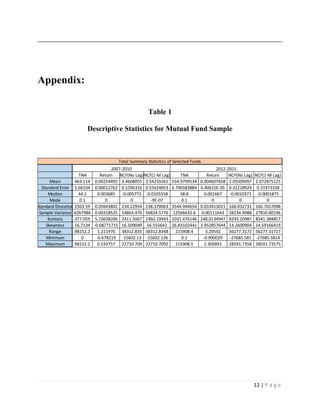

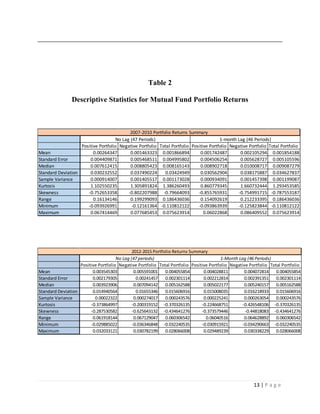

This document summarizes research analyzing the "smart money effect" and potential time lags using mutual fund data from 2007-2010 and 2012-2015. It describes literature on investors directing funds to skilled managers, and whether this is due to fund-specific information or momentum effects. The research forms portfolios based on funds' monthly net cash flows under two models (with and without a 1-month lag) and evaluates performance via 3-factor and 4-factor regressions. Results show mixed evidence of the smart money effect across periods, and momentum helps explain returns. The 1-month lag model generally performs better.