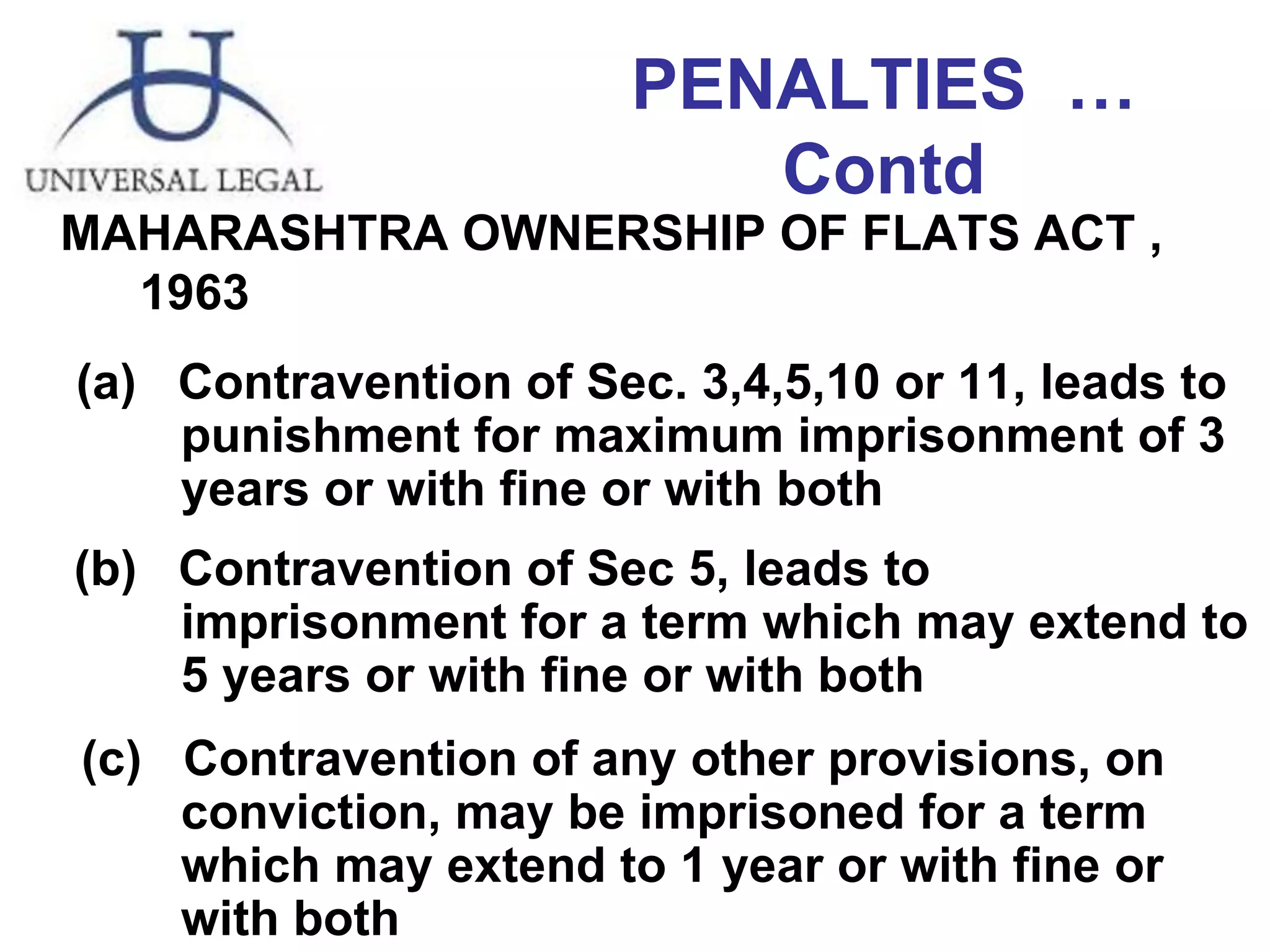

This document summarizes important considerations and legal requirements for buying and selling property in India. It outlines steps that should be taken to ensure clear title, inspect documents, follow proper procedures for booking, construction, agreements, payments, possession, defects, society formation, available remedies, and penalties for non-compliance. Key points include verifying title is clear and encumbrance-free, inspecting required construction permits and approvals, ensuring agreements clearly define terms, following proper processes for payments, possession, and post-sale support. Non-compliance with laws could result in legal action or criminal penalties.

![CONTACT US UNIVERSAL LEGAL 5th Floor, Kimatrai Building 77/79 Maharshi Karve Road Mumbai – 400 002 Phone : 2203 4293 - 95 Fax : 2203 9845 E-mail: [email_address]](https://image.slidesharecdn.com/presentationbuiiderapurva-12511816473535-phpapp01/75/Presentation-Buiider-Apurva-22-2048.jpg)