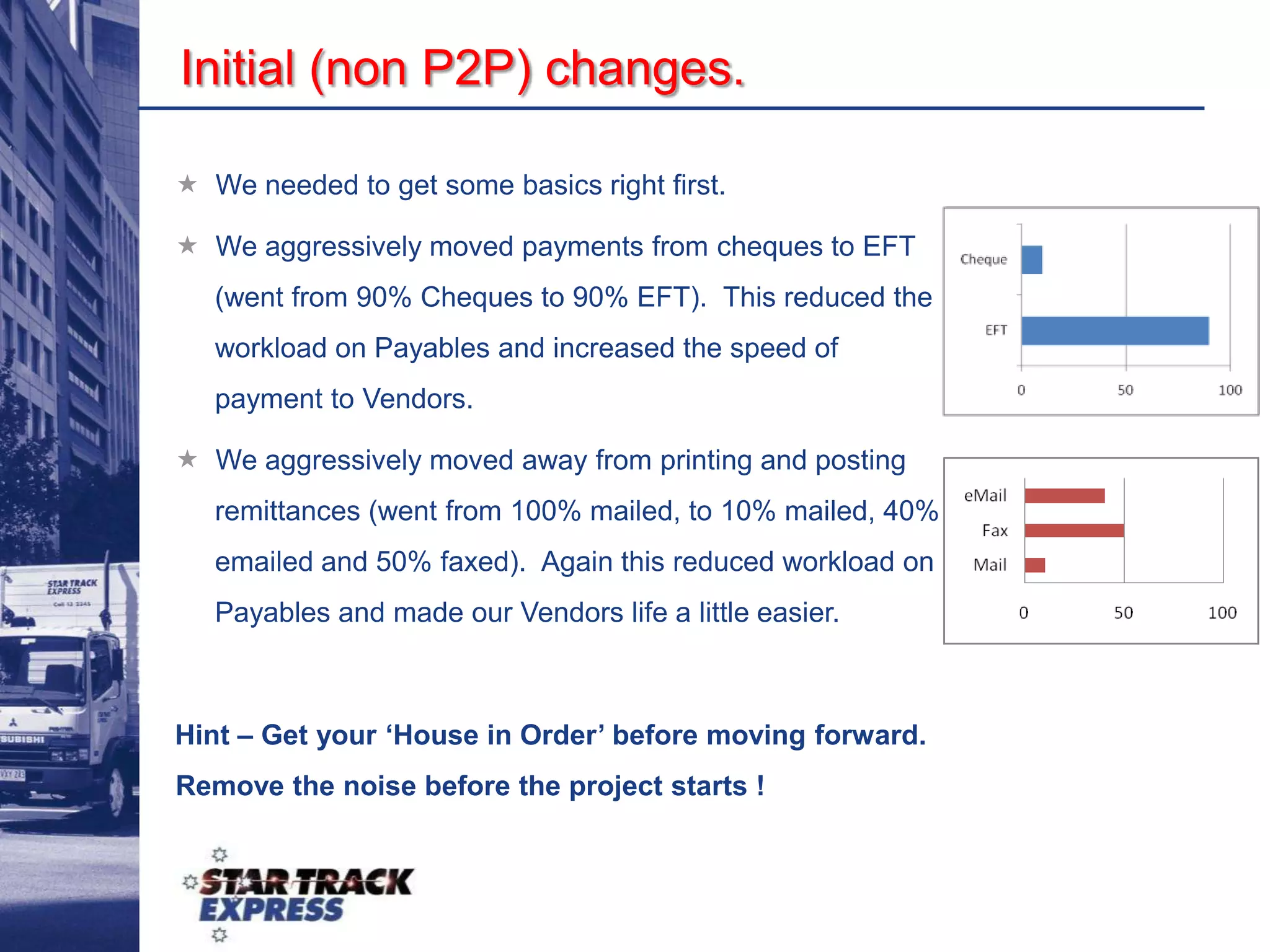

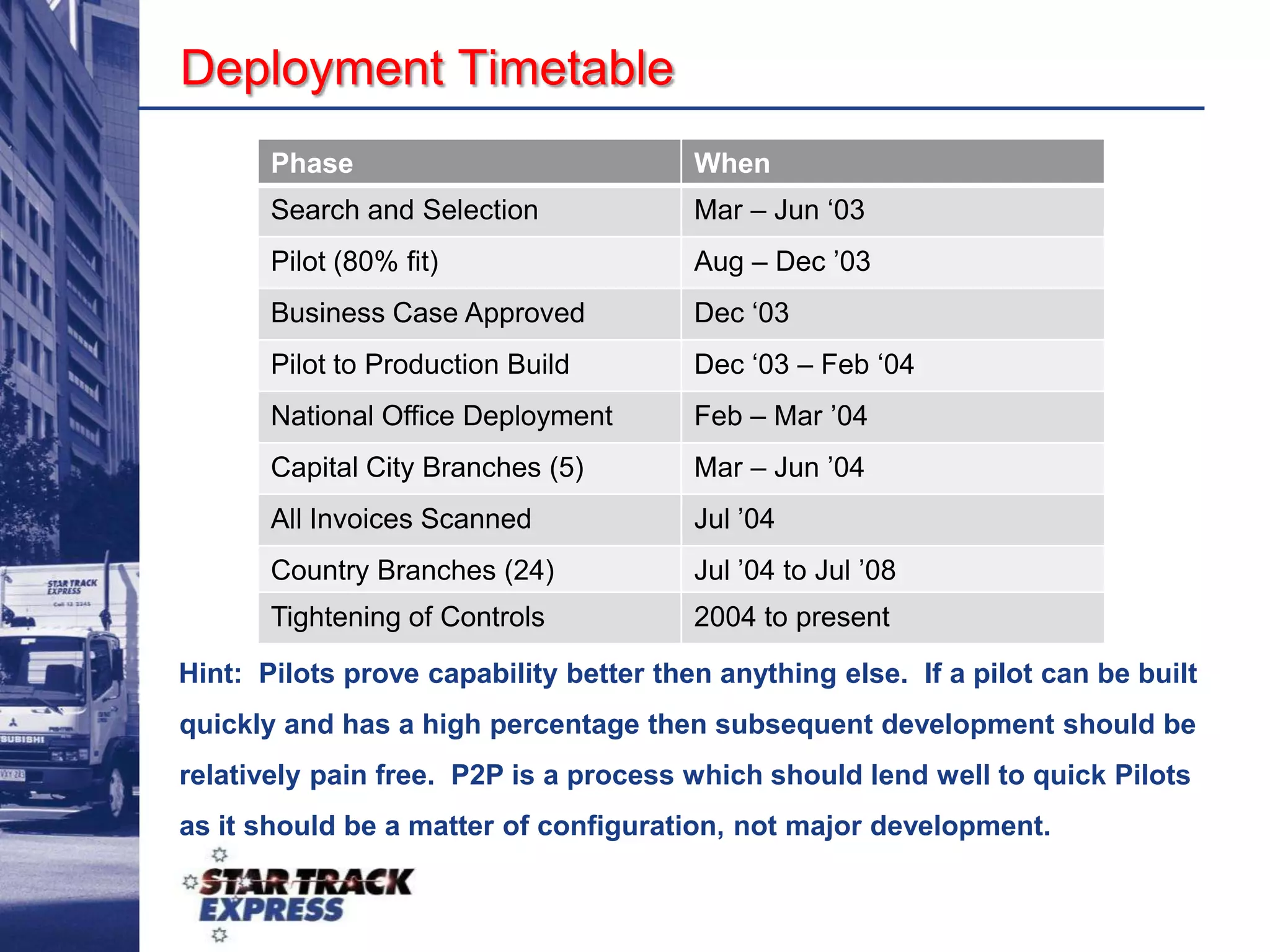

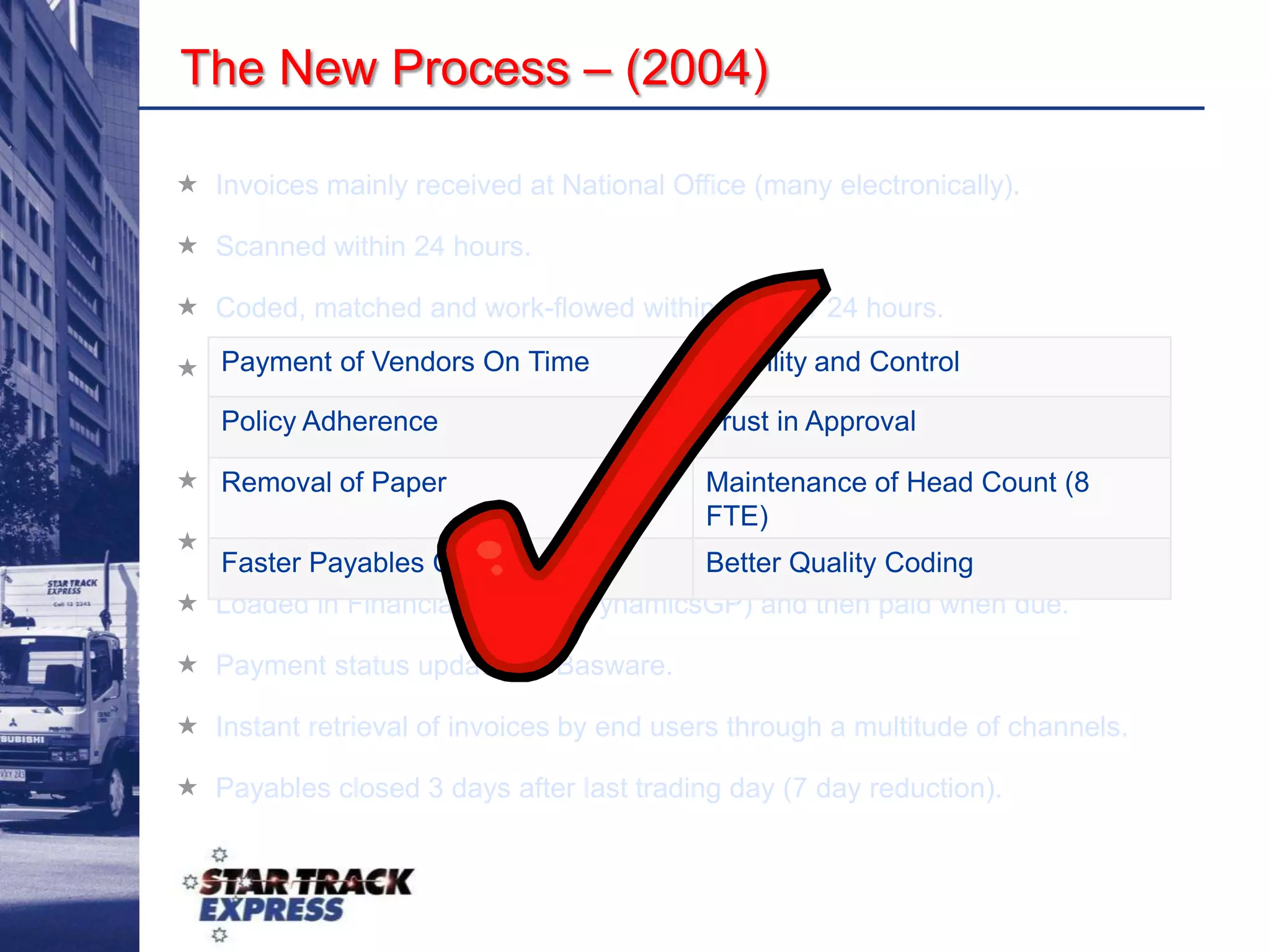

