4%) and reached a new record for the group; according to the press release, production volumes remained stable despite some planned and unplanned maintenance at some facilities. In petrochemicals, sales volumes improved YoY, as some plants returned to normal levels following unplanned outages in early 2017. Fertilizer sales volumes were almost flat despite a few planned and unplanned outages, while those in the steel segment saw significant growth on 2017, as billets started to be sold externally (was being used in the UAE steel facility previously). The company also noted product prices saw around 12% growth over 2017, mostly driven by strength in urea in 2H2018 and uptick in steel prices following iron ore recovery and shortage of some key consumables; IQCD also benefited from its new steel marketing strategy (the company is selling its steel volumes through Muntajat from May 2018 onward). PE prices improved slightly driven by strength in crude. On a like-for-like basis, management reporting revenue, assuming proportionate consolidation came in at QR16.3bn, which grew by 16% on 2017 but was below our estimate of QR16.5bn. IQCD continues to maintain a very strong balance sheet with group cash reaching QR13.1bn with debt of just QR26mn. Finally, IQCD recommended a cash DPS of QR6 (4.3%, a payout ratio of 72.2%), up 20% YoY but below our forecast of QR7. We continue to recommend a Market Perform on the shares with a PT of QR26. (QNB FS Research, Company releases, QSE) VFQS reports ~QR43mn net profit in 4Q2018, beating our estimate; DPS of QR0.25 a positive; Market Perform – Vodafone Qatar (VFQS) reported net profit of ~QR43mn in 4Q2018 as compared to a net loss of QR28.6mn in 4Q2017, and net profit of QR26.7mn in 3Q2018, besting our estimate of QR38.8mn (variation of ~+10%).The company's revenue came in at ~QR566mn in 4Q2018, which represents an increase of ~6% YoY (~+17% QoQ). In FY2018, VFQS posted a net profit of QR118mn, its first ever-profitable year, resulting in a significant increase of QR374mn compared to the year before. VFQS’ total revenue returned to YoY growth for the first time in four years, increasing 5.1% to reach QR2.1bn in 2018, driven by growth in postpaid, fixed and handset revenue. EBITDA for the reported period stood at QR584mn, representing an increase of 8.5% compared to last year, positively impacted by higher revenue and lower costs. As a result, the EBITDA margin improved by 0.9 percentage points to reach 27.8%. The company’s board of directors recommended the distribution of a cash dividend of 5% of the nominal share value, i.e. QR0.25 per share. Our DPS estimate was QR0.10 but we had alluded to possible upside to our DPS estimate previously. VFQS is now serving 1,417,000 customers. Postpaid customers grew nicely last year by 24.1%, due to the innovative products and the popularity of Vodafone’s ‘FLEX’, ‘Red’ and ‘Enterprise’ plans. Reflecting the company’s growth in the postpaid segment, the total average revenue per user (ARPU) for the year stood at QR105, a 5.6% YoY growth. We believe these are a decent set of results and the DPS upside will be taken positively by some investors but retain our Market Perform rating on valuation. (QNB FS Research, Company releases, Gulf-Times.com, QSE)

- 4. Page 4 of 9 BRES signs a financing agreement with a Qatari local bank – Barwa Real Estate Company (BRES) has announced signing a new financing agreement of QR1,200mn with a Qatari local bank. The purpose of the agreement is to finance a part of the company’s capital expenditures during the year 2019. The new facility period is 7 years from the date of the drawdown. It should be noted that there is no conflict of interest between the contracting parties to this agreement. (QSE) AHCS’ board meets to discuss the financial statements ended December 31, 2018 on February 27, 2019 – Aamal Company (AHCS) announced that its board of directors will meet on February 27, 2019 to discuss and adopt financial statements of the company for the period ended December 31, 2018. (QSE) QNCD embarks on strategy to diversify its product portfolio – Qatar National Cement Company (QNCD) embarked on a multi- pronged strategy that not only aims to diversify the product portfolio through adding new products to meet the growing local demand, but also explore export markets. This year’s roadmap of the company includes continued support to the infrastructure of the country to meet the market demand of