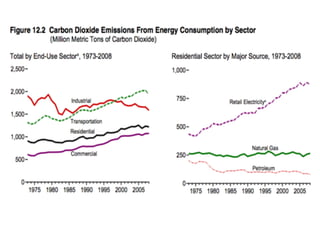

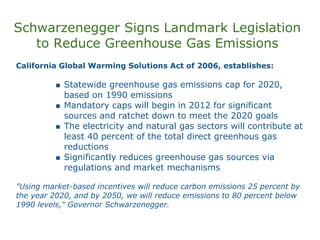

The document discusses several policies and initiatives to promote sustainable energy solutions through innovative financing in the US and California. It outlines the American Recovery and Reinvestment Act's $60 billion investment in clean energy jobs. It also summarizes California's Global Warming Solutions Act that establishes a state cap on greenhouse gas emissions and Schwarzenegger's Million Solar Roofs initiative to install solar panels on homes and businesses. PACE financing is introduced as a model that improves energy retrofits by lowering upfront costs through property tax assessments. Federal tax credits for consumer energy efficiency are also summarized.