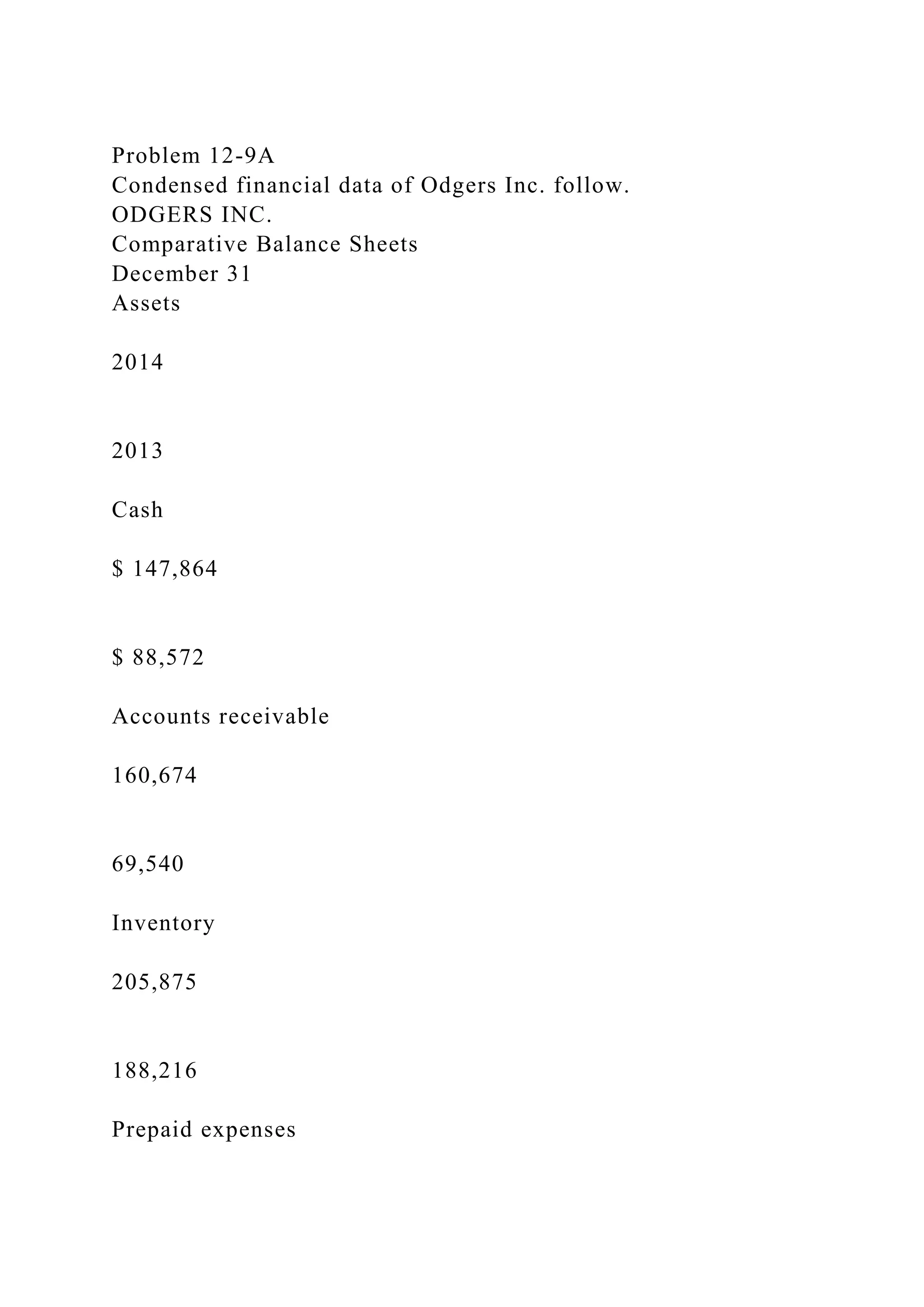

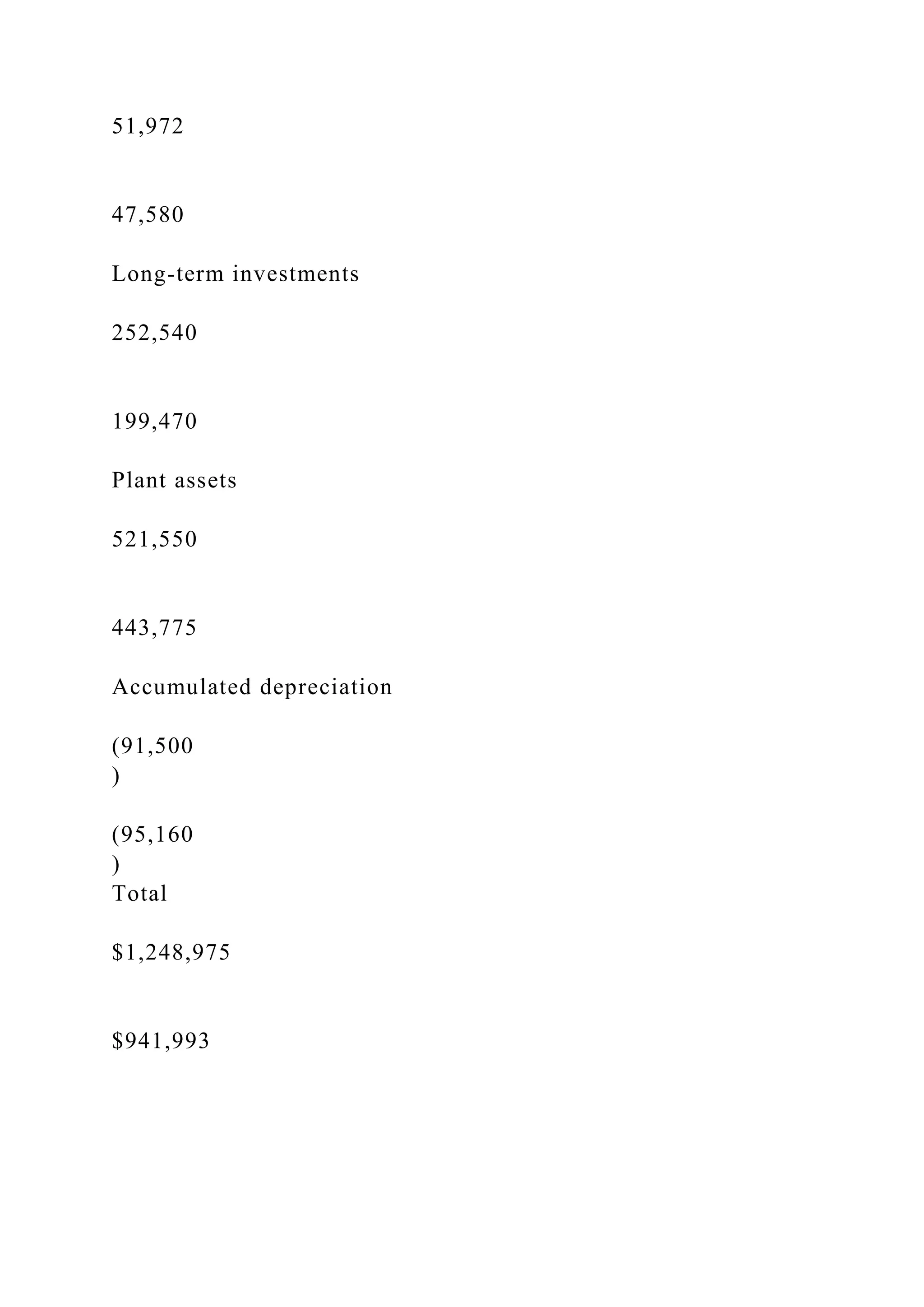

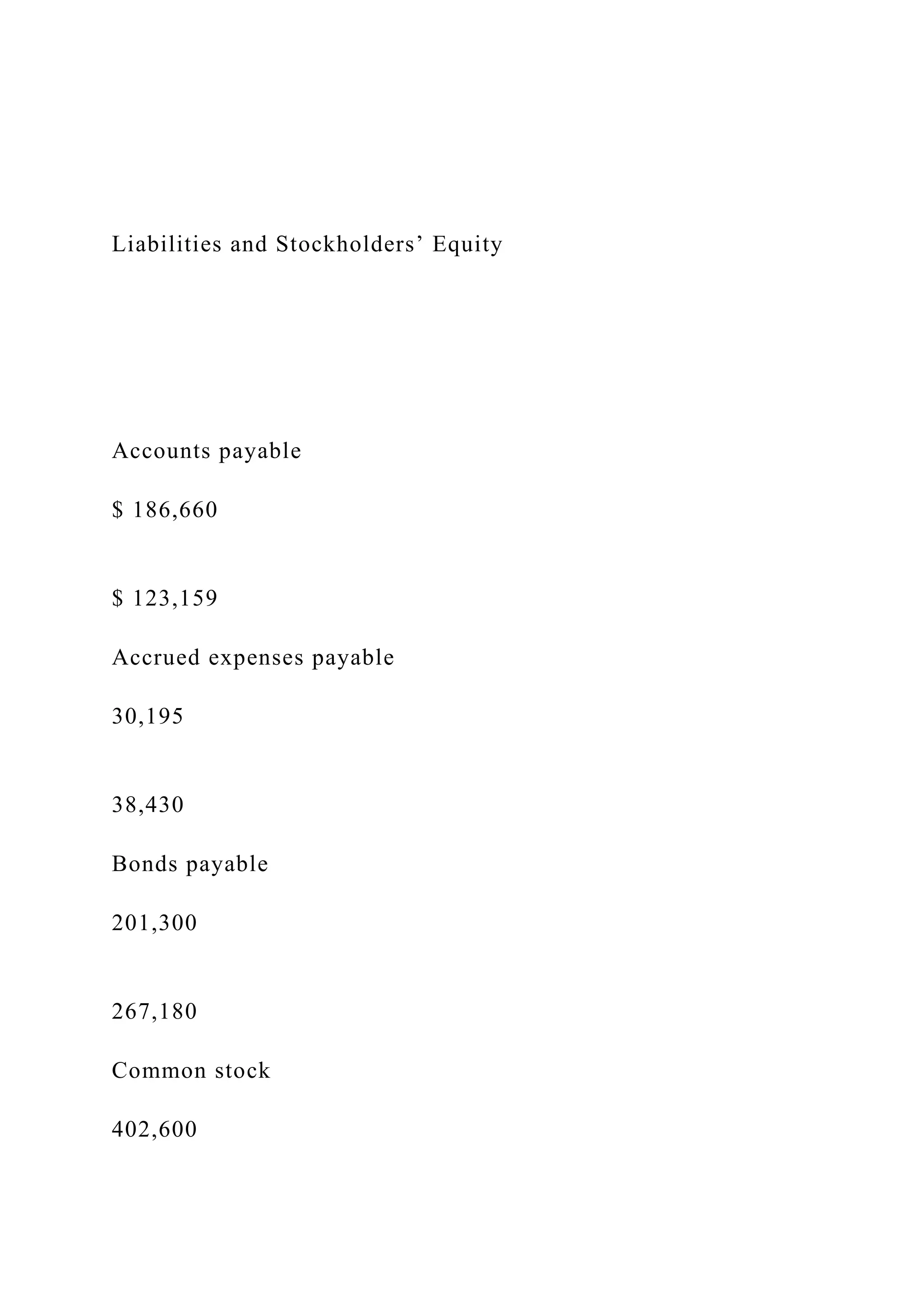

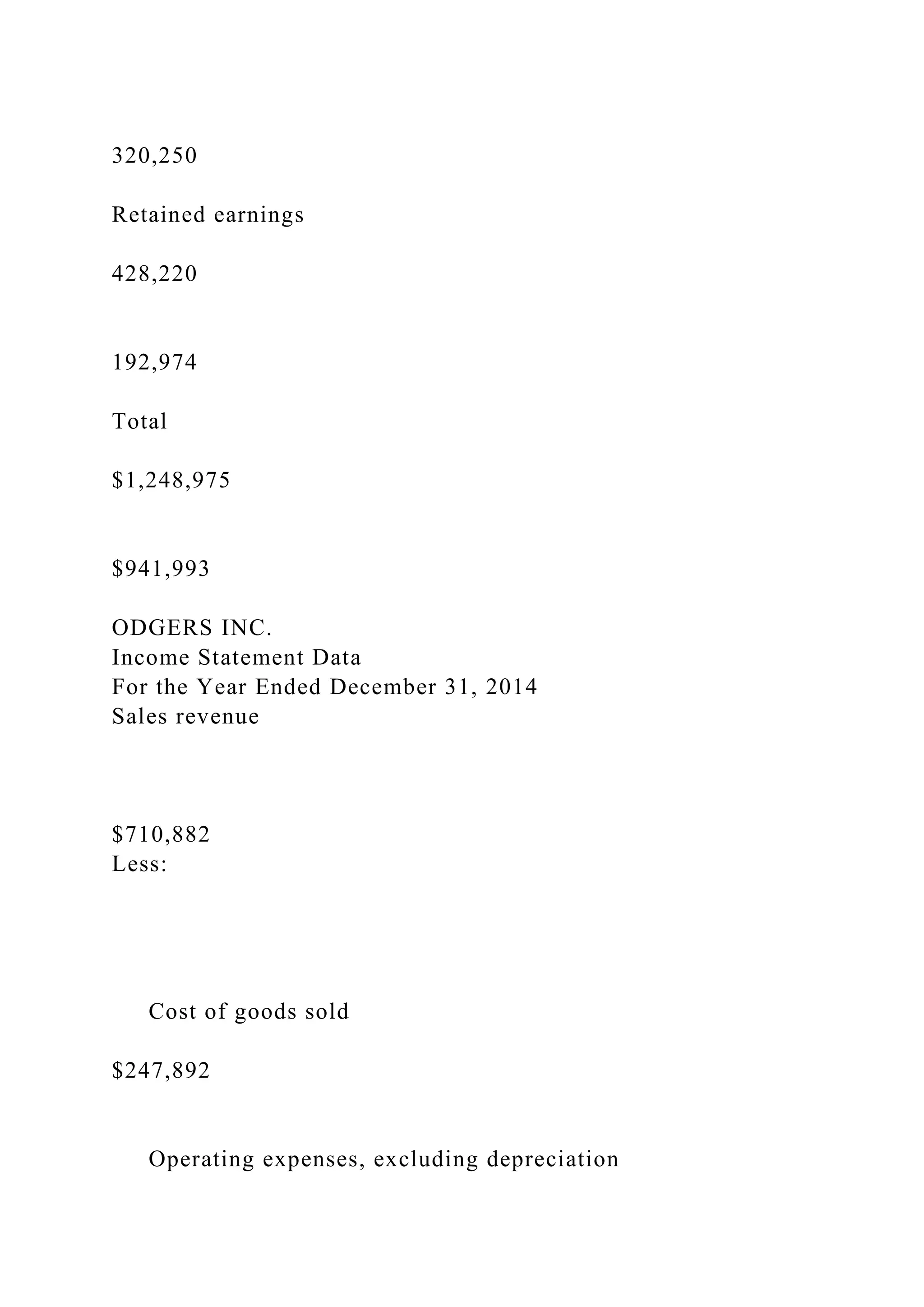

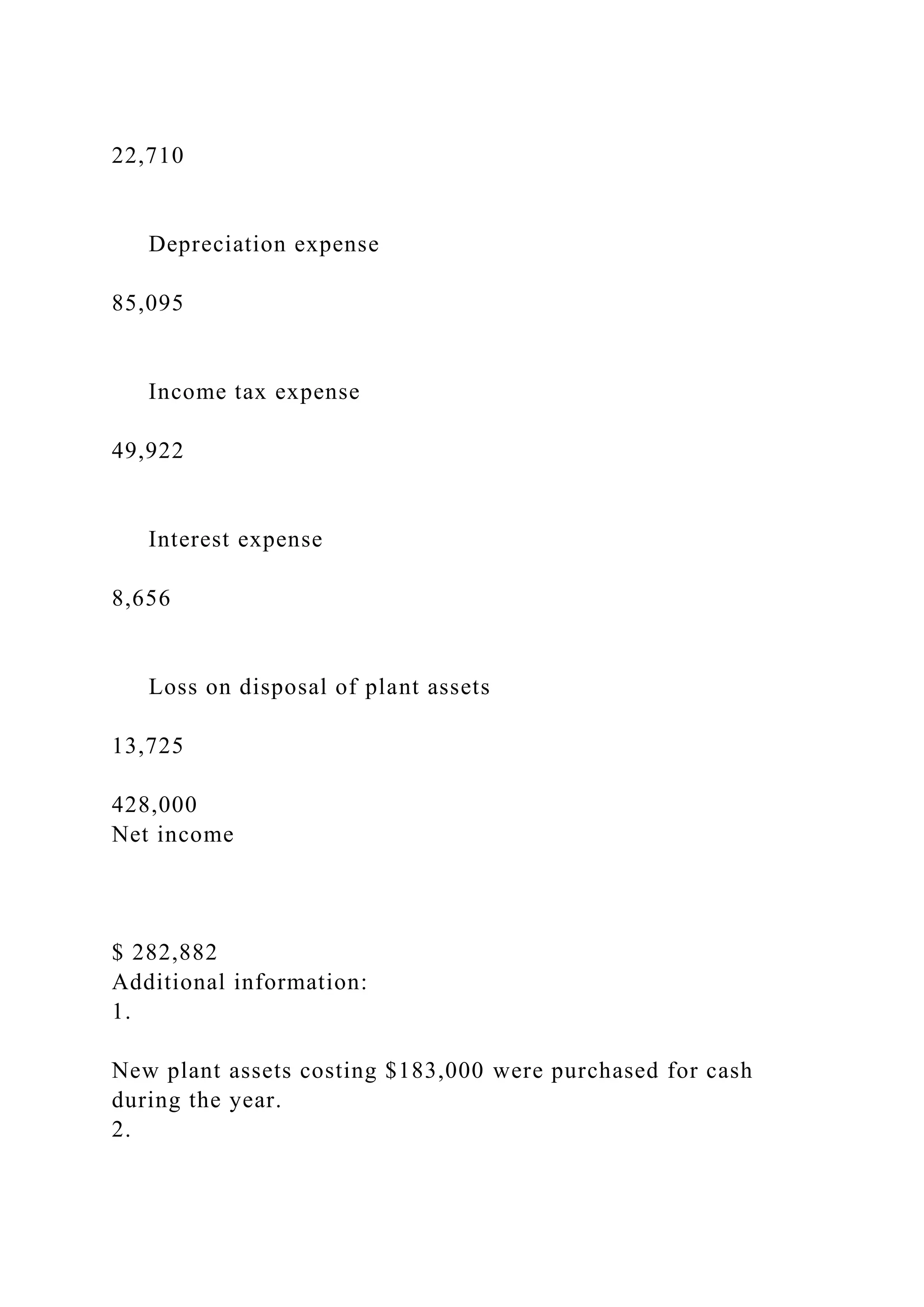

The document presents the condensed financial data of Odgers Inc. for the year ending December 31, 2014, including a comparative balance sheet and an income statement. Key highlights include total assets of $1,248,975 and net income of $282,882, alongside additional information on cash flows related to plant asset purchases and dividends. A statement of cash flows is requested to be prepared using the indirect method.

![Old plant assets having an original cost of $105,225 and

accumulated depreciation of $88,755 were sold for $2,745 cash.

3.

Bonds payable matured and were paid off at face value for cash.

4.

A cash dividend of $47,636 was declared and paid during the

year.

Prepare a statement of cash flows using the indirect method.

(Show amounts that decrease cash flow with either a - sign e.g.

-15,000 or in parenthesis e.g. (15,000).)

ODGERS INC.

Statement of Cash Flows

For the Year Ended December 31, 2014

$

$

$

[removed]](https://image.slidesharecdn.com/problem12-9acondensedfinancialdataofodgersinc-221128202523-37a60dde/75/Problem-12-9ACondensed-financial-data-of-Odgers-Inc-follow-ODGE-docx-6-2048.jpg)