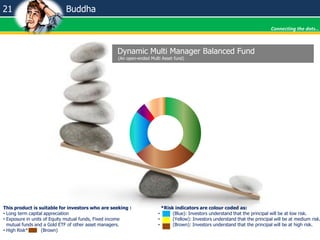

21 Buddha Dynamic Multi Manager Balanced Fund

- 1. 21 Buddha Connecting the dots… Dynamic Multi Manager Balanced Fund (An open-ended Multi Asset fund) This product is suitable for investors who are seeking : • Long term capital appreciation • Exposure in units of Equity mutual funds, Fixed income mutual funds and a Gold ETF of other asset managers. • High Risk* (Brown) *Risk indicators are colour coded as: • (Blue): Investors understand that the principal will be at low risk. • (Yellow): Investors understand that the principal will be at medium risk. • (Brown): Investors understand that the principal will be at high risk.

- 2. The World of investing welcomes you! 2 © Saurabh, Shared in investor’s interest The moment you get in touch with a financial adviser, you are bound to be greeted with plenty of investment choices depending upon your risk appetite and also a heavy dose of financial market jargons.

- 3. Table of contents About us1 What is a Multi Manager Balanced strategy?2 The Investment Case for Multi Manager Balanced Fund of Fund3 Benefits of Asset class diversification4 Lessons from history5 Introduction to 21 Buddha Multi Manager Balanced Fund6 Spotlight on the underlying funds7 Dispersion in Returns of the underlying sub-funds8 Impact of Asset allocation on Portfolio performance9 Impact of diversification on Risk reward parameter10 21BDMMF Investment Process11 3 © Saurabh, Shared in investor’s interest Scheme structure12 The Team13 Our Value Proposition summary14

- 4. About Us 4 © Saurabh, Shared in investor’s interest Firm Profile Established: 2011 Staff: 03 professionals Experience: 11 years Average client relationship: 3 years At 21 Buddha, we understand the unique challenges that come with managing wealth. As a new age Money Management boutique, we combine our financial research and risk management expertise to simplify investment decision making for our clients. Our client’s situation and goals remain our principal focus areas while delivering superior investment performance. Our core expertise lies in Investment manager’s due diligence and Portfolio positioning. Having got many innovative analytical tools in our arsenal we cater to all aspects of client’s wealth—from accumulation and growth through preservation and distribution. With our dedicated and proactive approach we are deeply committed to our client’s financial interest. Its our endeavour to delight clients with high quality investment products in the market.

- 5. What is a Multi Manager Balanced Strategy? 5 © Saurabh, Shared in investor’s interest Multi-Manager investment is an investment strategy that consists of multiple specialized funds. Each specialized fund may invest across different sectors and markets, or having managers investing in the same asset class but have different investment styles. This theory is founded on the premise that not all investment managers are good in all markets and that not all managers are successful at all times. Spreading the investment money across different asset classes or markets allows the investor to achieve the necessary diversification, reducing risk without sacrificing the return. Large Cap Equities Small & Midcap Equities Intermediate bonds Short term Govt. Bonds Gold Multi Manager Balanced Fund • Investment in various asset classes managed by specialist Portfolio managers offers true diversification through efficient risk and reward balance to investors. Diversification • Dynamically shuffle asset mix based on market outlook to optimize performance. Asset Allocation • The underlying funds are thoroughly researched by Fund research analysts. The Investment process should be based on blending the skills of best managers in their respective category to produce alpha from multiple streams. Manager/Fund research Highlights of a Dynamic Multi Manager Balanced Strategy

- 6. Why select a Multi Manager Balanced Fund? 6 © Saurabh, Shared in investor’s interest Creating the right Investment package for clients require striking the right balance between Investment products & client expectations. Research & ongoing monitoring Risk control Strategic & Tactical Asset allocation Diversification benefits Best of breed 21 Buddha Dynamic Multi Manager Balanced Fund We believe: • Asset class diversification is an important step towards achieving an efficient risk return trade off (illustrated in the next two slides). • No single Asset Manager is equally good in all asset classes. • Asset allocation must be carefully maneuvered to ride superior investment performance. • The best of breed Investment schemes can be cherry picked using our Proprietory Portfolio Ranking model. Multiple Investment Managers Multiple Asset class Multi Manager Balanced FoF

