This document describes the POWERGRID Employees Defined Contribution Superannuation Benefit (Pension) Scheme and Post Retirement Medical Benefit Scheme. It provides details on:

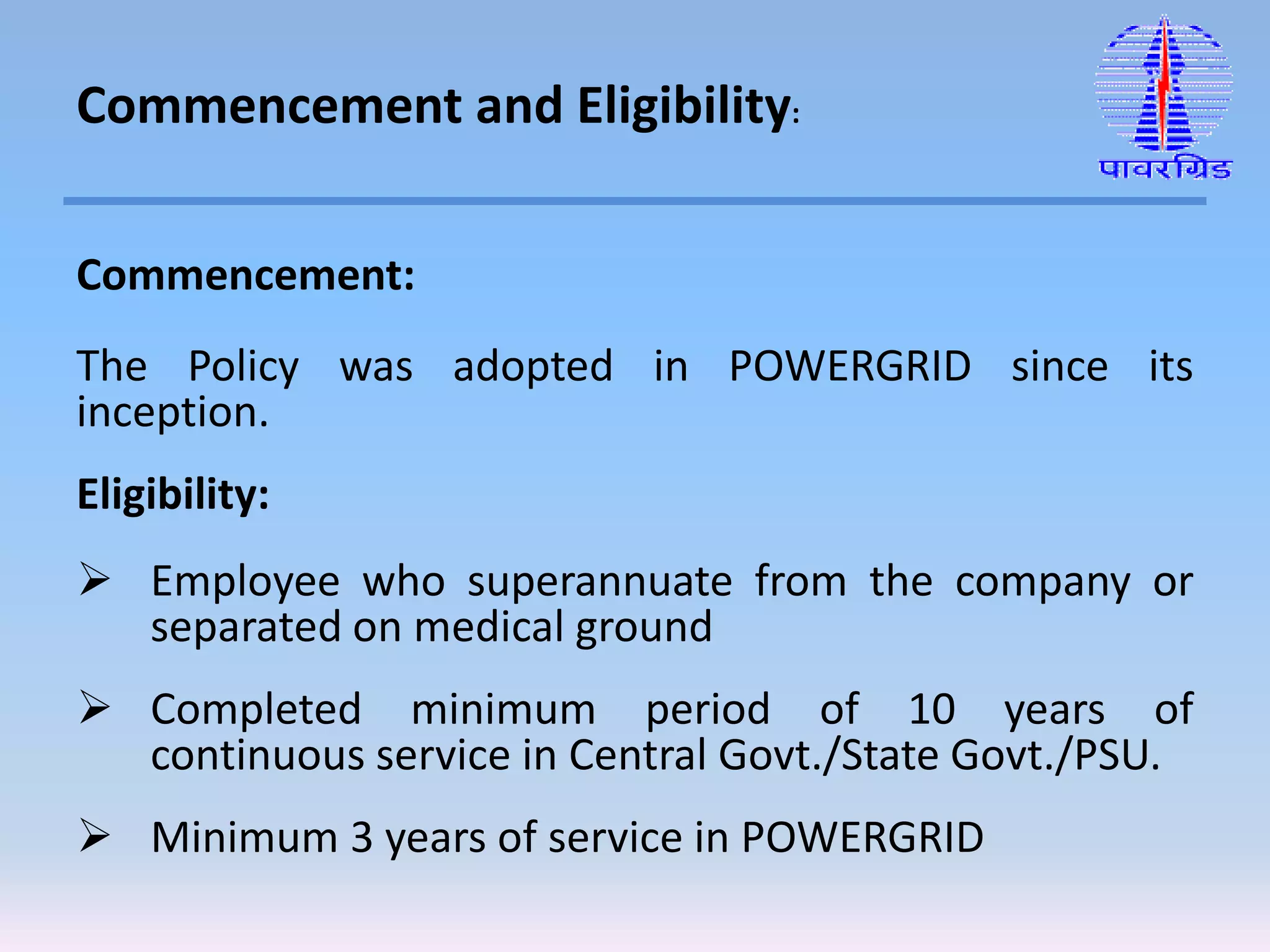