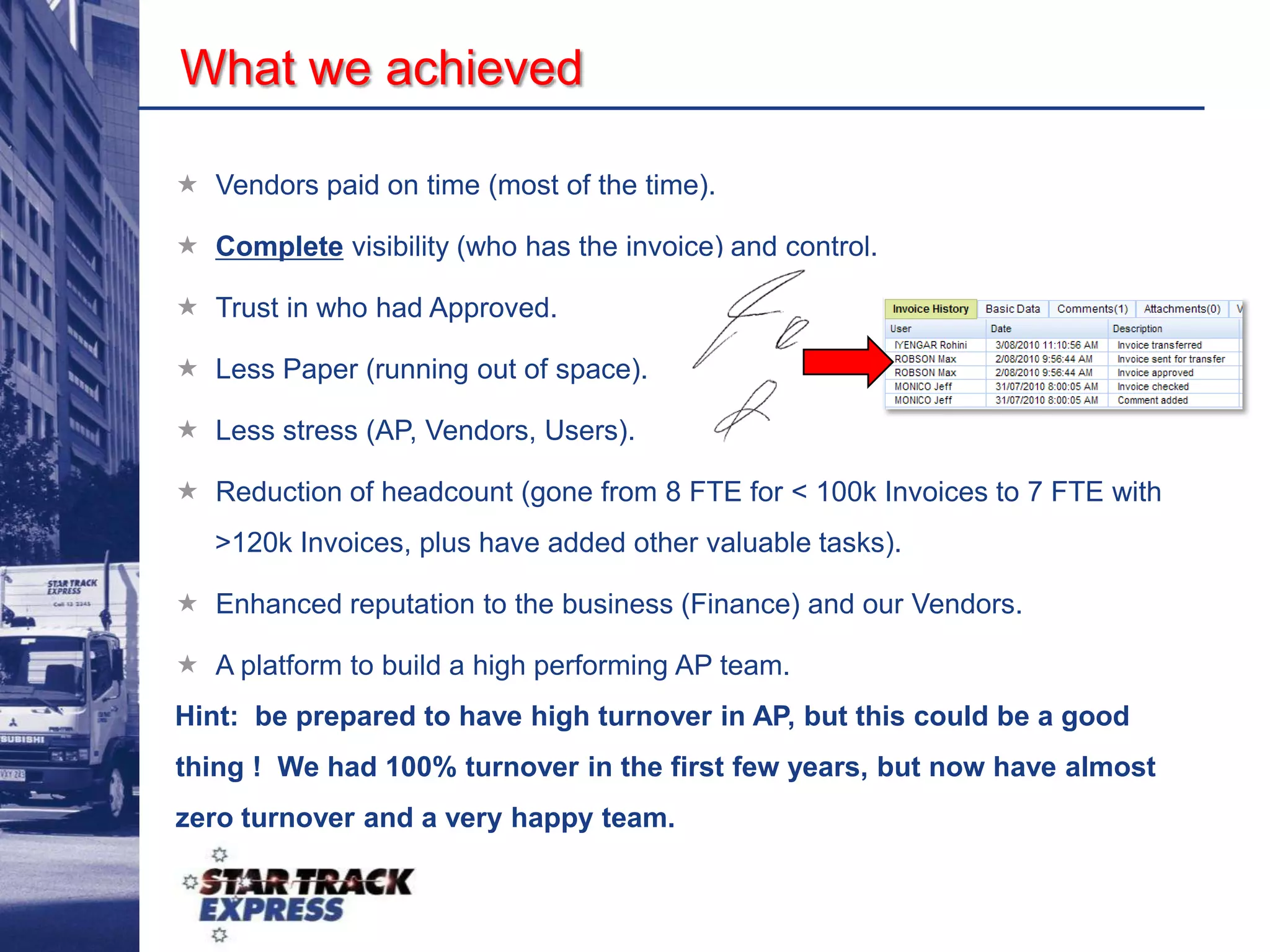

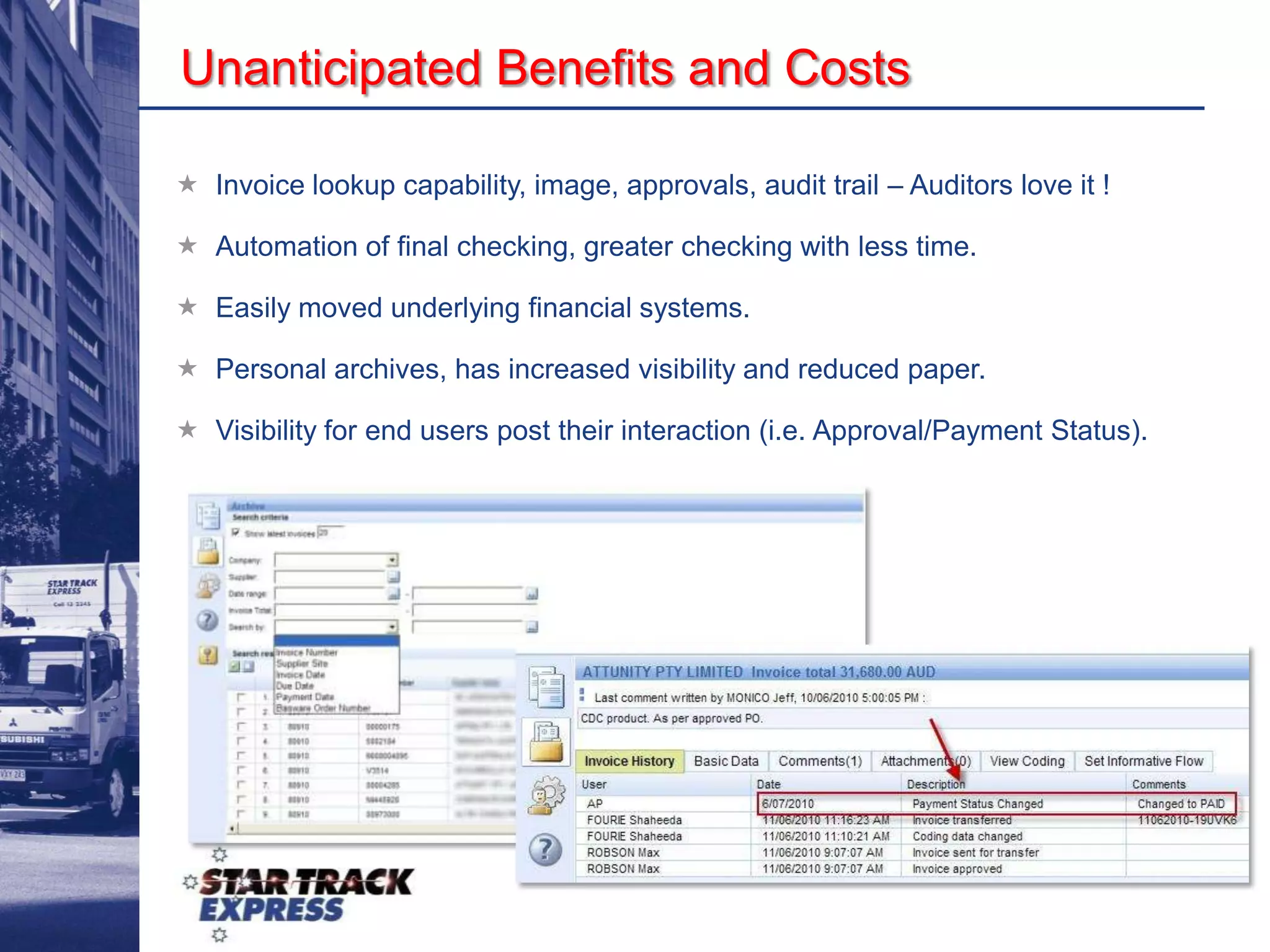

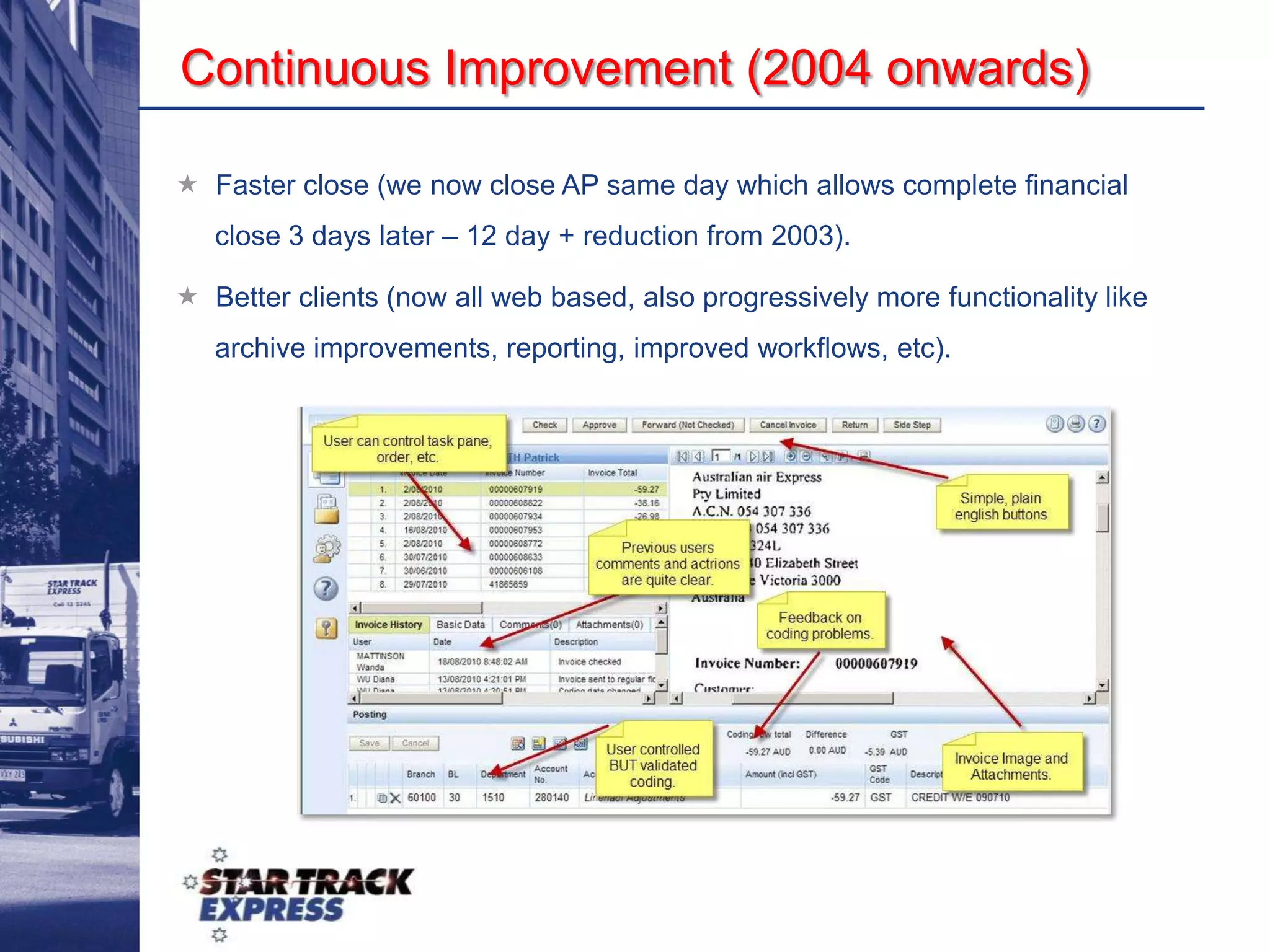