- 7. Benefits of Asset class diversification 7 © Saurabh, Shared in investor’s interest Correlation between three major asset classes over 15 years period. Sensex Govt. Bonds Gold Sensex 1.00 0.47 -0.09 Govt. Bonds 0.47 1.00 -0.15 Gold -0.09 -0.15 1.00 We see that: a) A low correlation exists between Equities & Bonds. b) Negative correlation exists between Equities & Gold and c) Again a negative correlation exists between Gold & Bonds. By mixing low or negatively correlated assets, investors can reduce the market risk factor to a great extent even without losing so much on the return side. We have often seen that investors spending time in the market with a multi- asset focus gets a far better long term reward than investors who rely on timing the market with a single asset. The idea of not putting all your eggs in one basket sounds really sensible in the investment world context. Source: Bloomberg

- 8. The concept of Sub-Asset class allocation 8 © Saurabh, Shared in investor’s interest The perfect platform to increase return for same level of risk. 21 Buddha Dynamic Multi Manager Balanced Fund Pooling sub-assets with low correlation can produce better risk-adjusted performance than a traditional multi asset portfolio. Risk % Return% The Usual Old Portfolio Proposed Portfolio with additional holdings Old Efficient frontier New Efficient frontier Large Cap Equity Small & Midcap Equity Interme diate Bonds Treasury Commo dities

- 9. Lessons from History 9 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund 17.04 40.09 53.98 13.83 21.25 -80.00 -60.00 -40.00 -20.00 0.00 20.00 40.00 60.00 2004-07 (Economic boom) 2008 (US Credit Crisis) 2009-10 (Market Recovery) 2011 (European Sovereign Credit Crisis) 2012-13 (Macro Policy Uncertainities) Sensex CNX Midcap Intermediate Bond Short Term Government Bond GSCI Gold Index (INR denominated) Performance through various market cycles indicate that there is no clear winner for all seasons. Source: Morningstar & Bloomberg Investors having bias for best near term performance tend to fall prey to long term underperformance. Returns from different asset classes vary significantly during various market cycles. Picking the right asset class before time requires a great deal of research efforts. We have seen that retail investors often commit mistake by picking the winning asset class towards the end of the rally. Sticking to a unique asset class could prove to be a wealth destroying proposition during distressed times.

- 10. Presenting our 21 Buddha Dynamic Multi Manager Balanced fund 10 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced fund is a hybrid fund of fund scheme which aims to create a dynamic balanced portfolio structure by leveraging the strength of various skilled Investment Managers in the country.

- 11. Product Snapshot 11 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund The fund’s objective lies in producing consistent returns over market cycles with low downside risk. It has two plans: Plan A with Growth option Plan B with Income option Both plans will have exposure to Equities (Large, Mid & Small caps), Bonds (Govt. & Corporate Debt) and Gold. Plan A will subscribe to Growth plans of the underlying funds whereas Plan B will subscribe to Income option of the underlying funds. So Plan A will offer dividend reinvestment option while Plan B will return dividend income to unit holders as and when it is declared. We have already indentified the underlying funds through which this FoF would take exposure to the predefined asset classes. This decision has been based on rigorous due diligence of those products via our Proprietory Fund Ranking model. However the performance of the underlying funds along with their peer group will be further tracked on an ongoing basis as part of our Standard Quality Control process. Asset allocation decisions will be taken by our team of in-house analysts. Exposures will be reviewed on a weekly basis. The Tactical portfolio rebalancing decisions would be primarily driven by a combination of macroecononomic factors and valuation multiples of the broader market. Due to the nature of its composition, a basket of Indices including S&P BSE Sensex, CNX Midcap, Crisil Composite Bond Fund Index, Short ICICI Securities Sovereign Bond index and MCX Gold quote would be used as a benchmark to track its relative performance. The weights of the constituent indices would be periodically adjusted to reflect portfolio allocation. 21 Buddha Multi manager Balanced Fund Large Cap Equities 21 Buddha Multi Manager Balanced Fund Large Cap Equities Small & Midcap Equities Intermediate Bonds Short Term Govt. Bonds

- 12. The List of Underlying Funds 12 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund • Category: Domestic Large Cap Equity • Benchmark: S&P BSE SensexFranklin India Bluechip Fund • Category: Domestic Small & Mid Cap • Benchmark: CNX Midcap IndexICICI Prudential Discovery Fund • Category: Intermediate Bond • Benchmark: Crisil Composite Bond Fund IndexCanara Robeco Income Fund • Category: Short term Treasury bills • Benchmark: Short ICICI Securities Sovereign Bond IndexDSP Blackrock Treasury Bill Fund • Category: Gold ETF • Benchmark: Domestic price of GoldGS Gold BeES The objective is to achieve superior risk adjusted returns by combining top of the order Investment products with complementary alpha streams, style bias and risk exposure.

