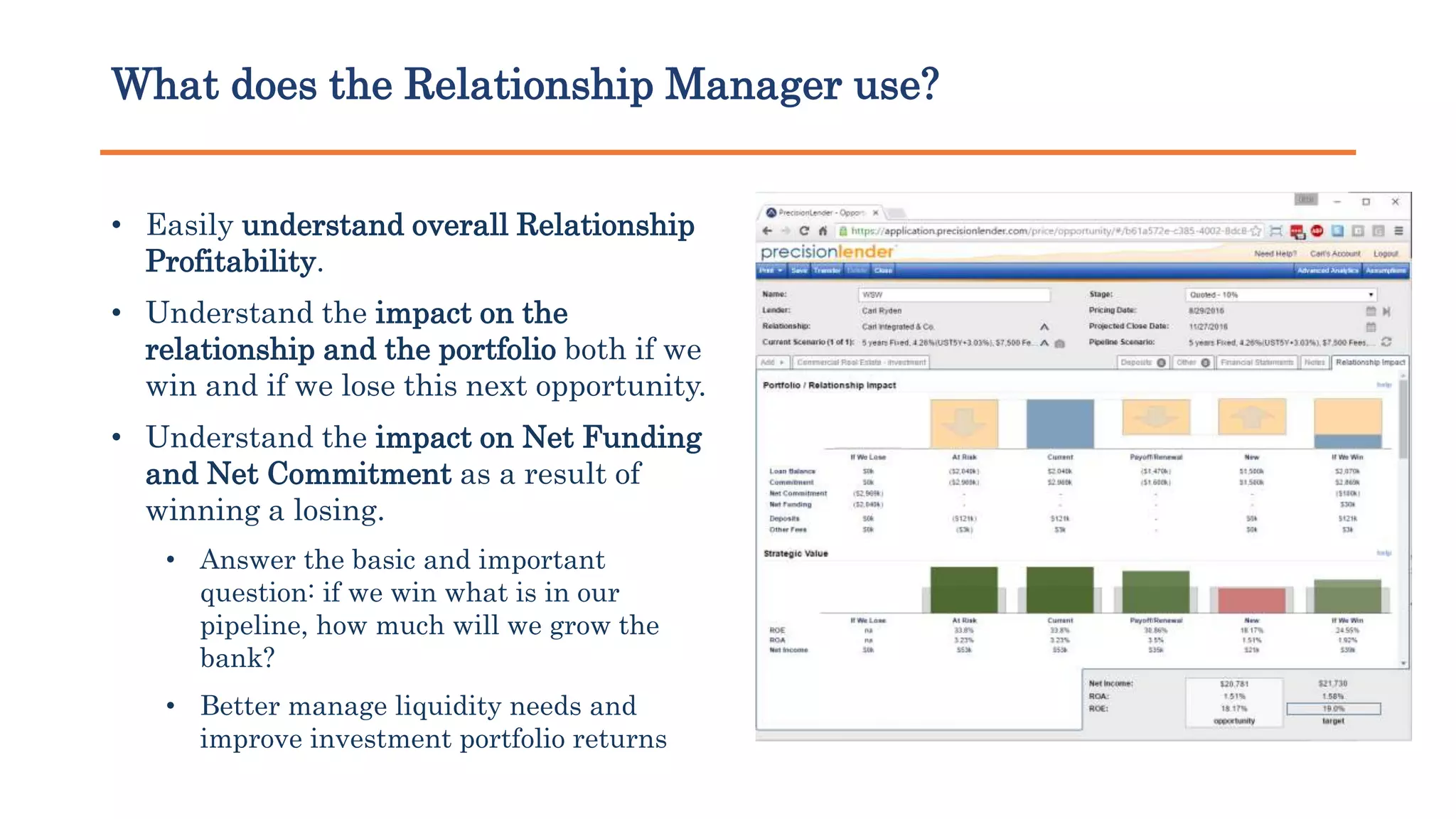

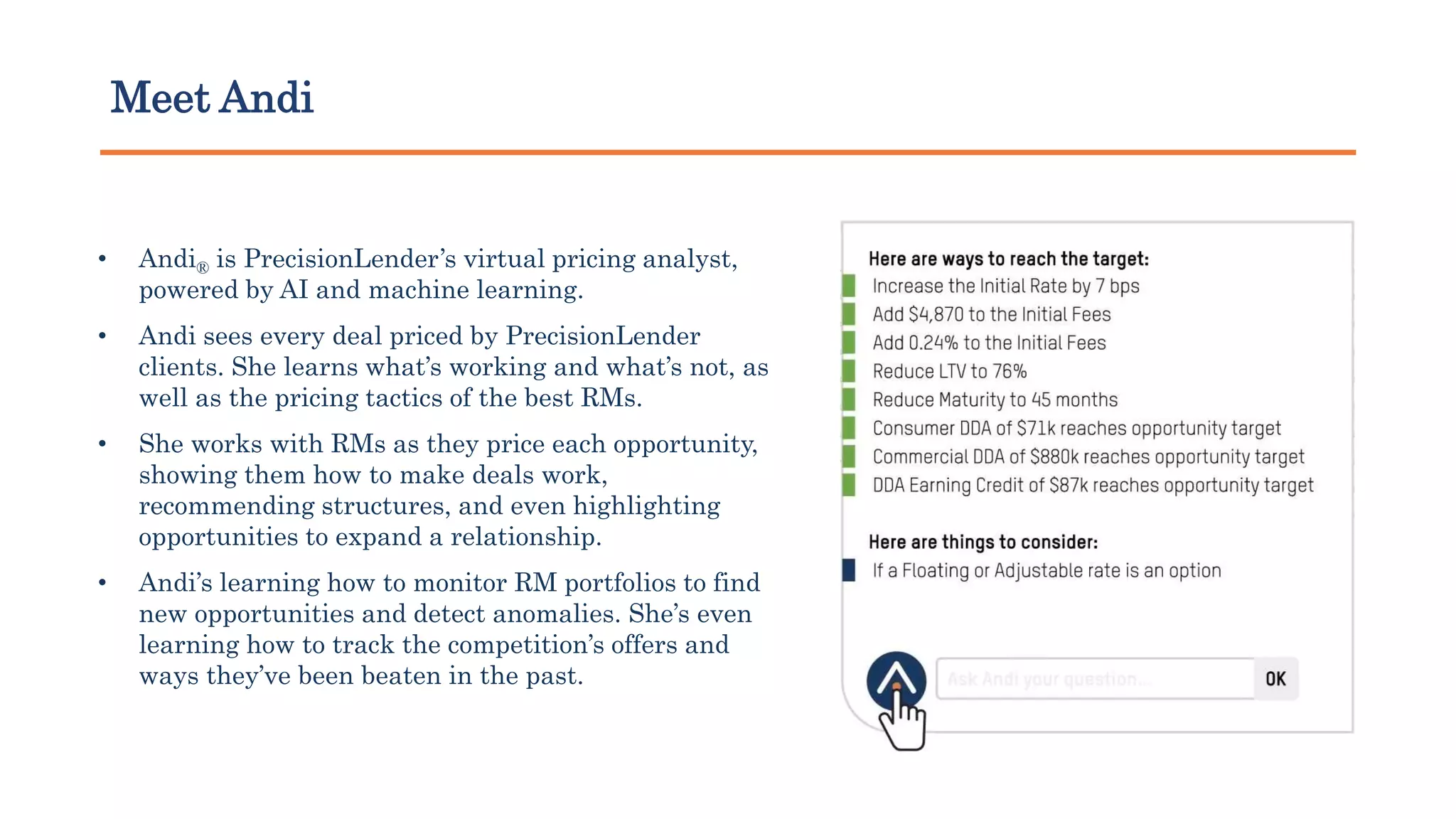

This document provides an overview of PrecisionLender and how it helps banks. PrecisionLender is a commercial loan pricing and portfolio management platform that has been implemented in over 200 banks. It helps relationship managers win deals by quickly structuring solutions, build stronger client relationships, and create a more valuable brand. PrecisionLender provides real-time options for improving deals, understands relationship and portfolio impacts, and empowers managers with pricing analytics and recommendations from its AI assistant, Andi. This helps banks price deals more competitively, qualify opportunities earlier, and focus on the most profitable relationships.