Q1 2013 Houston Industrial Market Report

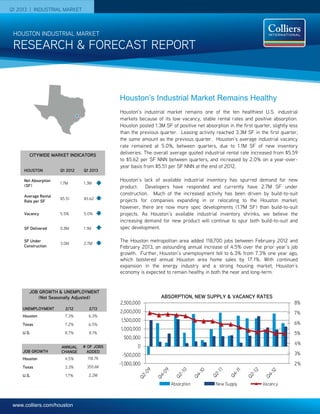

- 1. www.colliers.com/houston Q1 2013 | INDUSTRIAL MARKET 2% 3% 4% 5% 6% 7% 8% -1,000,000 -500,000 0 500,000 1,000,000 1,500,000 2,000,000 2,500,000 Absorption New Supply Vacancy Houston’s industrial market remains one of the ten healthiest U.S. industrial markets because of its low vacancy, stable rental rates and positive absorption. Houston posted 1.3M SF of positive net absorption in the first quarter, slightly less than the previous quarter. Leasing activity reached 3.3M SF in the first quarter, the same amount as the previous quarter. Houston’s average industrial vacancy rate remained at 5.0%, between quarters, due to 1.1M SF of new inventory deliveries. The overall average quoted industrial rental rate increased from $5.59 to $5.62 per SF NNN between quarters, and increased by 2.0% on a year-over- year basis from $5.51 per SF NNN at the end of 2012. Houston’s lack of available industrial inventory has spurred demand for new product. Developers have responded and currently have 2.7M SF under construction. Much of the increased activity has been driven by build-to-suit projects for companies expanding in or relocating to the Houston market; however, there are now more spec developments (1.7M SF) than build-to-suit projects. As Houston’s available industrial inventory shrinks, we believe the increasing demand for new product will continue to spur both build-to-suit and spec development. The Houston metropolitan area added 118,700 jobs between February 2012 and February 2013, an astounding annual increase of 4.5% over the prior year’s job growth. Further, Houston’s unemployment fell to 6.3% from 7.3% one year ago, which bolstered annual Houston area home sales by 17.1%. With continued expansion in the energy industry and a strong housing market, Houston’s economy is expected to remain healthy in both the near and long-term. RESEARCH & FORECAST REPORT HOUSTON INDUSTRIAL MARKET ABSORPTION, NEW SUPPLY & VACANCY RATES Houston’s Industrial Market Remains Healthy CITYWIDE MARKET INDICATORS HOUSTON Q1 2012 Q1 2013 Net Absorption (SF) 1.7M 1.3M Average Rental Rate per SF $5.51 $5.62 Vacancy 5.5% 5.0% SF Delivered 0.8M 1.1M SF Under Construction 3.0M 2.7M UNEMPLOYMENT 2/12 2/13 Houston 7.3% 6.3% Texas 7.2% 6.5% U.S. 8.7% 8.1% JOB GROWTH ANNUAL CHANGE # OF JOBS ADDED Houston 4.5% 118.7K Texas 3.3% 355.6K U.S. 1.7% 2.2M JOB GROWTH & UNEMPLOYMENT (Not Seasonally Adjusted)

- 2. RESEARCH & FORECAST REPORT | Q1 2013 | HOUSTON INDUSTRIAL MARKET COLLIERS INTERNATIONAL | P. 2 Vacancy & Availability Although 1.1M SF of new inventory delivered during the first quarter, Houston’s industrial vacancy rate remained unchanged between quarters at 5.0% and decreased by 30 basis points from 5.3% reported in first quarter 2012. At the close of the first quarter, Houston had 24.1M SF of vacant industrial space citywide, 224K SF less than the previous quarter. Among the major industrial corridors, the Northwest submarket has the largest amount of vacant space with 5.0M SF (3.8% vacancy), followed by the Southeast submarket with 4.9M SF vacant (5.9% vacancy), the North submarket with 4.6M SF vacant (6.3% vacancy), and the Southwest submarket with 3.7M SF vacant (5.9% vacancy). Houston’s industrial construction pipeline had 2.7M SF of projects underway at the end of the first quarter, including 1.7M SF of spec development. The largest project under construction is a 475,000-SF state-of-the-art foodservice distribution facility that will be the new Gulf Coast regional distribution hub for the Ben E. Keith Company. The facility is being constructed on an 82-acre tract located in Missouri City in the Beltway Crossing Business Park. A list of additional buildings currently under construction can be found on Page 4 of this report. The largest spec project in the pipeline is a 299,840-SF distribution warehouse located on Langfield Rd. in the Northwest industrial submarket. Rental Rates Houston’s overall average quoted industrial rental rate increased from $5.59 to $5.62 per SF NNN in the first quarter, and increased by 2.0% on a year-over-year basis from $5.51 per SF NNN. By property type, the average quoted NNN rental rates are as follows: $5.45 per SF for Distribution space; $4.43 per SF for Bulk Warehouse space; $7.21 per SF for Flex/Service space; with Tech/R&D space averaging $8.21 per SF. Absorption & Demand Houston’s industrial market posted 1.3M SF of positive net absorption in the first quarter, slightly less than the previous quarter. The Northwest and Southwest submarkets outperformed all others in the first quarter, posting the largest positive net quarterly absorption of 589K SF and 556K SF respectively. The Northeast submarket followed with 273K SF of positive net absorption. There were several major tenant move- ins contributing to net absorption gains in the first quarter, including Applied Cyro Technologies (173,000 SF); Crane Worldwide (150,000 SF); Dickson Furniture (94,000 SF); Seatex (38,405 SF); Noble Drilling (28,800 SF); and Bosch Rexroth Corporation (28,080 SF). Leasing Houston’s industrial leasing activity reached 3.3M SF in the first quarter, the same as the previous quarter. Some of Houston’s top first quarter industrial leases transactions include: PCS-CTS1,2 Alamo Crossing Mar-13 231,348 SF CADECO Industries, Inc.2 1060 Lockwood Distribution Ct. Jan-13 154,114 SF Crane Worldwide 6501 Navigation Blvd Feb-13 150,000 SF Intermarine Industrial Terminals 13901 Industrial Rd Mar-13 132,000 SF Dickson Furniture 6000 S Loop Fwy E Jan-13 94,000 SF Overseas Import Export, Inc.2 1800-1802 South St. Jan-13 66,000 SF Guardian Building Products1,2 7603 Prairie Oak Dr Mar-13 63,763 SF Delta Petroleum Co., Inc.1,2 3710 Cedar Blvd Feb-13 62,100 SF Bass Computers2,3 10558 Bissonnet Feb-13 55,967 SF Veritrust, Inc. 2155 Silber Rd Jan-13 41,937 SF Aluminum Screen Manufacturers1 9505 West Tidwell Mar-13 40,856 SF ThyssenKrupp Materials NA, Inc.1 12321 Cutten Rd Mar-13 40,000 SF Seatex 1406 Southgate Dr. Feb-13 38,405 SF 1 Colliers International transaction 2 Renewal 3 Expansion 4Sublease

