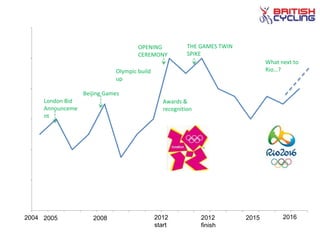

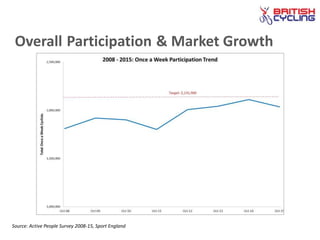

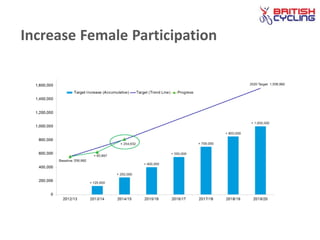

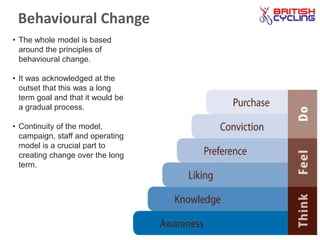

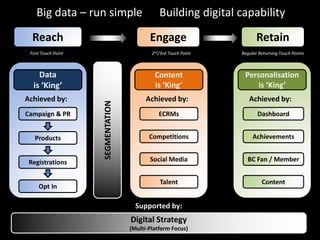

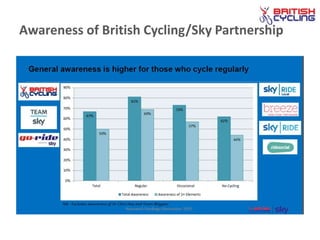

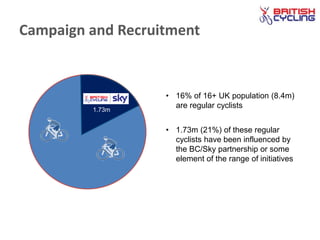

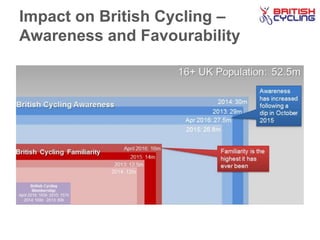

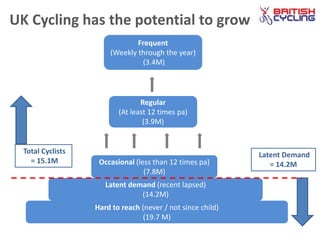

British Cycling aims to inspire more people to cycle through elite success and partnerships, targeting a substantial increase in participation by 2013. With initiatives focusing on awareness, behavioural change, and women's involvement, cycling has become the third most popular adult sport in England. The organization recognizes the importance of leveraging successful events to sustain growth and develop a long-term cycling culture across the nation.