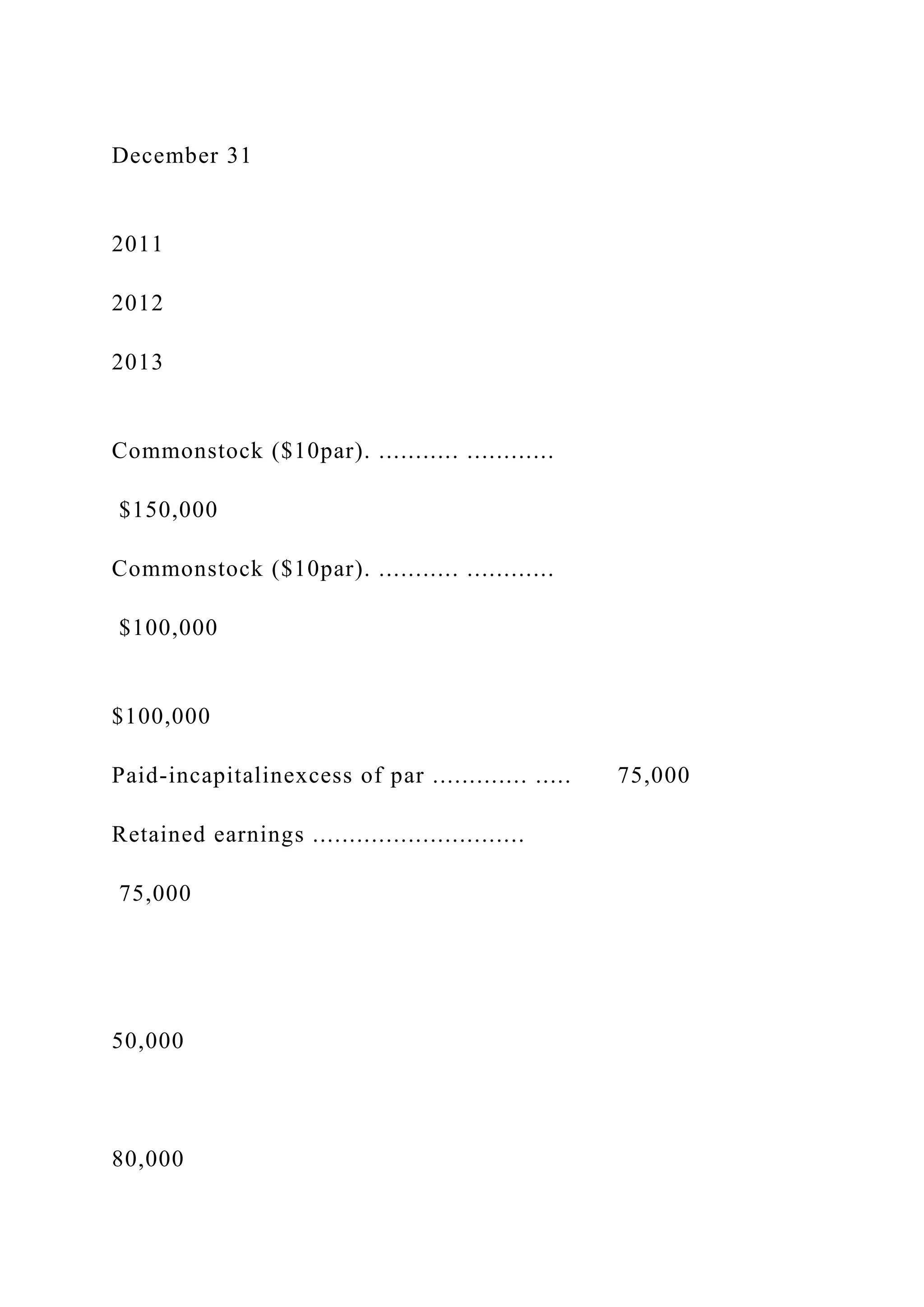

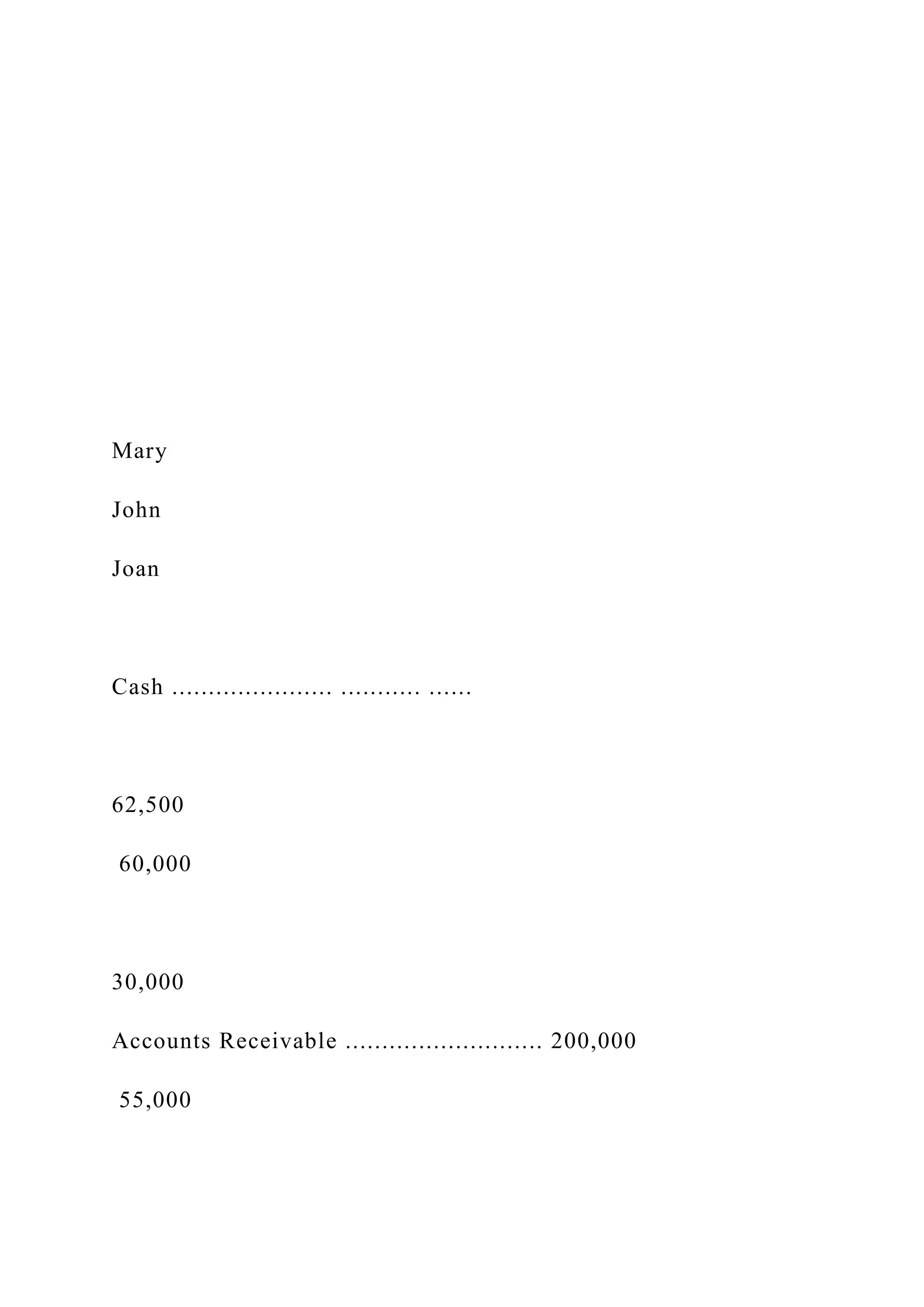

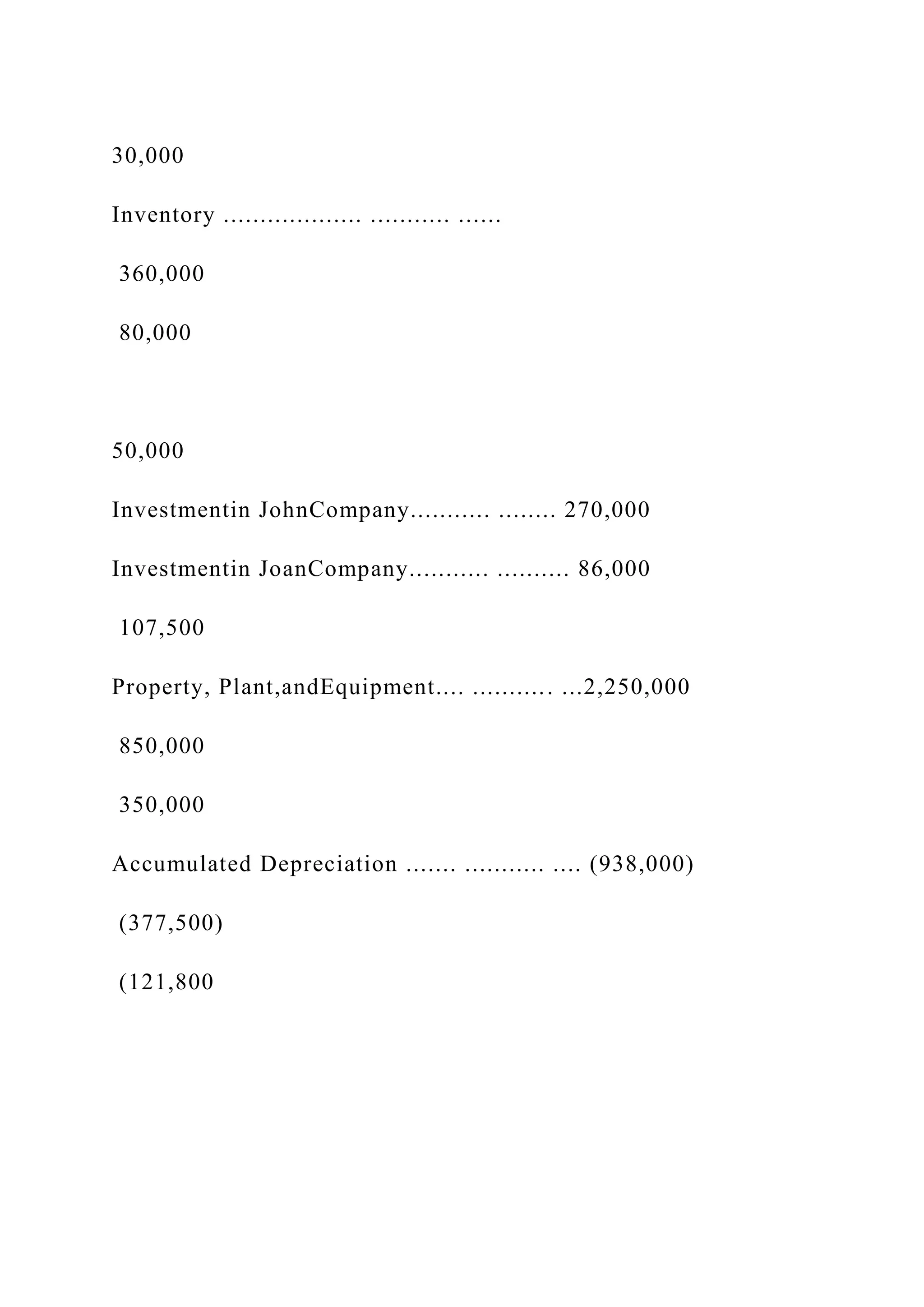