various products with high quality standard and competitive price. In his address to the shareholders at the Annual General Assembly, QNCD’s Chairman and Managing Director, Salem bin Butti Al-Naimi highlighted its efforts to diversify the production by adding new types of cement to meet the demand of local market and utilize the opportunity of exporting to external markets. Having operationalized the fifth plant, with a production capacity of 5,500 tons per day, the company has been able to fully meet the local demand and is now exploring options to export to markets in Oman, Iraq and Yemen. The Ordinary General Assembly saw shareholders’ approval for 50% cash dividend and the according of nod for the board’s suggestion of 1:10 stock split. The company is also seeking to optimize the production capacity of washed sand and calcium carbonate to meet the expected local market demand to achieve its targeted goals. For the first time in Qatar, the company started production of white cement, targeting utilization of production capacity and diversification of products. (Gulf- Times.com) Qatar’s PMI points to sharp rise in employment after the blockade – The operationalization of 40 new Qatari-owned manufacturing units, especially after the blockade, substantially enhanced employment, particularly within the non-energy private sector, thus helping Qatar’s PMI (Purchasing Managers Index) touch a six-month high in January, according to the Qatar Financial Centre (QFC). “Businesses remained strongly confident regarding expected activity at the start of 2019,” QFC stated, adding that driving the latest improvement was a series-record increase in employment, while both short-term output and new business measures ebbed slightly. Highlighting the sharp rise in employment, QFC stated companies in the non-hydrocarbon private sector raised headcounts at the strongest rate since the survey began in April 2017. The PMI was at 50.5 in January, up from 50.1 in December, remaining at a level broadly consistent with the about 2% annual growth in Qatari economy. The PMI was also boosted by a record expansion of input stocks, which reflected confidence among companies regarding future growth prospects, according to Sheikha Alanoud bint Hamad Al-Thani, Managing Director, Business Development, QFC Authority. In a further sign of a healthy labor market, wages and salaries increased at the fastest pace on record since July 2018, she added. (Gulf-Times.com) Qatari banking sector optimistic about new PPP model for schools – Qatar's banking industry appears optimistic about the new Public Private Partnership (PPP) model in the schooling sector, even as the sector is awaiting finer details. The PPP, the first of its kind in the social infrastructure of the country, provides for special purpose vehicle (SPV), which can source funding for the private sector for the construction of 45 public schools at an estimated capital expenditure of more than QR4bn in the next five years. The guaranteed payment and the government's shouldering of demand risk are particularly seen by the lending community as the positive micro elements in the new model. "We are yet to see the fine print (about the details regarding the special purpose vehicle that could be created and the funding mechanism)," a source in the banking sector said. Real estate is one of the sectors that have received renewed attention by the banking sector, which had extended QR198.8bn credit to the segment at the end of December 2018. The announced projects will be divided into six investment packages and be offered to the private sector at successive intervals. The first package consists of eight schools to be launched during the first quarter of this year. (Gulf-Times.com) Qatargas’ CEO: Natural gas plays major role in energy transition – Qatargas’ CEO, Sheikh Khalid bin Khalifa Al-Thani has underscored the significance of Liquefied Natural Gas (LNG) as a destination fuel in the future of energy, playing a major role in the ‘energy transition’ the world is embarking on. The CEO was speaking at a ‘CEO Conclave’ titled ‘Shaping the New Energy World’ held as part of the 13th International Oil & Gas Conference and Exhibition-Petrotech 2019. Sheikh Khalid said, “Natural gas remains the fastest growing fossil fuel globally, benefiting from its flexibility, competitive economics, and low emissions profile. Thus, natural gas is called to play a major role in the energy transition, supported