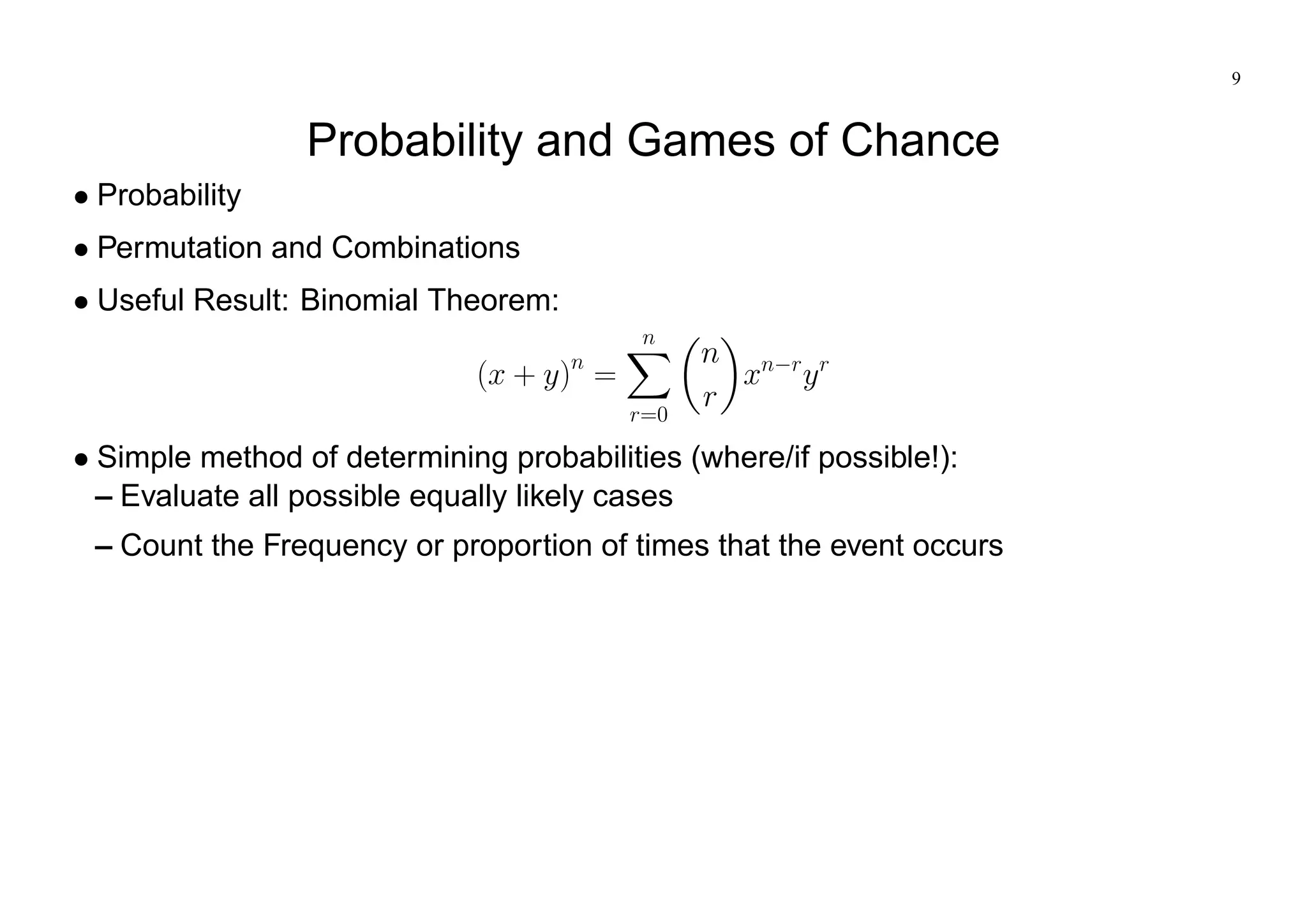

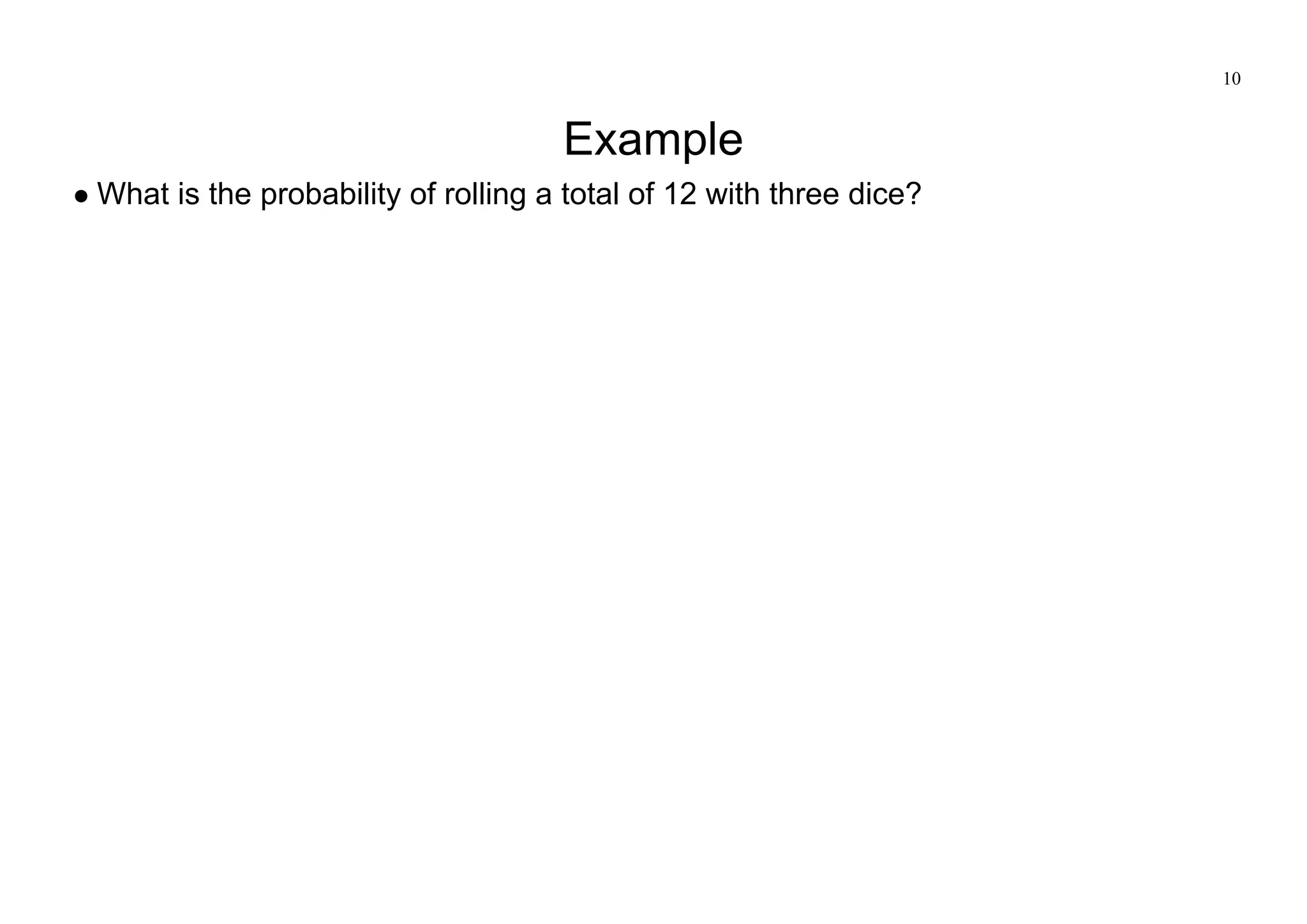

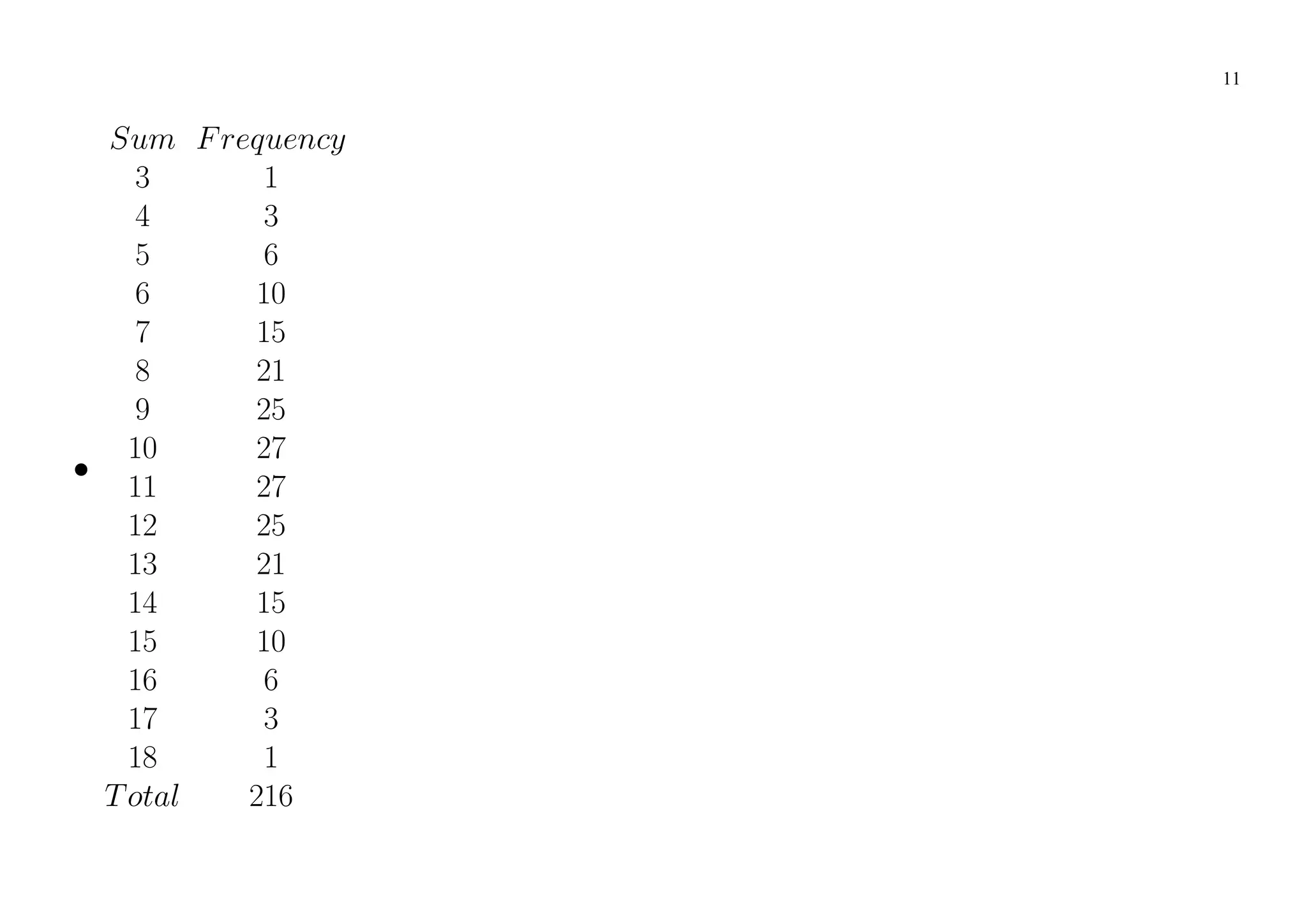

This document provides an overview of key principles of actuarial science including traditional applications in insurance, probability basics, common probability distributions used in actuarial science like Poisson and binomial, and concepts like expectation, variance, and moments. It also gives examples of calculating probabilities and parameters for Poisson and binomial distributions.

![15

Expectation

Discrete random variable - expectation of a function of a random variable g(X) is

defined as

E [g (X)] =

X

all x

g (x) f(x)

