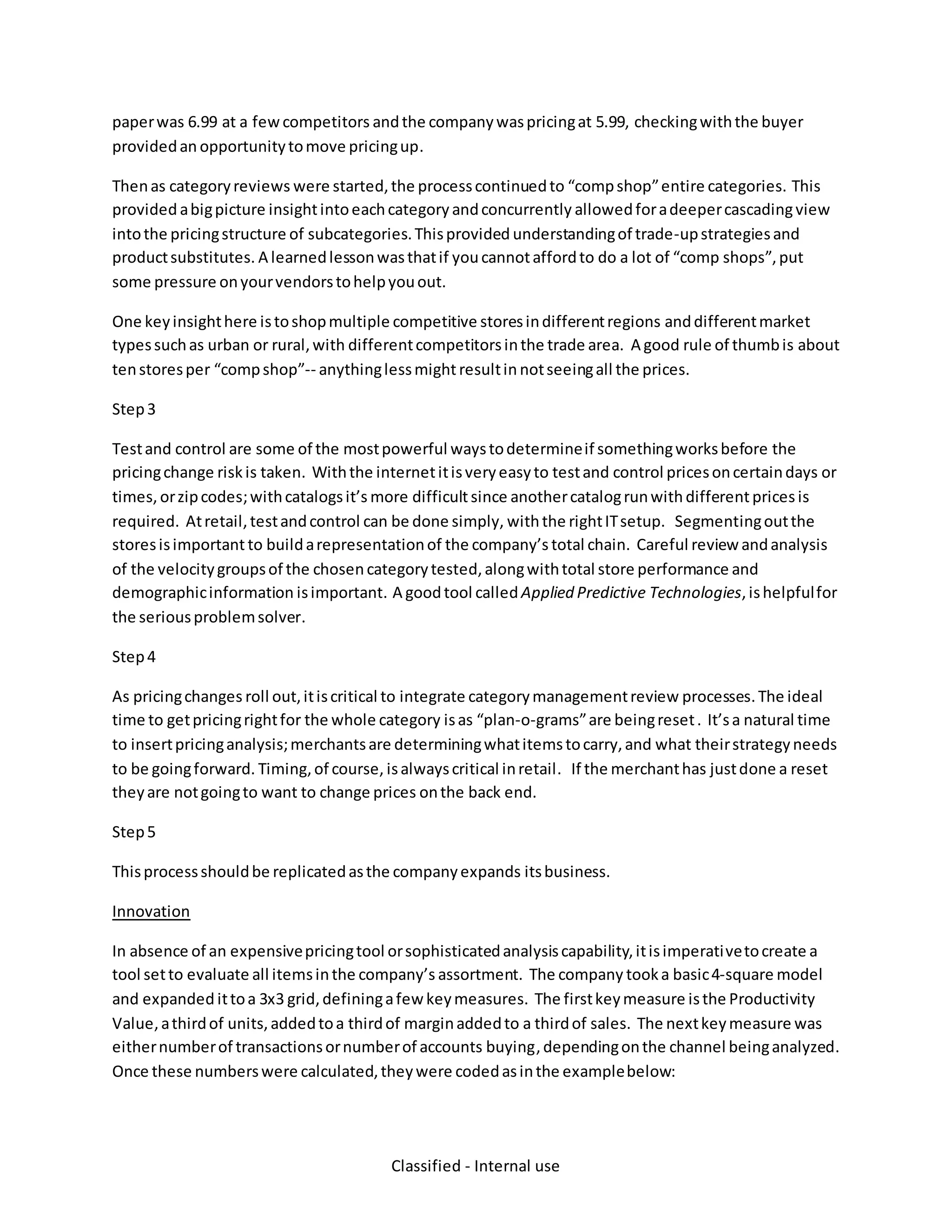

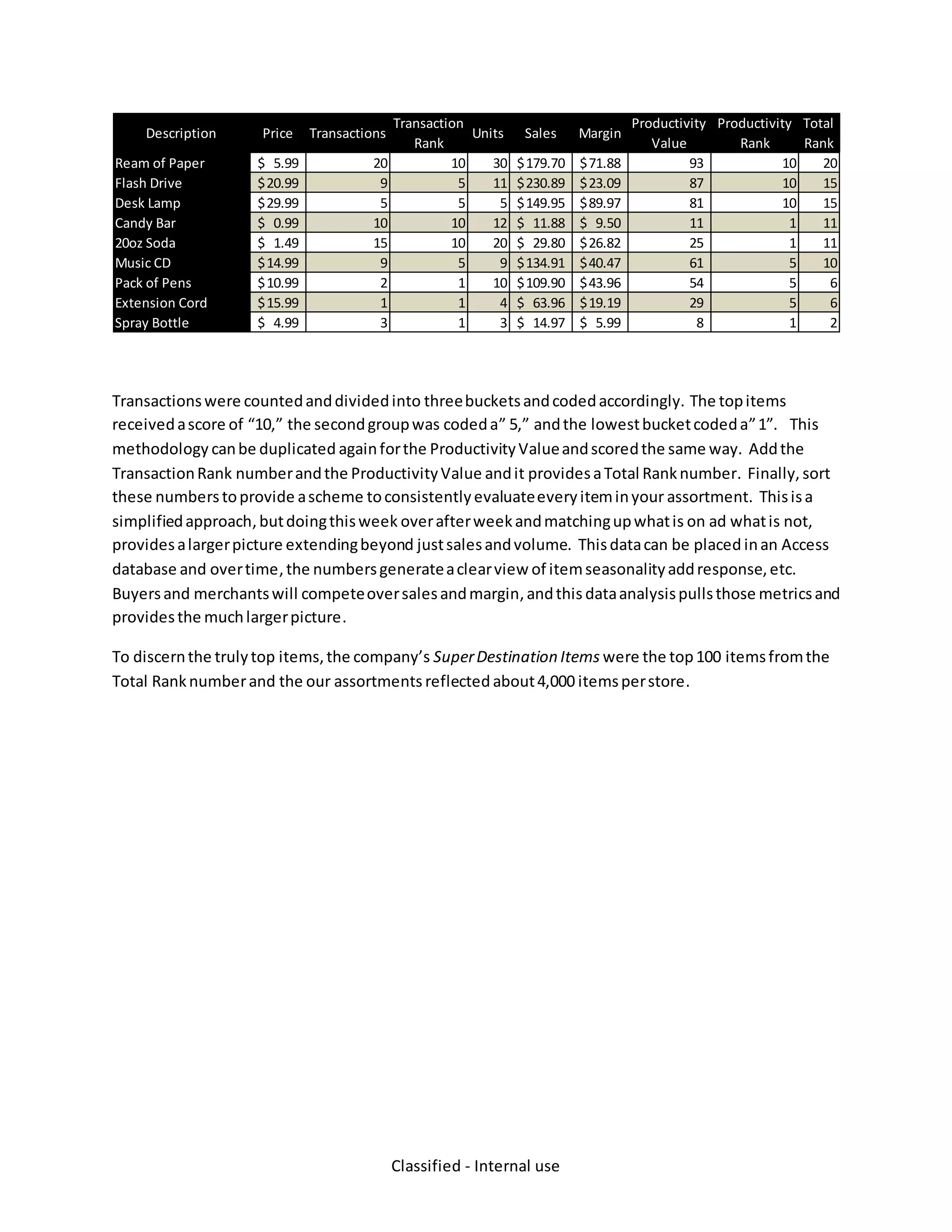

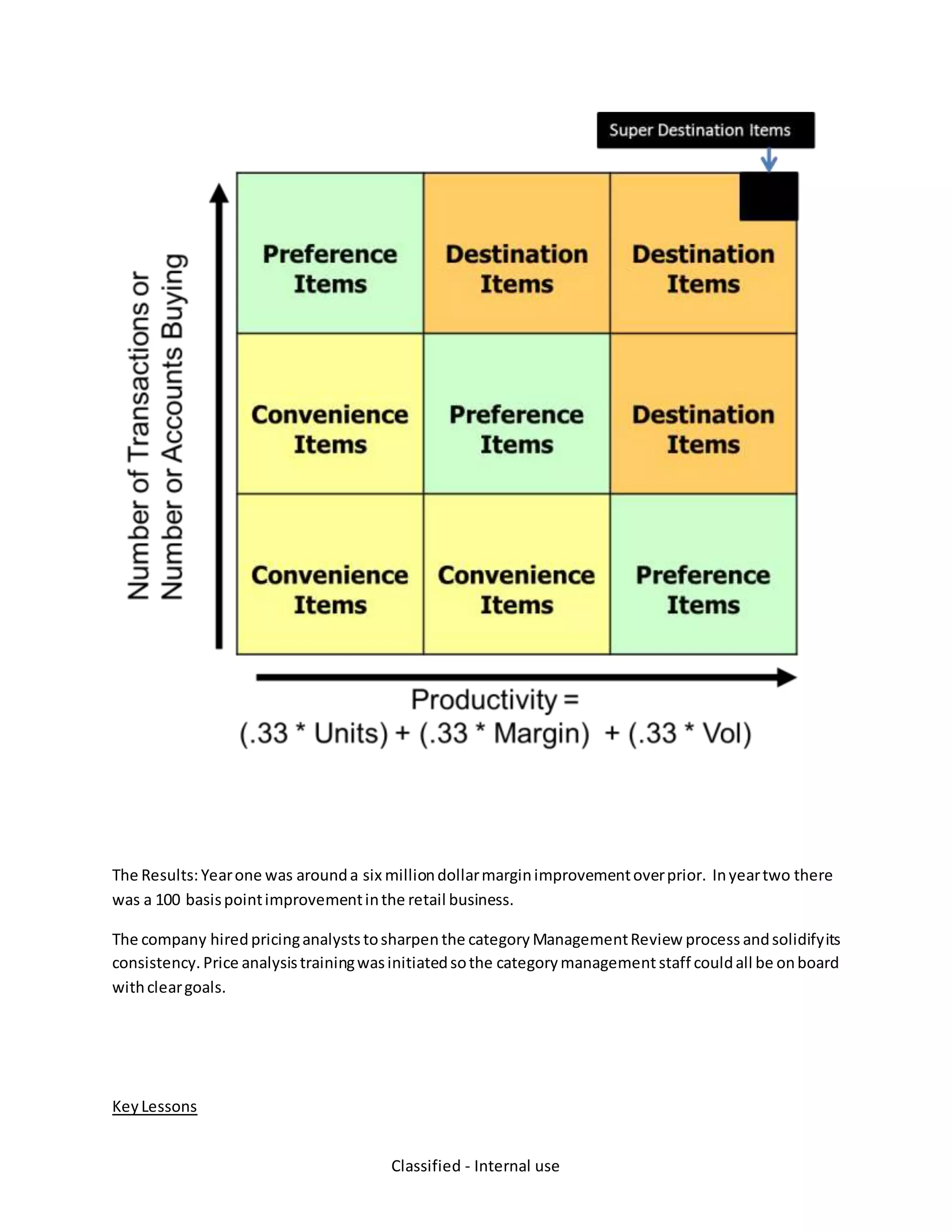

The document discusses best practices for creating a unified pricing strategy across multiple sales channels without significant cost. It outlines a 5-step process: 1) Gather input from different teams to understand priorities and build buy-in, 2) Develop pricing analytics and competitive data, 3) Test pricing changes, 4) Integrate pricing reviews into category management, 5) Repeat the process as the business expands. Key results included a $6 million margin improvement in year one and a 100 basis point retail business improvement in year two. Consistency, data-driven decisions, and strong team relationships were important to success.