- 3. RESEARCH & FORECAST REPORT | Q1 2013 | HOUSTON INDUSTRIAL MARKET COLLIERS INTERNATIONAL | P. 3 Houston Industrial Market Summary Houston industrial sales activity slowed between quarters with only 90 property sales recorded in Q1 2013, compared to 267 in Q4 2012. A few of the sales transactions that occurred in Q1 2013 are summarized at right. Sales Activity Amigo Real Estate Investments sold a 13,510-SF office/warehouse to an undisclosed owner/user for $63 per SF. The Class C property was built in 1979 and is located at 5092 Steadmont Dr. in the Northwest Inner Loop industrial submarket. The building was 100.0% leased at the time of sale. Market Rentable Area Direct Vacant SF Direct Vacancy Rate Sublet Vacant SF Sublet Vacancy Rate Total Vacant SF Total Vacancy Rate 1Q13 Net Absorption 4Q12 Net Absorption 1Q13 Completions 4Q12 Completions SF Under Construction Greater Houston Total 485,486,002 23,575,216 4.9% 549,350 0.1% 24,124,566 5.0% 1,332,391 1,882,980 1,108,430 949,497 2,670,272 CBD-NW Inner Loop 11,735,797 538,450 4.6% 22,200 0.2% 560,650 4.8% 7,548 (103,966) - - - Downtown 31,867,298 1,864,372 5.9% - 0.0% 1,864,372 5.9% (146,663) 175,283 - 38,232 - North Inner Loop 5,158,517 451,369 8.7% - 0.0% 451,369 8.7% - (40,000) - - - SW Inner Loop 7,434,557 108,923 1.5% - 0.0% 108,923 1.5% 25,090 (11,100) - - - Total Inner Loop 56,196,169 2,963,114 5.3% 22,200 0.0% 2,985,314 5.3% (114,025) 20,217 - 38,232 - North Fwy/Tomball Pky 15,731,936 1,638,618 10.4% 19,050 0.1% 1,657,668 10.5% (134,703) (101,093) 333,272 120,670 26,000 North Hardy Toll Rd 25,755,261 1,257,283 4.9% 11,956 0.0% 1,269,239 4.9% 133,234 (1,674) 290,665 - 897,599 North Outer Loop 17,779,955 977,544 5.5% - 0.0% 977,544 5.5% (107,271) (17,363) - - 123,391 The Woodlands/Conroe 13,649,381 696,961 5.1% - 0.0% 696,961 5.1% 45,462 107,445 - 65,000 74,901 Total North Corridor 72,916,533 4,570,406 6.3% 31,006 0.0% 4,601,412 6.3% (63,278) (12,685) 623,937 185,670 1,121,891 Northeast Hwy 321 1,188,527 1,980 0.2% 7,500 0.6% 9,480 0.8% 0 0 - - - Northeast Hwy 90 15,684,326 314,892 2.0% 129,000 0.8% 443,892 2.8% 13,914 10,190 20,000 - - Northeast I-10 3,975,829 118,003 3.0% - 0.0% 118,003 3.0% 30,669 1,492 21,000 - - Northeast Inner Loop 11,589,888 494,240 4.3% - 0.0% 494,240 4.3% 228,000 (40,652) - - - Total Northeast Corridor 32,438,570 929,115 2.9% 136,500 0.4% 1,065,615 3.3% 272,583 (28,970) 41,000 - - Hwy 290/Tomball Pky 15,036,842 652,292 4.3% 25,636 0.2% 677,928 4.5% 126,211 68,047 74,300 - 40,000 Northwest Hwy 6 4,234,621 96,123 2.3% - 0.0% 96,123 2.3% 23,924 1,865 - - - Northwest Inner Loop 60,107,686 2,499,502 4.2% 81,527 0.1% 2,581,029 4.3% 191,249 606,827 - 65,400 150,000 Northwest Near 16,509,429 675,066 4.1% 83,051 0.5% 758,117 4.6% 2,939 2,627 - 112,653 320,267 Northwest Outlier 13,029,062 351,050 2.7% 49,055 0.4% 400,105 3.1% 7,787 32,804 - 26,480 - West Outer Loop 22,948,670 475,204 2.1% 6,000 0.0% 481,204 2.1% 236,597 219,320 35,750 149,842 22,500 Total Northwest Corridor 131,866,310 4,749,237 3.6% 245,269 0.2% 4,994,506 3.8% 588,707 931,490 110,050 354,375 532,767 South Highway 35 31,243,555 