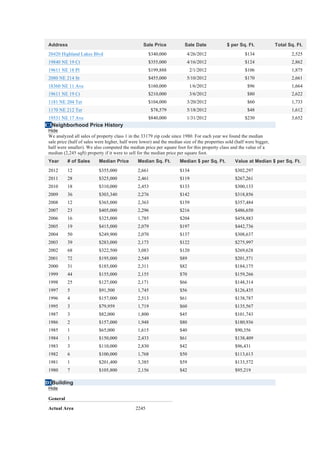

This document provides property details for 1864 NE 214 Ter in North Miami Beach, FL. It includes the address, parcel ID, legal description, zoning, taxes, sale history, ownership details, nearby sale comparables, and neighborhood price trends over time. The property is a 2,245 square foot, 3 bedroom, 2 bathroom single family home built in 1978 that last sold in 2011 for $385,000. Nearby comparable property sales have ranged from $78,579 to $840,000 with median prices per square foot of $134.