Embed presentation

Download to read offline

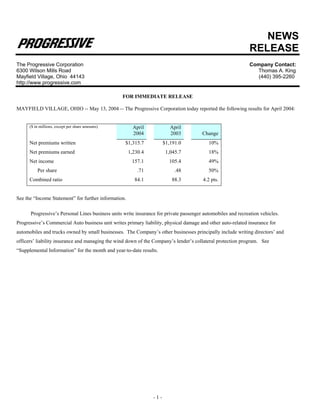

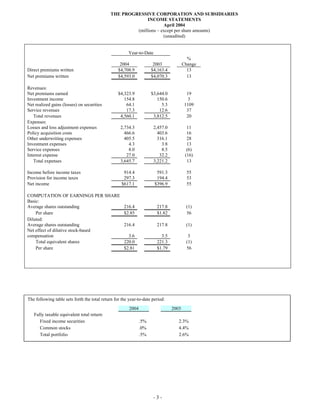

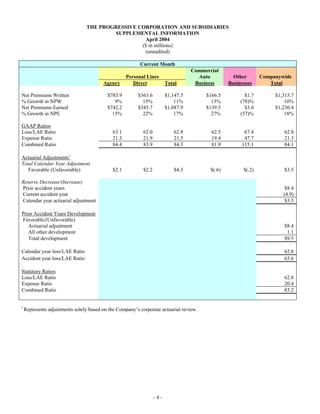

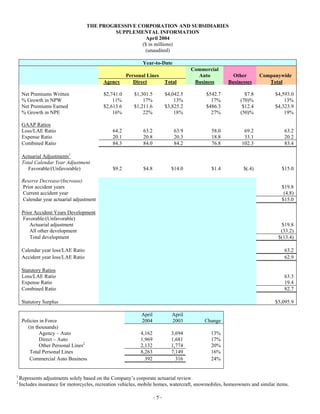

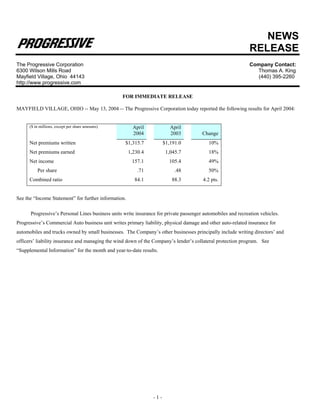

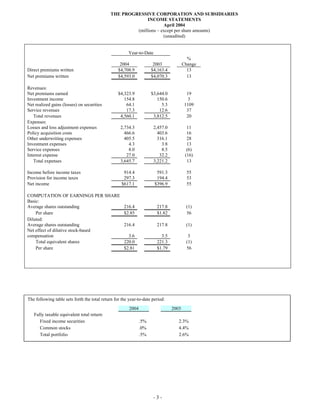

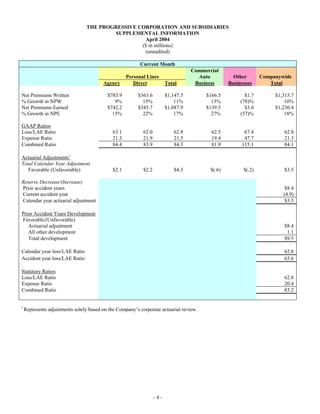

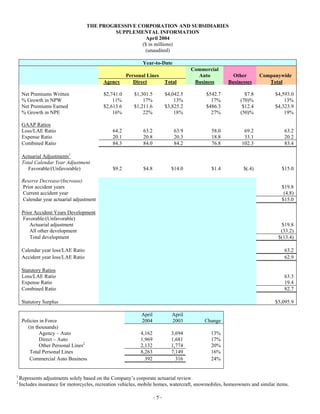

The Progressive Corporation reported financial results for April 2004, with the following key highlights: - Net premiums written increased 10% to $1.315 billion compared to April 2003. - Net income increased 49% to $157.1 million compared to April 2003. - The combined ratio improved 4.2 percentage points to 84.1% from 88.3% in April 2003. - Personal lines policies in force grew 16% year-over-year and commercial auto policies grew 24%.