by the industrialization and power demand particularly in emerging countries in Asia and Africa, and the continued ‘coal to gas’ switch, especially in India and China.” (Gulf-Times.com) Qatar to weigh Dollar bond sale to cement access to markets – Qatar is weighing plans to tap international bond markets as the gas-rich nation seeks to cement its status as a regular issuer, according to sources. Government officials are in talks with banks to gauge interest for a potential sale, sources added. Qatar will sell the bonds to underpin its relationship with global investors rather than meet budgetary needs. A sale could happen as soon as the first half of the year. The world’s biggest exporter of liquefied natural gas, whose debt carries the fourth- highest investment grade at S&P Global Ratings, raised $12bn from a bond sale in April. (Bloomberg) Qatari stake in Rosneft paves way for global energy deals – Qatari sovereign wealth fund's acquisition of a stake in Russia's Rosneft sets the stage for collaboration between the Russian oil major and Qatar Petroleum, Qatar's Ambassador to Moscow, Fahad bin Mohamed Al-Attiyah said in an interview with Reuters. Qatar Investment Authority (QIA) became a

- 5. Page 5 of 9 shareholder in Rosneft following the Russian state-controlled oil giant's privatization in late 2016, and now holds a 19% stake. Though Qatar is a small oil producer compared to its massive gas production, state oil firm Qatar Petroleum is on a drive to expand operations globally. The Ambassador said that QIA's stake opened the door to cooperation between Rosneft and Qatar Petroleum in projects around the world. Qatar is seeking international partnerships amid the blockade. (Zawya) International US job openings hit record high; workers more scarce – US job openings surged to a record high in December, led by vacancies in the construction and accommodation and food services sectors, strengthening analysts’ views that the economy was running out of workers. While the release of the Labor Department’s monthly Job Openings and Labor Turnover Survey (JOLTS) underscored labor market strength, there are worries the shortage of workers could hurt an economic expansion that has lasted nine-and-a-half years and is the second longest on record. Job openings, a measure of labor demand, increased by 169,000 to a seasonally-adjusted 7.3mn in December, the highest reading since the series started in 2000. That lifted the job openings rate to 4.7% from 4.6% in November. (Reuters) US small business confidence falls to more than two-year low – US small business optimism tumbled last month to its lowest level since President Donald Trump’s election more than two years ago amid growing uncertainty over the economic outlook. The National Federation of Independent Business stated its Small Business Optimism Index dropped 3.2 points to 101.2 in January, the weakest reading since November 2016. The index surged after Trump’s electoral victory, boosted by his administration’s $1.5tn tax cut package and deregulation policy. It has declined for five straight months since hitting an all-time high last August, but remains high by historic standards. (Reuters) US household debt in 2018 jumps nearly $400bn – Total debt held by US households surged by nearly $400bn in 2018 to more than $13.5tn, marking the sixth straight annual increase, even as home mortgages declined, according to released data. That puts total debt $869bn higher than the previous peak, just before the start of the global financial crisis in late 2008, the New York Federal Reserve Bank stated in its quarterly report. A decade after the crisis, mortgage debt increased $242bn to $9.1tn, but new home loans originated last year fell $131bn to the lowest point in four years, the data showed. (Qatar Tribune) US could extend China trade talk deadline to March 1 – The US President, Donald Trump said he would consider extending the deadline for a trade deal with China beyond March 1. "If we're close to a deal, where we think we can make a real deal, I could see myself letting that slide for a little while," Trump said. However, he added, "Generally speaking I am not inclined to do that." The comments came as the third round of trade negotiations were set to resume in Beijing to avert more than doubling tariffs on $200bn in Chinese imports. (Qatar Tribune) UK’s economy slowest since 2012, as Brexit and global worries weigh – Britain’s economy slowed