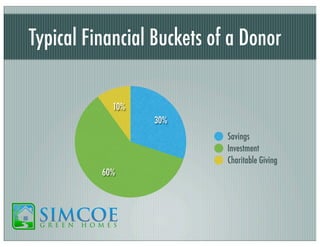

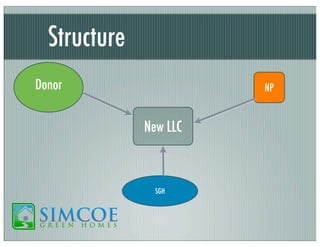

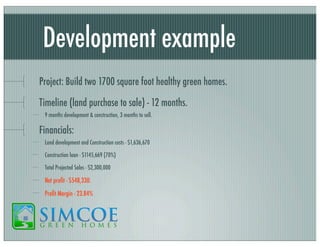

The document proposes a partnership between a nonprofit, donors, and a green home developer (Simcoe Green Homes) to generate income for all parties. Donors would invest in the developer's projects rather than donate, tapping into their larger investment funds. The developer would use these funds to build green homes. Profits would then be shared between the nonprofit, donor, and developer according to a predetermined split. This allows the nonprofit to access more funding, donors to earn returns on their investment while supporting a cause, and the developer to increase profits and support the nonprofit.