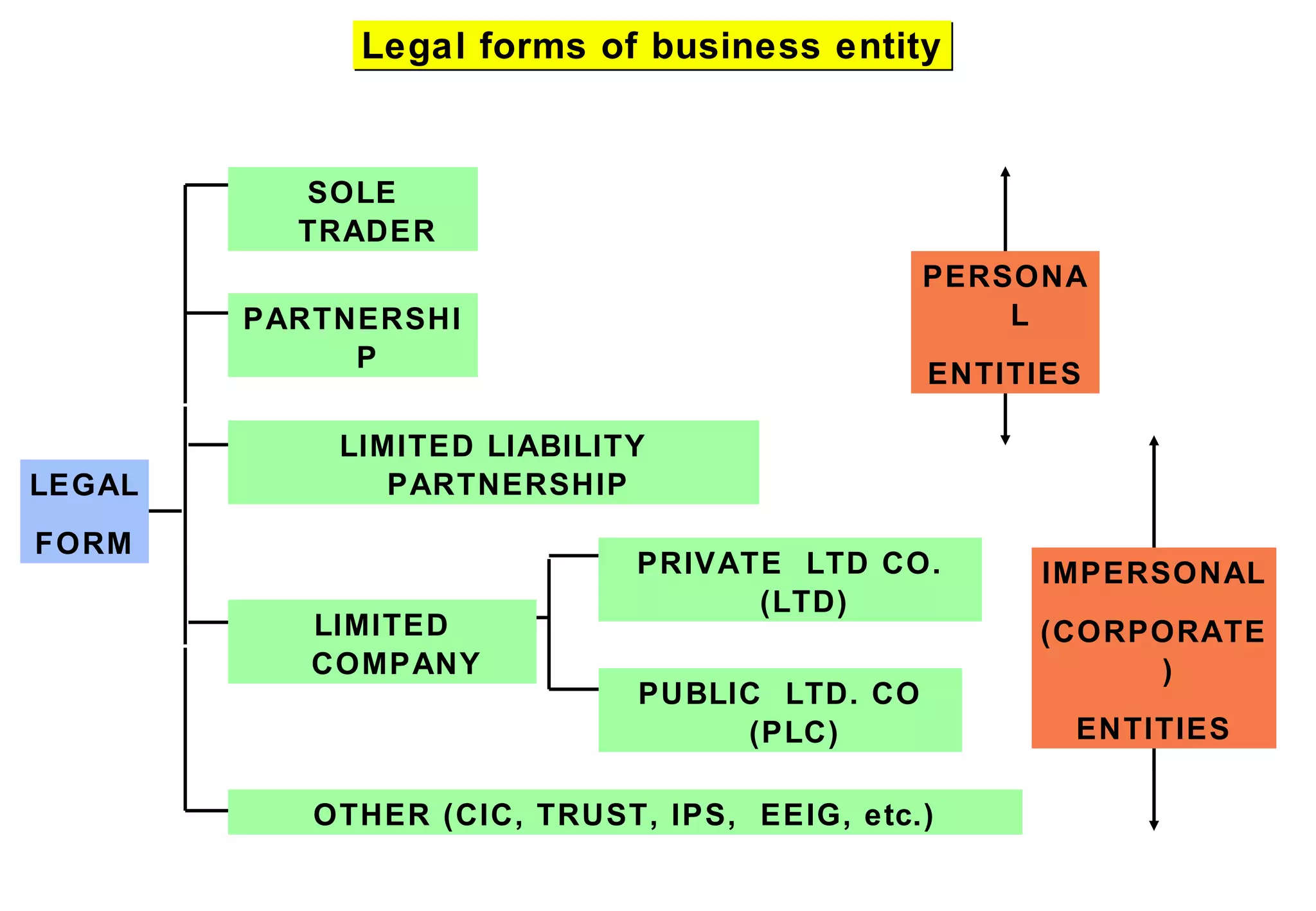

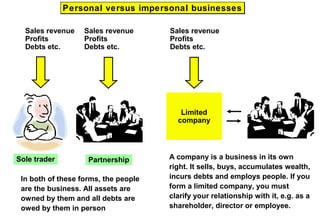

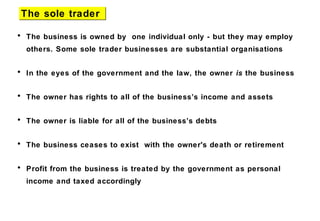

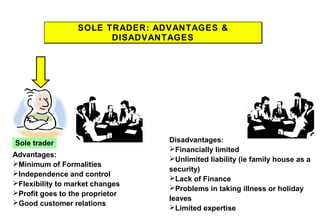

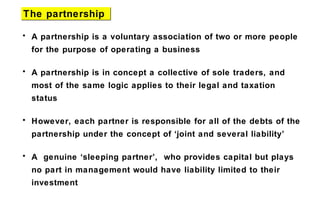

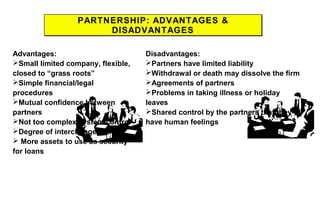

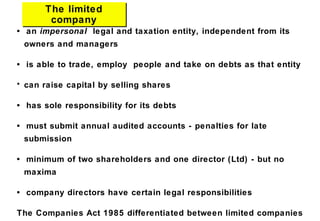

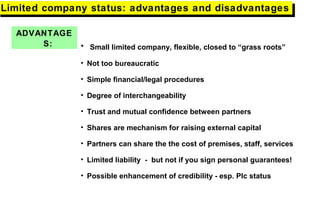

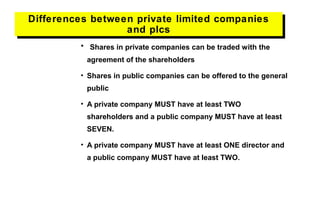

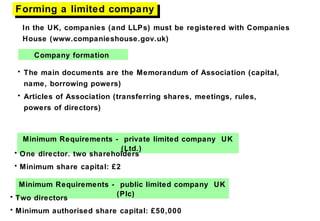

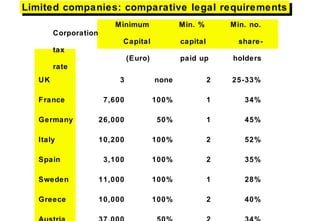

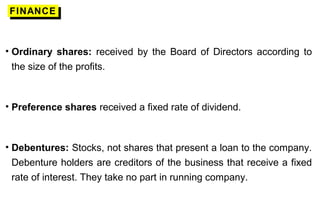

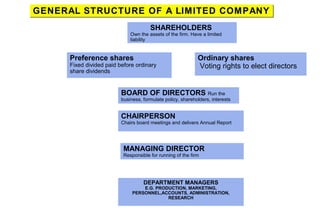

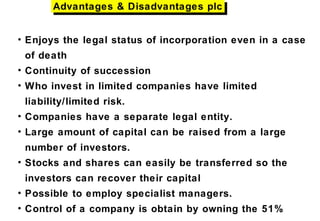

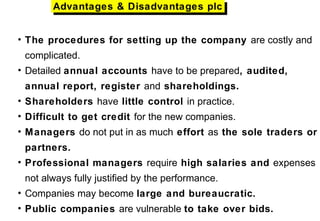

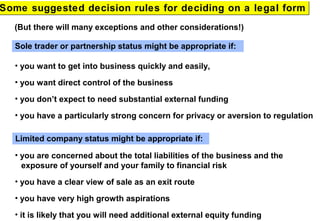

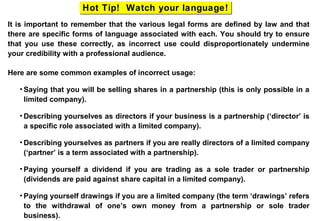

This document provides information on different types of business entities and their characteristics. It discusses the key differences between sole proprietorships, partnerships, and limited companies. Sole proprietorships are owned and operated by one individual, while partnerships involve two or more individuals who have joint ownership and liability. Limited companies exist as separate legal entities that can raise capital through issuing shares.