- 13. Spotlight on the Underlying funds Category: Large Cap Equities 13 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund Franklin India Bluechip Fund 4790.32 3625.76 1000 1500 2000 2500 3000 3500 4000 4500 5000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Cumulative Performance over the Years Fund Benchmark Winning Period Losing Period 13 24 50 Large 4 6 3 Mid 0 0 0 Small Value Blend Growth Based on last ten calendar yearsHoldings Style One of the best performing large-cap schemes in the country The relative performance looks quite impressive on all time scales. The Fund Manager has a strong quality bias in the bluechip universe. His dislike for leveraged balance sheet is well known and he factors-in non-financial parameters of the target stocks in his research model. Also he is never afraid to take high conviction contrarian calls as against the broader market. The Fund has a great blend of Cyclical, Sensitive & Defensive sectors. It has delivered strong performance on the risk-adjusted front. The Fund Manager doesn’t make any tactical allocation of cash and follows an unhedged policy. The fund’s expense ratio is lower than that its many Large Cap peers. It boasts of one of the longest survival history in the Indian asset management space. It enjoys outstanding ratings from Morningstar, Valueresearch & Lipper. Parameters 1 Year 3 Years 5 Years 10 Years Alpha -4.54 0.46 3.38 3.29 Beta 1.11 0.87 0.85 0.91 Information Ratio -1.12 0.32 0.40 0.49 Sharpe Ratio -0.34 -0.41 0.53 0.35 Volatility 15.37 16.42 20.02 23.34 Source: Lipper AUM (INR billion): 429 Structure: Open ended Annual Management fee: 1.25% TER: 1.82% Fund Manager: Anand Radhakrishnan, Anand Vasudevan Inception Date: 01/12/1993 Source: MorningstarNB: All the given data has been taken till 31-Dec-2013. This product is suitable for investors who are seeking long term capital appreciation with reasonable risk appetite in the short run.

- 14. Contd.. Category: Small & Midcap Equities 14 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund ICICI Prudential Discovery Fund 6879.45 3379.38 1000 2000 3000 4000 5000 6000 7000 8000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Cumulative Performance over the Years Fund Benchmark 4 16 6 Large 17 15 9 Mid 15 10 7 Small Value Blend Growth Winning Period Losing Period Holdings Style Based on last nine calendar years AUM (INR billion): 28.8 Structure: Open ended Annual Management fee: 1.25% TER: 1.92% Fund Manager: Mrinal Singh Inception Date: 16/08/04 NB: All the given data has been taken till 31-Dec-2013. Source: Morningstar One of the best performing Small & Midcap schemes in the country The Fund Manager follows a bottom-up investment approach. He combines absolute and relative valuation metrics in his investment screening process. Also he lays a strong focus on qualitative parameters of the investible universe. The Fund has adopted diversification religiously since inception. It has impressed investors with solid absolute and relative performance on all time scales. In 2008, though it produced negative returns but it contained further damages to investors by taking tactical exposure into non-equity instruments.. It has built up a great track record on risk & return parameter as well. The Fund Manager has always capitalized on recovery rallies. Its captured well in its stellar performance in 2009 & 2012 Calendar years. The fund’s expense ratio is lower than that other SMC peers. Parameters 1 Year 3 Years 5 Years Alpha 9.96 6.52 11.56 Beta 0.77 0.77 0.83 Information Ratio 1.89 1.19 1.19 Sharpe Ratio -0.07 -0.16 0.79 Volatility 16.50 18.27 24.15 Source: Lipper This product is suitable for investors who are seeking long term capital appreciation with reasonable appetite for short term volatility.