sharply in late 2018, pushing full-year growth to its weakest in six years as Brexit worries hammered investment by companies and the global economic slowdown weighed on trade, official data showed. The pace of economic growth fell to a quarterly rate of 0.2% between October and December from 0.6% in the previous quarter, in line with forecasts in a Reuters poll, while output in December alone dropped by the most since 2016. For 2018 as a whole, growth dropped to its lowest since 2012 at 1.4%, down from 1.8% in 2017. Exports suffered from global weakness and consumers and businesses grew increasingly concerned about the lack of a plan for when Britain is due to leave the European Union on March 29. (Reuters) German trade surplus with US declined in 2018 but was still almost EUR49bn – Germany’s trade surplus with the US, a frequent source of tension with US President, Donald Trump, declined last year but nonetheless remained at around EUR49bn, Reuters showed. Trump has frequently criticized the large trade surplus that Europe’s biggest economy has with the US and has threatened to put tariffs on German cars in return. Preliminary calculations from the Federal Statistics Office showed that German exports to the US rose by 1.5% to a record high of EUR113.5bn in 2018. That meant the US remained the biggest buyer of Made in Germany goods - ahead of France, which purchased EUR105bn worth, and China, which bought EUR93bn worth. German imports from the US increased by around 4% to EUR64.6bn. That meant the surplus with the US was around a billion Euros smaller than in 2017. However it was still the largest surplus Germany has with any country and accounts for more than a fifth of Germany’s overall export surplus of around EUR228bn in 2018. (Reuters) Moody's: October 'opportune time' for Japan to raise sales tax – October is still an opportune time for Japan to raise its sales tax as risks posed by global trade tensions are likely to be temporary, an official at ratings agency Moody’s Investors Service (Moody’s) stated. Christian de Guzman, Vice President of sovereign ratings, also said Japan’s growth outlook remains stable partly because it is supported by accommodative monetary policy. The Bank of Japan can keep its accommodative policy in place for the time being, because the country’s financial sector is robust enough to withstand the current low-interest-rate environment. Moody’s views may help ease some concern that Japan’s economy is not strong enough to withstand an increase in the sales tax needed to pay for rising welfare costs due to its rapidly ageing society. Japan is scheduled to raise the tax to 10% from 8% in October. (Reuters) China's 2018 tourism revenue growth slowest in a decade as economy cools – Growth in China’s tourism revenue fell to its lowest level last year since the global financial crisis a decade ago, official data showed, highlighting growing risk in a fast- growing sector as Chinese consumers became more cautious. Overall tourism earnings grew 10.5% in 2018 from a year earlier to CNY5.97tn, decelerating from 2017’s 15.1% gain and marking its slowest pace of growth since 2008, when it was just 5.8%, data from the Ministry of Culture and Tourism showed. Revenue from tourism accounted for about 11% of GDP in 2018, the ministry stated. Despite the slowdown in domestic tourism spending, more Chinese are opting for international travel, continuing a trend that has made Chinese the world’s biggest spenders on international tourism. In 2018, Chinese people made 149mn international tourist trips, up 14.7% from a year

- 6. Page 6 of 9 earlier, when growth was less than half, the ministry added. (Reuters) Reuters poll: China’s January exports, imports seen falling again in blow to global growth – China’s trade engine likely remained stuck in reverse in January, with imports and exports expected to fall for the second month in a row, adding to concerns the economy may be at risk of a sharper slowdown. China is the world’s largest trading nation, and the extent of the declines will be closely watched by international investors and policymakers as anxiety grows over cooling global demand. Imports are expected to have fallen 10.0% in January from a year earlier, which would be the biggest decline since July 2016, according to the median estimate of 30 economists in a Reuters poll. That compared with a 7.6% drop in December. China’s exports in January also likely contracted, though