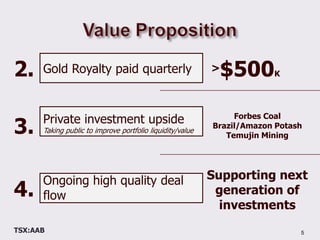

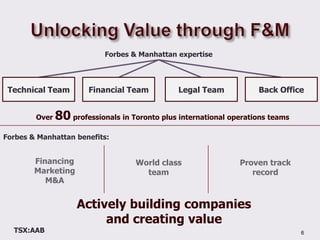

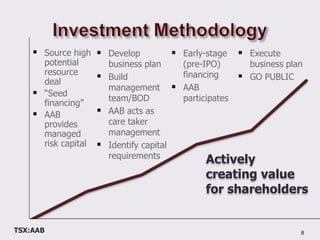

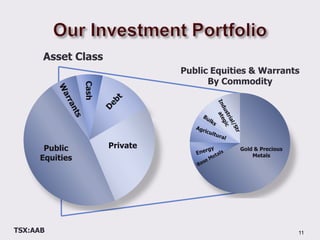

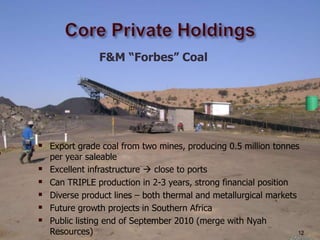

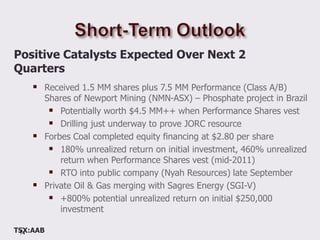

This document provides an overview of a global resource investment company and merchant bank. It summarizes the company's value proposition as an active investor in private resource companies, with the goal of generating triple digit returns. It highlights some of the company's key assets and investment portfolio, including holdings in gold, coal, agriculture and oil and gas. The document also outlines the company's investment methodology, management team, and provides contact details.