- 15. Contd.. Category: Intermediate Bonds 15 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund Canara Robeco Income Fund 2273.14 1702.10 1000 1200 1400 1600 1800 2000 2200 2400 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Cumulative Performance Over the Years Fund Benchmark Winning Period Losing Period High CreditQuality Medium Low High Medium Low Interest Rate Sensitivity Fixed Income Style Based on last ten calendar years AUM (INR billion): 3.5 Structure: Open ended Annual Management fee: 1.25% TER: 1.90% Fund Manager: Akhil Mittal Inception Date: 19/09/02 Characteristics Effective Maturity 6.50 Yield to Maturity 8.63 Yield to Worst 8.64 Modified Duration 4.67 OAD 4.68 Period Sharpe Ratio Volatility 1 Year -0.92 4.38 3 Years -0.68 2.59 5 Years -0.32 3.08 10 Years 0.25 3.91 Source: Bloomberg & Lipper NB: All the given data has been taken till 31-Dec-2013. Source: Morningstar One of the best performing Intermediate-Term bond funds in the country The Fund has a dynamic asset allocation policy. It invests in debt & money market instruments of various maturity and issuers of different risk profile. The Portfolio manager lays strong focus on macroeconomic drivers and take active bets on Yield curve movements. Based on the interest rate view, duration of the portfolio is decided along with the asset allocation pattern between govt. & corporate bonds. On most time scales it has beaten the Crisil Composite bond fund index. Its risk adjusted performance looks reasonably well and it scores high on peer group performance ranking. In 2008, it surprised investors with huge gains of 29.95% by increasing exposure to cash. Though some advisors had criticized the Fund house of violating the stated investment mandate. 75.34 19.58 5.08 Govt. Debt Corporate Debt Cash This product is suitable for investors who seek capital appreciation with limited downside risk.

- 16. Contd.. Category: Short term Treasury Bills 16 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund DSP Blackrock Treasury Bill Fund 1751.74 1658.21 1000 1100 1200 1300 1400 1500 1600 1700 1800 2003 2005 2007 2009 2011 2013 Cumlative Performance Over the Years Fund Benchmark High CreditQuality Medium Low High Medium Low Interest Rate Sensitivity Winning Period Losing Period Fixed Income Style Based on last ten calendar years AUM (INR billion): 8.67 Structure: Open ended Annual Management fee: 0.75% TER: 0.6% Fund Manager: Dhawal Dalal Inception Date: 30/09/99 NB: All the given data has been taken till 31-Dec-2013. Source: Morningstar One of the most efficient Short term Government bond fund in the country It is an open ended Money market scheme which generates income through investment in a basket of Treasury bills and other Sovereign bonds with a residual maturity of not more than one year. The Investible universe of Short term Indian Treasuries is small and the mandate doesn’t call for taking too many active decisions by the Fund Manager. It has consistently given low but positive relative return over the risk free rate. This is quite evident in its Sharpe ratio on various time scales. Due to the nature of its holdings, the fund has always been less volatile on the charts. The fund’s expense ratio is lower than that its peers. Characteristics Effective Maturity 0.49 Yield to Maturity 8.16 Yield to Worst 8.16 Modified Duration 0.46 OAD 0.47 Period Sharpe Ratio Volatility 1 Year 0.41 1.27 3 Years 0.46 0.83 5 Years 0.25 0.97 10 Years 0.05 0.87 Source: Bloomberg & Lipper 94.06 5.94 Govt. Debt Cash This product is suitable for investors who seek low risk income over short term horizon.

- 17. Contd.. Category: Gold 17 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund Goldman Sachs Gold ETF AUM (INR billion): 24.6 Category: Gold ETF listed on NSE TER: 1% Pricing per unit: Approximately 1 gram of gold Fund Manager: Vishal Jain Inception Date: 15/03/07 Source: Morningstar The oldest and the biggest Gold ETF as per AUM in the country. This product is suitable for investors who believe in asset class diversification and want to safeguard a part of their portfolio during uncertain times. •To provide returns that, before expenses, closely track the returns provided by domestic price of gold through physical gold. Investment Objective: •Due to its scale and efficient cost structure it has the lowest expense ratio amongst the Gold ETF peers. Expense •As a passively managed mandate, its performance should closely follow the benchmark. Its tracking error is as low as 0.23% on annualized basis. Tracking error 0.49 99.51 0 50 100 150 Cash Gold 1000 1500 2000 2500 3000 3500 4000 Oct-06 Feb-08 Jul-09 Nov-10 Apr-12 Aug-13 Dec-14 Cumulative Performance over the Years GBeES Benchmark Source: gsam.in Why invest in a Gold ETF? Portfolio Diversification: It has low or negative correlation with traditional asset classes. Inflation hedge: Gold’s purchasing power has not seen erosion across market cycles. In fact its price has seen steady increase over the years. Demand: In a country like India where people have an emotional connect with Gold jewelries, the demand & supply equation will always be tilted in Gold’s favour. The ETF convenience: It has reduced many hassles in the way investors take exposure into Gold. The ticket size of minimum investment has been reduced considerably. Now the gold buyers don’t need to worry about its safekeeping. Some ETF providers also give investors the choice to receive physical gold bars while redeeming units.