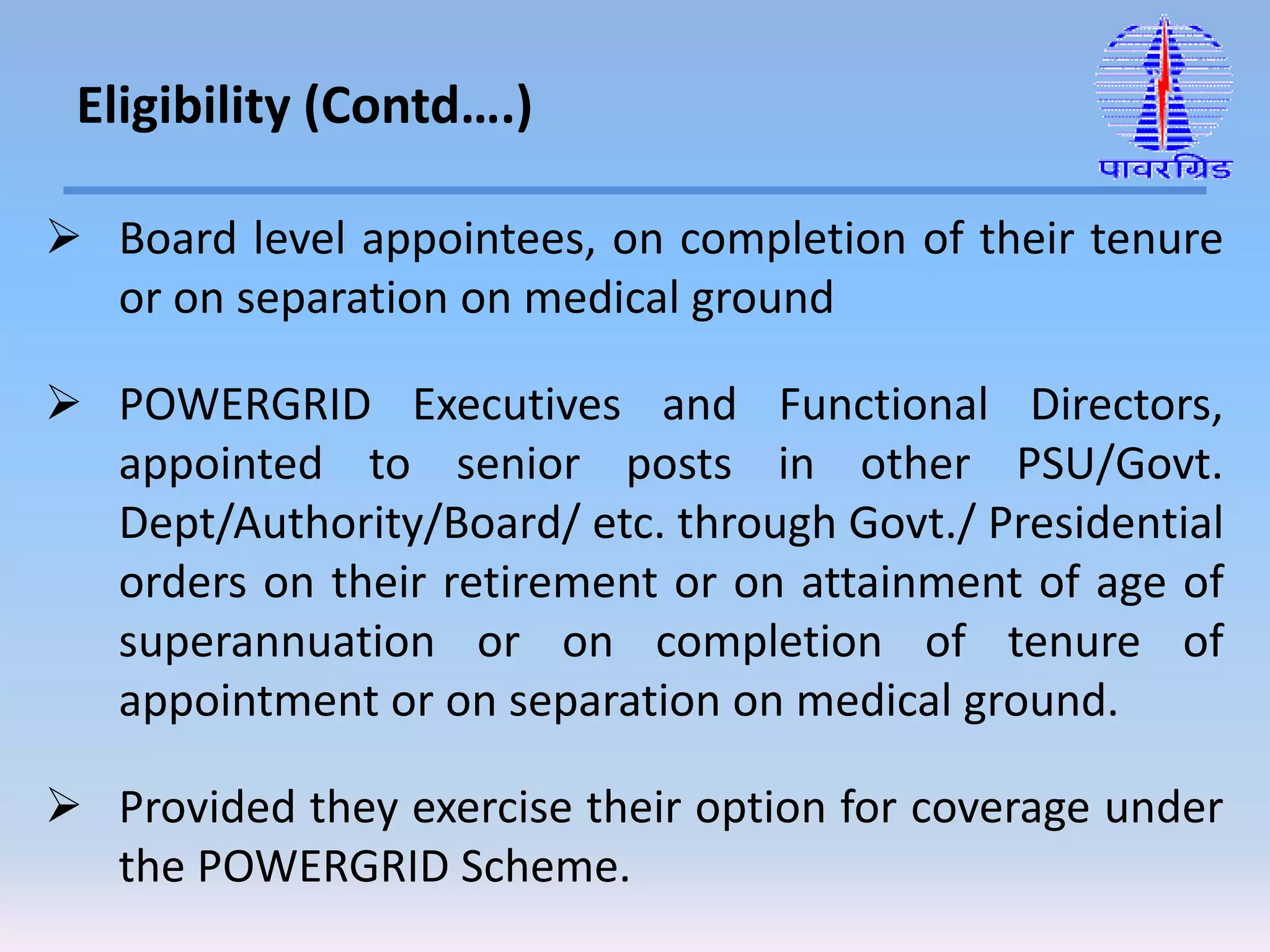

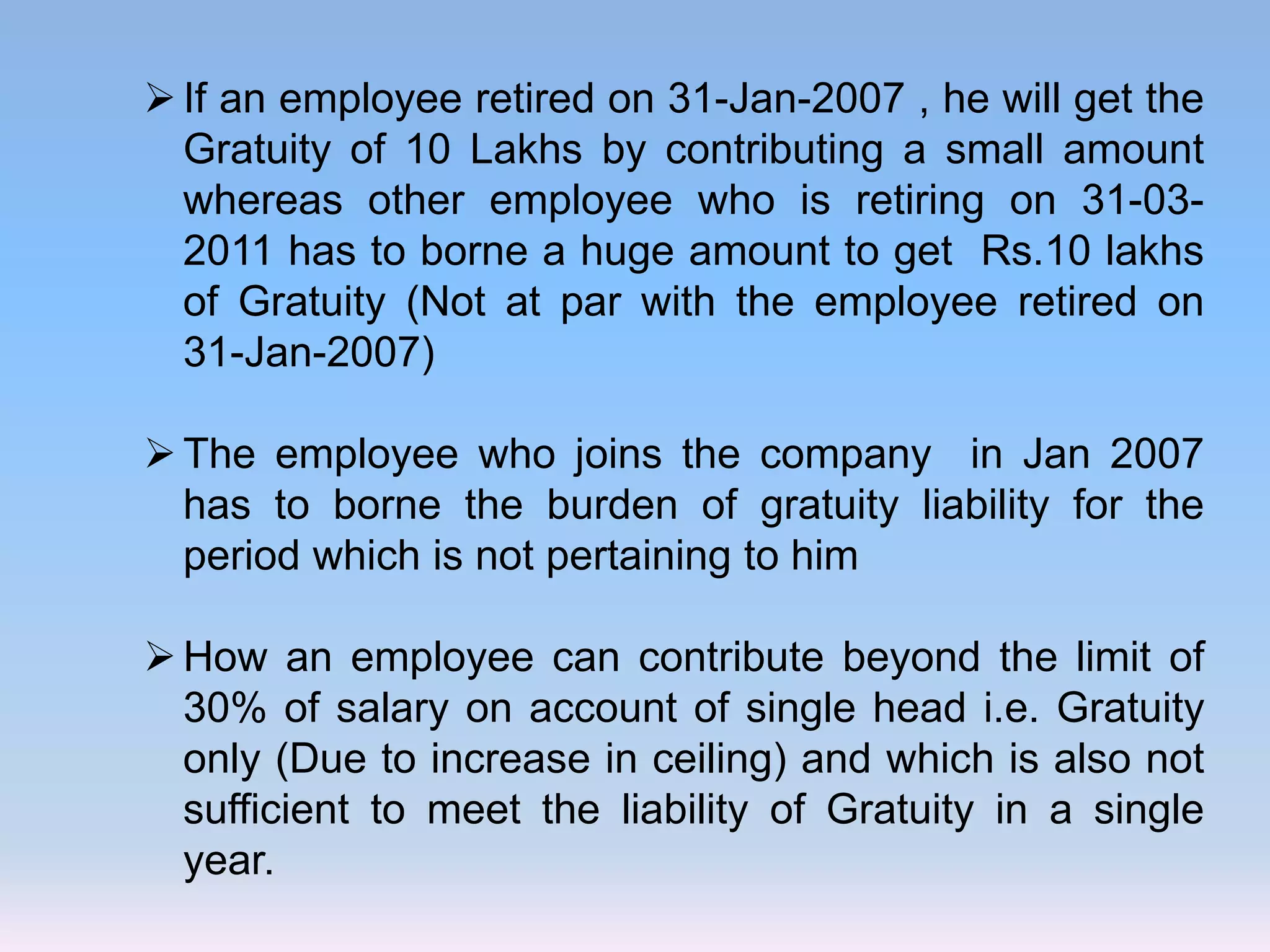

- Background and applicability of the pension scheme which was restructured from defined benefit to defined contribution in 2004.

