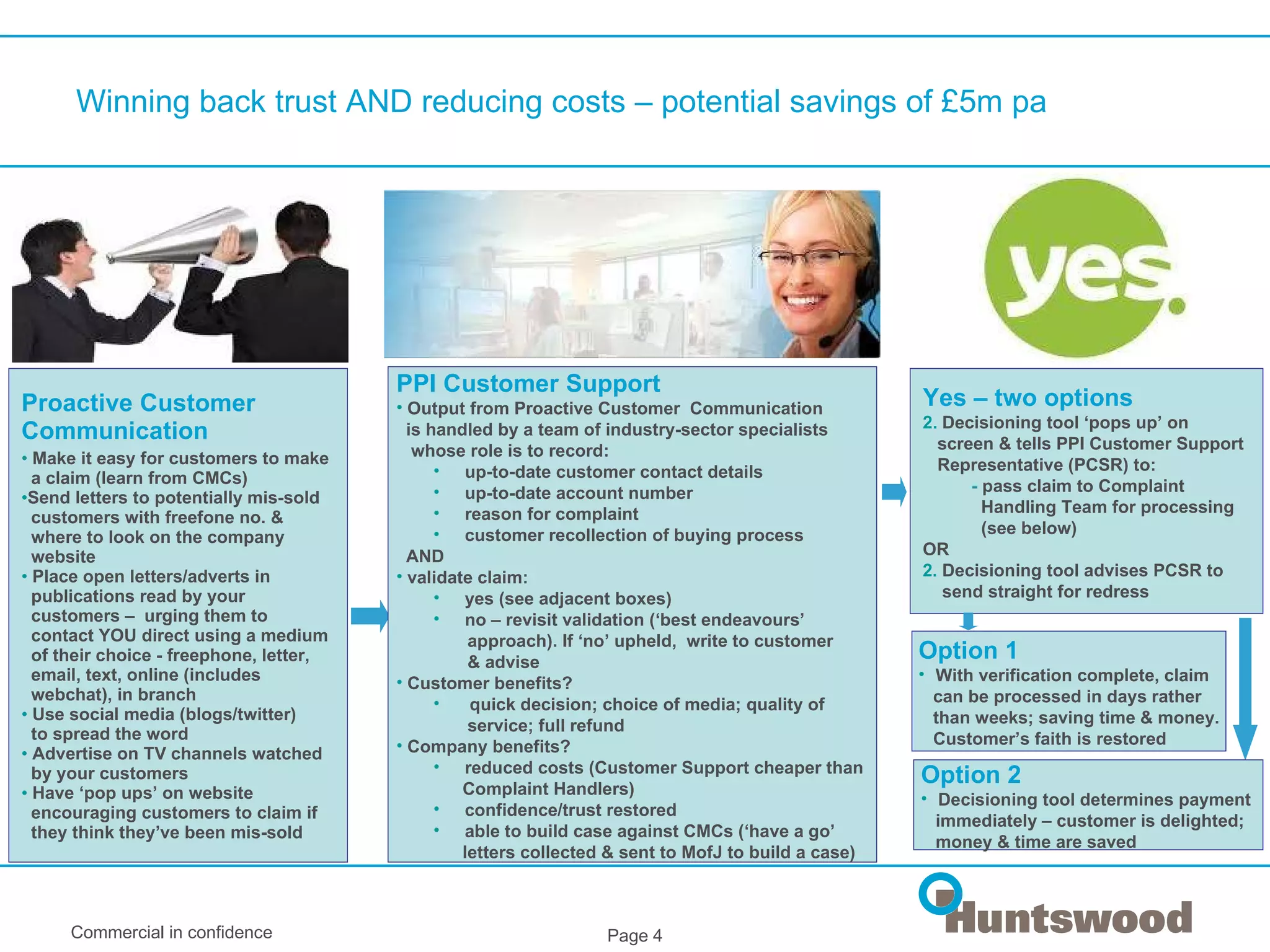

Huntswood provides a proactive, efficient, and cost-effective solution for handling PPI claims to help financial institutions mitigate damage, reduce costs, and restore customer trust. Their solution involves proactive customer outreach, a customer support team to quickly validate and resolve claims, and complaint handling to process claims and provide redress, saving up to £5 million per year. Financial institutions can outsource the entire end-to-end claims process or elements to Huntswood to enhance customer experience, reduce costs, and rebuild trust in their brand.

![Philip Festa Director, People Learning & Development 07770 694 162 [email_address]](https://image.slidesharecdn.com/ppipropositionjune2011-13123752189614-phpapp01-110803075856-phpapp01/75/Ppi-Proposition-June-2011-6-2048.jpg)