- 18. Dispersion in Sub Fund’s Returns 18© Saurabh, Shared in investor’s interest Funds 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Franklin India Bluechip 24.60 41.22 45.52 47.41 -48.14 84.49 22.96 -18.25 26.79 4.08 ICICI Prudential Discovery NA 63.74 28.69 39.65 -54.56 134.32 27.71 -23.73 46.01 8.31 Canara Robeco Income 2.28 9.81 4.60 6.46 29.95 6.84 4.98 7.76 9.93 5.26 DSP Blackrock Treasury Bill NA NA NA 0.70 -0.43 0.27 0.40 0.34 0.44 0.53 GS Gold BeES NA NA NA NA 24.46 24.94 21.69 29.87 11.22 -6.39 >50% dispersion between various assets Clients may have the best performing funds in their portfolio. However taking standalone exposure into these products can erode principals during testing times. Holding a wrong asset during adverse market movements can prove to be an expensive mistake momentarily. We all know that Equities outperform all other conventional asset classes in the long run. But imagine the plight of an investor who has been holding Equities since long time thru’ some large cap Equity funds and he had a big liability lined up for 2008. In that case, he has no other choice but to book heavy losses in his Equity portfolio. A multi-asset portfolio can cut these losses significantly. Further a multi-asset portfolio with dynamic asset allocation strategy can be even more rewarding. Note: a) The 2004 return for ICICI Pru Discovery is not available for 2004 since it was launched in the same year. a) For DSP BR Treasury Bill Fund, the returns are not available prior to 2007. a) GS Gold BeES ETF was launched in 2007, so the returns till 2007 are missing. Source: Bloomberg

- 19. Sub Asset Class Allocation & its Impact on Performance 19© Saurabh, Shared in investor’s interest Our Model Asset allocation Sub Asset class 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Large Cap 40% 35% 40% 40% 30% 35% 35% 30% 35% 35% Small & Midcap 25% 30% 25% 25% 25% 35% 35% 25% 35% 30% Intermediate Bond 15% 10% 15% 15% 20% 15% 15% 20% 15% 20% Short Term Treasury 5% 5% 10% 5% 5% 5% 5% 5% 5% 5% Gold 15% 20% 10% 15% 20% 10% 10% 20% 10% 10% Performance Results 21BDMMB FOF 22.86% 43.35% 25.95% 33.67% -17.22% 80.12% 20.67% -3.87% 28.11% 4.36% 6856.602212 4790.317167 6879.445372 2273.141343 1022.845255 5176.215824 1000 2000 3000 4000 5000 6000 7000 8000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Cumulative Performance 21BDMMB Large Cap Small & Midcap Intermediate Bond Short Term Treasury Gold The Asset allocation decision factors-in our internal team’s view on the yield potential of sub-asset classes at various stages. The annual weights used in the above chart have been averaged. In actual practice, the asset allocation decisions are reviewed on a weekly basis. *Red reflects decrease in weight while Green indicates rise in allocation. Source: Bloomberg

- 20. Performance Comparison 20© Saurabh, Shared in investor’s interest Source: Bloomberg 4.36 8.73 22.81 21.23 4.08 2.56 19.60 16.96 8.31 6.45 29.27 21.27 5.26 7.63 6.94 8.56 0.53 0.44 0.40 0.23 -6.39 10.58 15.50 17.87 -10.00 -5.00 0.00 5.00 10.00 15.00 20.00 25.00 30.00 35.00 1 Year 3 Years (Ann) 5 Years (Ann) 10 Years (Ann) 21BDMMB Large Cap Small & Midcap Intermediate Bond Short Term Treasury Gold The above chart reflects that the Multi Manager Dynamic allocation is definitely not a low return strategy. It has delivered high returns with low downside risk. Note: These figures have been compiled for illustration purpose only and shouldn’t be construed as future performance of 21 Buddha Dynamic Multi Manger Balanced fund.