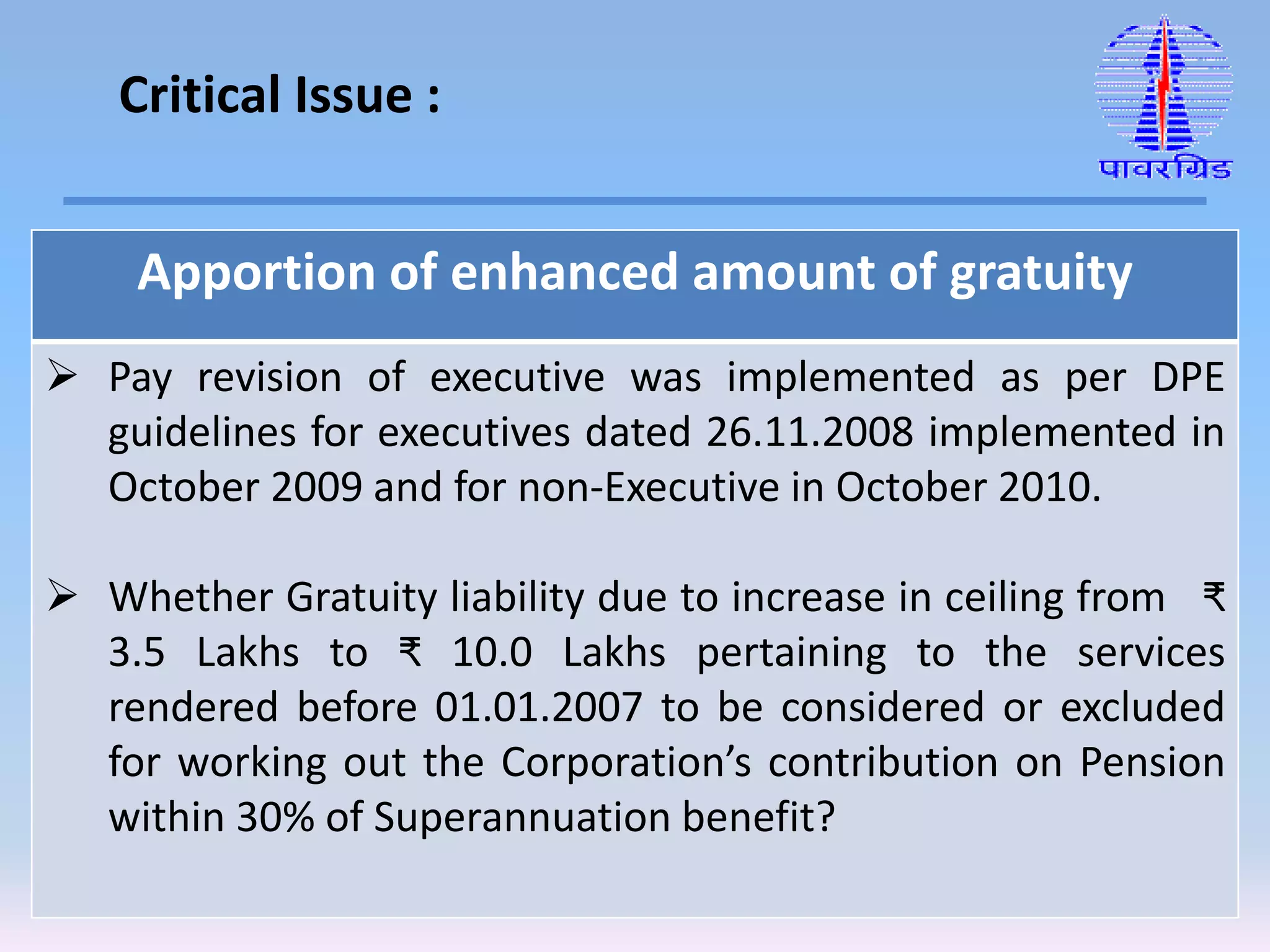

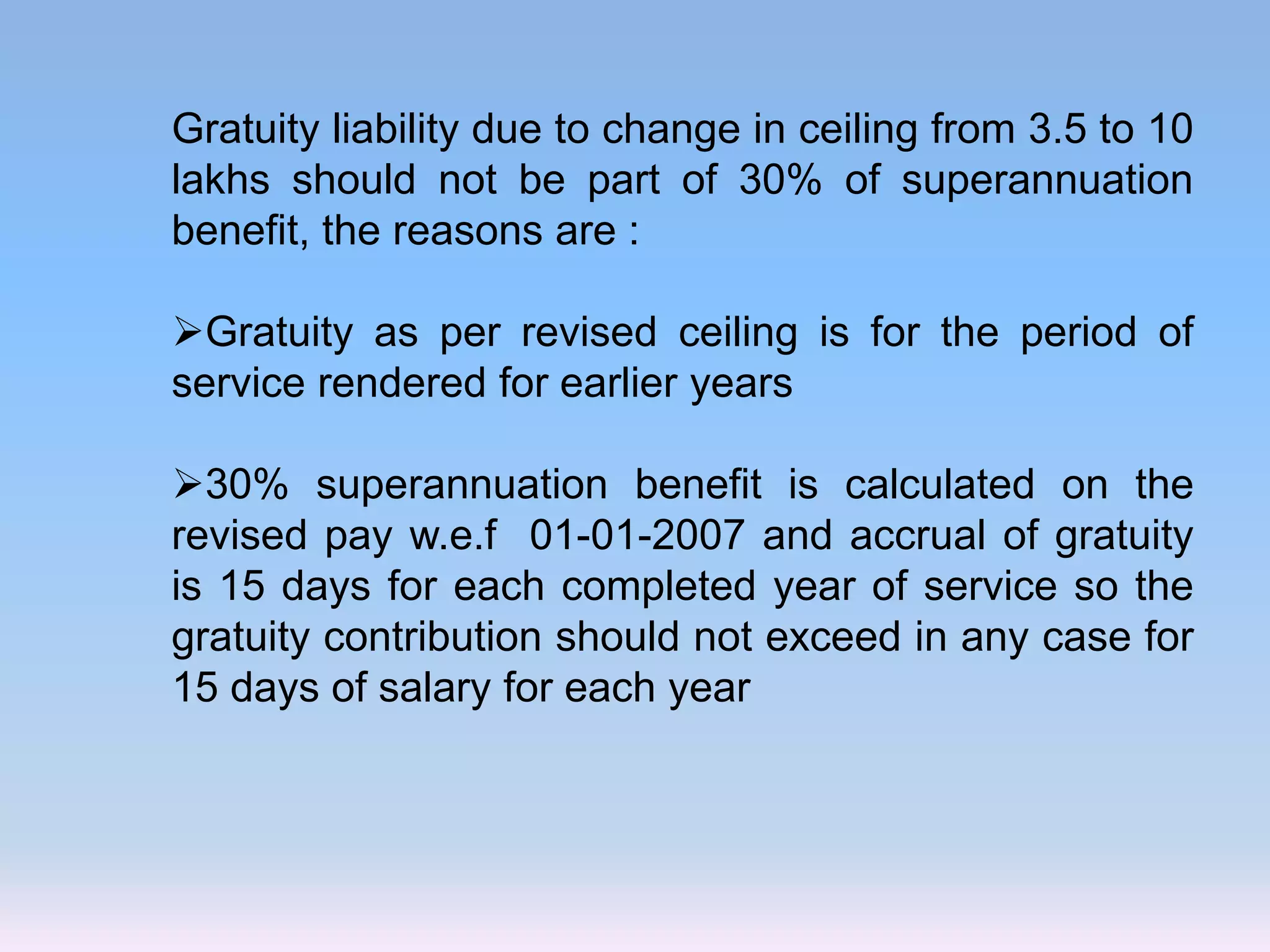

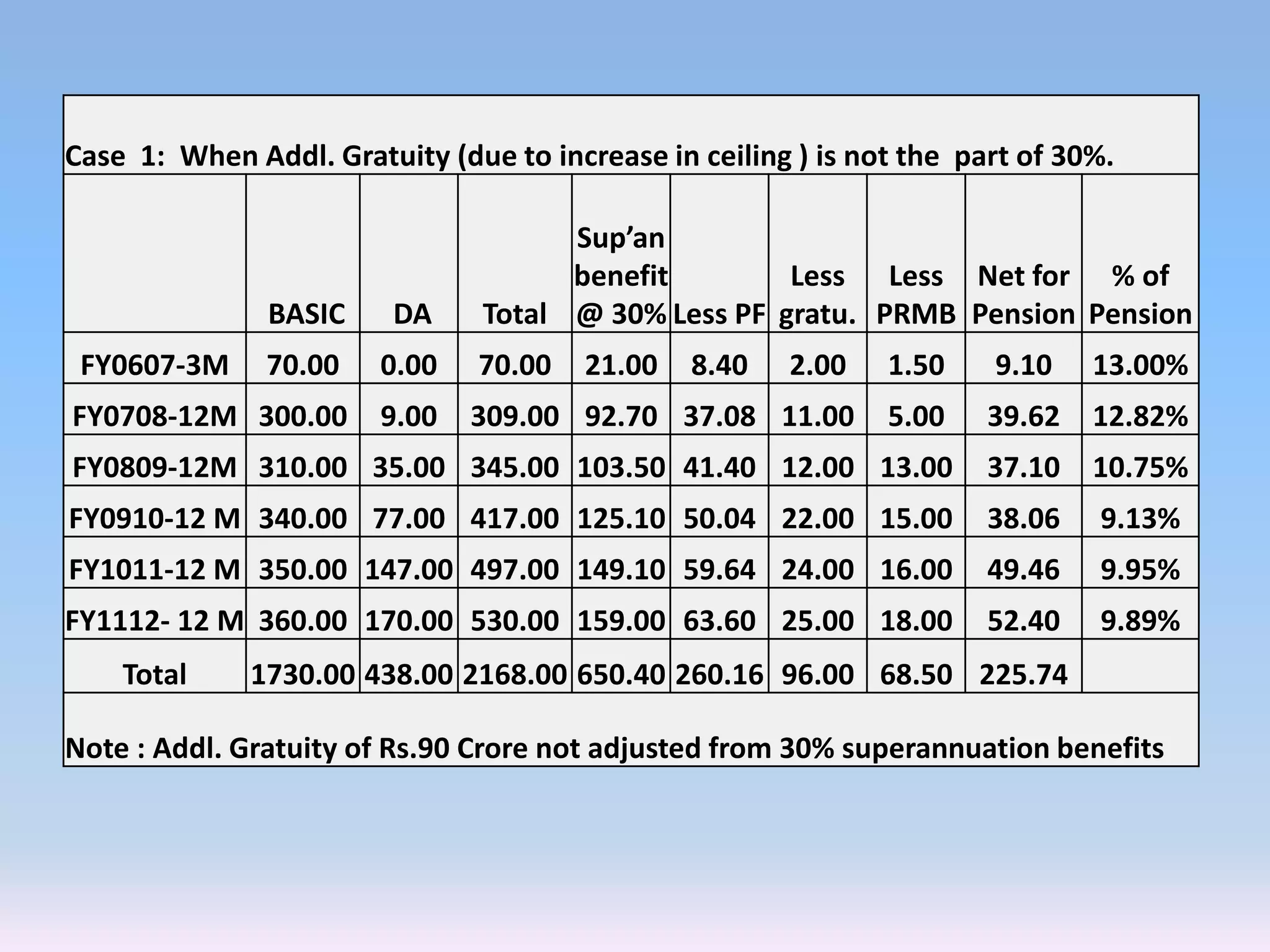

