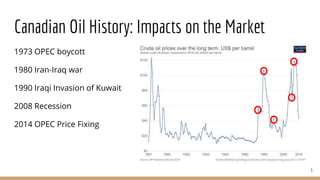

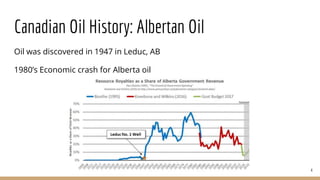

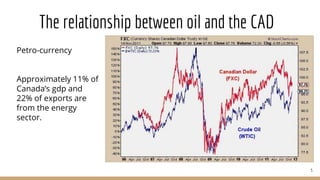

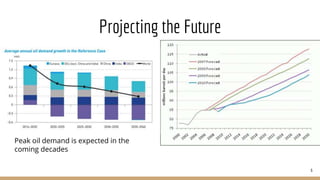

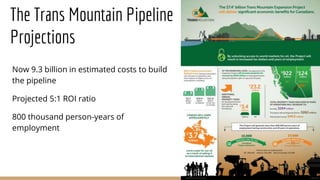

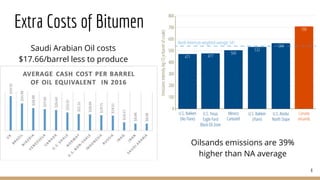

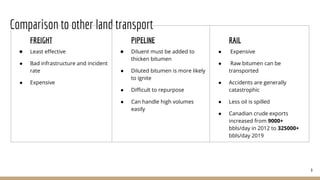

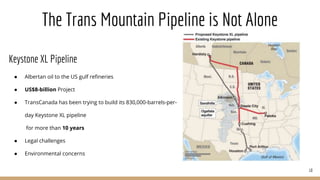

The document discusses the economics of the proposed Trans Mountain Pipeline expansion project in Canada. It provides background on Canada's oil industry history and importance to the economy. It then examines projections for the Trans Mountain Pipeline, including estimated costs, employment impacts, and revenue. It also compares different methods for transporting oil, noting the advantages and disadvantages of pipeline, rail, and freight transportation. Finally, it briefly discusses Canada's dependence on oil and the proposed Keystone XL pipeline project.