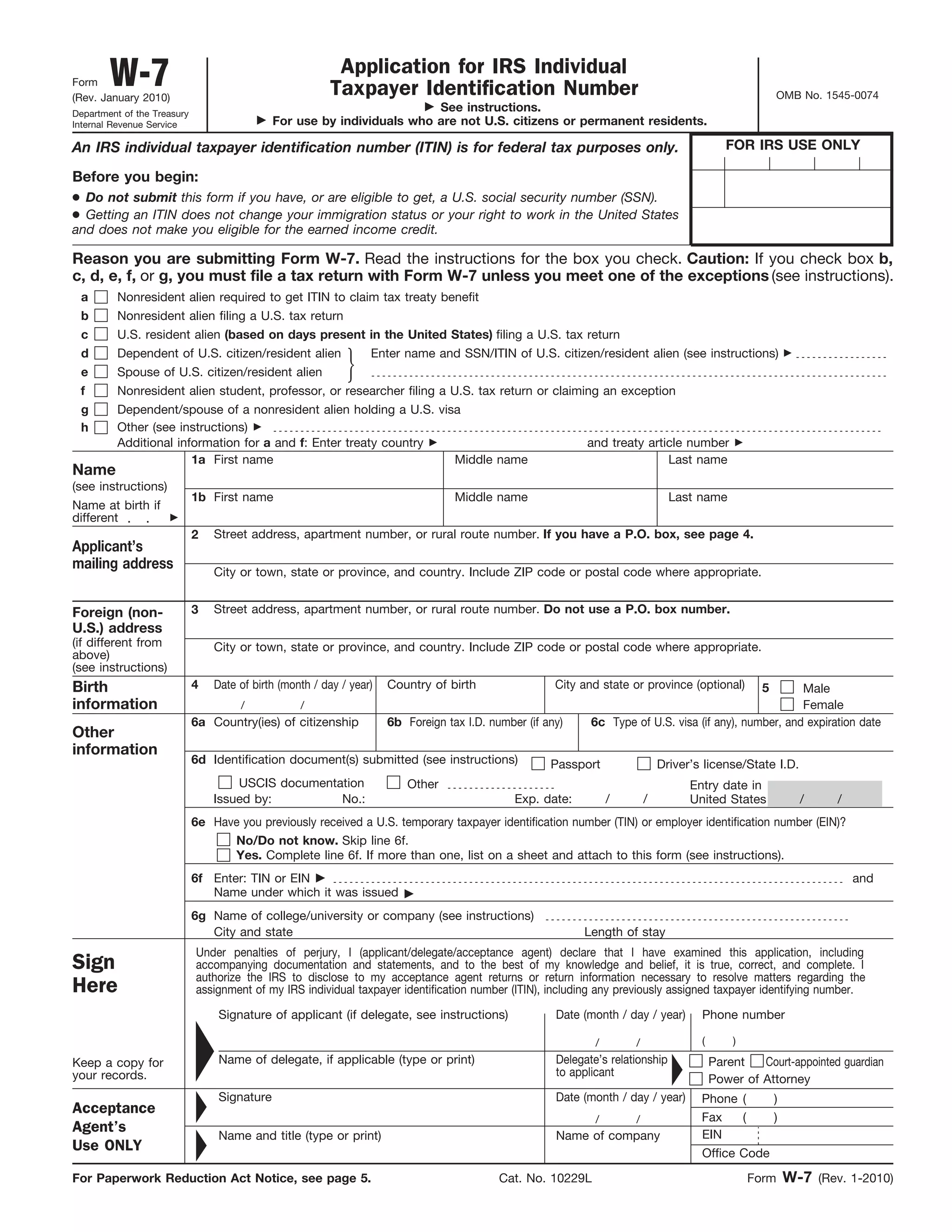

The Form W-7 is an application for an Individual Taxpayer Identification Number (ITIN) from the IRS that is used by individuals who are not U.S. citizens or permanent residents to file a U.S. tax return. The form collects information such as the applicant's name, address, date of birth, country of citizenship, visa information if applicable, and tax filing reasons in order to apply for an ITIN. Applicants must sign the form under penalty of perjury to authorize the IRS to disclose return information as needed to process the ITIN application.