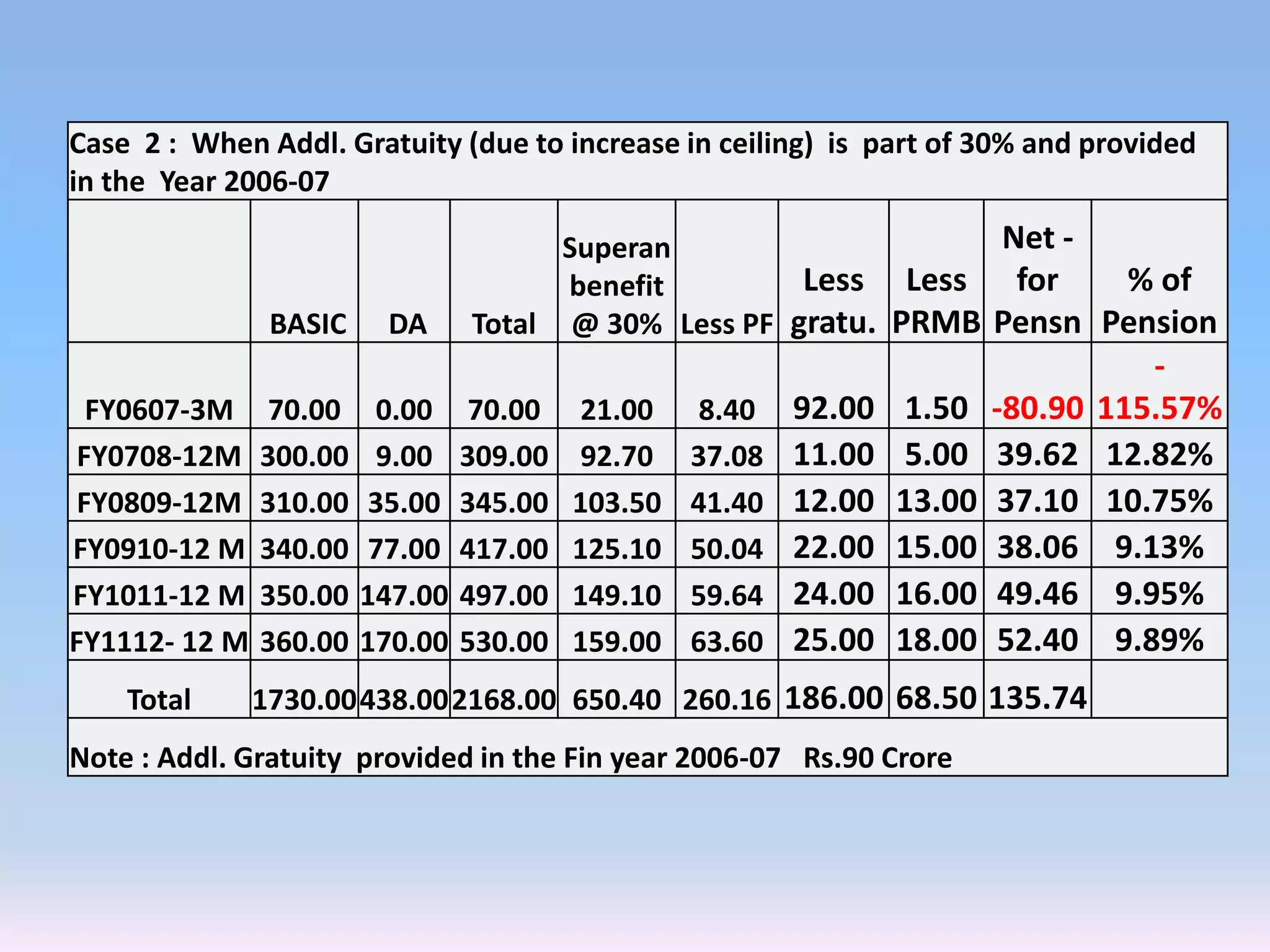

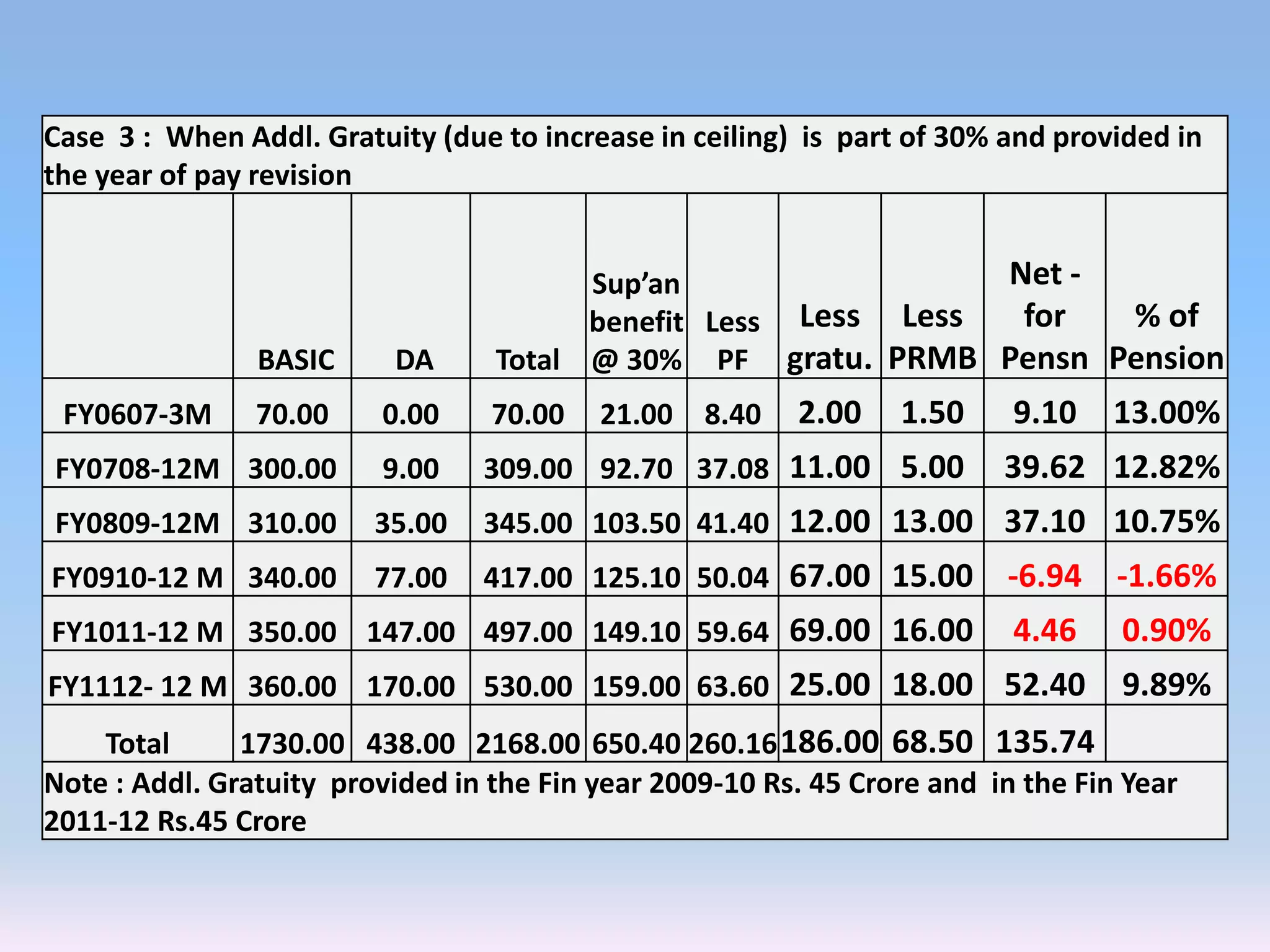

- Contribution rates for members at 3% of basic pay plus DA and corporation contribution within 30% of salary after discounts.