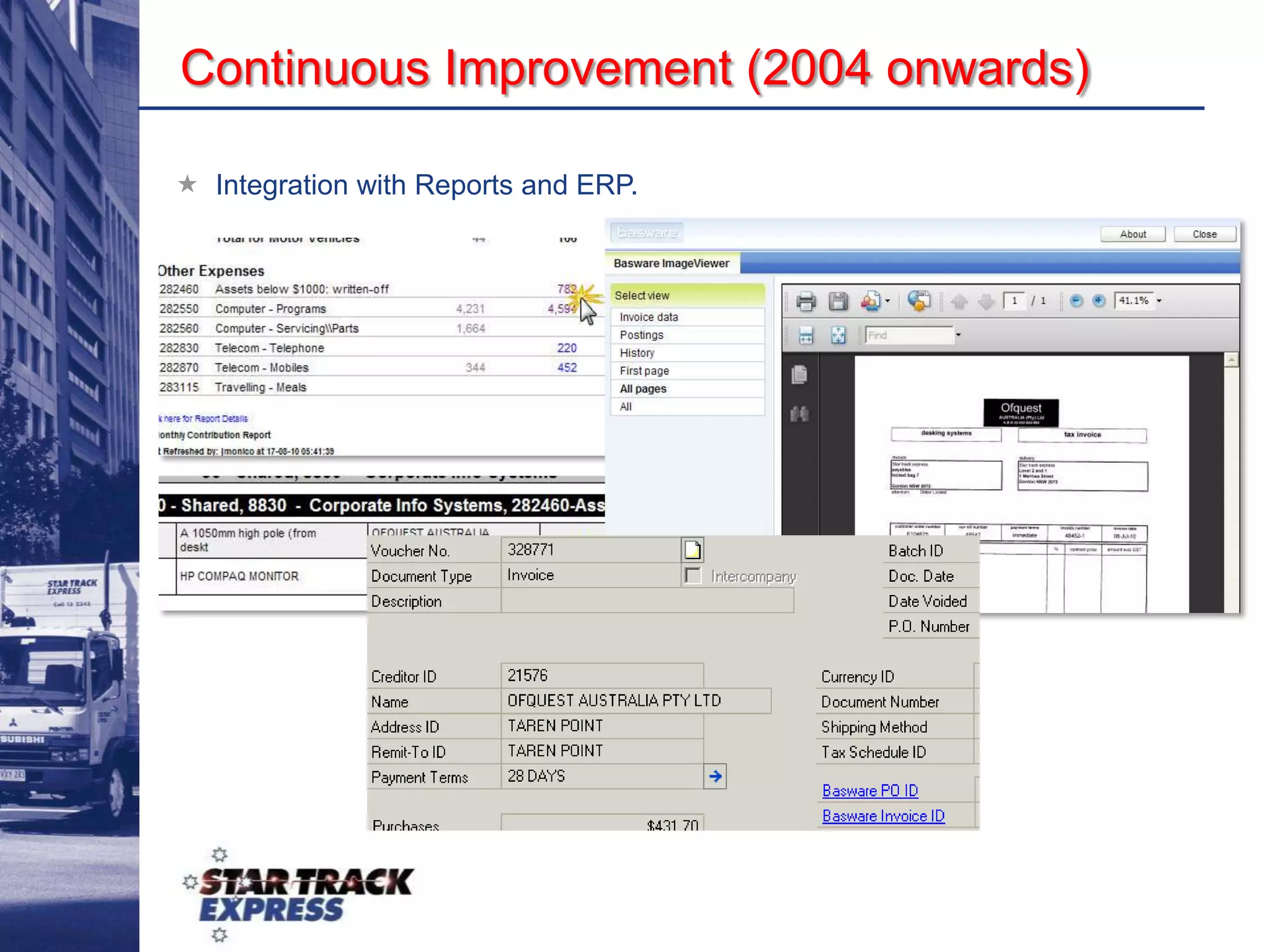

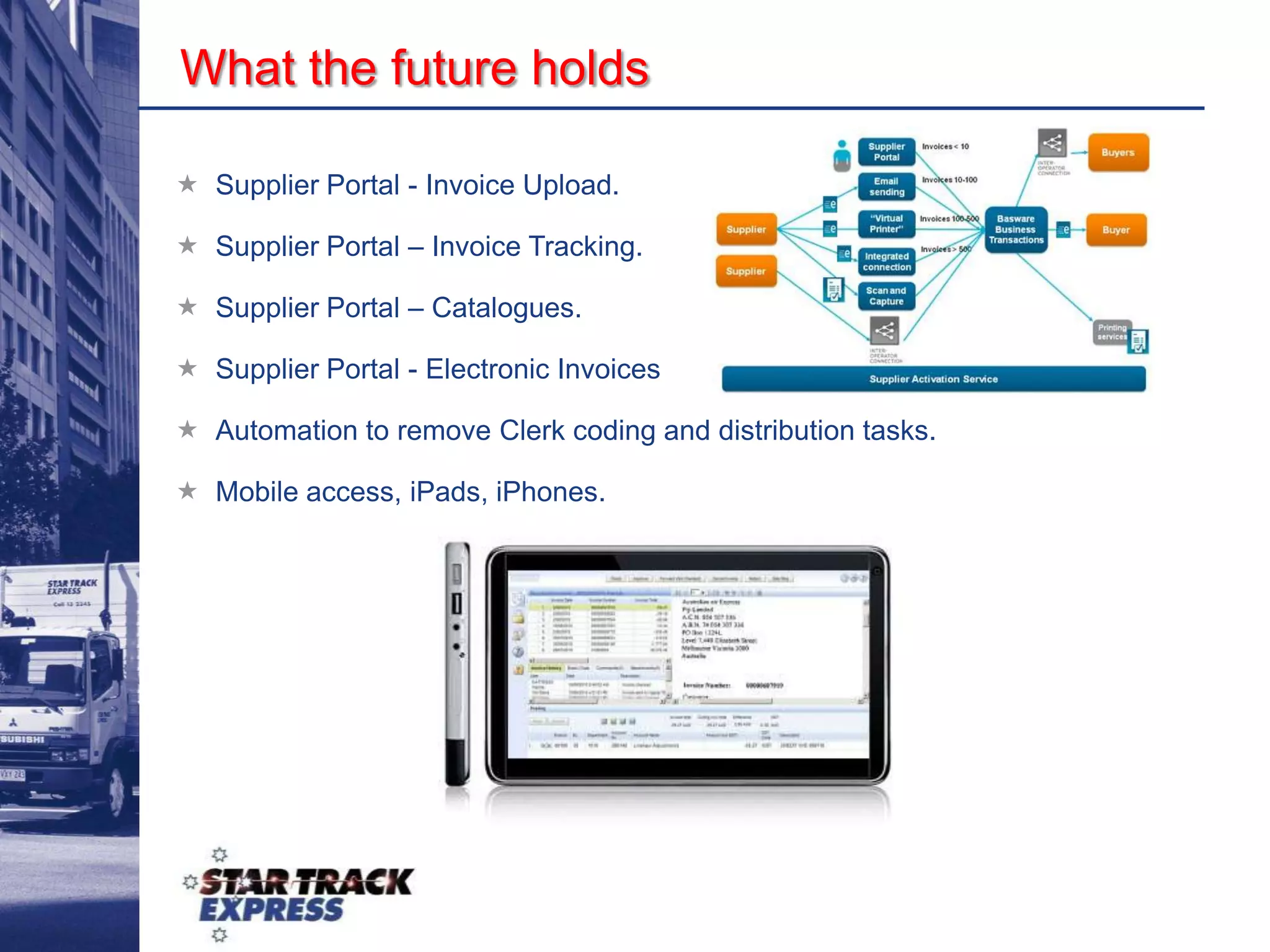

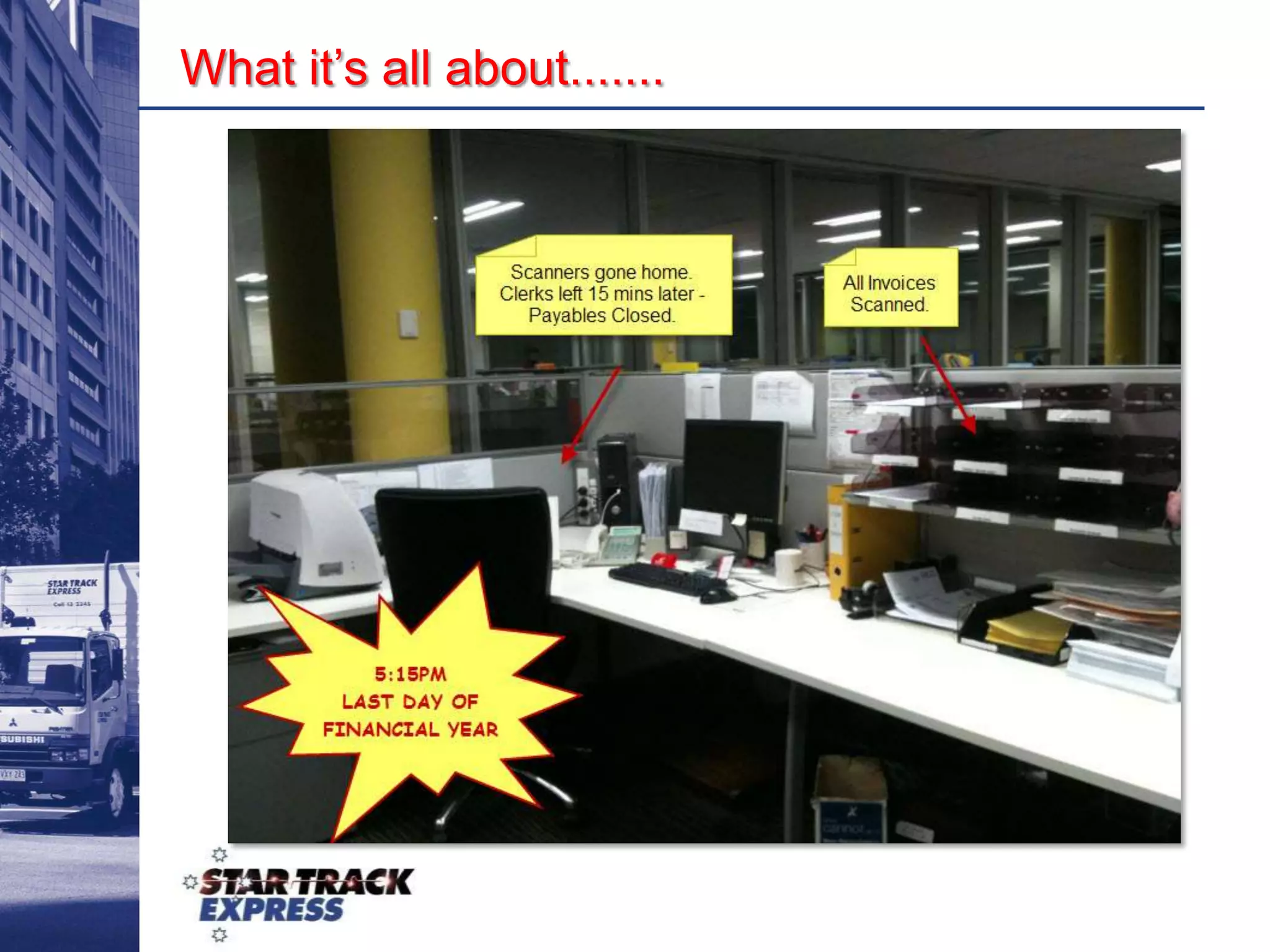

Star Track Express, an Australian express freight company, transformed its inefficient invoice processing system from a chaotic paper-based approach to a streamlined electronic workflow, significantly enhancing payment efficiency and visibility. By implementing new technologies like e-flow (Basware) and adopting digital payments, they reduced processing times and improved compliance, resulting in substantial operational benefits. Continuous improvements and future enhancements, including a supplier portal and mobile access, are planned to further optimize their accounts payable processes.