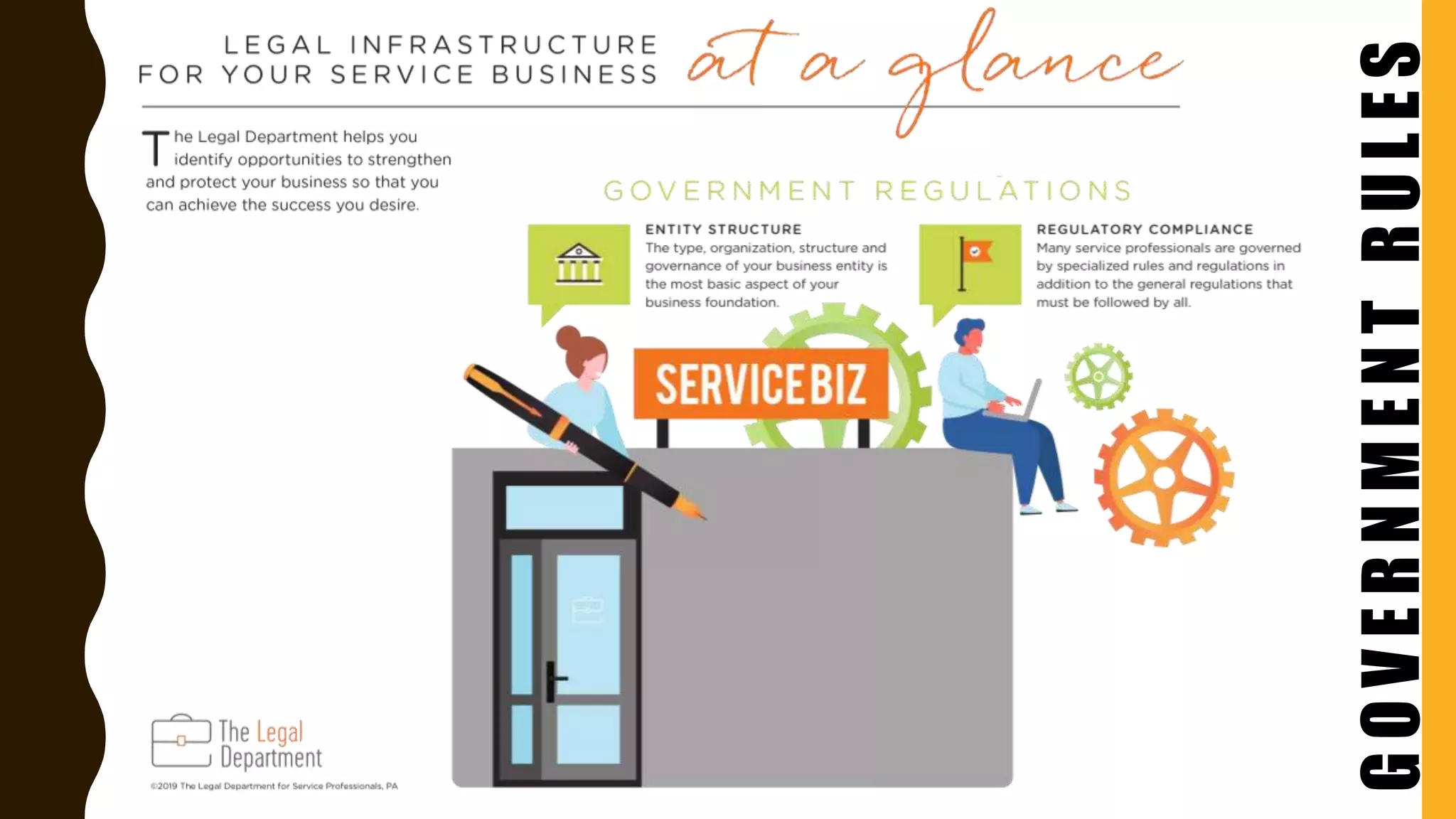

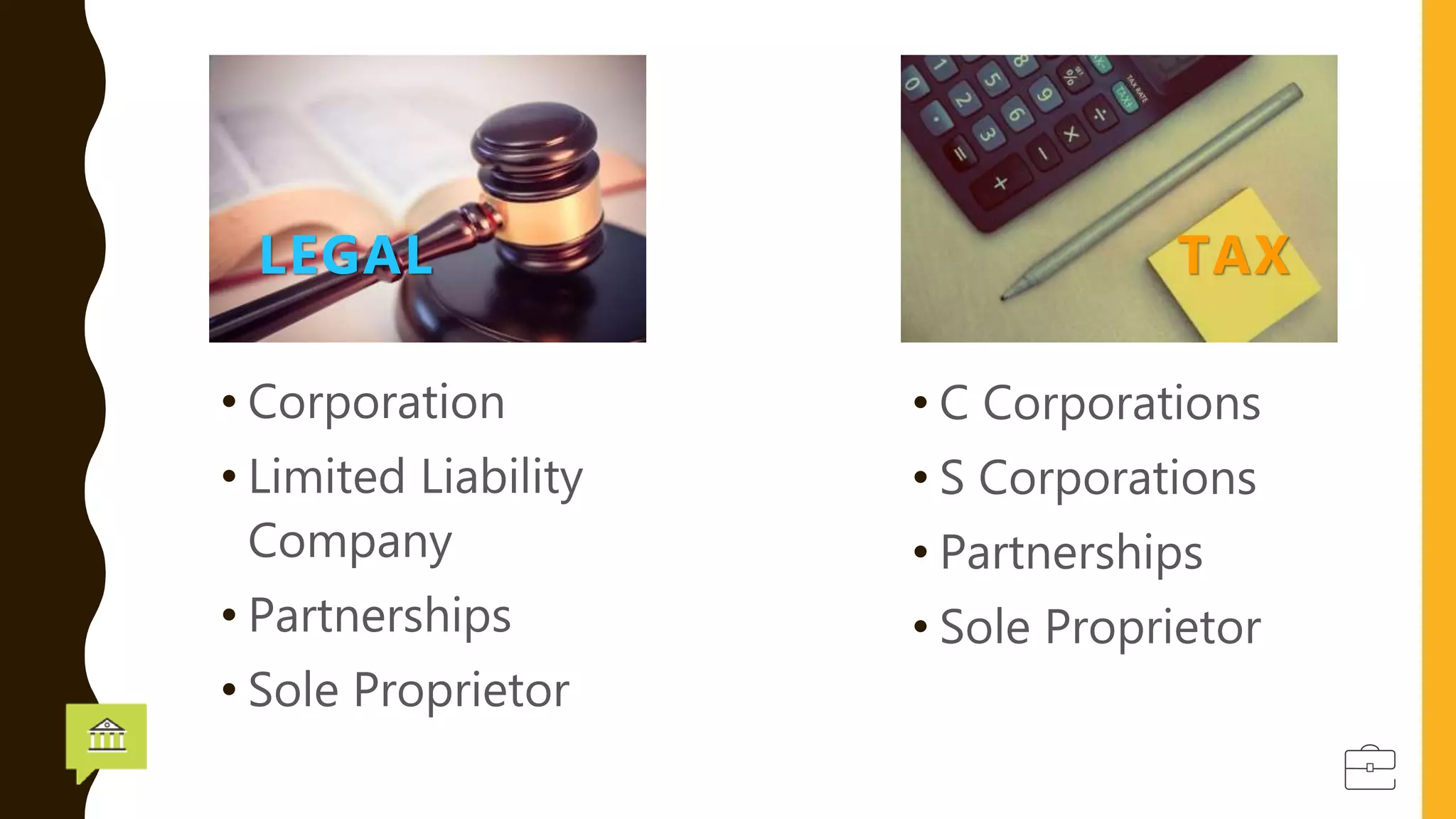

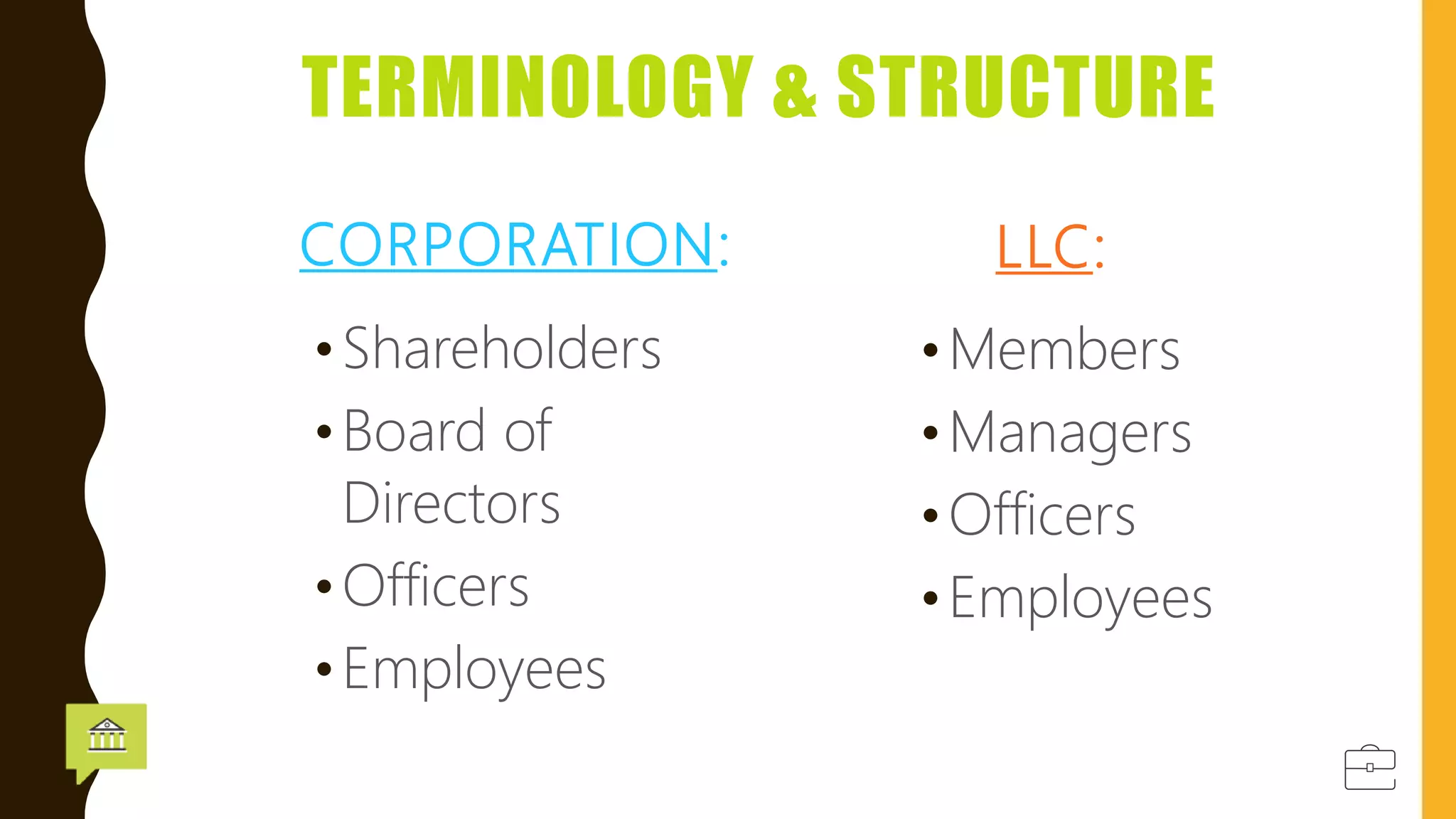

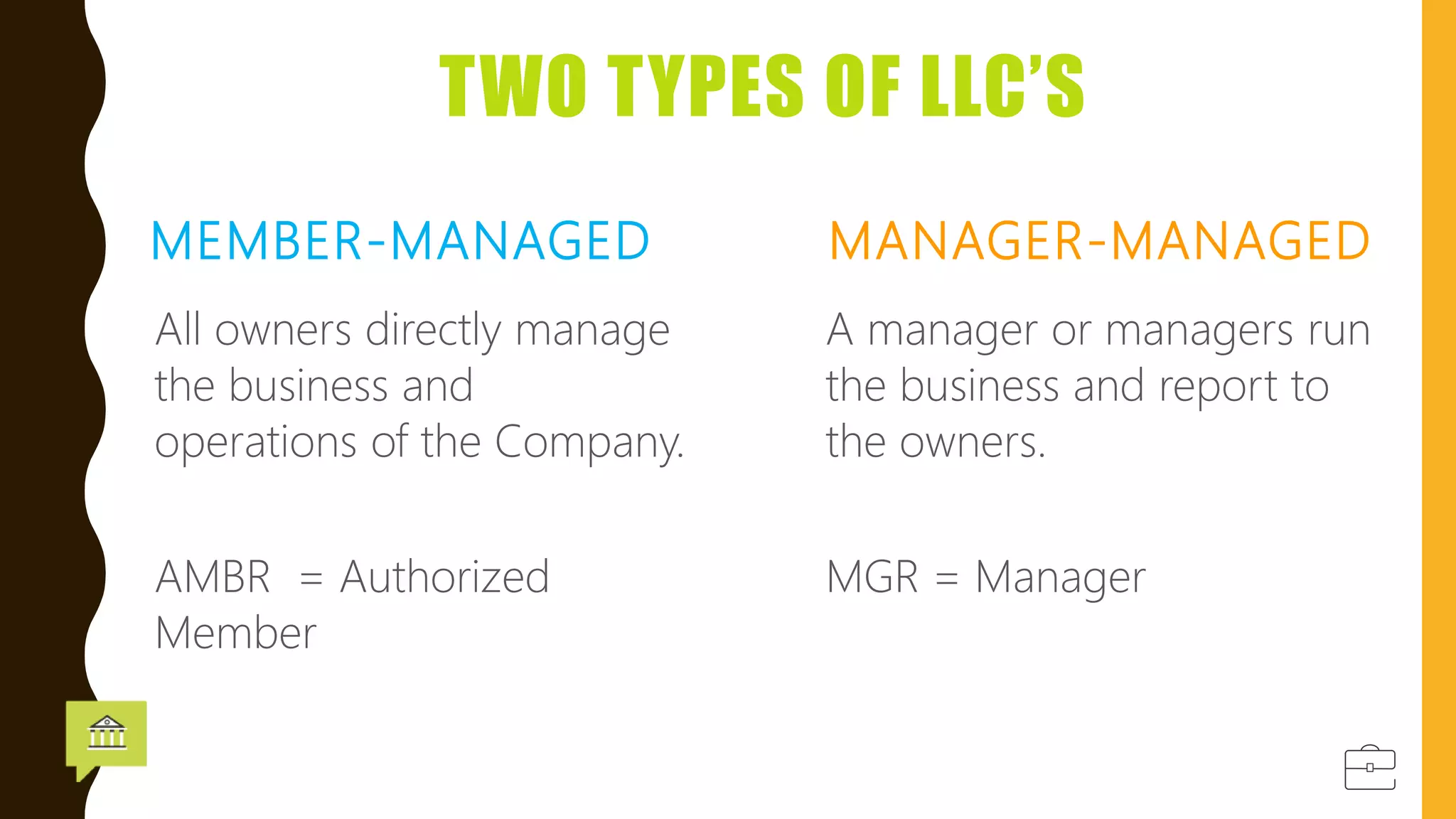

