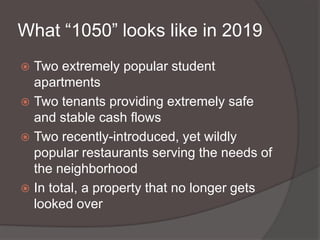

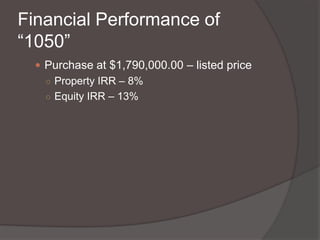

This document discusses an investment opportunity involving a mixed-use property located at 1050 Lancaster Avenue. The property consists of 4 commercial units, 2 student apartments, 1 office, and 1 garage for a total of 7,500 square feet. The investor proposes 3 capital projects: improving the parking lot, updating the exterior facade, and rehauling the back courtyard. They also want to improve the tenant mix by filling the current vacancy and adding 2 popular restaurants. Financial projections estimate property investment returns of 8-12% and equity investment returns of 13-21%, depending on the purchase price. The document argues this is an investment opportunity that is "too good to walk away from."