- 21. Sub Asset Diversification Impact on Risk & Return Scale 21© Saurabh, Shared in investor’s interest Source: Bloomberg -5 0 5 10 15 20 25 0 10 20 30 40 50 60 Return(%) Risk (%) Based on last ten years data 21BDMMF Large Cap Small & Midcap Intermediate Bond Short Term Treasury Gold 10 Years 5 Years Sub Asset class Return Risk Return/Risk Large Cap 16.96 37.05 0.46 Small & Midcap 21.27 50.58 0.42 Intermediate Bond 8.56 7.80 1.10 Short Term Treasury 0.23 0.34 0.66 Gold 17.87 14.94 1.20 21BDMMF 21.23 26.90 0.79 Sub Asset class Return Risk Return/Risk Large Cap 19.60 38.24 0.51 Small & Midcap 29.27 59.45 0.49 Intermediate Bond 6.94 2.02 3.44 Short Term Treasury 0.40 0.10 4.01 Gold 15.50 14.39 1.08 21BDMMF 22.81 32.87 0.69 The Asset class diversification improves risk return efficiency. Our FOF has beaten Equities on Risk adjusted basis on all time scales.

- 22. The FOF Investment Process 22© Saurabh, Shared in investor’s interest Broad Universe of India domiciled Mutual funds Screening of funds using our Proprietory Portfolio appraisal process Strategic asset allocation with well defined bands Dynamic asset allocation using cues from macroeconomic indicators and broader market valuation multiples. Portfolio oversight on ongoing basis Dynamic Asset allocation Govt. Debt & Inflation Earnings Yield of Sensex stocks Bond Yield

- 23. The FOF Scheme Structure 23 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund 21 Buddha Dynamic Multi Manager Balanced Fund Options: Regular Growth (Class A) & Income option (Class B) Outperformance Target: 1.50% per annum on Gross of Fees basis Minimum Redemption amount: INR 1000 (plus in multiples of INR1) Entry Load: Not Applicable Exit Load: 1% if redeemed/switched before 1 year from the date of allotment, after 1 year: Nil Asset allocation: Equities should range between 40%-65%, Debt & Money market exposure should lie between 15% to 30% Gold: 10%-20% All assets invested in Indian Domestic market and no currency hedging shall be permitted. Benchmark: Blend of the following indices reflecting the dynamic weights of actual portfolio assets: a) S&P BSE Sensex b) CNX Midcap c) Crisil Composite Bond Fund Index d) Short ICICI Securities Sovereign Bond Index and e) MCX Gold Quote Minimum Investment: In lump sum INR 5000 (plus in multiples of INR 1), SIP: INR 1000

- 24. Biographies 24 © Saurabh, Shared in investor’s interest India Multi Asset Team Kalyan Dawson, CIPM Head of Equity Manager Research Responsibilities: Kalyan Dawson is responsible for Equity Manager Research and Portfolio Analytics. He also plays an active role in framing Asset allocation decisions. Experience: Kalyan is one of the co-founders of 21 Buddha. He carries more than 15 years experience in the Buy-side and has served several well known Asset Management firms in Performance Measurement & Risk domain. Responsibilities: Patrick Pandey is responsible for Fixed Income & Commodities research and tactical asset allocation. Experience: Patrick joined 21 Buddha in 2011. He carries more than 20 years experience and has served as a Bond Fund Manager in his various stints with few well known Global Asset Management firms. He holds FRM certification and he is also a member of Global Association of Risk professionals. Patrick Pandey, FRM Head of Fixed Income & Commodities

- 25. Our Value Proposition Summary 25 © Saurabh, Shared in investor’s interest Why Us & the 21BDMMF? Dedicated Investment boutique firm: Unlike many financial supermarket giants we are in no other business except Investment management. Our client’s financial well being is our principal objective. We believe in Performance driven values. Manager selection: Our proprietory product screening methodology is one of the first in the Indian market. Our rigorous manager appraisal process combines the elements from Performance Measurement, Investment Analytics & Risk domain. The outcome has been designed to distinguish skill versus luck for the asset managers. Our model discounts other subjective factors like scale of the firm, track record of other products and brand worthiness of Star Fund managers. Objective recommendation: We have no affiliation with any financial services firm and we have no cross selling agenda. Our only source of income is the management fee that we earn from our own products. Experienced team: We have a small but a very capable team who are well known experts in their domain. Robust Investment Process: Our manager selection and asset allocation mechanism churns out best of the breed underlying funds with near optimal weights to generate superior risk adjusted returns for our investors. Investors should have 21BDMMF as an alpha generating tool in their core portfolio.