1,133,397 3.6% 23,600 0.1% 1,156,997 3.7% (62,932) 216,492 10,672 66,841 88,000 South Inner Loop 13,358,702 641,050 4.8% - 0.0% 641,050 4.8% (51,349) 42,379 - - - Total South Corridor 44,602,257 1,774,447 4.0% 23,600 0.1% 1,798,047 4.0% (114,281) 258,871 10,672 66,841 88,000 East I-10 Outer Loop 15,747,527 115,135 0.7% - 0.0% 115,135 0.7% 400 2,500 - - - East-SE Far 47,891,137 4,498,359 9.4% 31,163 0.1% 4,529,522 9.5% 172,985 386,337 292,771 62,115 365,462 SE Outer Loop 20,408,405 293,812 1.4% - 0.0% 293,812 1.4% 32,990 38,940 - - - Total Southeast Corridor 84,047,069 4,907,306 5.8% 31,163 0.0% 4,938,469 5.9% 206,375 427,777 292,771 62,115 365,462 Highway 59/Highway 90 21,873,520 901,913 4.1% 50,372 0.2% 952,285 4.4% 195,530 60,247 - 223,000 475,000 Southwest Far 10,253,568 909,688 8.9% - 0.0% 909,688 8.9% 16,489 120,156 - 19,264 57,152 Southwest Outer Loop 12,640,729 772,901 6.1% 4,240 0.0% 777,141 6.1% 119,207 27,988 - - - Fort Bend County/Sugar Land 18,651,277 1,097,089 5.9% 5,000 0.0% 1,102,089 5.9% 225,084 77,889 30,000 - 30,000 Total Southwest Corridor 63,419,094 3,681,591 5.8% 59,612 0.1% 3,741,203 5.9% 556,310 286,280 30,000 242,264 562,152 Houston Industrial Market Statistical Summary 1st Quarter 2013 Intermarine, LLC sold a 132,000-SF Class C industrial warehouse and 95- acre industrial shipping terminal to Lexington Real Trust for $81.4M. Intermarine leased back the property and is constructing a $10M operations center on the site. This terminal is situated along the Houston Ship Channel. Sources: Real Capital Analytics; CoStar Comps

- 4. RESEARCH & FORECAST REPORT | Q1 2013 | HOUSTON INDUSTRIAL MARKET COLLIERS INTERNATIONAL | P. 4 Q1 2013 Industrial Under Construction – 25,000 SF or greater Q1 2013 Industrial Deliveries - 25,000 SF or greater Submarket Cluster Submarket Building Address RBA % Leased Developer Estimated Delivery Southwest Corridor Ind Hwy 59/Hwy 90 1001 Cravens Rd 475,000 100.0 Ben E Keith Jun-13 Northwest Corridor Ind Northwest Near 7310 Langfield - Bldg 200 299,840 0.0 Avera Companies Jun-13 Southeast Corridor Ind East-Southeast Far 3750 Highway 225 185,168 0.0 The Carson Companies Sep-13 North Corridor Ind North Hardy Toll Rd 16200 Central Green Blvd 181,067 100.0 Liberty Property Trust Sep-13 North Corridor Ind North Hardy Toll Rd 500 Northpark Central Dr 174,200 0.0 Prologis Inc. Jun-13 North Corridor Ind North Hardy Toll Rd 14650 Heathrow Forest Pky 121,919 100.0 Wolff Properties Jun-13 Southeast Corridor Ind East-Southeast Far 3700 Highway 225 118,500 0.0 The Carson Companies Sep-13 North Corridor Ind North Hardy Toll Rd 4730 Consulate Plaza Dr 101,200 0.0 EastGroup Properties Jun-13 North Corridor Ind North Hardy Toll Rd 250 Century Plaza Dr 91,520 0.0 Avera Companies Jul-13 North Corridor Ind Woodlands/Conroe 4001 Technology Forest Blvd 74,901 0.0 Stream Realty Partners, L.P. May-13 Northwest Corridor Ind Northwest Inner Loop 1315 W Sam Houston Pky N - Bldg 1 70,000 0.0 Caldwell Companies May-13 Southeast Corridor Ind East-Southeast Far 3800 Highway 225 61,794 0.0 The Carson Companies Sep-13 North