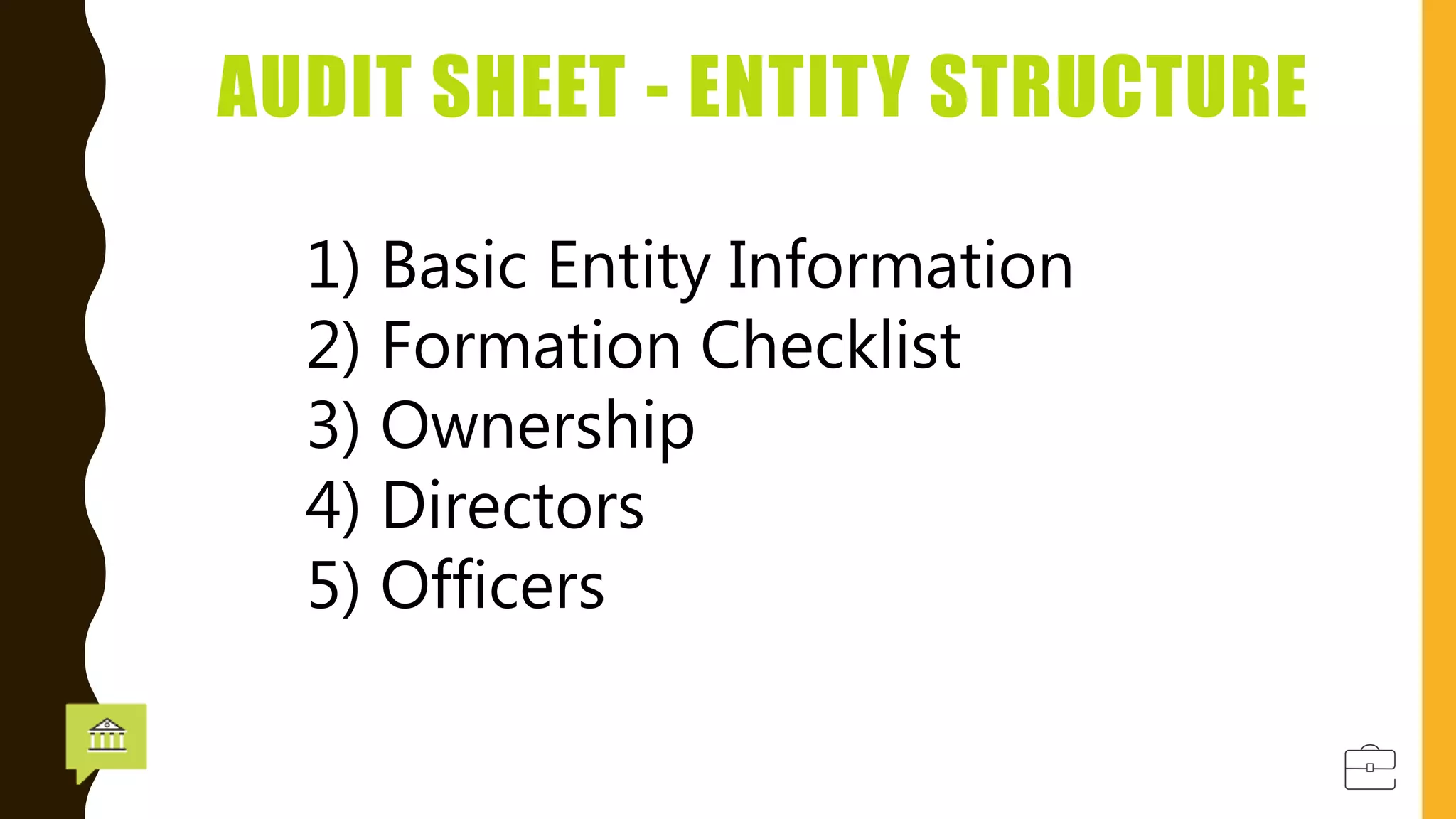

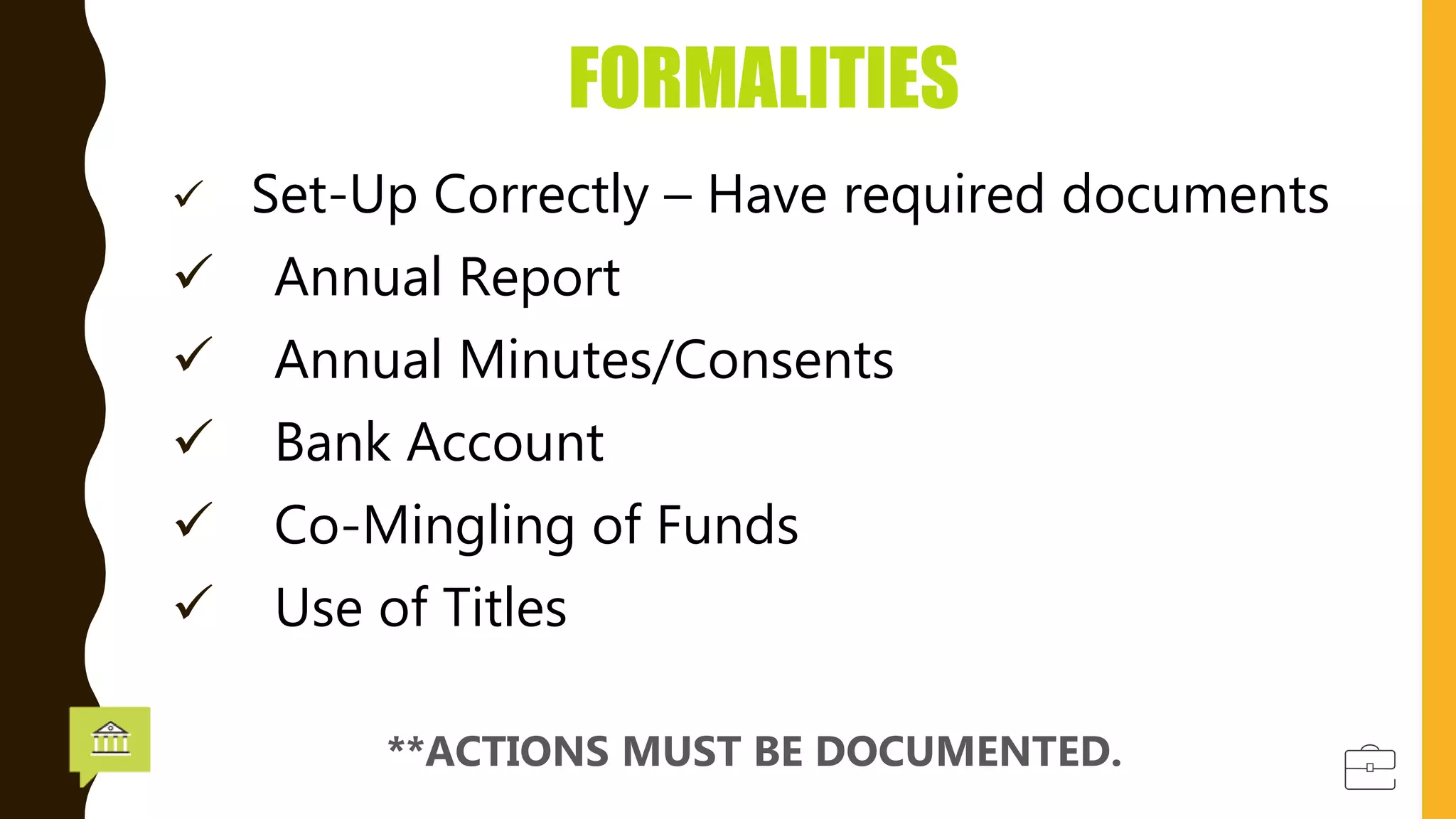

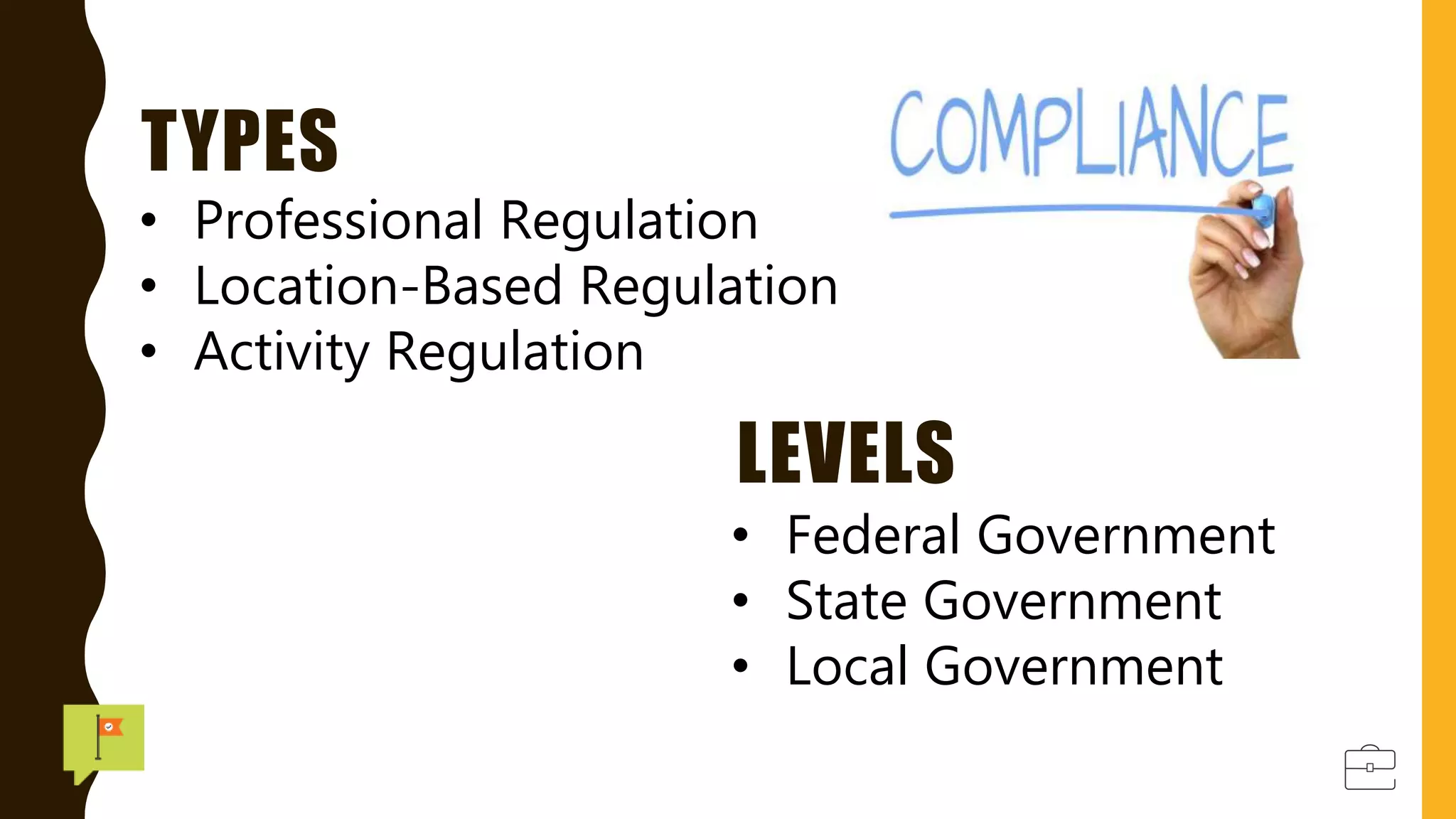

