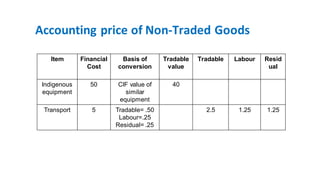

The document discusses the accounting principles for non-traded and traded goods using the little Mirrless approach, including concepts such as shadow prices, accounting prices, and the accounting rate of return (ARR). It highlights the calculation of marginal social costs and benefits for non-traded goods, the significance of shadow wage rates, and provides a mathematical example involving investment analysis for a project to calculate average annual profit and ARR. Overall, it emphasizes the importance of properly assessing social opportunity costs in project management.