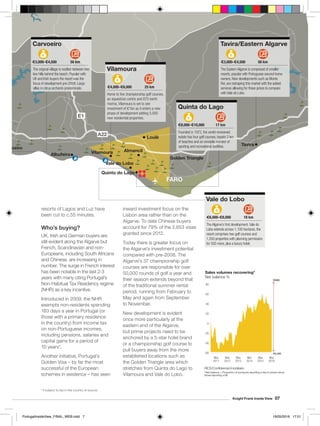

This document provides an overview of the luxury real estate market in Portugal's Algarve region. It discusses how the region was hard hit by the financial crisis but prices have begun to recover in recent years. Buyers are increasingly investing in prime locations along the coast like Quinta do Lago and Vale do Lobo, drawn by amenities, security, and rental potential. The CEO of Quinta do Lago discusses renovations making the popular resort appealing to younger families and a more global clientele.