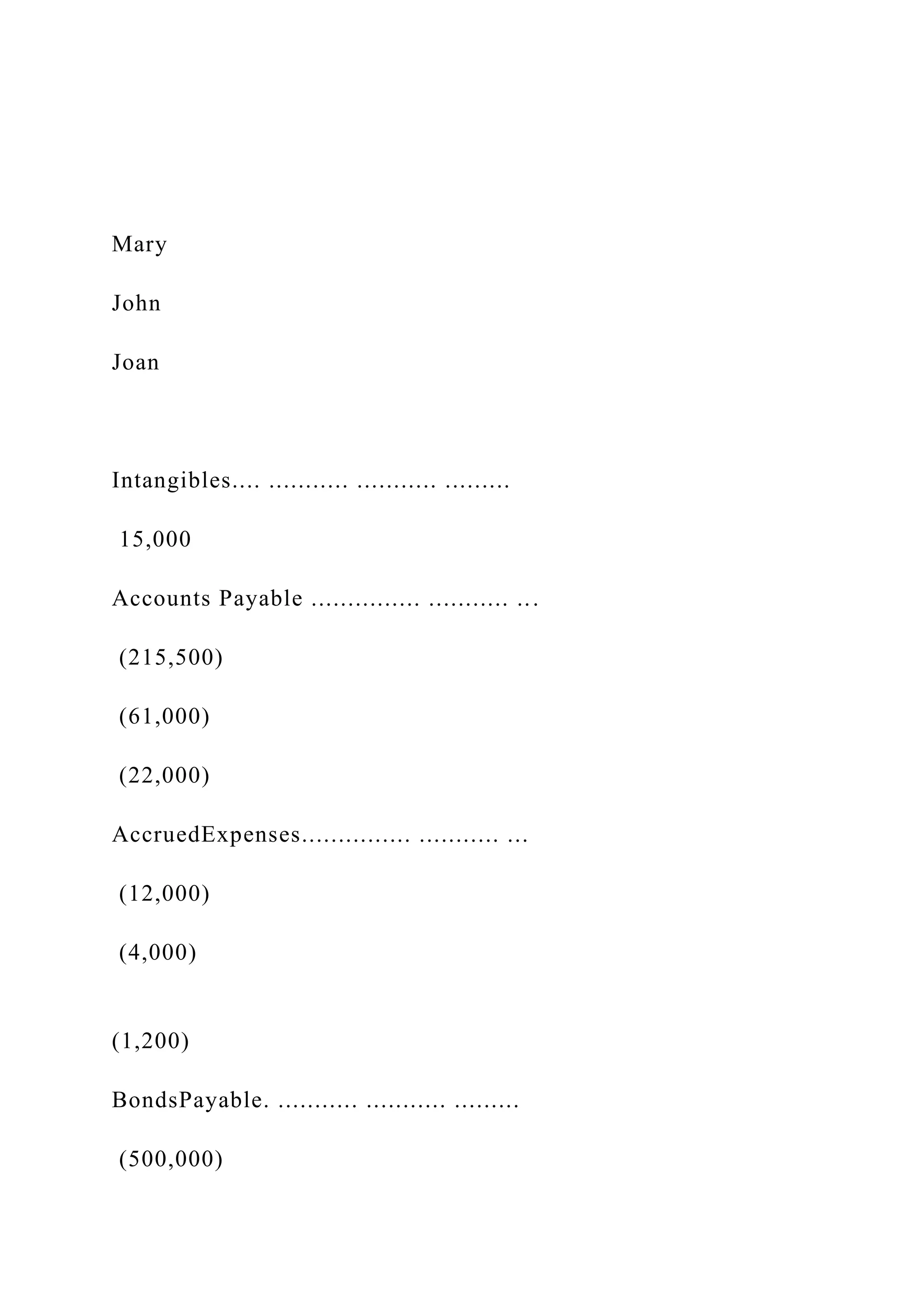

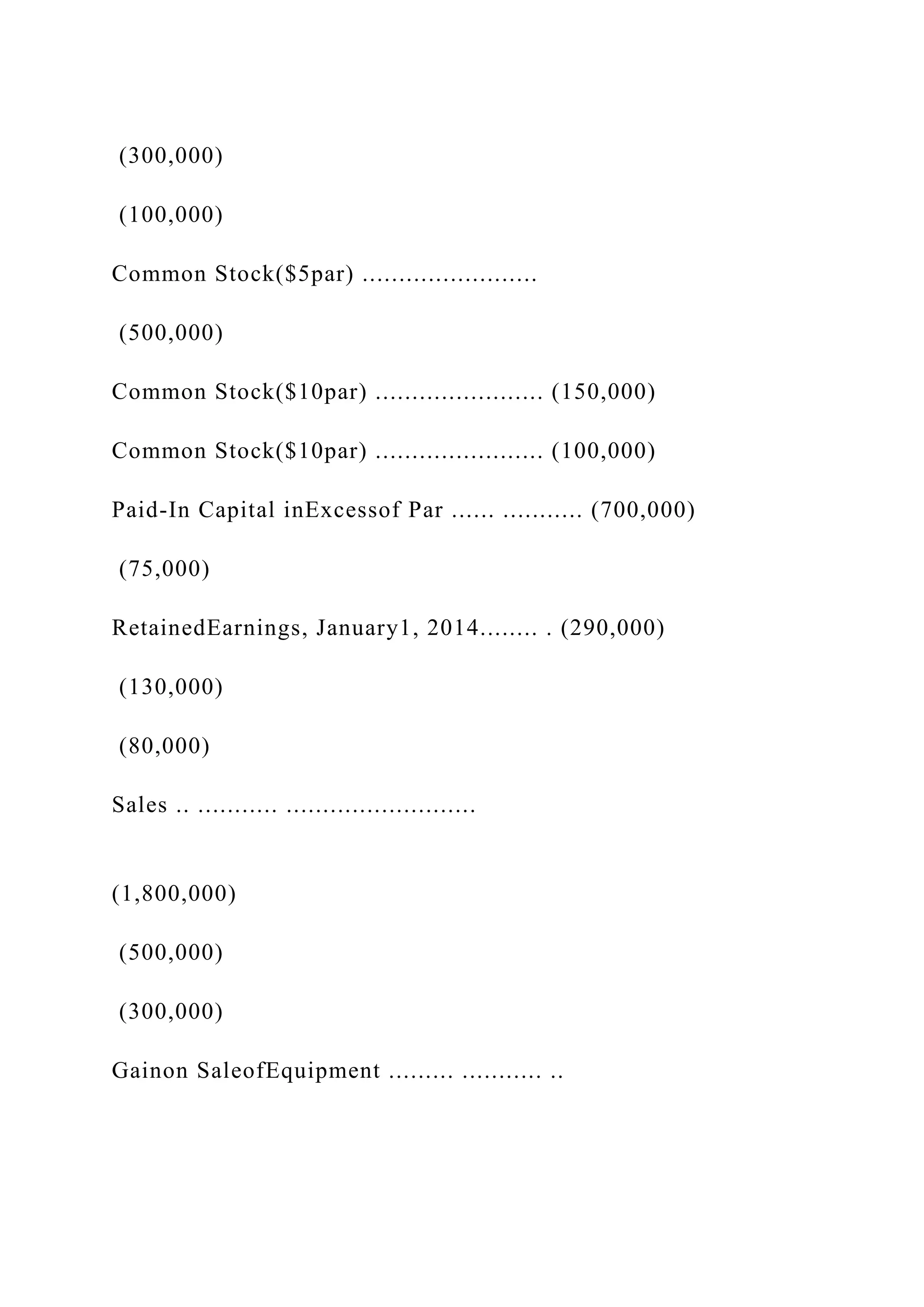