not as much. Outbound shipments are expected to have fallen 3.2% from a year earlier, compared with the previous month’s 4.4% decline. (Reuters) China says consumption growth likely to slow further this year – Consumption growth in China is very likely to slow further this year as the economy cools, the commerce ministry stated, underlining the rising risks facing the Asian giant as it navigates a trade war with the US. Chinese authorities have already rolled out a flurry of support measures to temper the effects of the trade dispute on businesses and investment, and are counting on the nation’s vast consumer base to cushion a broader economic slowdown. “The medium- to long-term accumulated contradictions and risks throughout economic development are going to become more prominent in 2019. The pressure facing the consumer market will increase and consumption growth is very likely to slow further,” Wang Bin, a commerce ministry official said. (Reuters) India's January retail inflation rate hits 19-month low; industrial output grows 2.4% in December – India’s retail inflation rate fell to 2.05% in January from a year earlier, its lowest since June 2017, government data showed. The decline was due to a fall in food prices and smaller increases in fuel costs. Economists in a Reuters poll predicted retail inflation would edge up to 2.48% in January from the downward revised December figure of 2.11%. India’s industrial output in December rose 2.4% from a year earlier, slightly higher than forecast, government data showed. A Reuters poll of economists had predicted growth of 2.0% for December. December’s growth was much faster than a downwardly revised 0.3% YoY increase in November. (Reuters) Regional Citigroup sees Saudi Arabia, UAE as top Middle East markets for deals this year – Citigroup expects the majority of investment banking opportunities in the Middle East to come from Saudi Arabia and the UAE this year, Citigroup’s Head of Investment Banking, Middle East and Africa, Miguel Azevedo said. The US lender, which is working towards a full banking license in Saudi Arabia, ended a five-decade presence in the Kingdom in 2004 but in 2015 won permission to invest directly in the local stock market and last year gained approval to begin investment banking operations. “I can see real interest awareness and potential demand for Saudi exposure,” he said. He said that a number of companies in Saudi Arabia were working on initial public offerings and that he was optimistic on the level of demand for Saudi Arabian stocks. (Reuters) UK approaches Gulf countries on post-Brexit trade pact – Britain has approached the UAE and other Gulf countries on a possible trade pact after Britain leaves the European Union, the UAE’s Economy Minister, Sultan bin Saeed al-Mansouri said. Such agreements can take years to negotiate, he said. He gave no further details. Britain is due to leave the EU on March 29, but it has yet to find an agreement acceptable to both Brussels and UK lawmakers, raising the prospect of a disorderly exit that could damage the world’s fifth-largest economy. The UK is “looking forward” to a free-trade agreement with the Gulf Cooperation Council (GCC), Liam Fox, the UK state secretary for international trade, said. The GCC comprises the UAE, Qatar, Saudi Arabia, Oman, Kuwait and Bahrain. In 2017, trade between the UAE and UK totaled GBP17.5bn, up 12.3% from 2016, according to official figures. By 2020, the UK government wants that number to increase to about GBP25bn. (Reuters) OPEC cuts oil supply steeply but sees growing 2019 headwinds – OPEC stated that it has cut oil production steeply under a global supply deal, although it flagged headwinds confronting its efforts to prevent a glut this year, including weaker demand and higher rival output. In a monthly report, OPEC said its oil output fell almost 800,000 barrels per day in January to 30.81mn bpd. That is still slightly more than the demand OPEC expects for its crude, on average, in 2019. Worried by a drop in oil prices and rising supplies, the OPEC and its allies including Russia agreed in December to make supply cuts. Under the deal, OPEC is lowering output by 800,000 bpd from January 1. In the report, OPEC cut its forecast for 2019 world economic growth by 0.2 percentage point to 3.3% and highlighted a range of headwinds such as a slowdown in global trade. (Reuters) Boeing: Middle East requires 3,000 new commercial airplanes over next 20 