The document analyzes various financial ratios of First Security Islami Bank Ltd over a 5 year period from 2009-2013. Key findings from the ratio analysis include:

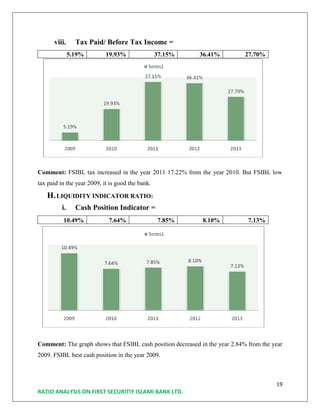

- Return on equity fluctuated over the period but was highest in 2009 and lowest in 2013. Liquidity and credit risk ratios also varied each year.

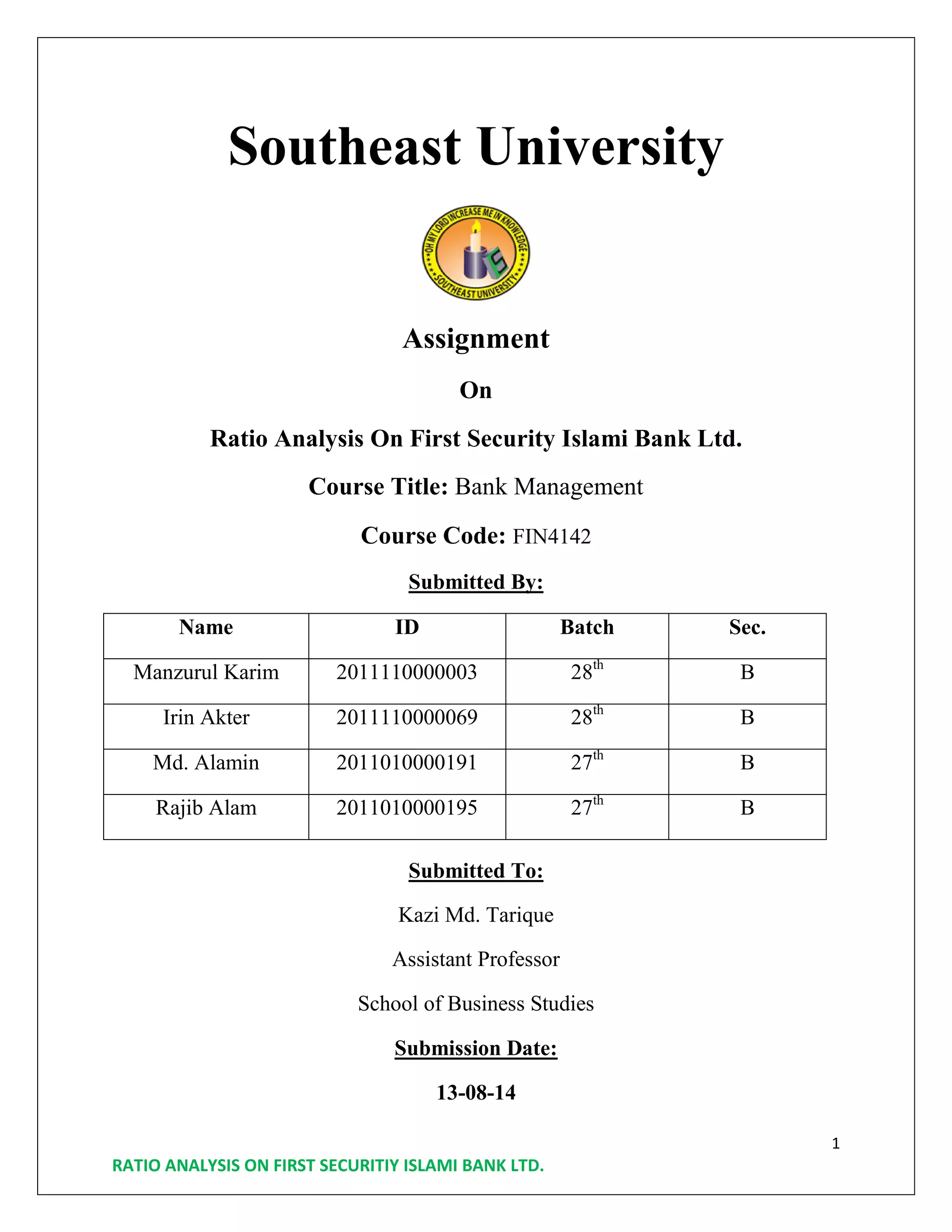

- Expense control efficiency decreased each year, indicating rising expenses. Tax management efficiency and funds management efficiency increased in some years.

- Capital adequacy ratios showed the bank was undercapitalized or adequately capitalized most years except 2010 when it was in a better position.

- Asset quality deteriorated in 2010 as substandard investments increased sharply that year before declining in subsequent years.