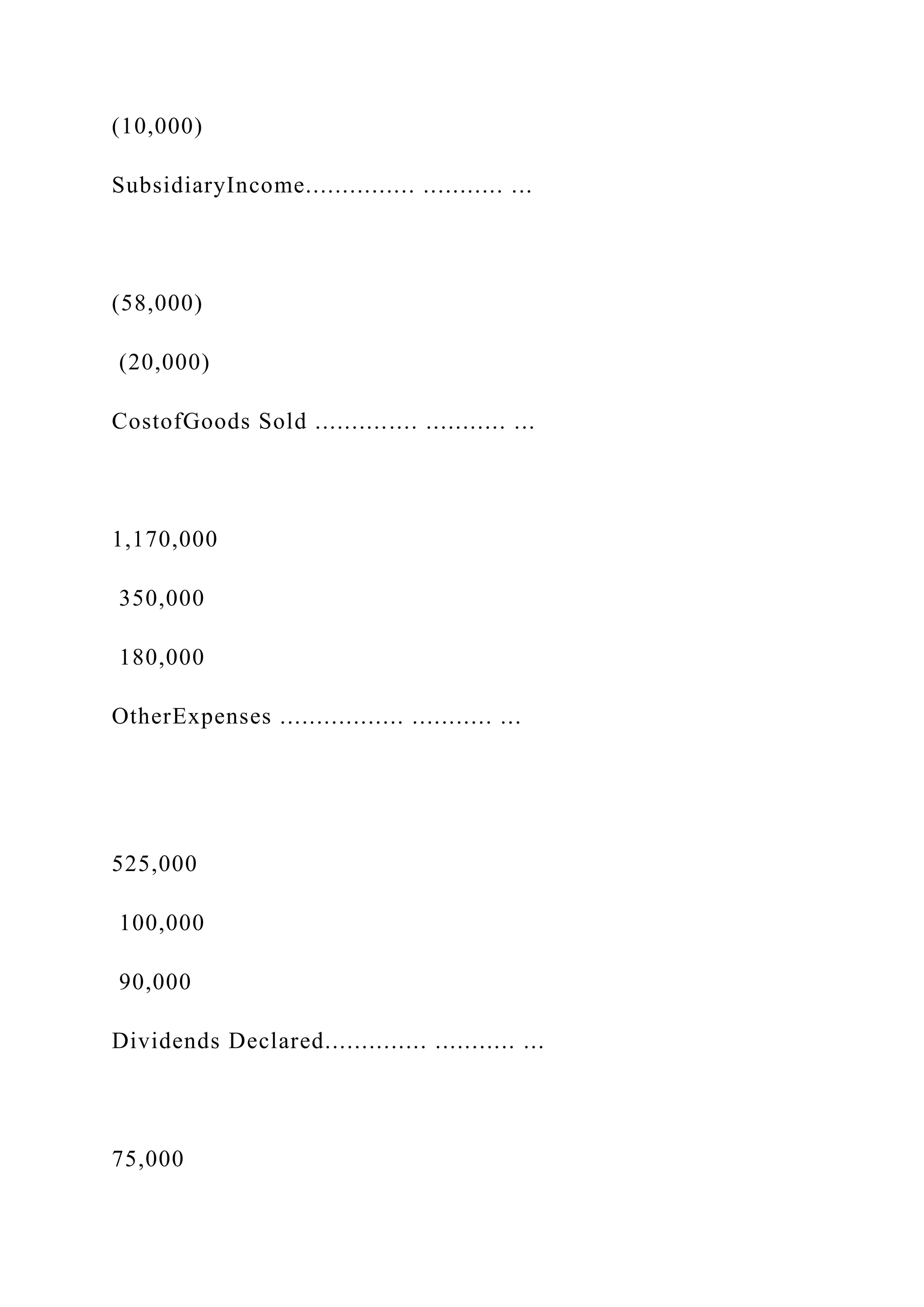

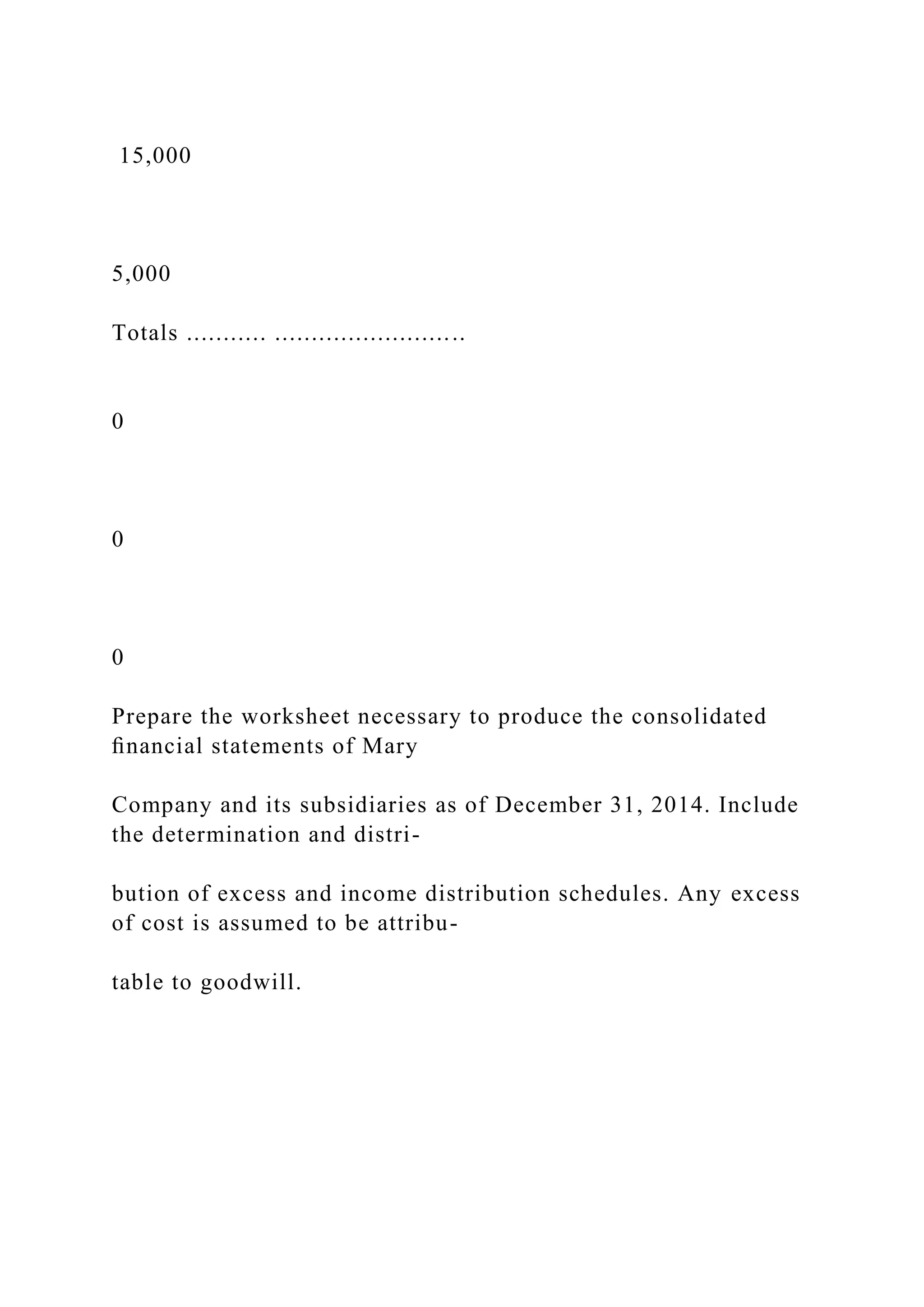

The document outlines the intercompany relationships and financial transactions between Mary Company, John Company, and Joan Company as of December 31, 2014, including ownership stakes and acquisitions. It details the purchase of interests, sales of merchandise, and a machine, while providing trial balances and the necessity for a consolidated financial statement worksheet. The worksheet is to include excess and income distribution schedules, assuming any excess of cost is attributable to goodwill.