Continuous random variable

E [g (X)] =

Z 1

1

g (x) f(x)dx](https://image.slidesharecdn.com/ct10l01-230108160219-e9368233/75/Principles-of-Actuarial-Science-Chapter-1-15-2048.jpg)

![16

Moments

Moments (about the origin) of a random variable are defined as

E [Xr

] r = 1; 2; : : :

First moment (r = 1) is the mean of the distribution of the random variable - usually

denoted by .

Discrete random variable

E [X] = =

X

all x

xf(x)

Continuous random variable

E [X] = =

Z 1

1

xf(x)dx](https://image.slidesharecdn.com/ct10l01-230108160219-e9368233/75/Principles-of-Actuarial-Science-Chapter-1-16-2048.jpg)

![17

Moments - Variance

The mean is a measure of central tendency for a distribution.

The second moment about the mean is referred to as the variance of the distribution.

Variance usually denoted by 2

V ar [X] = 2

= E

h

(X )2

i

The standard deviation is the square root of the variance, .

The variance is a measure of dispersion or spread of the distribution.](https://image.slidesharecdn.com/ct10l01-230108160219-e9368233/75/Principles-of-Actuarial-Science-Chapter-1-17-2048.jpg)

![20

Poisson Distribution

The Poisson distribution

- often used to model the probability of occurrence of rare events such as insurance

claims

- also as an approximation for the chance of dying for a small enough parameter .

