1. The document provides an overview of fraud awareness training for Premier Healthcare Exchange, outlining their commitment to detecting, preventing, and eliminating fraud, abuse, and waste.

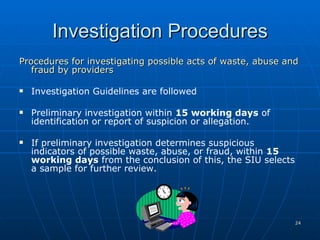

2. Premier will employ a Special Investigations Unit to identify possible fraudulent acts using electronic systems and employee training. Suspected acts will be investigated and overpayments recovered.

3. Common types of healthcare fraud by providers and consumers are described, including billing for services not rendered, falsifying diagnoses, and various schemes to obtain unauthorized payments.

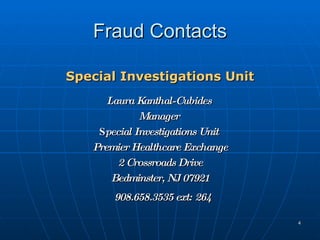

![Fraud Contacts Fraud Hotline 1-877-PHX-TIPS E-mail [email_address] Correspondence Premier Healthcare Exchange 2 Crossroads Drive Bedminster, NJ 07921](https://image.slidesharecdn.com/phxfraudandabusetrainingmodule-124447025162-phpapp02/85/Phx-Fraud-And-Abuse-Training-Module-5-320.jpg)