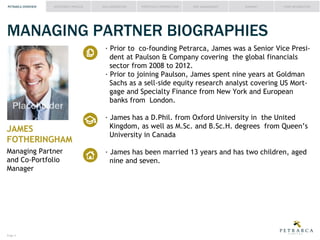

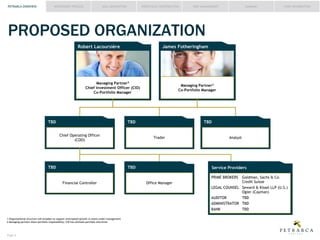

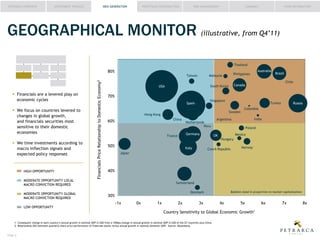

This document provides an overview of the Petrarca Capital Management Global Financials Sector Fund. It introduces the fund's investment strategy, which focuses on global financial securities, and its investment process of idea generation, portfolio construction, and risk management. It also profiles the fund's two managing partners, Robert Lacoursière and James Fotheringham, who have decades of experience in analyzing financials and previously managed $10 billion together at Paulson & Co.