Poisson ( )

Pr (X = x) =

e x

x!

x = 0; 1; 2 : : :

E [X] =

V ar [X] =](https://image.slidesharecdn.com/ct10l01-230108160219-e9368233/75/Principles-of-Actuarial-Science-Chapter-1-20-2048.jpg)

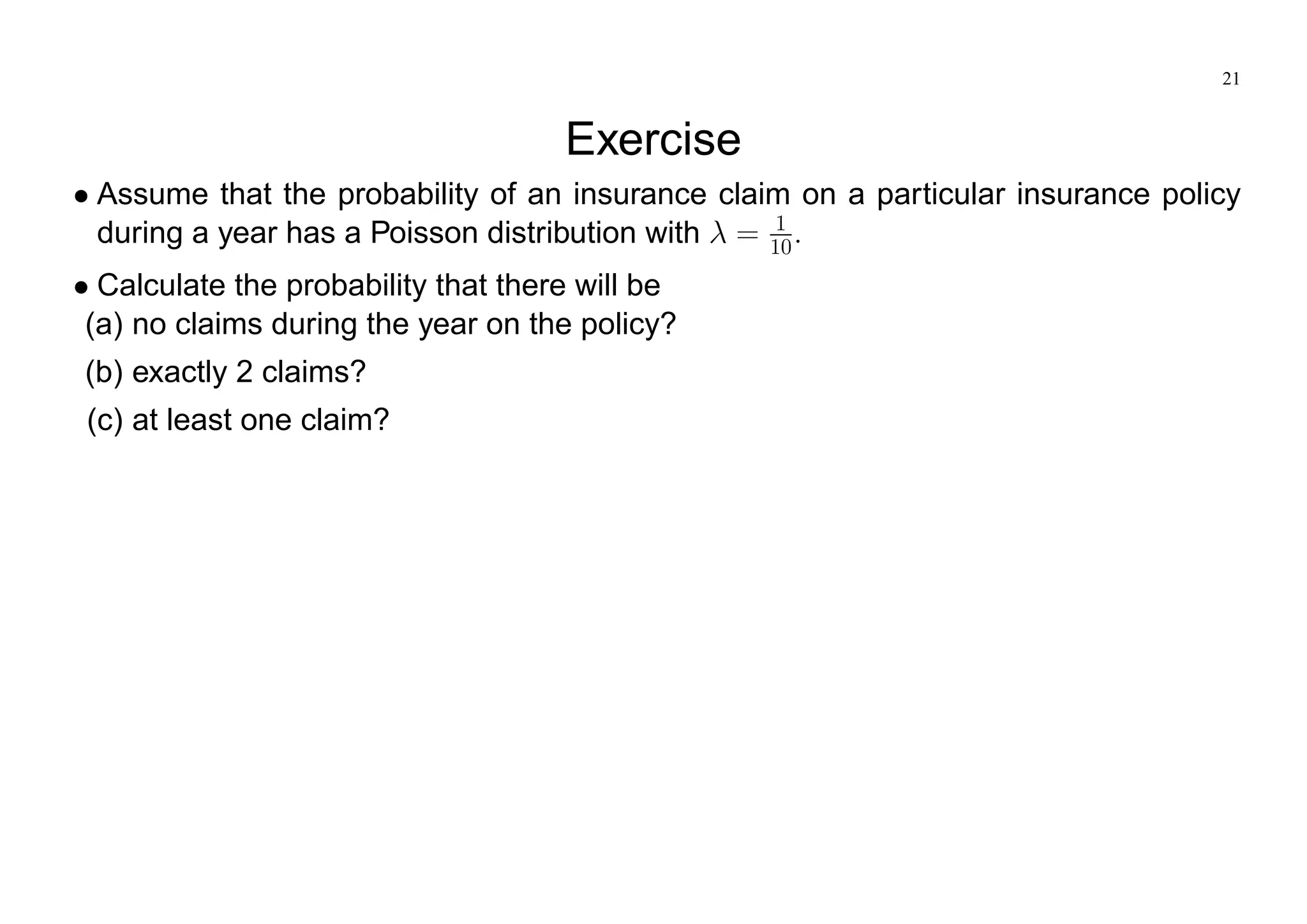

![22

Binomial Distribution

Number of successes (x) in a series of n independent trials where each success has

probability p.

In actuarial science

– probability that a number of lives in a group of lives with the same chance of dying

will die assuming independence between the lives.

Binomial (n; p)

Pr (X = x) =

n

x

px

(1 p)n x

x = 0; 1; 2 : : :

E [X] = np

V ar [X] = np (1 p)](https://image.slidesharecdn.com/ct10l01-230108160219-e9368233/75/Principles-of-Actuarial-Science-Chapter-1-22-2048.jpg)