years – The Middle East will require $745bn in aviation services through 2037 to keep pace with growing passenger and freight traffic in the region, according to a new report released by Boeing. The high value services market is largely driven by the demand for nearly 3,000 new commercial airplanes in the Middle East over the next 20 years, more than tripling the existing fleet. The growing fleet requires aviation services, including supply chain support (parts and parts logistics), maintenance and engineering services, and aircraft modification. Boeing’s Services Market Outlook (SMO) 2018- 2037–Middle East Perspective forecasts growing need for services that increase fleet productivity and reduce operating costs. According to the report, the Middle East will drive more than 8% of global demand for aviation services, representing $745bn, and growing at a projected 4.6% annually. Nearly 218,000 new personnel – 60,000 pilots, 63,000 technicians, and 95,000 cabin crew will be needed in the Middle East over the next 20 years. (Gulf-Times.com) Saudi Arabia would need oil at $80-$85 a barrel to balance budget – Saudi Arabia will need oil priced at $80-$85 a barrel to balance its budget this year, an International Monetary Fund (IMF) official said. Riyadh’s breakeven oil price depends on several factors, including the level of oil production, how much of Saudi Arabia’s oil revenues are transferred to the budget, and how non-oil revenues perform this year. “But if you take the

- 7. Page 7 of 9 (2019) budget as presented with everything remaining equal, a breakeven point would be around $80-$85 dollars,” Director of the IMF’s Middle East and Central Asia department, Jihad Azour said. “It will not affect their ability to finance themselves, because when you look at Saudi, its (bond) spreads are very tight, but it has an effect on fiscal accounts,” he said. Saudi Arabia has increasingly borrowed in the international debt markets after the plunge in oil prices from mid-2014 bruised its revenues. He said that the increase in Saudi Arabia’s debt was not worrying, particularly when compared to its foreign exchange reserves and in light of positive investor sentiment, as reflected by low bond spreads. (Reuters) Saudi Arabia’s crude output will fall to 9.8mn bpd in March – Saudi Arabia plans to produce around 9.8mn barrels per day of oil in March, over half a million bpd below its pledged production level under a global supply-cutting deal, Energy Minister, Khalid Al-Falih told. Exports would fall in March to 6.9mn bpd. The March production figure means Saudi Arabia will be voluntarily cutting output by more than 500,000 bpd below its pledged production level under a deal between the OPEC and allies led by Russia. Under the deal reached in December and which came into effect at the start of the year, Saudi Arabia’s target production is 10.311mn bpd. Production in March will be 1.2mn bpd lower than Saudi Arabia’s November output, which was an all-time high. (Reuters) Saudi Aramco and Egypt's SUMED sign oil storage deals – Saudi Aramco’s trading arm, Aramco Trading Company (ATC), signed a deal with Egypt’s SUMED to provide 222,000 cubic meters of gas oil storage capacity in Sidi Kerir for re-export to Europe, Egypt’s petroleum ministry stated. The companies also signed a second deal to supply fuel oil storage capacity of 165,000 cubic meters in the Red Sea port of Ain Sokhna, it stated. That deal may include re-exporting and supplying fuel oil to power plants in Saudi Arabia, meeting the needs of the Egyptian market and providing fuel to ships in the region, according to the statement. SUMED is 50% owned by the Egyptian government and the rest is held by Arab oil exporters in the Gulf. The deals were signed on the sidelines of an energy forum in Cairo. (Reuters) ALAWWAL Bank's net profit falls 15.4% YoY to SR1,130mn in FY2018 – Alawwal Bank (ALAWWAL) recorded net profit of SR1,130mn in FY2018, registering decrease of 15.4% YoY. Total operating profit fell 4% YoY to SR3,564mn in FY2018. Total revenue for special commissions/investments fell 3.8% YoY to SR3,755mn in FY2018. Total assets stood at SR82.0bn at the end of December 31, 2018 as compared to SR99.9bn at the end of December 31, 2017. Loans and advances stood at SR57.8bn (- 9.2% YoY), while customer deposits stood at SR64.6bn (-17.5% YoY) at the end of December 31, 2018. EPS came in at SR0.99 in FY2018 as compared to SR1.17 in FY2017. (Tadawul) UAE’s