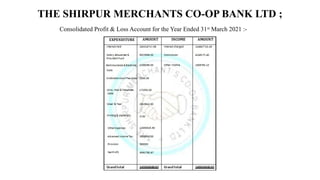

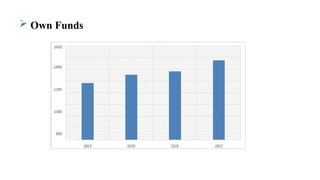

The document presents a financial planning and forecasting overview for the Shirpur Merchants Co-operative Bank, detailing its definition, advantages, objectives, and the company's history. Key benefits include goal setting, budgeting facilitation, financial performance insight, risk management, and informed decision-making. The bank, founded in 1946, is poised for a strong future, with increasing net working capital and improved financial performance projected for 2022-23.