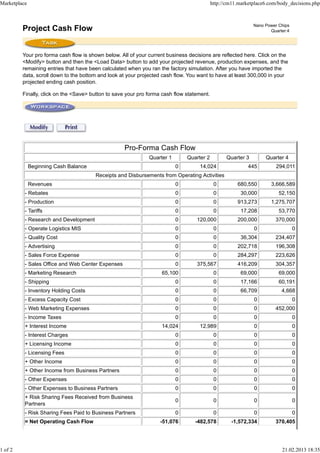

The document is a pro forma cash flow statement for a company over 4 quarters. It shows projected revenues, expenses, cash flows from operations and investing/financing activities. The cash flow aims to have at least $300,000 in ending cash for the fourth quarter. It also includes a cost of goods sold calculation to estimate the income statement.