Energy Minister: Oil market will reach balance in 1Q2019 – The oil market should reach a balance between supply and demand in the first quarter of this year, UAE’s Energy Minister, Suhail Al Mazrouei told Al-Arabiya television. He said that he was satisfied with the implementation of an agreement to cut supply by the OPEC and allies, including Russia. OPEC, Russia and other non-OPEC producers - an alliance known as OPEC+ - agreed to reduce supply by 1.2mn bpd from January 1. He said that it is premature to discuss compensating crude output losses in some of the exporting countries. Iran, Libya and Venezuela registered falls in output as a result of unrest and trade sanctions. “Most OPEC and non-OPEC countries are doing their part” to balance the market, he said. He also called on the US to increase the share of renewables and natural gas in its power mix, and reduce coal, to address climate change concerns. (Reuters) Dubai’s January whole economy PMI rises MoM to 55.8 – In a release by Emirates NBD and IHS Markit for Dubai’s whole economy, the PMI Index rose to 55.8 in January from 53.7 in December; however, it declined YoY from 56. This is the highest reading since June 2018. The output rose to 60 in January 2018 as compared to 58 in December 2018. (Bloomberg) Dubai plans desert city's first solar-powered desalination plant – Dubai will seek partners this year to build its first solar- powered desalination plant as the Emirate tries to diversify away from burning fossil fuels to increase its water supply, the Head of Dubai Electricity and Water Authority (DEWA), Saeed Mohammed Al Tayer said. The plant, using reverse osmosis technology, will have capacity to produce 120mn gallons a day of drinkable water by 2024, he said. DEWA is also developing a reservoir to hold as much as 6bn gallons of water reserves, and the utility currently stores about 700mn gallons, Al Tayer said at the World Government Summit in Dubai. (Bloomberg) NBF posts 30.4% YoY rise in net profit to AED615.3mn in FY2018 – National Bank of Fujairah (NBF) recorded net profit of AED615.3mn in FY2018, an increase of 30.4% YoY. Operating Income rose 14.2% YoY to AED1,573.8mn in FY2018. Operating profit rose 15.2% YoY to AED1,052.1mn in FY2018. Total assets stood at AED39.8bn at the end of December 31, 2018 as compared to AED36.7bn at the end of December 31, 2017. EPS came in at AED0.33 in FY2018 as compared to AED0.24 in FY2017. (ADX) UNB's net profit narrows to AED1,190.7mn in FY2018 – Union National Bank (UNB) recorded net profit of AED1,190.7mn in FY2018 as compared to AED1,644.8mn in FY2017. Net interest income came in at AED2,640.5mn in FY2018 as compared to AED2,444.8mn in FY2017. Operating income came in at AED3,312.1mn in FY2018 as compared to AED3,631.2mn in FY2017. Total assets stood at AED107bn at the end of December 31, 2018 as compared to AED107.5bn at the end of December 31, 2017. Loans and advances measured at amortized cost stood at AED72.3bn, while customers’ deposits stood at AED77.4bn at the end of December 31, 2018. EPS came in at AED0.40 in FY2018 as compared to AED0.57 in FY2017. (ADX) Kuwait Finance House to sell non-core assets, including land – Kuwait Finance House, which is in talks to buy Bahrain’s Ahli United Bank, plans to sell some of its non-core assets this year, its CEO, Mazin Al Nahedh said. "A significant portion of them is basically raw land that Kuwait Finance House owns," he said. "So now our assessment, those raw lands at today’s given market environment are not worth developing. And as such we are looking to sell them and divest away from them, thus releasing capital so we can use it for our banking operation focused on our core assets," he added. (Bloomberg) Commercial Bank of Kuwait posts full year net income at KD63.8mn – Commercial Bank of Kuwait reported net income of

