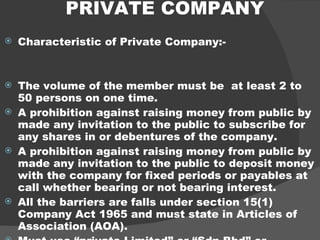

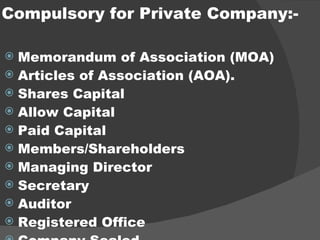

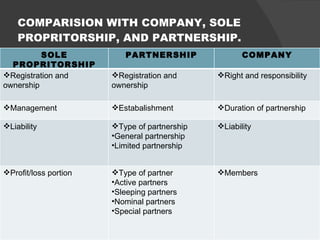

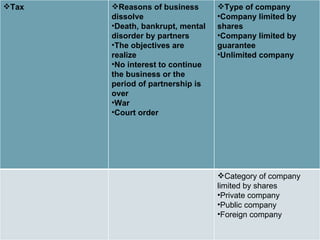

This document discusses different types of business entities under company law, including private limited companies. A private limited company has between 2 to 50 members, is prohibited from inviting public investment, and must include "Private Limited" or equivalent in its name. It offers advantages like easy capitalization and limited shareholder liability but also restrictions like mandatory audits and an inability to trade shares on public markets. The document compares private limited companies to sole proprietorships, partnerships and other types of companies.