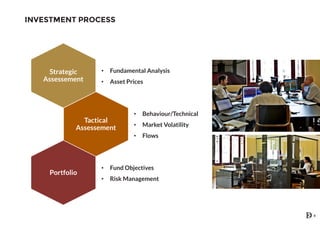

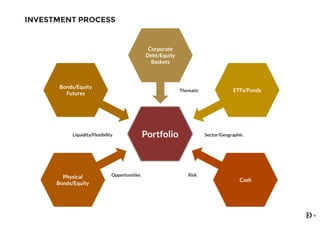

This document provides an overview of Dunas Capital Group, an asset management company based in Portugal. It summarizes Dunas Capital's investment team and philosophy, which focuses on flexible allocation between asset classes. It also outlines Dunas Capital's investment process, which involves both strategic and tactical assessment. Finally, it provides an example portfolio breakdown for one of Dunas Capital's funds, Dunas Património, which had 49.76% in equities and -31.28% in fixed income as of the date shown.