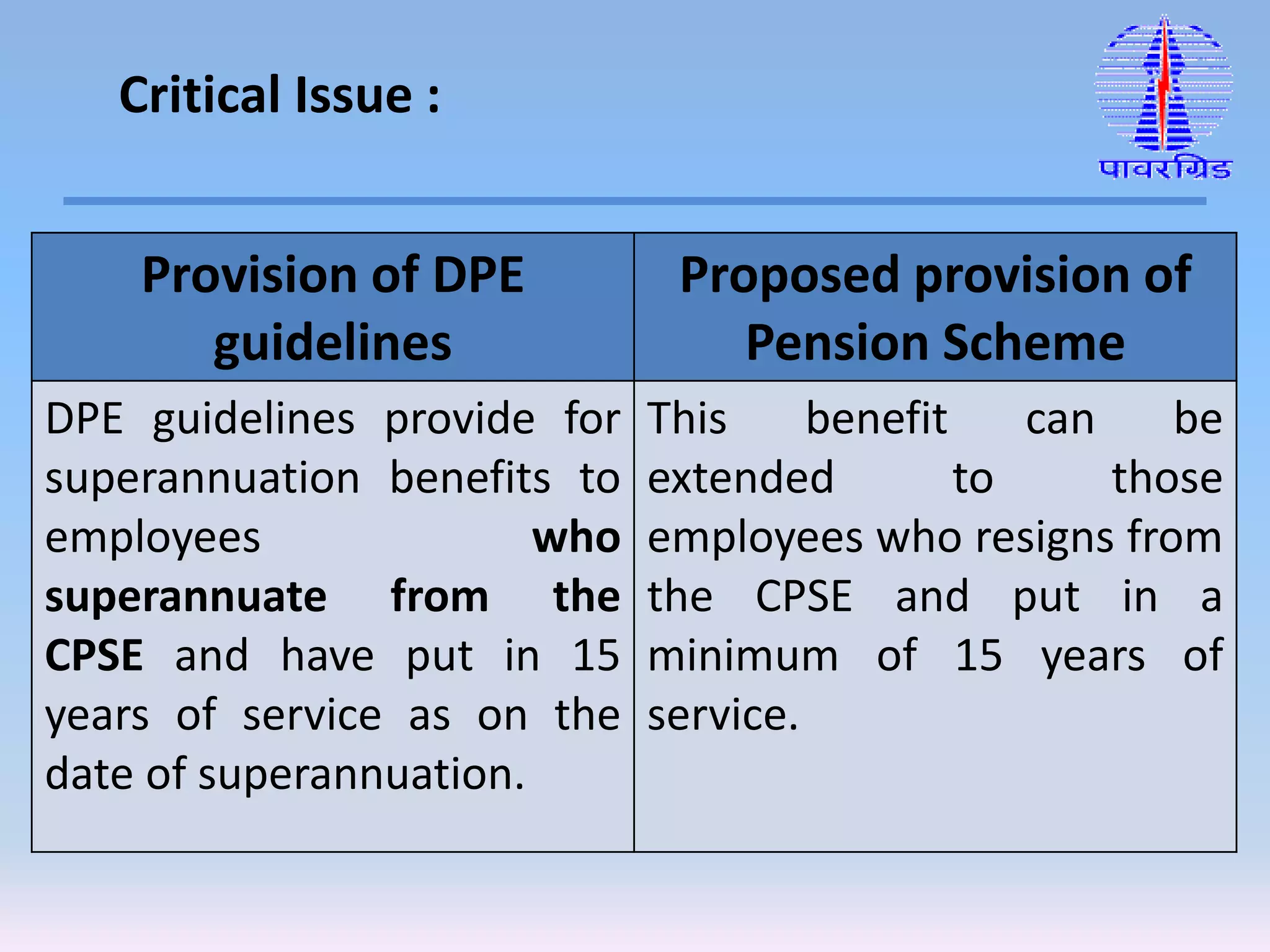

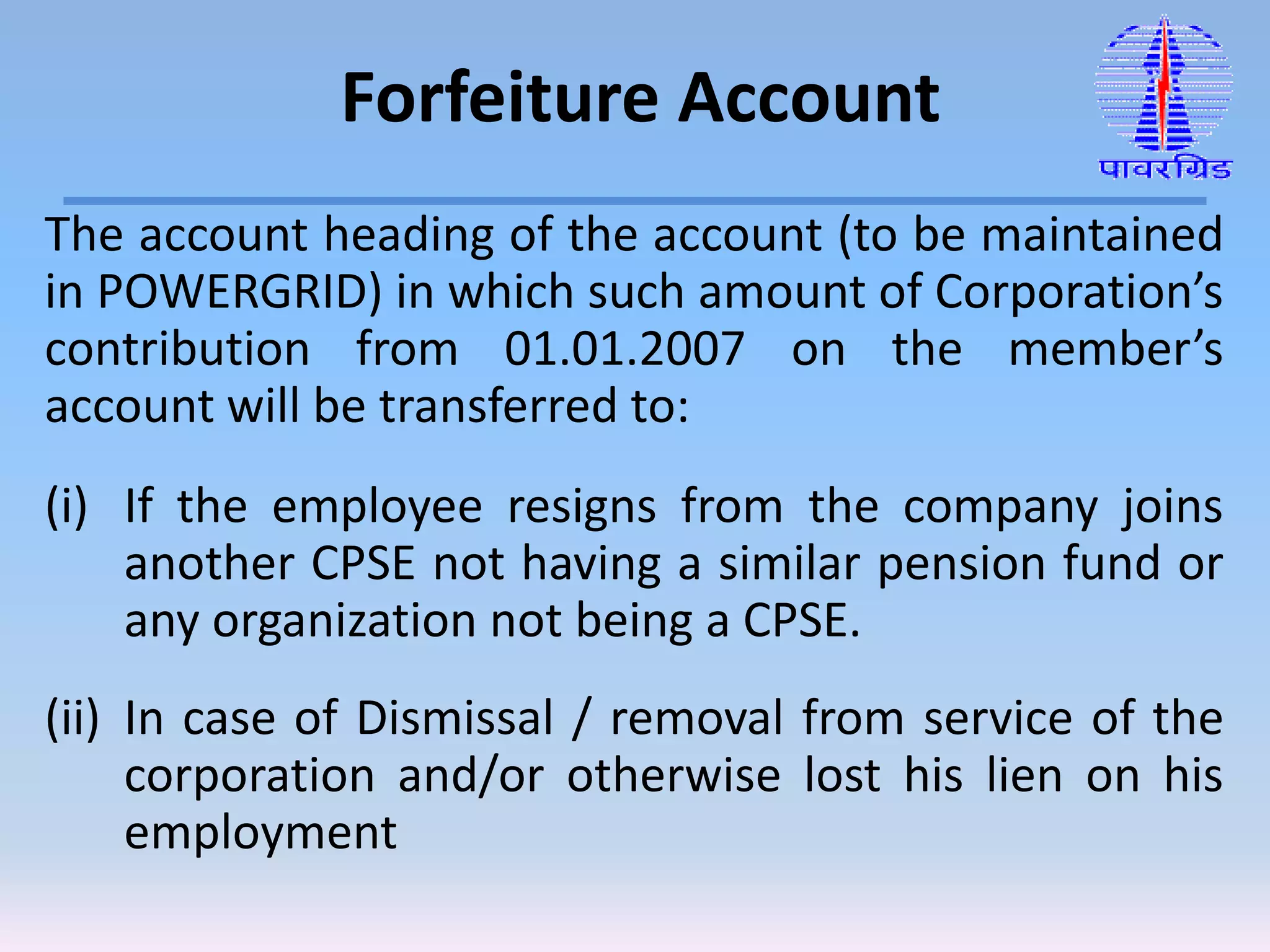

- Benefits including annuity purchase at superannuation or death. Resignation benefits depend on joining another CPSE scheme.

- Administration by trustees and individual pension accounts.