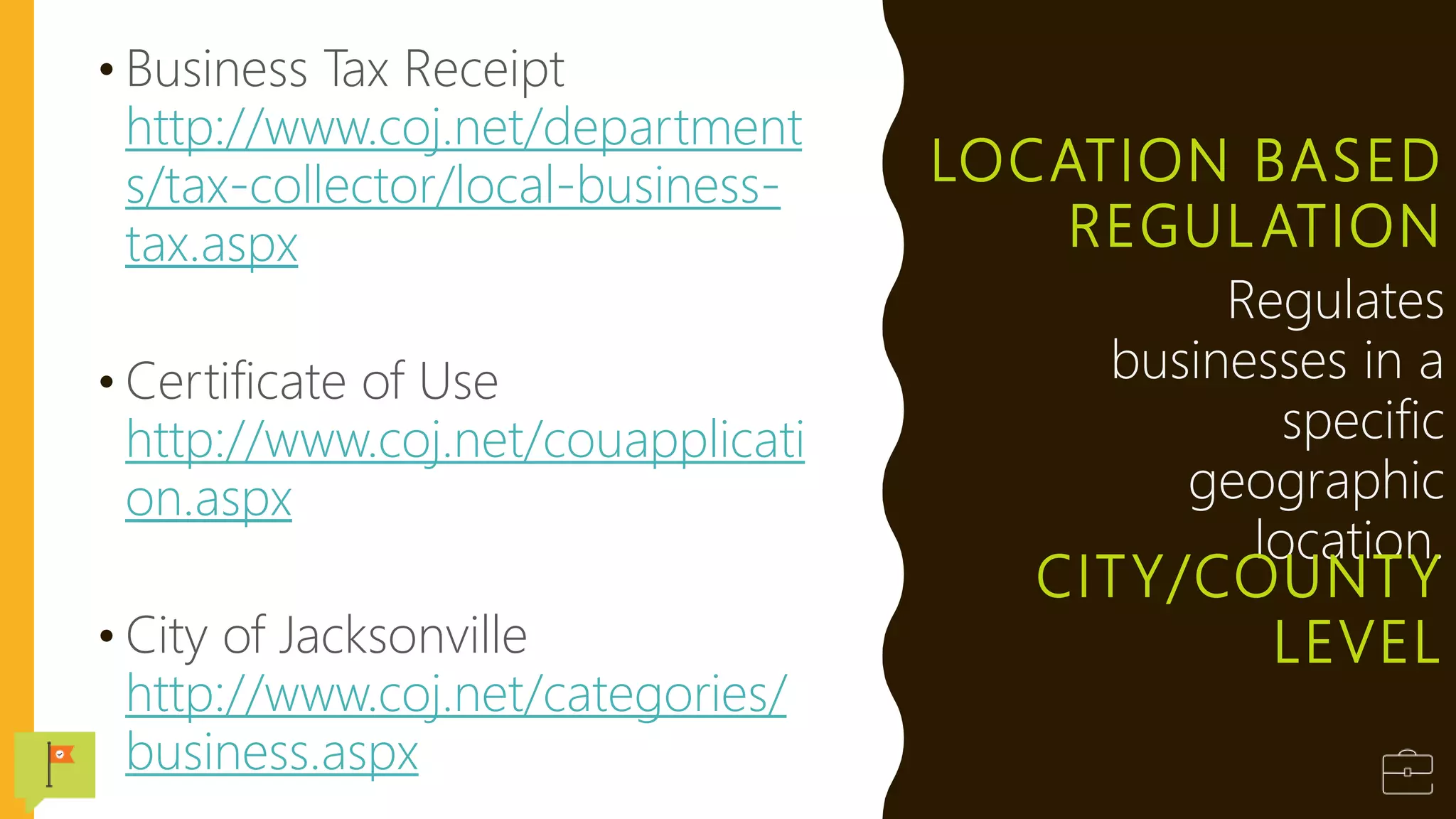

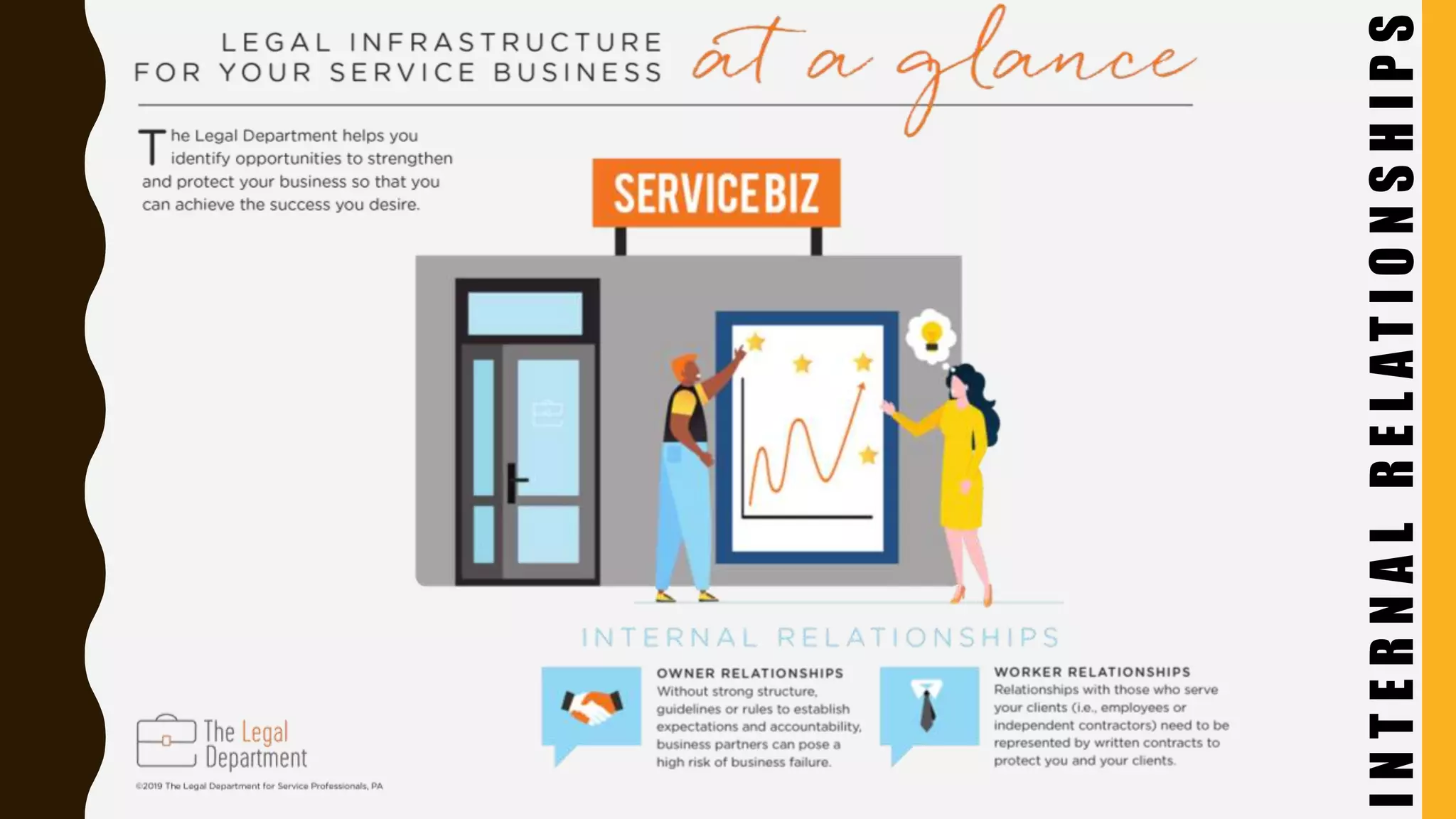

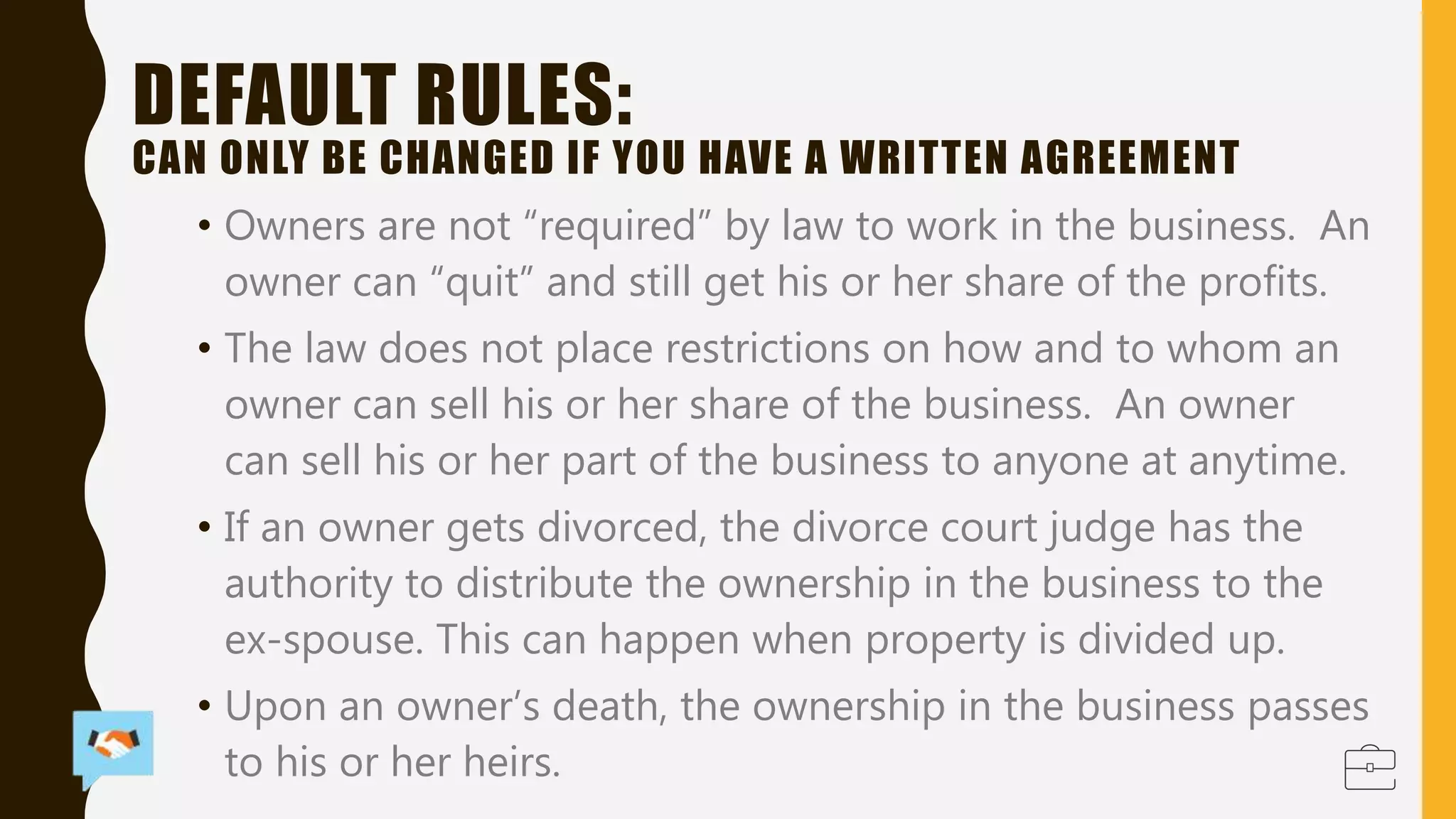

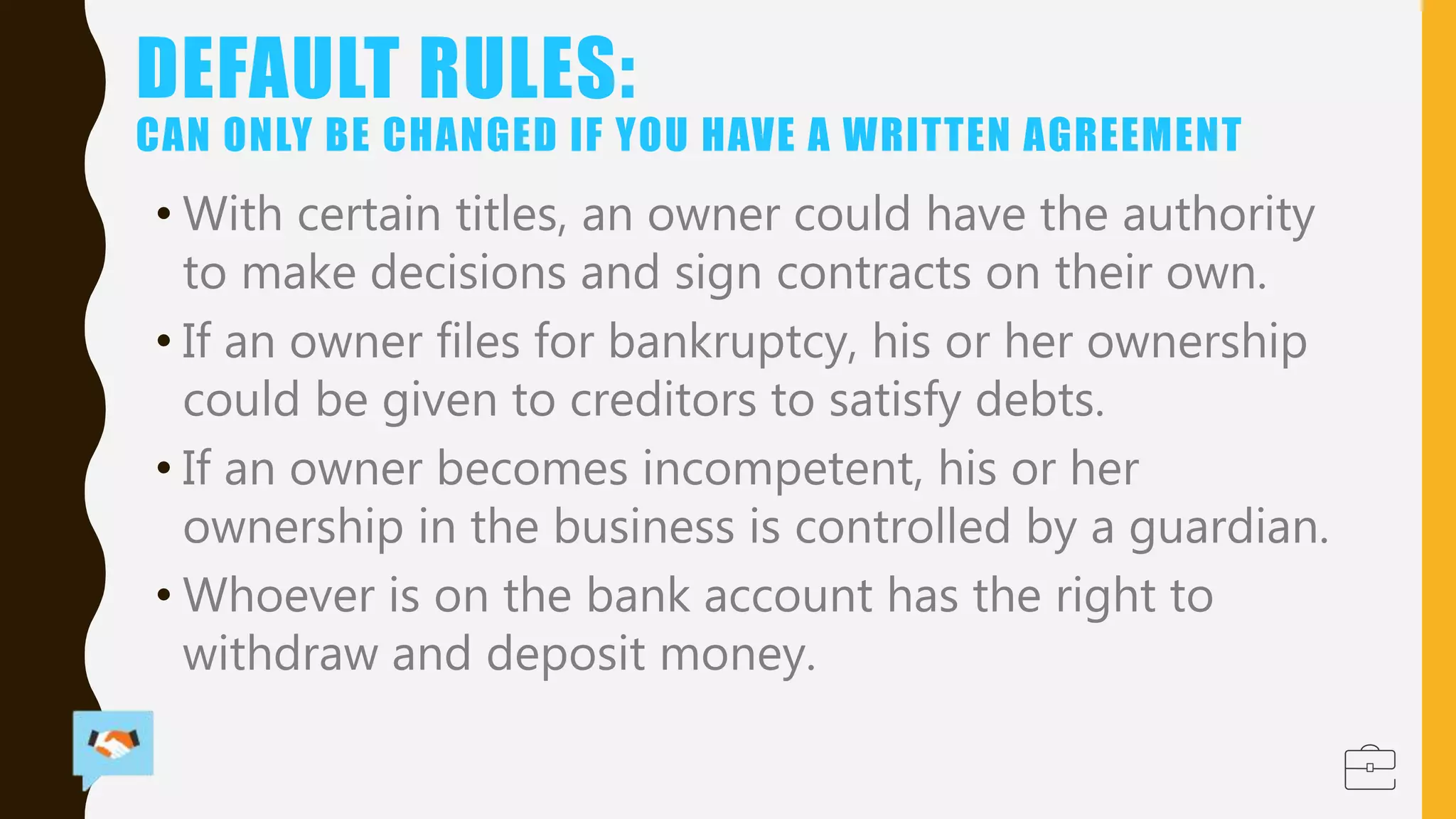

