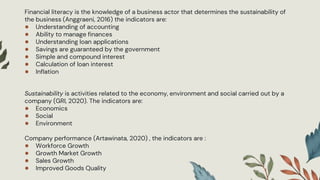

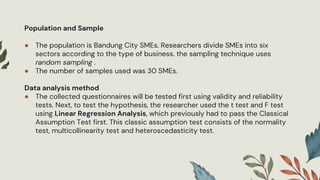

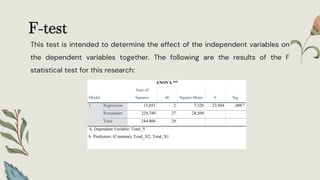

The document discusses how financial literacy and sustainability perception impact SME performance. It reviews literature on financial literacy, sustainability, company performance and sustainability reporting. The study aims to assess the impact of financial literacy and sustainability perception on SME performance. Hypotheses are formed that financial literacy and sustainability perception individually and jointly impact performance. A three stage research method is proposed to test this, including surveys, data analysis and hypothesis testing. Results found that financial literacy and sustainability perception individually and jointly significantly influence SME performance, in line with several prior studies.