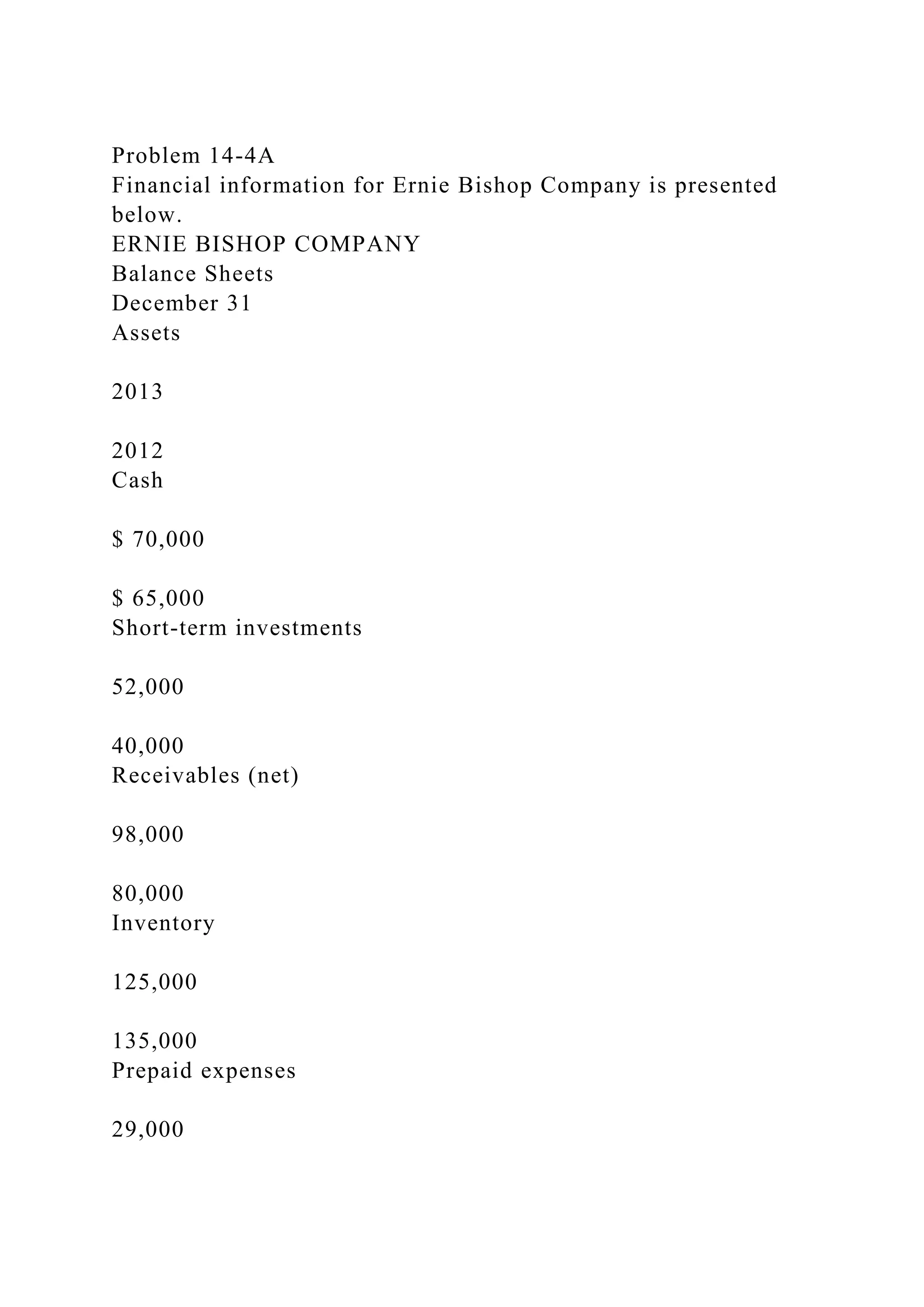

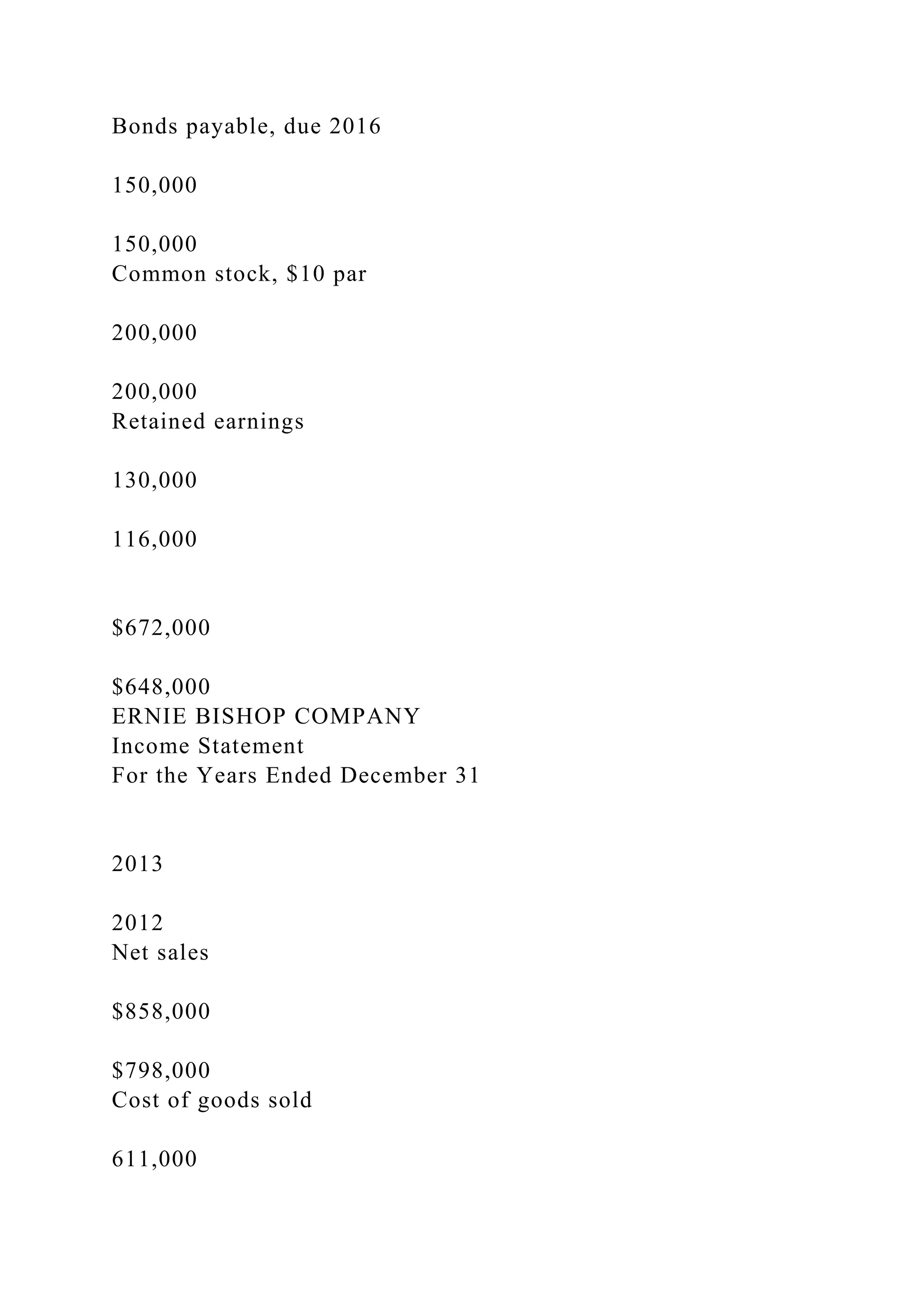

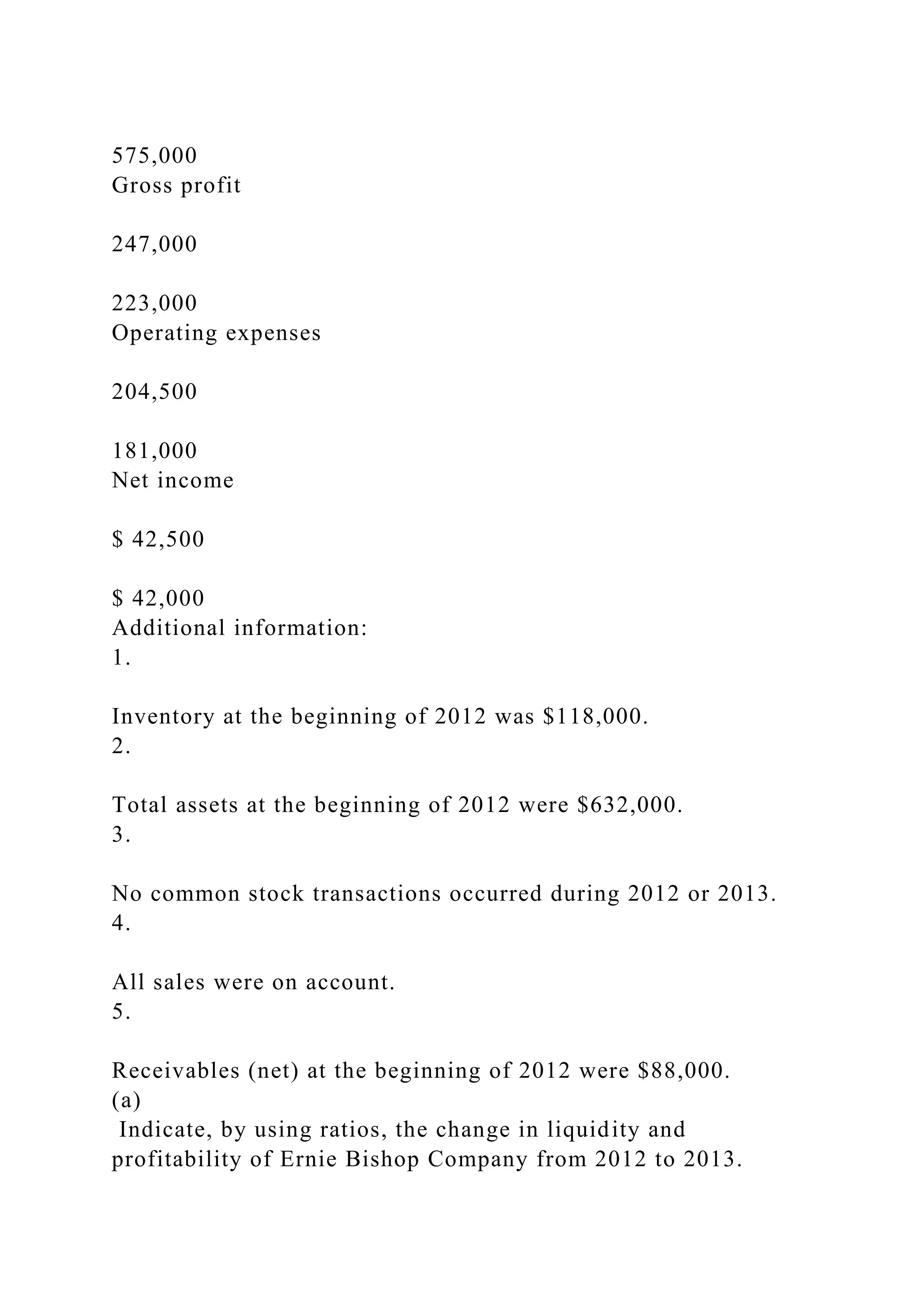

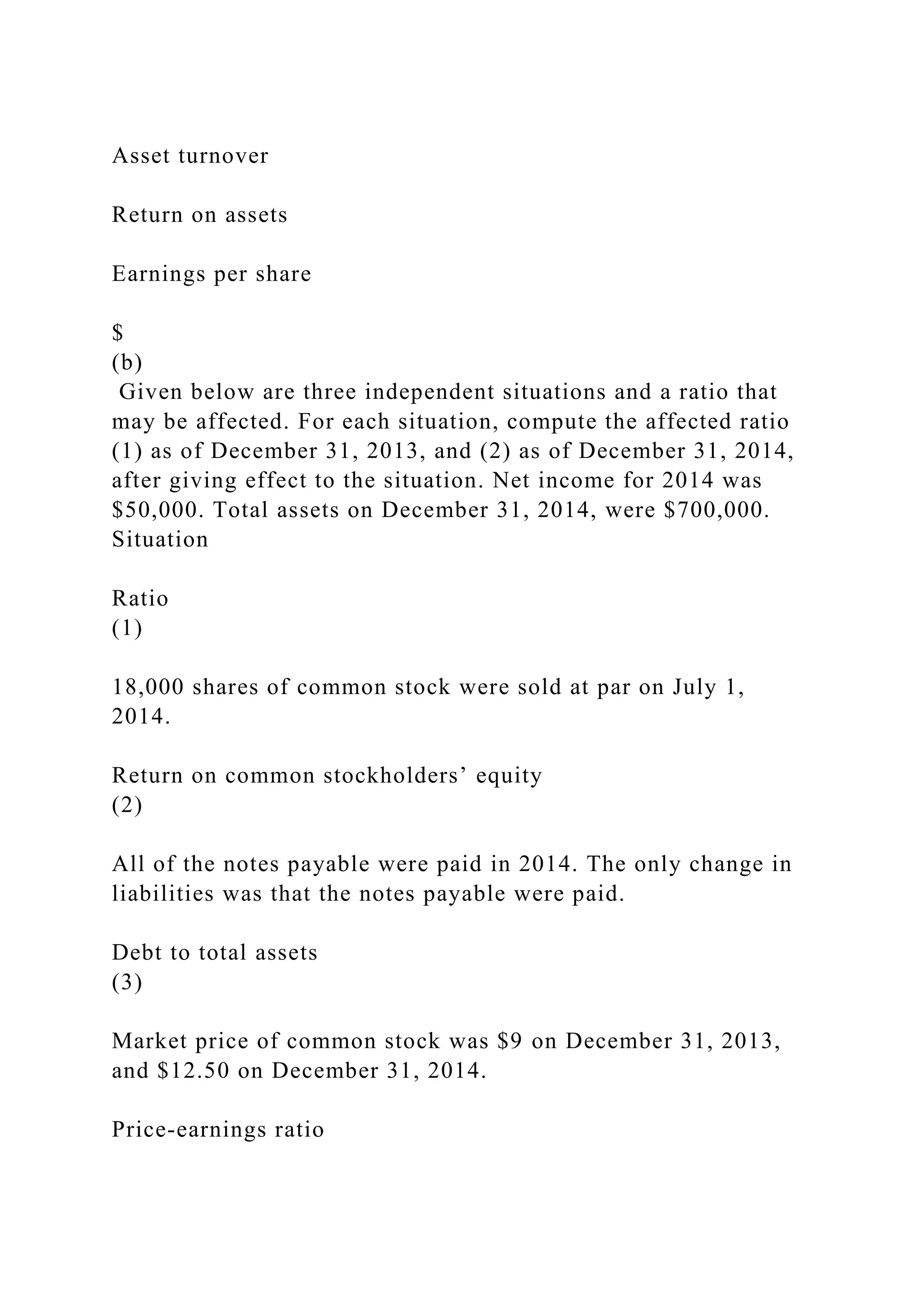

The document presents financial data for Ernie Bishop Company, including balance sheets and income statements for 2012 and 2013, highlighting changes in assets, liabilities, and net income. It indicates a small increase in net income from $42,000 in 2012 to $42,500 in 2013, alongside changes in liquidity and profitability ratios. Additional computations are requested for scenarios affecting specific financial ratios in 2014.