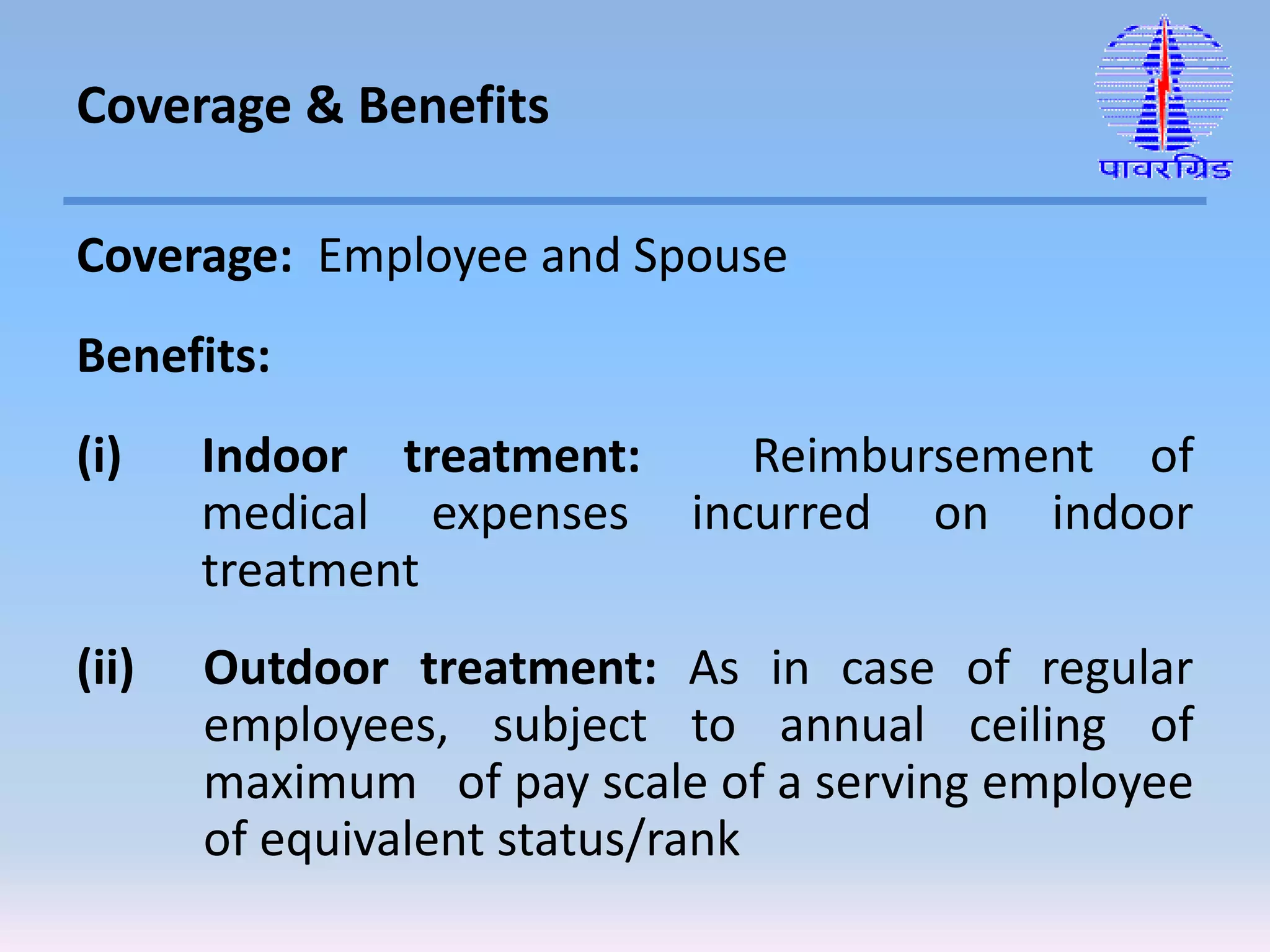

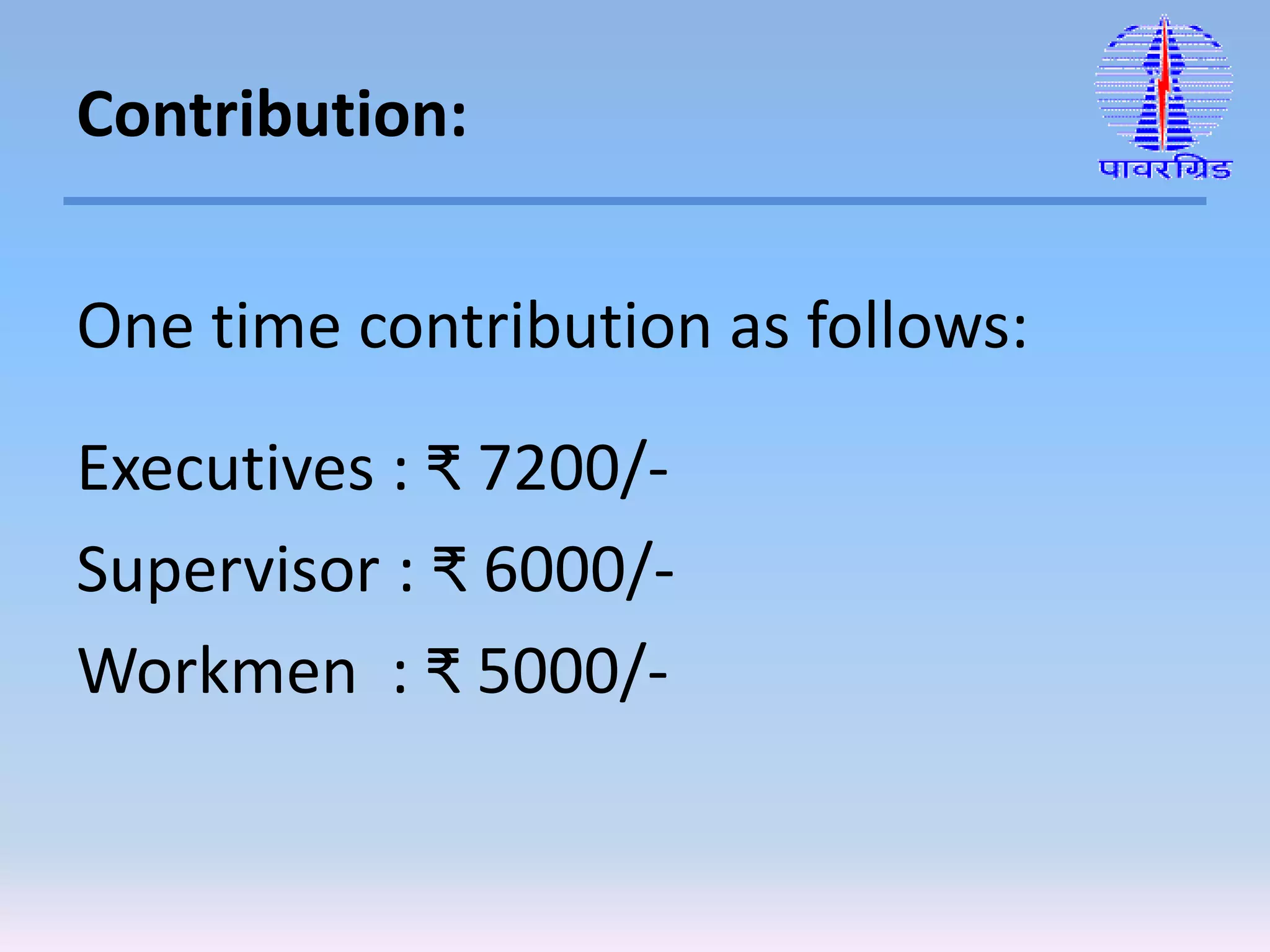

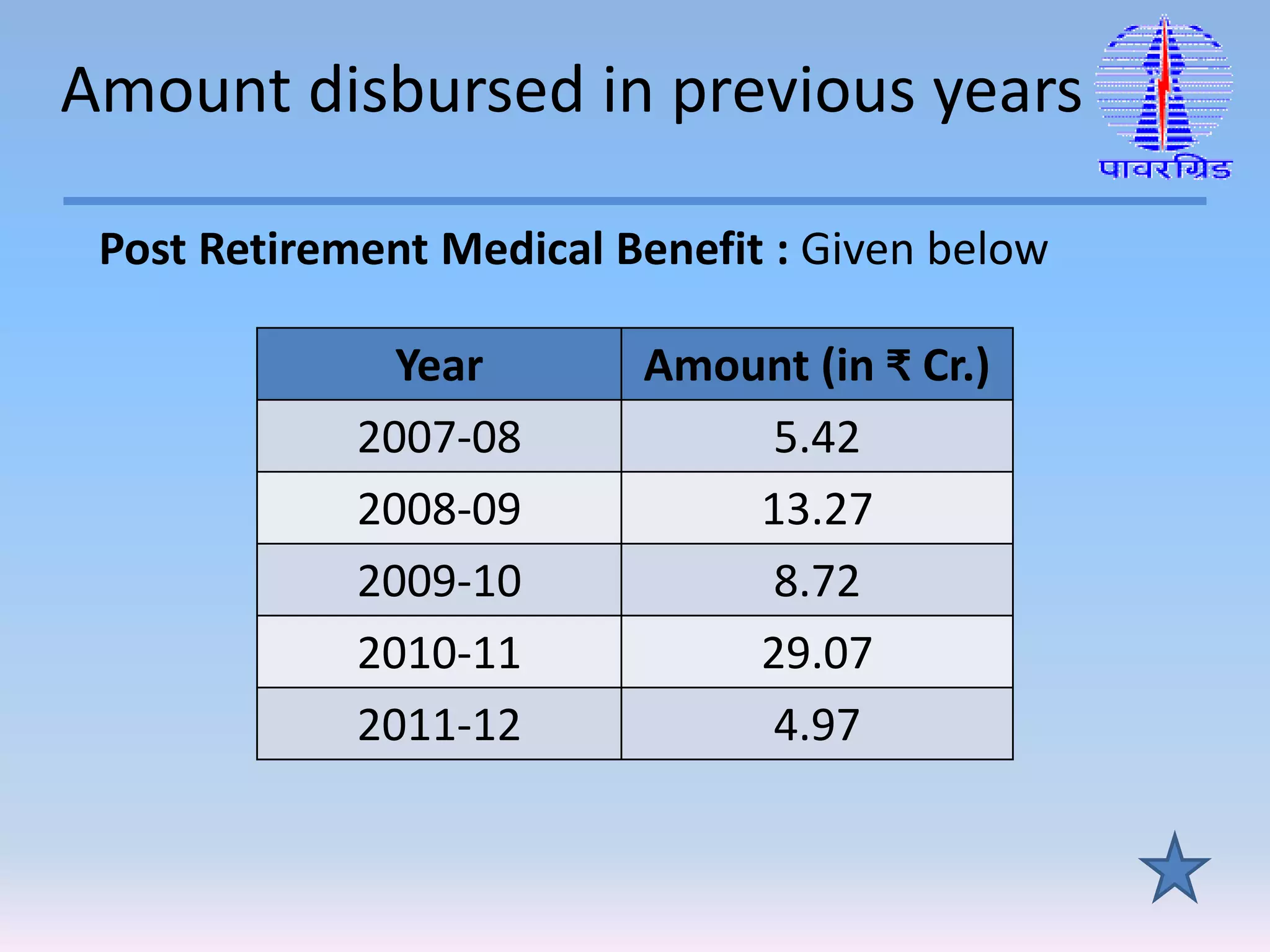

- Post Retirement Medical Benefit Scheme eligibility, coverage, and benefits including one-time