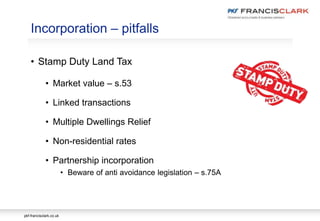

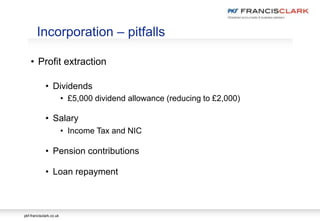

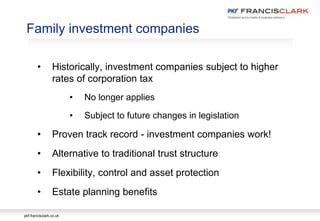

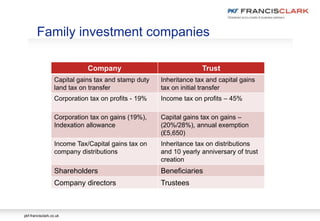

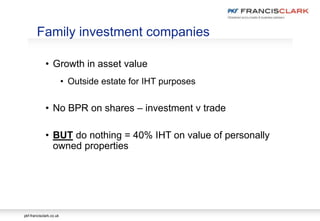

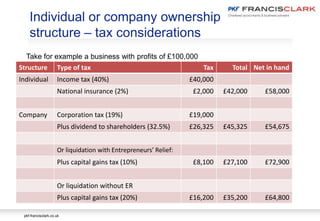

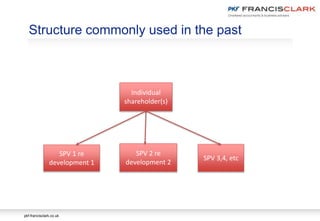

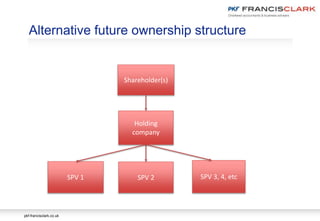

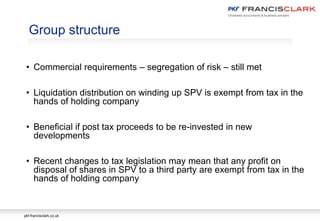

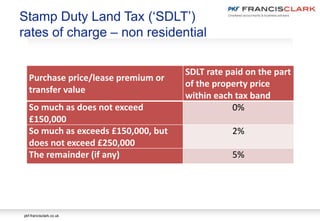

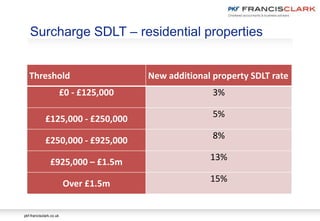

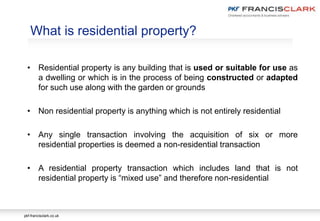

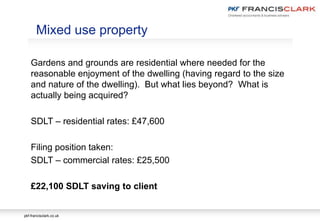

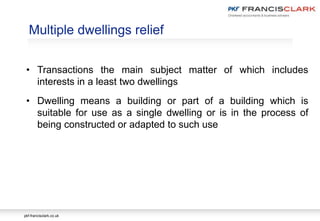

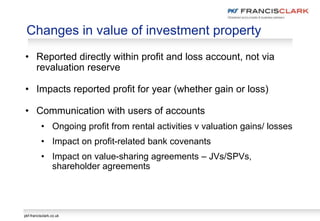

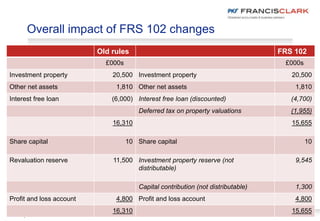

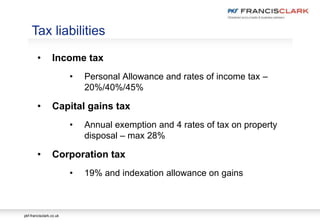

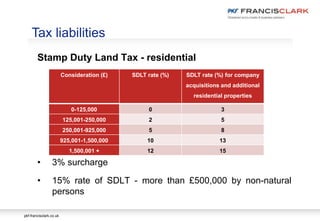

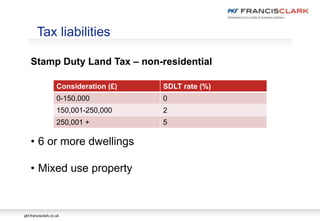

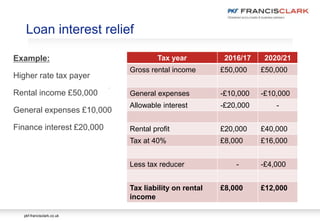

The document provides an annual update on the property sector, discussing key topics such as the housing crisis, tax implications for landlords, and the impact of Brexit. It emphasizes the importance of ownership structure, particularly with Special Purpose Vehicles (SPVs), and highlights recent changes in tax legislation and accounting standards that affect property valuation and transactions. Additionally, it covers detailed insights into stamp duty land tax rates and reliefs, taxation strategies for property companies, and the implications of the targeted anti-avoidance rule.

![pkf-francisclark.co.uk

.

Incorporation – pitfalls

• Capital Gains Tax

• Connected parties – deemed MV

• S.162 incorporation relief?

• Ramsay v Revenue and Customs [2012]

• What constitutes a “business”?

• 20 hours per week

• Shares v loan account](https://image.slidesharecdn.com/fullpresentationforprinting-170929111451/85/Property-Sector-Annual-Update-2017-106-320.jpg)