- 26. Annexure 1: Our Due Diligence Toolkit 26 © Saurabh, Shared in investor’s interest • Ex-Post Measures: Sharpe, Jensen’s Alpha, Beta, Information ratio, Volatility • Ex-Ante Measures: VaR, Liquidity management • Style bias • Holdings analysis • Diversification check • Absolute Performance • Relative vis-à-vis benchmark and peer group • Outperformance target • Performance Attribution: decomposing drivers of alpha • Parent history • Product history • AUM growth History Performance Risk management Style Analysis

- 27. Annexure 2: Why Indian market? 27 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund 0 5 10 15 20 25 30 35 40 03 04 05 06 07 08 09 10 11 12 Domestic Savings Rate Unemployment Rate Despite the fiscal slippage and the recent political turmoil we are long on the Indian economy. 0 2 4 6 8 10 12 14 03 04 05 06 07 08 09 10 11 12 GDP Growth Fiscal Deficit (% of GDP) CAD (% of GDP) Inflation (CPI) India’s high domestic savings and low unemployment rate is commendable. India’s GDP growth has fallen in the last couple of years and the government’s fiscal indiscipline too has invited unwanted attention from the rating watchdogs. But the levers of economic growth are still intact. India has a large pool of working age population (>50%). Its Service sector enterprises are already thriving in the global environment. It also boasts of a well developed Capital market structure. If GOI shows some solid intent to deliver on key reforms measure, the GDP growth can still go north of 7% without much efforts. Source: Planning Commission Note: All these are FY ending numbers.

- 28. Annexure 3: Market Data 28© Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund Source: RBI & Bloomberg -30 -20 -10 0 10 20 30 40 50 0 5000 10000 15000 20000 25000 04 05 06 07 08 09 10 11 12 13 Sensex PE Ratio Annual EPS Growth Equities 0 20 40 60 80 100 120 140 160 180 200 09 10 11 12 13 Barclays Indian Government Bond Index Indian Government - Index Value -100000 -50000 0 50000 100000 150000 200000 04 05 06 07 08 09 10 11 12 13 Equity Debt FII Net Investment (in INR Crore) Source: SEBI 0 50 100 150 200 250 300 350 04 05 06 07 08 09 10 11 12 13 FX Position FX Reserve (USD Billion) USD/INR Spot Rate Bond markets have given steady gains. Though Equities have been remained volatile post 2008 but the quality of corporate earnings have improved in the last of couple of years. Many sector leaders have been able to expand margins in their recovery course. We have seen that the inflation numbers have eased in the last quarter. Now a rate cut by RBI coupled by the formation of a stable govt. at the centre in the next six months can put markets on a new high. FIIs have shown tremendous faith in the Indian markets. Though this hot money inflow has strong correlation to US Fed’s QE decisions. With tapering finally in place, we expect this money to flow back to a certain extent in the near term. India had a temporary currency crisis in the middle of 2013. It was eventually controlled by RBI’s intervention in the FX market. However with FX reserves worth 292 billion USD, the concerns of a fresh BOP crisis are unfounded.

- 29. Disclaimer 29 © Saurabh, Shared in investor’s interest 21 Buddha Dynamic Multi Manager Balanced Fund This presentation has been prepared and issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact and terms and conditions and features of 21 Buddha Dynamic Multi Manager Balanced fund (21BDMMF). The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as a standalone investment recommendation to any party. All opinions, figures, charts/graphs and data included in this presentation are as of 31st December, 2013 and are subject to change without notice. While utmost care has been exercised while preparing this document, 21 Buddha Asset Management Company Limited does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include some forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible / liable for any decision taken on the basis of this presentation. No part of this document may be duplicated in whole or in part in any form and/or redistributed without prior written consent of the 21 Buddha Mutual Fund/ 21 Buddha Asset Management Company Limited. Readers should before investing in the Scheme make their own investigation and seek appropriate professional advice. Mutual Fund investments are subject to market risk, read all scheme related documents carefully. 01-Feb-2014, © 21 Buddha 2014 (Saurabh Kumar| kaashyap.saurabh@gmail.com|+91-8374109195) Registered Office: Somewhere in Bangalore