Corridor Ind North Hardy Toll Rd 4741 World Houston Pky 56,513 0.0 EastGroup Properties Jun-13 South Corridor Ind South Hwy 35 2425 Mowery Rd - Bldg A 53,000 0.0 Colliers International Apr-13 North Corridor Ind North Hardy Toll Rd 4740 Consulate Plaza Dr 50,340 100.0 EastGroup Properties Jun-13 North Corridor Ind North Hardy Toll Rd 4721 World Houston Pky 45,040 0.0 EastGroup Properties Jul-13 North Corridor Ind North Outer Loop 14134 Vickery Dr 41,964 100.0 Clay Development & Construction Inc. Apr-13 Northwest Corridor Ind Northwest Inner Loop 1315 W Sam Houston Pky N - Bldg 2 40,000 0.0 Caldwell Companies May-13 Northwest Corridor Ind Northwest Inner Loop 1315 W Sam Houston Pky N - Bldg 3 40,000 0.0 Caldwell Companies May-13 Southwest Corridor Ind Southwest Far 1145 Highway 90 A 38,000 0.0 Jacob Realty Group Jun-13 North Corridor Ind North Hardy Toll Rd 1368 E Richey Rd 33,000 0.0 Northwinds Commercial Jun-13 North Corridor Ind North Outer Loop 4641 Kennedy Commerce Dr 31,427 100.0 Clay Development & Construction Inc. Jun-13 Southwest Corridor Ind Fort Bend Co/Sugar Land 19830 FM 1093 30,000 0.0 Moody Rambin Interests Aug-13 North Corridor Ind North Fwy/Tomball Pky 6611 Willowbrook Park Dr 26,000 0.0 Capital Commercial Investments May-13 North Corridor Ind North Outer Loop 6010 Dwyer Dr 25,000 0.0 Nobel House Real Estate Jun-13 North Corridor Ind North Outer Loop 4615 Kennedy Commerce Dr 25,000 100.0 Clay Development & Construction Inc. Aug-13 South Corridor Ind South Hwy 35 12233 Robin Blvd 25,000 0.0 Colliers International Sep-13 Submarket Cluster Submarket Building Address RBA % Leased Developer Delivered Southeast Corridor Ind East-SE Far 1902 S 16th St 261,291 0.0 ML Realty Partners Jan-13 North Corridor Ind North Hardy Toll Rd 16330 Central Green Blvd - B 10 163,600 0.0 Liberty Property Trust Jan-13 North Corridor Ind North Fwy/Tomball Pky 14300 Hollister Rd 111,065 76.8 Liberty Property Trust Jan-13 North Corridor Ind North Fwy/Tomball Pky 12101 Cutten Rd 101,123 100.0 Clay Development Feb-13 North Corridor Ind North Fwy/Tomball Pky 7505 Bluff Point Dr 86,823 0.0 EastGroup Properties Jan-13 North Corridor Ind North Hardy Toll Rd 2330 Peyton Rd 56,915 0.0 Capital Commercial Feb-13 Northwest Corridor Ind West Outer Loop 5915 Brittmoore Rd 35,750 0.0 Triten Real Estate Partners Mar-13 North Corridor Ind North Fwy/Tomball Pky 12031 North Fwy 34,261 100.0 Structure Tone, Inc. Jan-13 Southeast Corridor Ind East-Southeast Far 11804 Fairmont Pky 31,480 0.0 VIGAVI Realty Feb-13 Southwest Corridor Fort Bend Co/Sugar Land6510 FM 723 Rd - B 1 30,000 16.7 Wayne Stone Properties Jan-13 North Corridor Ind North Hardy Toll Rd 20221 Carriage Point Dr 25,050 100.0 The National Realty Group, Inc. Feb-13

- 5. RESEARCH & FORECAST REPORT | Q1 2013 | HOUSTON INDUSTRIAL MARKET Accelerating success. COLLIERS INTERNATIONAL | HOUSTON 1300 Post Oak Boulevard Suite 200 Houston, Texas 77056 Main +1 713 222 2111 5COLLIERS INTERNATIONAL | P. LISA R. BRIDGES Director of Market Research Houston Direct +1 713 830 2125 Fax +1 713 830 2118 lisa.bridges@colliers.com