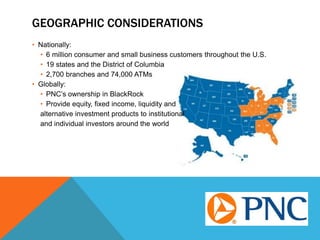

PNC has a long history dating back to the 1800s through several mergers and acquisitions. It now serves individuals, small businesses, and corporations through various banking products and services across 19 states. Key ratios show declining profit margins but increased sales from 2010-2012. PNC faces risks from economic conditions, regulations, and competition. However, its diversified business model, geographic reach, and recent stock price increase make it a reasonable investment.