- 8. Page 8 of 9 KD63.8mn in FY2018 as compared to KD55.4mn in FY2017. Profit came in at KD48.5mn in 4Q2018 as compared to KD41mn in 4Q2017. Operating revenue came in at KD36.8mn in 4Q2018 as compared to KD40.1mn in 4Q2017. In FY2018, operating revenue came in at KD150.9mn as compared to KD150.9mn in FY2017. Operating profit came in at KD106.1mn in FY2018. The rise in profit of 15% is due to increase in fees and commissions, net gain from dealing in foreign currencies and decline in impairment and other provisions. (Bloomberg) IMF sees no credit crunch in Oman, advises speedy fiscal reforms – Oman is not facing a credit crunch but the Gulf Arab oil producer should speed up implementation of fiscal reforms like the introduction of a value-added tax (VAT), an IMF official said. In December, rating agency Fitch downgraded Oman - among the hardest hit in the region by the drop in oil prices – to ‘junk’ status, citing fiscal challenges from oil market volatility. Omani government debt yields spiked on the back of the downgrade and the cost of insuring against a potential debt default has increased by over 25% since then. “Oman needs to keep on the adjustment agenda that was articulated a few years back when we saw a drop in oil price. I think it’s very important to keep and accelerate some of the highlighted reforms like the introduction of the VAT,” IMF Middle East and Central Asia director, Jihad Azour said. “If they do the right steps, they are not heading to a credit crunch,” he said, when asked if the IMF was concerned about Oman potentially defaulting on its debt. (Reuters) Bahrain's Mumtalakat hires banks for Dollar Sukuk – Bahrain’s sovereign wealth fund, Mumtalakat has hired banks to arrange fixed income investor meetings ahead of a potential issue of five-year Sukuk, denominated in US Dollars, a document issued by one of the banks showed. BNP Paribas, Citi, HSBC, National Bank of Bahrain (NBB) and Standard Chartered Bank have been mandated as joint lead managers and joint book runners. Subject to market conditions, the Sukuk issue will be of benchmark size, which generally means upwards of $500mn. (Reuters) Fitch affirms Mumtalakat Sukuk trust certificate issuance program – Fitch Ratings has affirmed Bahrain Mumtalakat Holding Company's (Mumtalakat; ‘BB’-/’‘Stable’/‘B’) trust certificate issued through Mumtalakat Sukuk Holding Company (MSHC) at 'BB-' and assigned the potential Sukuk to be issued under the program an expected rating of 'BB-(EXP)'. The ratings are in line with Mumtalakat's Long-Term Issuer Default Rating (IDR) and senior unsecured rating. MSHC is the issuer of the certificates and trustee. MSHC is an exempted company with limited liability incorporated in the Cayman Islands, which has been established for the sole purpose of issuing the certificates, and is owned by Mumtalakat. (Bloomberg) Bahrain seeks US partners to help develop its shale oil find – Bahrain is courting partners in the US to develop a shale oil and gas deposit off the coast of the island Kingdom. The smallest energy producer in the Persian Gulf plans to present data in Houston to potential investors, Oil Minister, Shaikh Mohammed bin Khalifa Al Khalifa said. Bahrain seeks investors from North America to fund the development of Khaleej Al Bahrain Basin, he said. (Bloomberg) Bahrain's Investcorp buys properties in the US for $330mn – Investcorp Bank has acquired eight properties in the US for $330mn as the Bahraini firm pushes ahead with real estate investments abroad. The investment “demonstrates the important role we see our real estate investment business playing in our overall investment strategy for 2019,” Co-CEO, Rishi Kapoor said. “Looking ahead, the US remains a priority market for us,” he added. (Bloomberg)

- 9. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( * Market was closed on February 12, 2019) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSEIndex S&PPanArab S&PGCC 0.7% (1.3%) 0.5% (0.7%) (0.4%) (0.4%) (0.5%) (1.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar* Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,310.80 0.2 (0.3) 2.2 MSCI World Index 2,045.12 1.2 1.2 8.6 Silver/Ounce 15.71 (0.0) (0.8) 1.4 DJ Industrial 25,425.76 1.5 1.3 9.0 Crude Oil (Brent)/Barrel (FM Future) 62.42 1.5 0.5 16.0 S&P 500 2,744.73 1.3 1.4 9.5 Crude Oil (WTI)/Barrel (FM Future) 53.10 1.3 0.7 16.9 NASDAQ 100 7,414.62 1.5 1.6 11.7 Natural Gas (Henry Hub)/MMBtu 2.71 (1.8) 3.4 (16.6) STOXX 600 362.78 0.9 1.2 6.2 LPG Propane (Arab Gulf)/Ton 64.25 4.0 4.0 0.4 DAX 11,126.08 1.5 1.9 4.3 LPG Butane (Arab Gulf)/Ton 80.75 8.0 12.5 16.2 FTSE 100 7,133.14 0.4 0.6 7.2 Euro 1.13 0.4 0.0 (1.2) CAC 40 5,056.35 1.3 1.8 5.7 Yen 110.48 0.1 0.7 0.7 Nikkei 20,864.21 1.9 1.9 4.1 GBP 1.29 0.3 (0.4) 1.1 MSCI EM 1,042.13 0.6 0.6 7.9 CHF 0.99 (0.3) (0.6) (2.5) SHANGHAI SE Composite 2,671.89 1.0 1.6 8.8 AUD 0.71 0.5 0.1 0.7 HANG SENG 28,171.33 0.1 0.8 8.8 USD Index 96.71 (0.4) 0.1 0.6 BSE SENSEX 36,153.62 0.2 (0.2) (1.0) RUB 65.88 0.1 0.1 (5.5) Bovespa 96,168.40 3.2 1.5 14.2 BRL 0.27 1.3 0.5 4.6 RTS 1,215.47 1.2 1.3 13.7 98.1 92.1 80.1