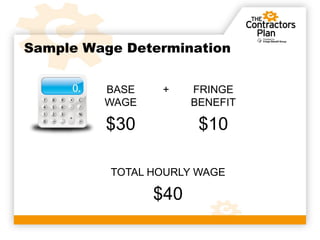

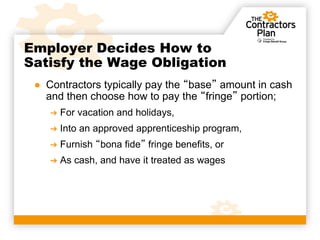

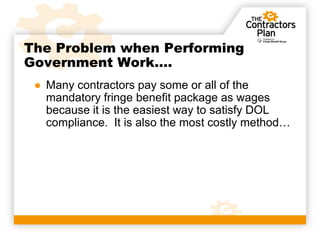

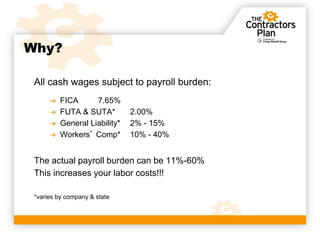

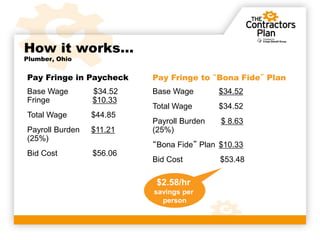

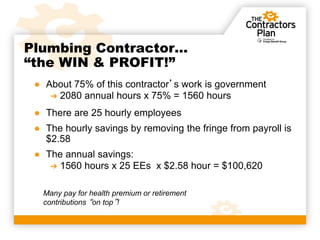

This document discusses how a company called Associated Benefits Consultants can help non-union employers who bid on prevailing wage government projects reduce their labor costs and increase profits. It notes that while contractors can pay fringe benefits as cash wages, this is the most expensive option due to payroll taxes and burdens. ABC instead proposes paying fringe benefits into bona fide plans to avoid these costs, potentially saving a plumbing contractor over $100,000 per year in the example provided. Contact information is given for those interested in learning how this approach could benefit their company.