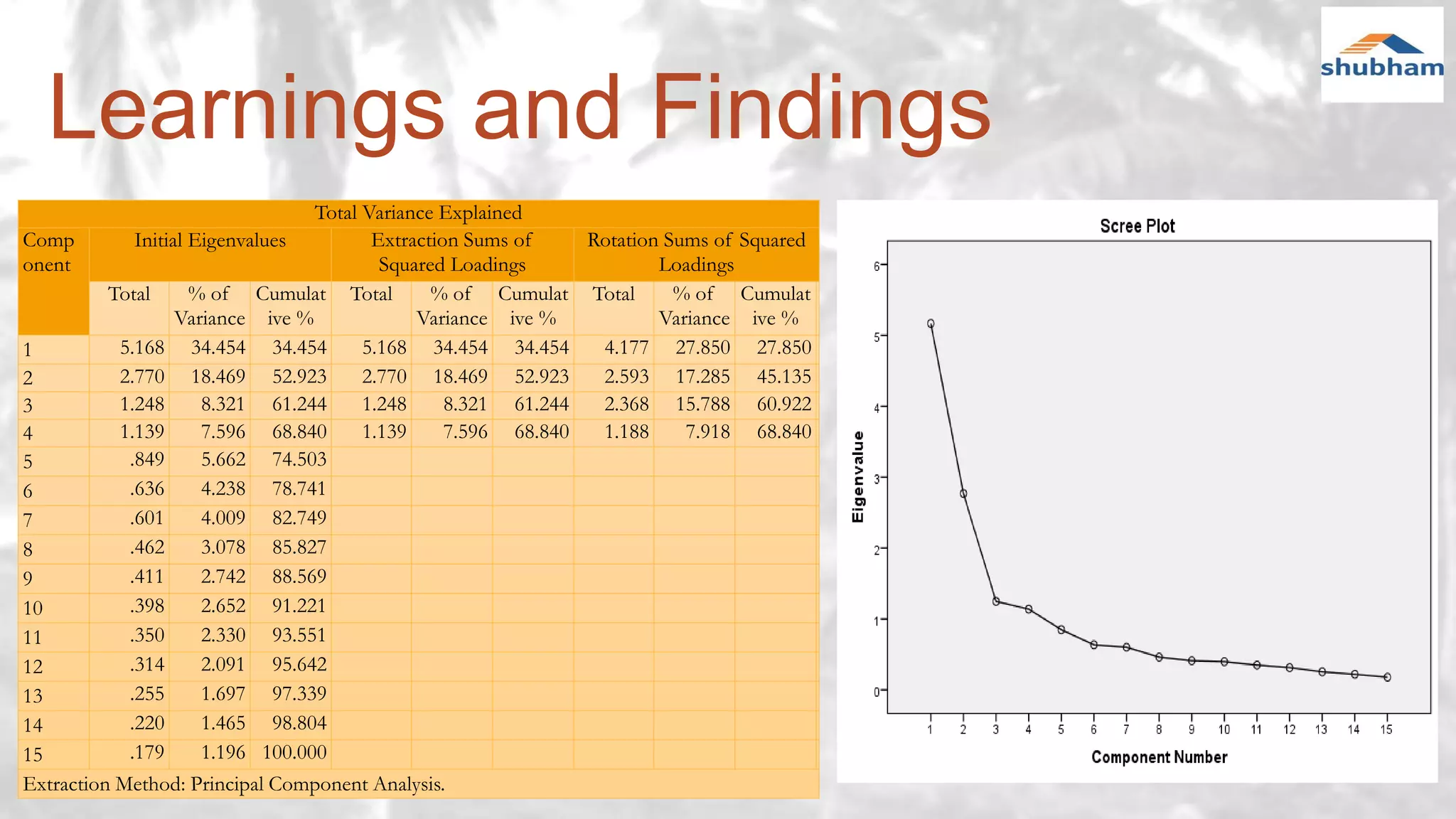

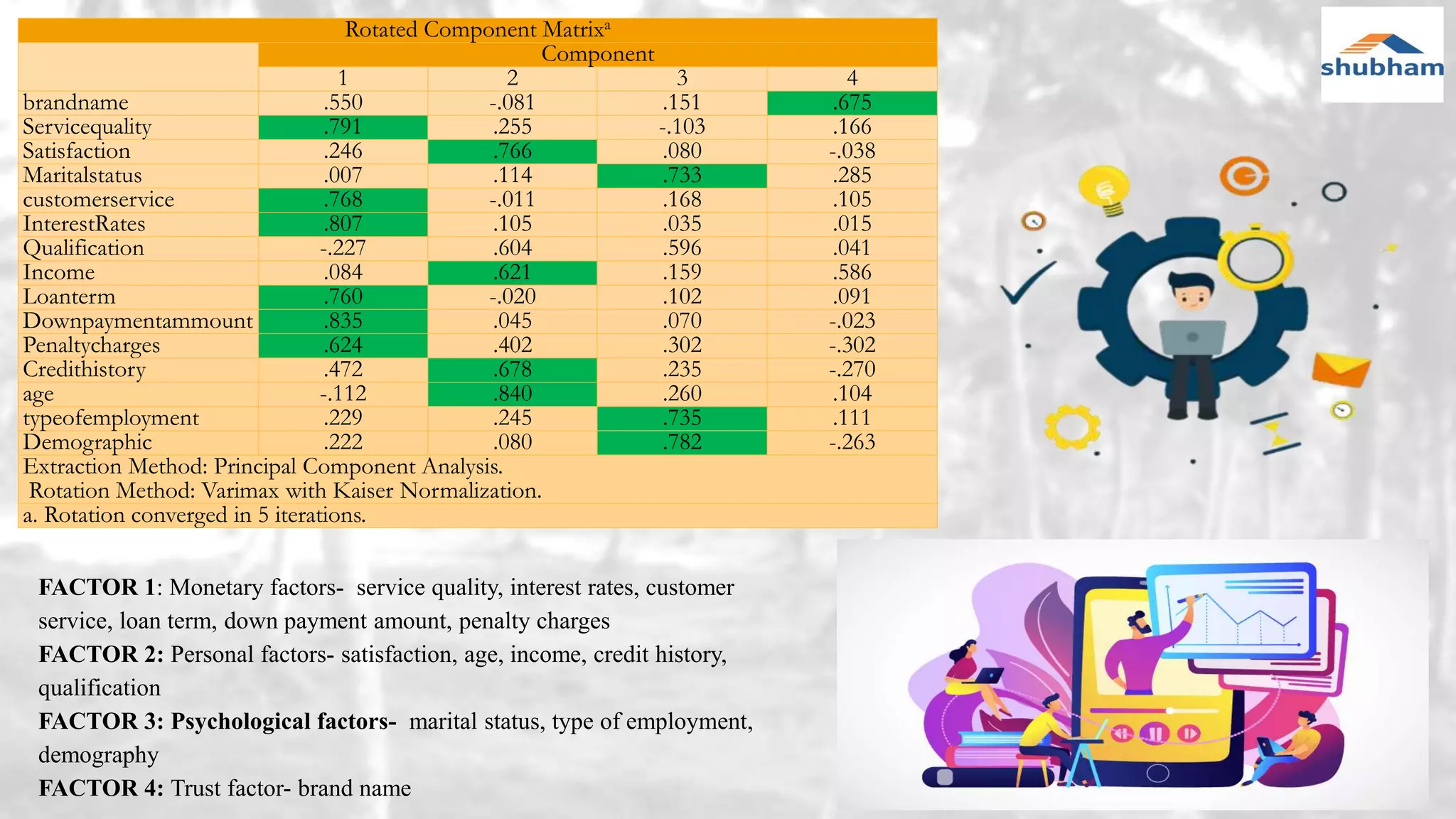

The document provides an analysis of Shubham Housing Development Finance within the context of India's rapidly evolving financial sector, highlighting the emergence of non-banking financial companies (NBFCs) in retail finance. It discusses the company’s efforts to provide formal housing credit to individuals with informal incomes and shares findings from reliability tests and factor analyses related to service quality, customer satisfaction, and demographic influences. Recommendations include focusing on underserved areas and enhancing market visibility, particularly in response to challenges posed by COVID-19.