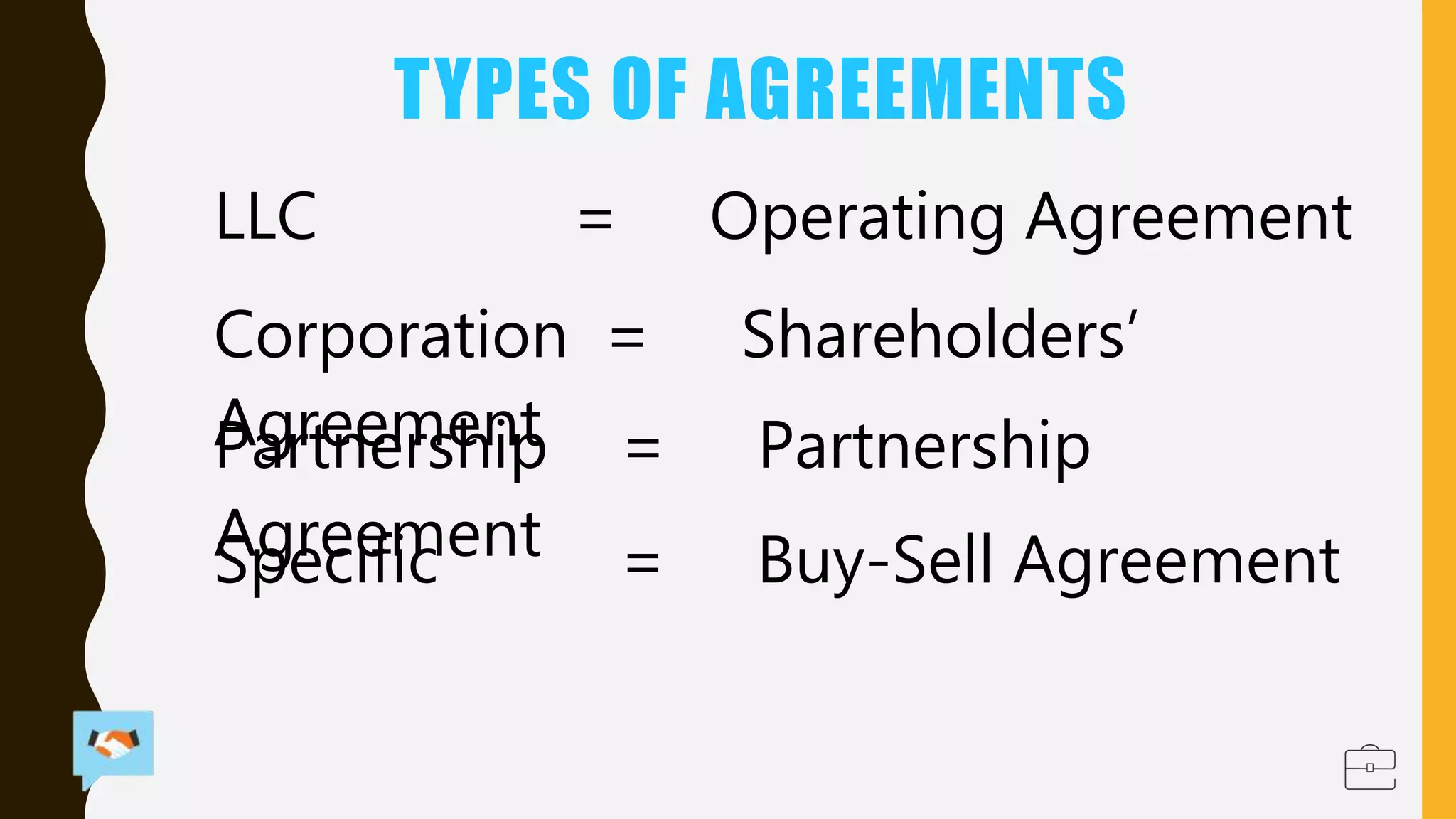

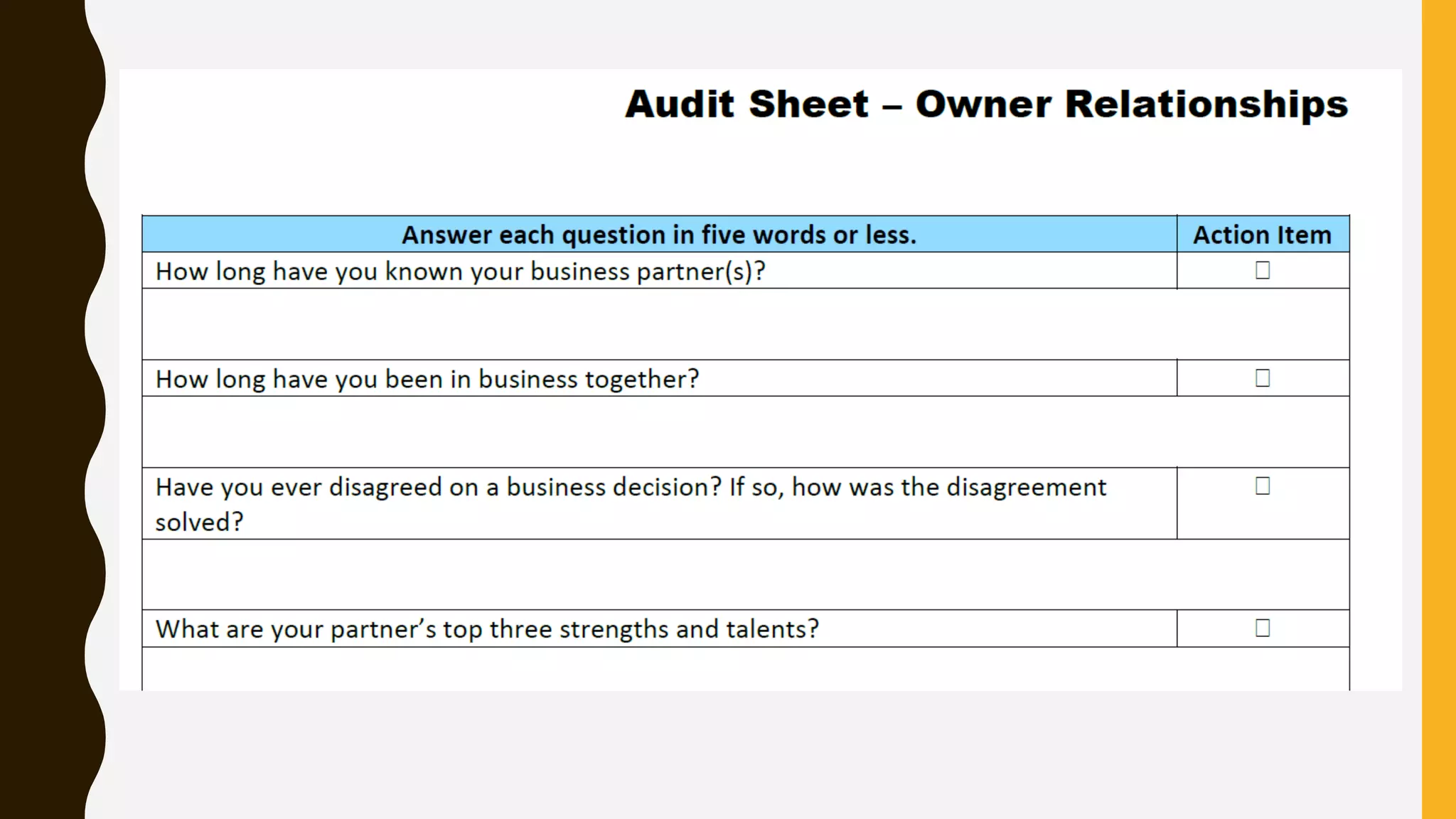

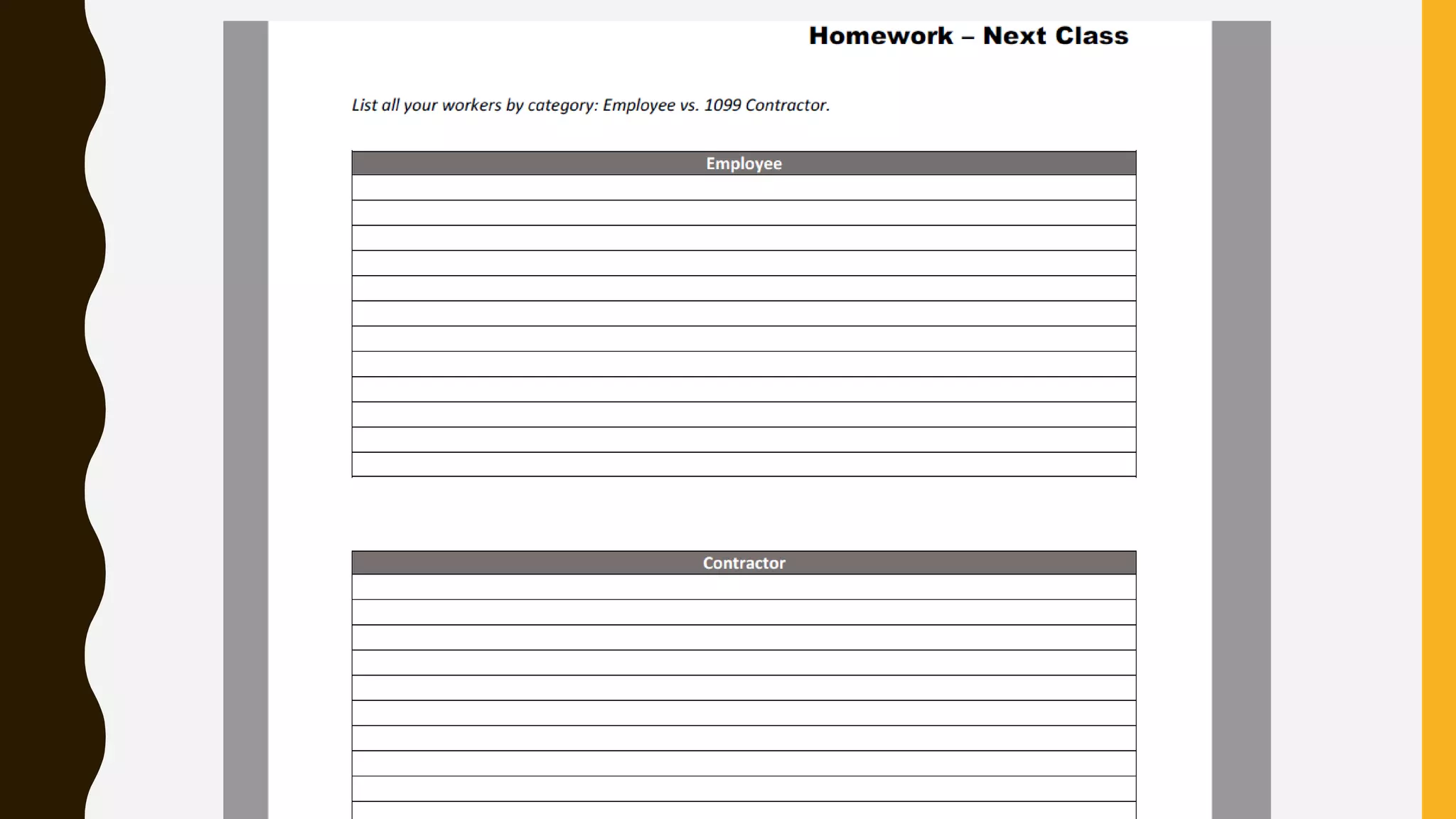

This document provides an overview of important considerations for building a business, including entity structure, government regulations, and internal relationships. It discusses choosing an entity structure like an LLC or corporation that establishes liability protection and tax implications. It also outlines different levels of government regulations at the federal, state, and local levels that may apply based on industry, location, and activities. Finally, it emphasizes the importance of establishing clear internal relationships between owners through written agreements to address ownership, decision making, responsibilities and other issues.