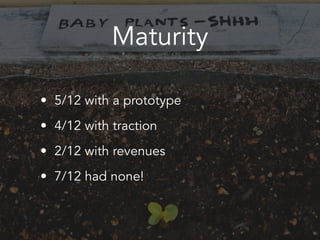

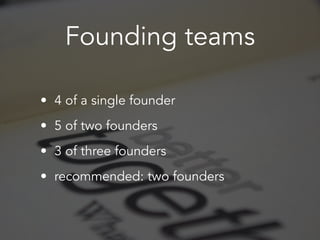

Jeremie Openfund II is a €11.7 million pre-seed and seed stage venture fund that has made 12 investments so far out of around 800 applications received, accepting 1.5% of startups. The portfolio companies operate in a wide range of software sectors and are at various stages of maturity, with 5/12 having a prototype, 4/12 having traction, and 2/12 having revenues already. On average, pre-seed investments are €106k and seed investments are €302k. Most founding teams have 2-3 founders, which is recommended. The portfolio has created 82 jobs so far and aims to help companies turn ideas into products and businesses that can impact millions of users.